[ad_1]

imagedepotpro/iStock via Getty Images

Investment Thesis

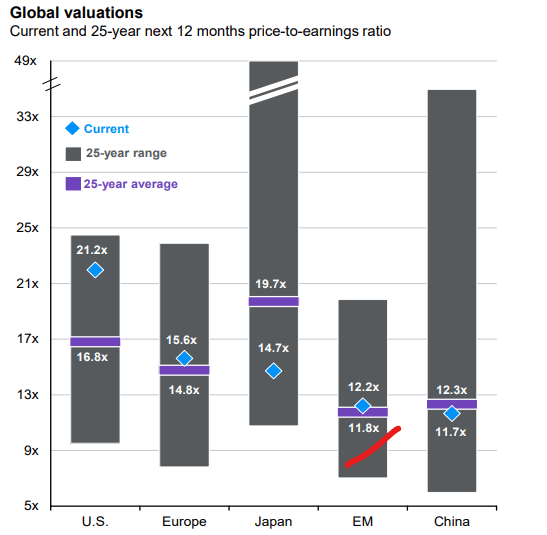

Given how rocky US markets have been since the start of the year, many investors are seeking refuge internationally. Developed markets seem to be an interesting candidate to park capital for a limited period of time, considering how cheap valuations are compared to the US.

JPM – Guide to the Markets

However, investing in developed markets outside the US comes with a unique set of challenges. Low expected GDP growth rates, elevated inflation, poor demographic trends, and a high level of both public and corporate leverage are some of the main issues that are likely to lead to poor performance for equities in many developed countries. For the above-mentioned reasons, I think that other markets such as the US offer better growth prospects to investors once valuations will be in value territory.

Strategy Details

The iShares MSCI EAFE ETF (NYSEARCA:EFA) tracks the investment results of the MSCI EAFE Index. The index is composed of large and mid-cap developed market stocks, excluding the US and Canada. The fund provides broad exposure to markets in Europe, Australia, and Asia.

If you want to learn more about the strategy, please click here.

Portfolio Composition

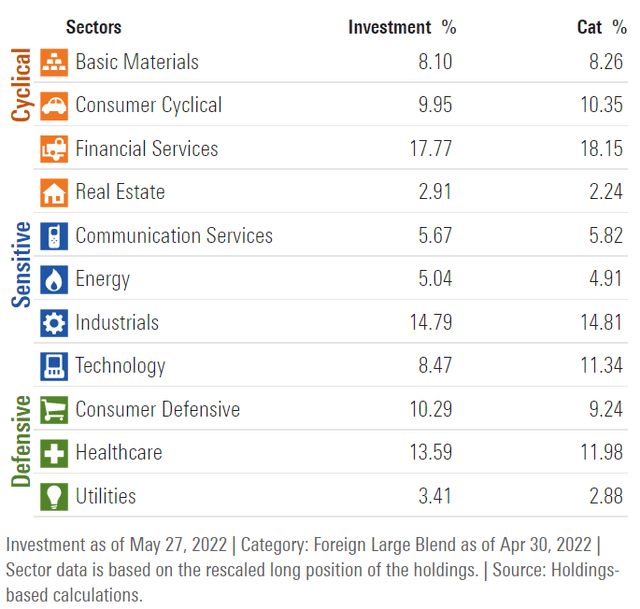

The ETF invests ~18% of total assets in Financials, followed by the Industrials (~14.7%) and the Healthcare sector (~13.7%). The largest three categories have a combined allocation of approximately 46%.

Morningstar

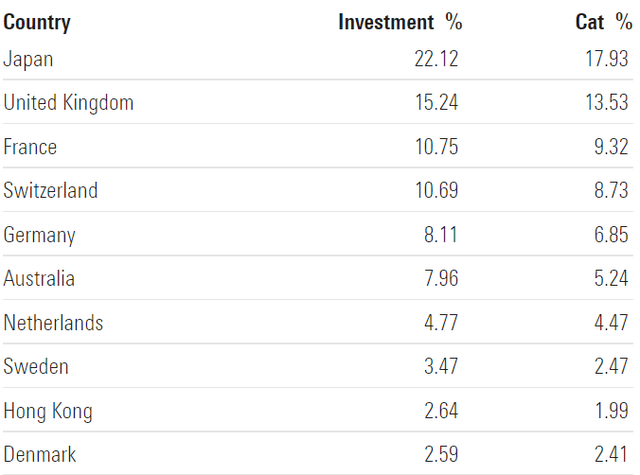

In terms of geographical allocation, the top 10 countries represent nearly 88% of the portfolio. Japan accounts for 22%, whereas other countries such as Denmark seem to be underrepresented given the low weight (only a ~2.6% allocation to Denmark).

