[ad_1]

kevron2001/iStock via Getty Images

This bear market has not been friendly to any of us, and bad news keeps mounting. Value is still dead. Our growth friends have been giving into inflationary pressures. We still have no idea whether we’re headed for a soft landing or not, but we do know that it’s taking way too long to get there. The Shiller CAPE is right around 1929 Black Tuesday levels, and everyone knows that stocks are still expensive after being down 18% since January. Burry, Grantham, and Kiyosaki are saying the bubble is about to burst. In our hearts, we know they’re right because anyone can see that we’re in a bubble and have been for a long time. Bonds aren’t much help either, since bonds are also suffering due to rising interest rates. To make matters worse, this is only considering the US markets.

All of this is bad news if you’re a total return investor. We are due to pay back the returns that were bestowed upon us in 2021. In many cases, this means thousands, or even tens of thousands of dollars evaporating from our accounts in a single day, seemingly every day, for weeks, months, and maybe years to come. It is difficult to live with this pessimism.

Fortunately, price action is less relevant to income seekers. And, where there’s fear, there’s opportunity. When everyone’s looking for safety in stretches of uncertainty, we may be able to find these opportunities in the riskiest income instruments. If we do that, we come across the iShares Fallen Angels USD Bond ETF (NASDAQ:FALN).

What Is FALN?

“Fallen angel” bonds are corporate bonds that have recently been downgraded from investment-grade to junk bond status. Downgrading is generally a bad thing. Firms will try to get rid of their junk bonds – for example, investment-grade bond index funds and institutions who contractually cannot hold junk bonds for their clients.

But, there lies the opportunity. Fallen angels are sold off because they were downgraded, not necessarily because the corporations that issue these bonds are any worse off. One might argue that fallen angels are systematically undervalued for this reason. The bonds are classified as junk, which gives them their price, yet they are the least junky of the junk bond universe. Moreover, if the fallen angels are upgraded back to investment-grade status, that recovers the market value of our bonds.

FALN is an ETF that invests in fallen angels on the basis that fallen angels are sold for cheap. It offers you this service for a 0.25% expense ratio, which is not too bad all things considered. FALN also has a turnover ratio of 21%, which can somewhat, but not materially, add to your expenses.

