[ad_1]

India’s incumbent Prime Minister Narendra Modi and his pro-business Bharatiya Janata Party are widely expected to win the ongoing elections, but that doesn’t mean investors should consider buying iShares MSCI India ETF (INDA), which is the largest and most-liquid India focused fund. That’s because the ETF’s underlying holdings have risen substantially in the run-up to the elections and the valuation doesn’t look compelling anymore. Besides, the country is facing some headwinds. I believe investors should steer clear of the iShares MSCI India ETF for now.

Image courtesy of Pixabay

India has recently started the largest election exercise in the world as 900 million eligible voters in 20 states and union territories start casting their ballot to elect a new lower house of parliament in 91 constituencies. The elections will be carried out in seven phases through 19 May. Mr. Modi of the Hindu nationalist BJP is fighting for a second term after achieving a landslide victory in 2014 and his primary rival is Rahul Gandhi led Congress party. The opinion polls have predicted a victory for Modi. This could be a good thing for India since it means that the ongoing reforms (such as land and labor law reforms) and economic growth will continue in the future. India’s GDP expanded by 7.2% in the previous fiscal year ending March 2018 which made it the fastest-growing major economy.

The iShares MSCI India ETF is a well-known India-focused fund. With almost $5.1 billion of assets under management and daily trading volume of more than 4 million shares (prev. 20-day average), the iShares MSCI India ETF is by far the largest and most liquid ETF that tracks Indian companies. Its closest rivals are the WisdomTree India Earnings Fund (EPI) and the iShares India 50 ETF (INDY) which have $1.36 billion and $831 million of assets under management respectively.

I believe INDA also comes with a reasonable expense ratio of 0.68%, which includes a management fee of 0.64% and other expenses, including foreign taxes, of 0.04%. This means that the fund charges $68 on every $10,000 of investment, which makes it cheaper than most India-focused ETFs. WisdomTree India Earnings Fund and the iShares India 50 ETF, for instance, come with expense ratios of 0.84% and 0.92% respectively. Furthermore, most country-focused ETFs, such as the iShares China Large-Cap ETF (FXI) and the VanEck Vectors Russia ETF (RSX), come with expense ratios of between 0.60% and 0.80%, which also makes INDA one of the cheapest funds in this context.

INDA tracks the MSCI India Index, which is designed to measure the performance of shares of those Indian companies that represent top-85% of the Indian stock market in terms of market cap. INDA is heavily tilted towards large-cap and mid-cap companies. Overall, the fund holds 79 companies operating in various sectors of India’s economy.

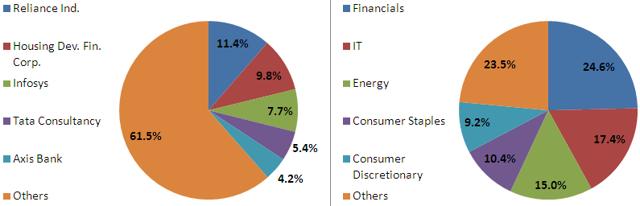

What I also like about INDA is that it is a fairly diversified ETF, which isn’t heavily exposed to a single company or one sector, even though it is a top-heavy fund. INDA is overweight on financials, information technology, and energy sectors, but no single category gets more than 25% of the assets. Its top holding is India’s diversified energy giant Reliance Industries, but it gets just 11.4% of the assets, which is in contrast to concentrated funds in which the leading company gets more than 20% of assets. Additionally, INDA hasn’t allocated more than 10% of assets to any other company besides Reliance. India’s leading housing finance company House Development Finance Corporation and the well-known IT services provider Infosys (INFY) are the ETF’s largest holdings after Reliance, and they account for 9.79% and 7.69% of the assets, respectively.

Image: Author

Modi’s re-election can help a lot of Indian companies if he introduces additional economic reforms which will make the business environment more conducive for investment. For instance, the land reforms, which will feature digitization of property records, can go a long way in helping a number of companies in acquiring new land and expanding their businesses. Those companies engaged in infrastructure and manufacturing businesses, such as INDA’s top holding Reliance, could be one of the biggest beneficiaries of land reforms. If elected, Modi could also lower corporate taxes and remove excessive regulation and red tape as part of his pro-business agenda. It seems, however, that the markets have already priced Modi’s victory and a number of Indian stocks have moved higher in the run-up to the election.

In the last two months, INDA has climbed 10%, easily outperforming the broader emerging markets, as measured by iShares MSCI Emerging Markets ETF (EEM), which have risen by 5% in the same period. India’s benchmark Nifty-50 Index has posted gains of almost 8% in the corresponding period. The shares of INDA’s top holding and Nifty-50 component Reliance Industries have increased by 8.2% in the same period. Thanks to the rally, the Indian stocks aren’t looking like bargains anymore. The Nifty-50 was at 11,643 points at the time of this writing, slightly below its all-time high of 11,761 points, and is trading 17 to 18 times forward earnings estimates, as per data from Thomson Reuters and Bloomberg. That’s higher than the five-year average of 16 times. Reliance stock is trading 17 times next year’s earnings estimates, as per data from Thomson Reuters, and its shares are currently at Rs 1,356, close to their all-time highs of Rs 1,406. INDA’s second largest holding Housing Development Finance Corporation is also expensive, with shares trading almost 32-times next year’s earnings estimates. Infosys is priced 18.3 times future earnings.

I believe the biggest risk Indian stocks are facing is that of a major correction. The stocks may decline once the election results are announced after votes are counted on May 23 and Modi’s BJP ends up losing. There is also a possibility of a negative reaction from the market if BJP wins but with a narrow majority. In this scenario, India may get a weak coalition government instead of a strong and decisive one which could make it difficult for Modi to roll out bold economic reforms. Remember, even at a time when Modi’s government enjoyed a clear majority at center, the introduction of the widely lauded Goods and Services Tax was so chaotic that some economists believe it may have dragged the country’s GDP growth. Bereft of a powerful majority, Modi will likely find it challenging to move forward with the reforms agenda. That could dampen the outlook of Indian companies.

On top of this, the Indian economy itself is facing headwinds. Although India remains the world’s fastest-growing major global economy, it has witnessed a slowdown. In the previous fiscal year (FY-2018), the country’s GDP expanded by 7.2%, down from 8.2% in FY-2017, and is forecasted to decelerate to 7% in FY-2019, as per the central bank’s estimates. The data from Statistics Ministry also implies that the country’s growth clocked in at just 6.1% in the final quarter of FY-2018 ended March-2019, down from a recent high of 8% in the April-June period in 2018.

India is exposed to softness in key global markets which could hurt its exports. In addition to this, consumer spending has also slowed, which is worrying since it accounts for 60% of India’s economy. Things may not get meaningfully better in the short-term since inflation could climb in the coming quarters. Oil prices have risen by almost 40% this year which could hurt India since it is an oil importing country. Besides, food prices are already near 13-month highs and weather agencies have predicted lower levels of rainfall which could impact harvests. The Reserve Bank of India, however, is taking steps to ensure the country’s growth momentum stays intact and inflation remains within the target range. But there’s also no denying that India’s economy is currently not on a solid footing.

In this backdrop, I believe investors should rather watch India’s elections from the sidelines and avoid the iShares MSCI India ETF.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News