Morningstar

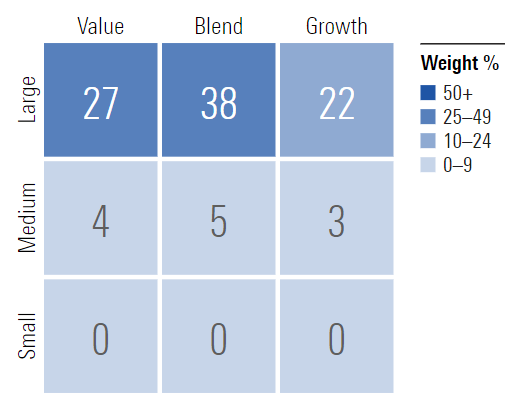

~38% of the portfolio is invested in large-cap “blend” equities, characterized as large-sized companies where neither growth nor value characteristics predominate. Large-cap issuers are generally defined as companies with a market capitalization above $8 billion. The second-largest allocation is large-cap value equities, which account for 27% of the portfolio.

Morningstar

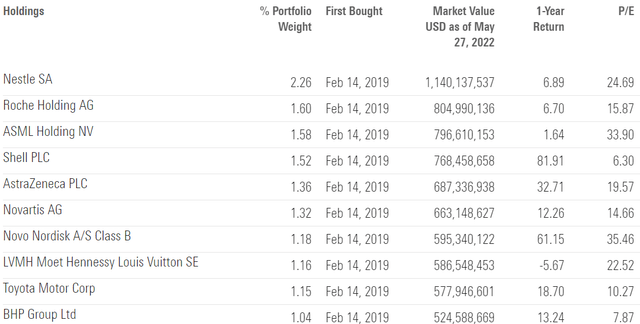

The fund is currently invested in 827 different stocks. The top 10 holding account for ~14% of the portfolio, with no single stock weighting more than 3%. In my opinion, EFA is well-diversified and has a low level of unsystematic risk.

Morningstar

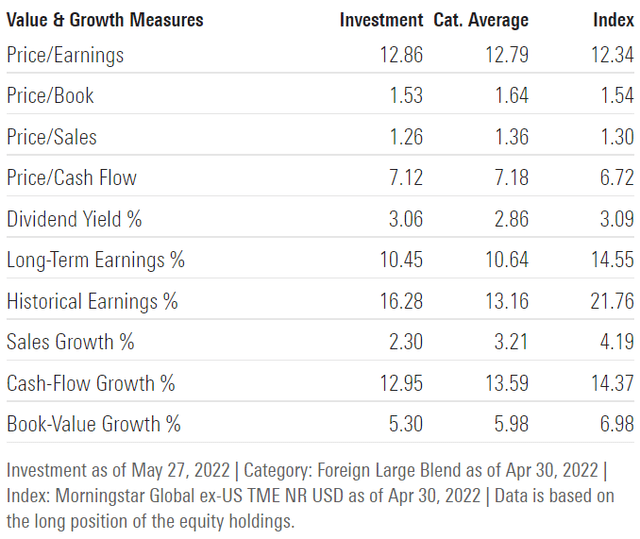

Since we are dealing with equities, one important characteristic is the portfolio’s valuation. According to data from Morningstar, EFA trades at a price-to-book ratio of ~1.5 and has a price-to-earnings ratio of ~13. These multiples are lower than what you would be paying to acquire a plain-vanilla S&P 500 ETF, which trades right now at ~18x earnings and has a price-to-book ratio of ~3.4. I believe EFA offers a good deal at the current valuation but investors still need to check how the multiples look on a cyclically adjusted basis. At the same time, it is important to highlight that several countries included in the portfolio have bleak economic prospects compared to the US. If we take Japan, for instance, we know very well that the country’s demographics will be a real drag on future economic growth.

Morningstar

Is This ETF Right for Me?

I have compared below EFA’s price performance against the Vanguard Total World Stock ETF (VT) over the last 5 years to assess which one was a better investment. Over that period, VT clearly outperformed EFA by a ~32 percentage points margin, thanks to the strong performance of the US equity market. However, it is interesting to see that both strategies delivered similar returns up until Q1 2018 when the performance spread widened and VT started to outperform.

To put EFA’s performance into perspective, a $100 investment 5 years ago in this ETF would now be worth ~$106.12. This represents a ~1.2% compound annual growth rate, excluding dividends, which is a terrible absolute return, especially when adjusted for 2% inflation.

Refinitiv Eikon

If we take a step back and look at the performance from a 10-year perspective, the results don’t change much. VT came on top once again, outperforming both EFA since mid-2014.

In my opinion, EFA’s past performance accurately reflects the state of the majority of developed economies. A limited GDP growth rate, combined with high government spending and, in some cases, a negative trade balance, is a recipe for disaster over the long term and will prove to be unsustainable. Despite all the talks about how high inflation is in the US, I still believe an S&P 500 ETF will provide better returns over the long term than EFA.

Refinitiv Eikon

Key Takeaways

EFA provides exposure to large and mid-cap stocks in developed markets, excluding the US and Canada. The fund is well-diversified both across industries and constituents. Based on the fundamentals of these markets, which include a low GDP growth rate, high government spending, and an elevated level of leverage, I believe EFA is poised to underperform the S&P 500 going forward. There are a lot of talks about an incoming global recession at the moment, and I believe Europe and Japan are particularly vulnerable if this scenario would become true.

[ad_2]

Source links Google News