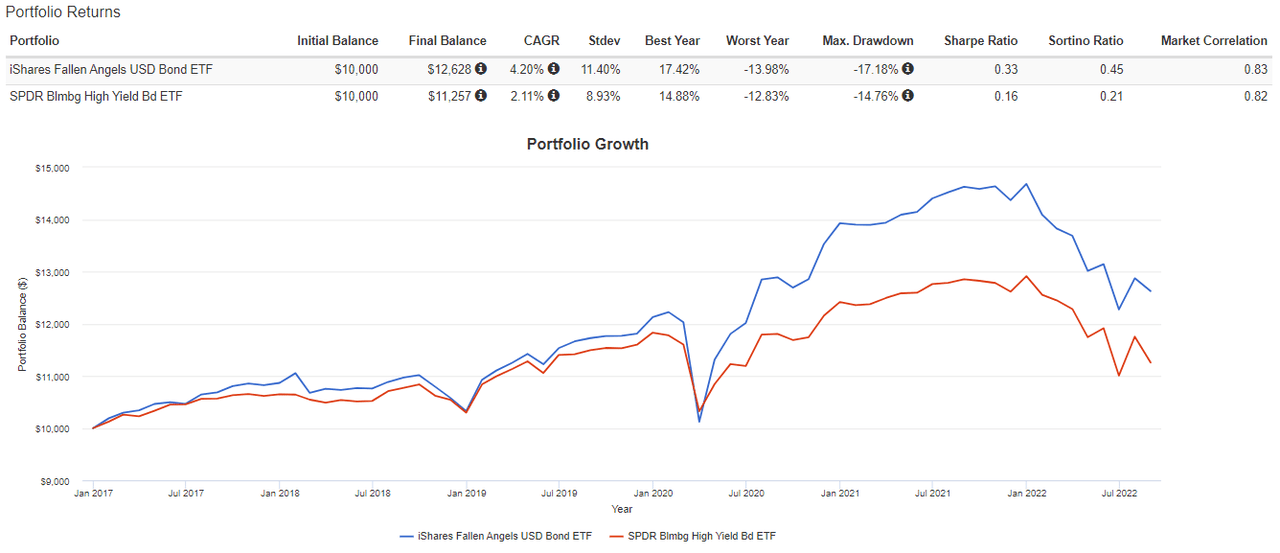

This thesis has played out perfectly since FALN’s inception. FALN, in blue, has outpaced typical junk bond ETFs, in red, using the SPDR Bloomberg Barclays High Yield Bond ETF (JNK) as a benchmark. The outperformance is nearly 2% annually.

FALN has beaten typical junk bond indices since 2016. (Portfolio Visualizer)

Even though FALN owns risky bonds, FALN owns 260 of them. This mitigates concentration risk. Also, due to the rules of the index FALN tracks, FALN cannot have any one bond occupy more than 3% of the fund’s holdings. This means that even in the unfortunate case of a bond defaulting, it won’t affect the fund’s value too much. FALN is diversified across market sectors as well. There is a bit of a tilt towards the financial and service industries, but overall, the sector diversification is reasonable.

FALN has passable sector diversification. (ETF.com)

While past returns have been low, rising interest rates have now increased FALN’s 30-day SEC yield to 6.90% as of September 1st, 2022. This makes FALN among the highest yielding bond ETFs on the market right now.

FALN is a good ETF in terms of doing what it says on the box. It’s giving you exposure to fallen angel junk bonds for a reasonable fee. But, should you be investing in fallen angels at all?

Junk Bonds are Junk (Usually)

Junk bonds can be said to be the “worst of both worlds”. They bear the risk of stocks, but at the same time they do not fully capture the returns of bull markets. They go against the mantra of “bonds are for safety”. They are stockish bonds. Many critics argue that, as a result, there is dubious value junk bonds can add to your portfolio.

A handful of investors are fans of junk bonds in some capacity, notably Rick Ferri and Antti Ilmanen. The latter is even specifically interested in fallen angels. Still, proponents are few and far between. Many experts say you shouldn’t own junk bonds at all, claiming that you are not adequately compensated for the risk. (Funny, how many of those who say that the reward isn’t there will still claim that the market is efficient.)

All of this is true. But, why do people buy junk bonds then?

Junk Bonds and Asset Pricing Models

The term and credit risk factors are tools that can help us understand the sources of returns for bond funds. This means that we can perform two-factor regressions on many bond funds from 2016 (the inception of FALN) to 2022 and plot their exposures to term and credit risk. We can do this with FALN, JNK, investment-grade corporate bond ETFs (short, intermediate, and long term), Treasury bond ETFs (short, intermediate, and long term), and a total bond market ETF. We know that junk bonds are exposed to market beta as well, but for the simplicity of having only two dimensions, market beta isn’t included when creating the plot below.

Term and credit risk factor regressions for typical bond ETFs. (Portfolio Visualizer)

What immediately stands out is that FALN offers the most credit risk for the least term risk. This is unrivaled by any other bond fund, with the possible exception of JNK, the red diamond. Even there, we’ve established FALN’s potential advantages over JNK. This is promising because it suggests that FALN offers something that cannot be provided by other bond funds – targeted exposure to credit risk.

This makes for an interesting use case. For investors with short-term income obligations that cannot be supported by Treasuries or investment-grade corporates, FALN can meet those needs. You cannot afford to take the term premium due to your time horizon, so instead, you opt for the credit premium. In exchange for higher yields in your short-term strategy, you’re risking a short-term market decline.

