[ad_1]

iShares Core High Dividend ETF (HDV) is an ETF that provides exposure to high-quality U.S. companies which have high dividend yields. It provides investors an attractive dividend yield and potential capital appreciation (28% in past 5 years).

Investment Thesis

HDV tries to track the investment results of an index composed of relatively high dividend paying U.S. equities. As such, it provides access to 75 U.S.-based high-quality, high dividend paying companies.

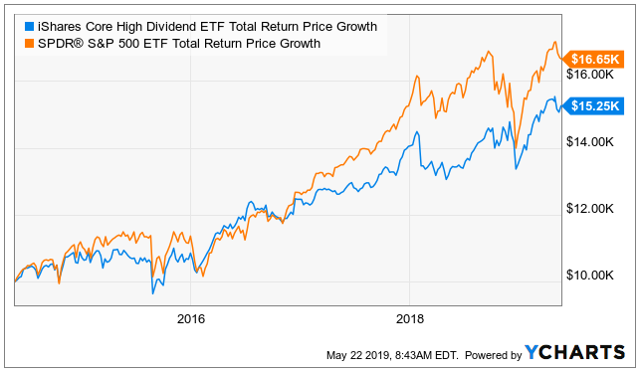

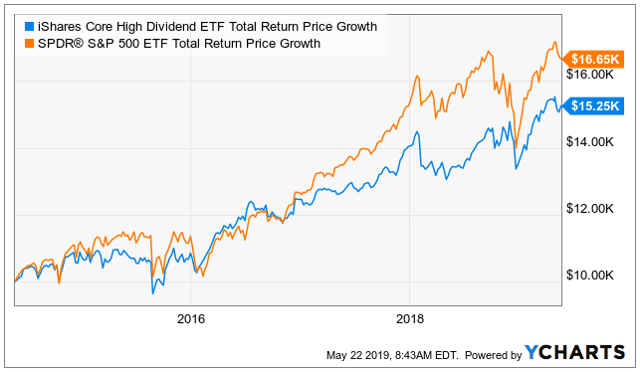

iShares Core High Dividend ETF provides access to 75 U.S.-based high-quality companies that pay high dividends. It performed not as well as the S&P500 in the past 5 years, but HDV has a higher yield than the SPDR S&P 500 ETF (SPY).

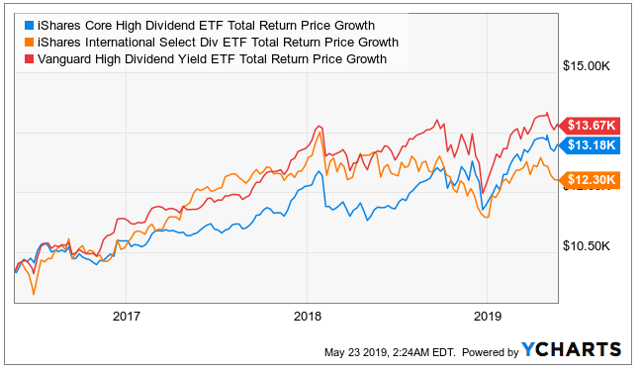

When we compare the performance of HDV to other similar dividend ETFs, such as iShares International Select Dividend ETF (IDV) and Vanguard High Dividend Yield Index Fund ETF (VYM) we can see that on a total return basis HDV has outperformed the other ETFs.

I believe that because of HDV’s performance compared to similar ETF’s make it worth consideration to include it in your portfolio. Later in this article, we go into more details about the valuation and the costs associated with this ETF.

Overview

Since being founded in 2011, the fund has amassed $7.1 billion in assets and has 75 holdings. It trades on average 540,503 shares per day which provides enough liquidity. In addition, HDV has an expense ratio of 0.08%.

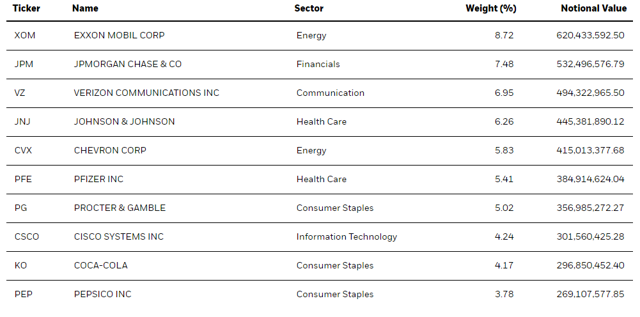

The top 10 investments make up 57.8% of the total portfolio and include some well-known companies such as Exxon Mobil (NYSE:XOM) and JPMorgan (NYSE:JPM).

Source: Ishares

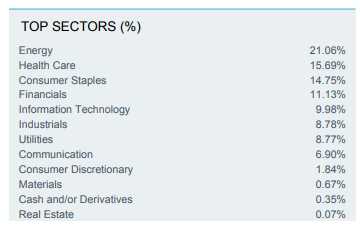

The top sectors the fund has equity in, are energy (21.06%), healthcare (15.69%) and consumer staples (14.75%). With this high exposure to the energy sector, the fund could have a significant impact on a market downturn in this sector.

Source: Ishares

Valuation – Comparison between similar ETFs

HDV’s Beta is only 0.72, meaning that it is much less volatile than the broad market. IDV has a beta of 0.91 and VYM has a beta of 0.86. HDV’s expense ratio is 0.08%, IDV is 0.5% and VYM has an expense ratio of 0.06%. When we look at the performance (mentioned before in this article), HDV performed just slightly worse than IDV.

As for dividends, HDV has a yield of 3.28%, which comes down to an annual payment of $3.12. In the past 5 years, the dividend growth rate was 6.77%. For comparison, IDV has a dividend yield of 5.79% and a 5-year CAGR of 0.04% and VYM has a yield of 3.16% with a 5-year dividend CAGR of 8.66%

Summary

| ETF | Expense ratio | Performance (3yr) | Beta | Yield | Dividend 5-yr CAGR |

| HDV | 0.08% | +30.62% | 0.72 | 3.28% | 6.77% |

| IDV | 0.5% | +22.22 | 0.91 | 5,79% | 0.04% |

| VYM | 0.06% | +35.61% | 0.86 | 3.16% | 8.66% |

Source: Self-made table based on ETF data

I believe that of the three different ETFs, HDV is a decent choice for a dividend investor, it is less volatile than the other ETF’s, it has a dividend CAGR of 6.77% and decent performance in the past 3 years. For yield chasers, IDV is the better choice but it comes at the cost of higher beta and a lower dividend growth rate. However, one should also consider VYM as that ETF has a lower expense ratio compared to HDV and has had better historical returns.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News