Junk Bonds in a Barbell Strategy

FALN sees utility in portfolios with longer time horizons as well. From a diversification perspective, we want our portfolios to be exposed to multiple independent sources of risk. This is true with equities, and this is true with bonds as well. We can use a barbell strategy and mish-mash our own diversification using FALN (most credit risk) and a Vanguard’s Long-Term Treasury ETF (VGLT) (most term risk). This is the same idea that drives some investors towards small cap and value stocks.

Because FALN and VGLT are risky bond funds, we may need to hold some cash in reserve to make things fair for backtesting. In the plot below, a portfolio of 20% FALN, 30% VGLT, and 50% cash, in blue, produced excess returns and excess risk-adjusted returns than the total bond market, in red, for roughly the same volatility. This isn’t a perfect comparison for a few reasons – for example because FALN has some market beta in it – but it highlights the power of how FALN can boost portfolio returns when used purposefully and with small allocations.

A barbell strategy involving FALN can offer improvements over the total bond market. (Portfolio Visualizer)

Junk Bonds as Leverage

Leverage is another way that investors can improve their expected returns. To be clear, FALN is not a leveraged fund. But, I make a case that it can behave like one.

Below is a plot of two portfolios: 100% FALN, in blue, and 20% Vanguard’s Total Stock Market ETF (VTI) + 240% Vanguard’s Short-Term Corporate Bond Index ETF (VCSH), in red. Yes, this is a 20/80 stock/bond portfolio, but with 3x leverage on short-term corporate bonds. As the plot shows, the risk-return characteristics of both portfolios are actually quite similar.

FALN, in some ways, acts like a leveraged bond ETF. (Portfolio Visualizer)

Because fallen angels have little term risk, FALN can adjust to interest rates without too much pain – which is exactly what we want in a rising interest rate environment. VCSH is also not very susceptible to interest rate risk, but it cannot offer much credit risk either. This is why one might want to 3x leverage VCSH. As such, one could say that FALN acts like a 3x-leveraged short-term corporate bond fund (with a bit of equity risk). FALN is possibly a way to access leverage-like risk without having to dip into margin.

Should You Buy FALN?

I find the reasons for owning FALN to be more compelling than the reasons to not own FALN. I find that FALN can play an important role in many diversified portfolios. Having said that, is now a good time to buy FALN?

Having targeted exposure to credit risk means that you want to buy FALN when credit spreads rise like in the 2007-08 and 2020 recessions. Right now, though, credit spreads are hovering near average levels. When will the spread go back up? Timing the market is observed to be a losers game, so I cannot endorse it. Timing the credit spread is about as difficult as regular market timing – it’s not going to happen consistently. But, given that bond yields have been on the rise, and that the yield curve is somewhat flat, I think it’s sensible to store some cash in short-term instruments and wait to see if you can get a better deal on FALN.

For those who want to invest right away, you would want to implement FALN as part of a diversified portfolio according to your predefined investment plan. A commonly recommended amount is no more than 20% of your bond holdings. That seems a bit of a random number to me. For what it’s worth, I would not mind closer to 40% if your situation warrants it.

Credit spreads over the last 25 years. (Federal Reserve Bank of St. Louis)

All this said, I don’t own FALN in my own portfolio. This is principally because I don’t need income. If I do need income, it would probably be for the long-term (20+ years), and I would start with long-term Treasuries as I’ve vouched for in the past. If my income obligations are short-lived (10 years), then I’d be likely to invest in FALN. Either way, I won’t hesitate to buy when the coming recession knocks down the price a bit more.

I think FALN is a good deal right now, but I don’t think it’s a good idea right now. I’m giving it a Hold rating. Seeking Alpha’s Quant agrees, with a rating of 2.87/5. It’s nice when the human and machine learning algorithms agree, even if we agree for different reasons.

Quant agrees with a Hold rating. (Seeking Alpha)

The best time to buy FALN in recent memory was during the 2020 flash crash. If you missed out on that fire sale, then still keep FALN on your radar. You might have another chance in a few months depending on how the market shakes out.

[ad_2]

Source links Google News