[ad_1]

z1b/iStock via Getty Images

The markets panicked on Thursday, May 5. The Nasdaq (QQQ) sank by as much as 6% intraday before partially recovering, while even diversified commodities (DBC) and bonds (AGG) turned moderately to sharply lower. There seems to be a loose consensus that the intense bearishness across nearly all major asset classes was caused more by market dynamics (e.g., stop losses, forced deleveraging) than by a change in fundamental factors (e.g., economic growth or inflation expectations).

When we are slapped on the wrist, our human instinct is to pull our hand out of danger. This is why most investors must have felt uneasy about Thursday’s market action. But in the world of investing, the opposite tends to pay off. Boldly buying when everyone else seems to be selling has consistently produced the best future returns.

For this reason, I think that the stock-and-bond iShares Core Conservative Allocation ETF (NYSEARCA:AOK) is a good buy on the dip.

What is AOK?

I wrote about the iShares Core Conservative Allocation fund in November 2021 and explained my bullish stance, only a few weeks before the ETF began its second worst unwind in a decade (see below). As a recap:

The ETF is a diversified, multi-asset instrument that holds, primarily, bonds of different kinds and duration (roughly 70% allocation). The fund directs the remainder of its capital to a handful of other iShares ETFs (global stocks ranging from small to mega cap) plus an immaterial amount to cash. AOK is basically a fund of funds.

AOK is fairly large, with around $1 billion in assets under management. The ETF also trades frequently, which makes it liquid: nearly $10 million trades on an average day — although May 5 saw almost three times the normal volume. The management fee is a moderate 15 basis points that I believe to be consistent with the ETF peer group.

Why AOK could make sense

Fundamentally, it is not easy to be bullish bonds (the lion’s share of AOK’s holdings) in a period of rapidly rising yields; or even stocks, ahead of what could be a period of economic growth deceleration. Being an optimist today is even harder when sentiment and momentum are taken into account, especially following a day of carnage in the markets.

But look forward a couple of years at least, and I believe that the early 2022 dip in stocks and bonds presents a compelling opportunity. I have explained recently that treasuries and other investment-grade fixed income instruments have become much more attractive lately. The same higher yields that inflict pain in the short term anticipate a period of much better returns for bonds in the next few years.

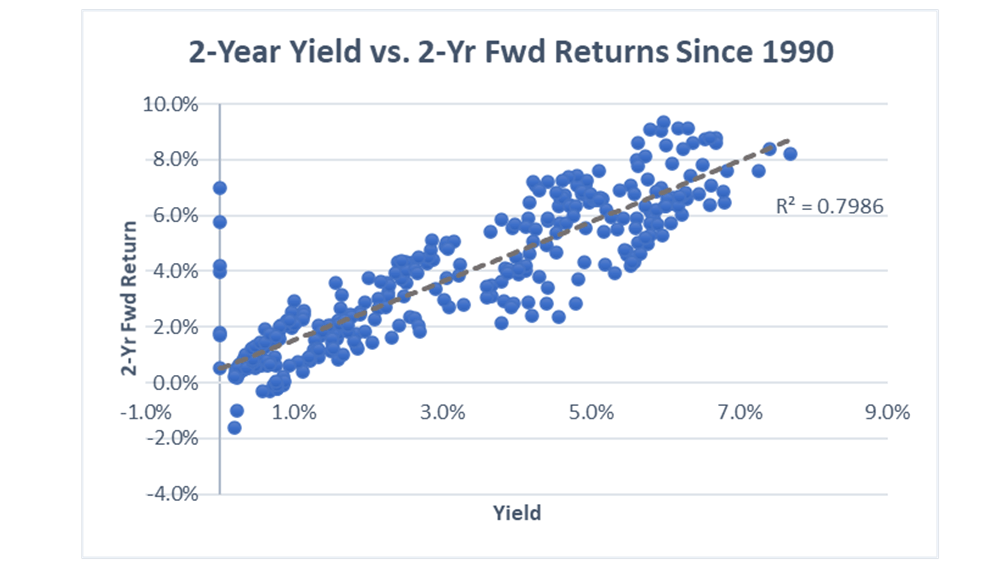

The scatter plot below shows how current yields tend to correlate very tightly with forward returns in bonds, and for very intuitive reasons. Annual return projections of around 3% on safe instruments like treasuries do not sound so terrible today, certainly compared to the near-zero rate days of 2020.

2-Year Yield vs. 2-Yr Fwd Returns in SCHO Proxy Since 1990 (DM Martins Research)

The case for bullishness in the equities world is a bit harder to support, in my view. This is the case not only because of recession fears over the next 12 months, but also because stocks (unlike bonds) offer no guarantee of future cash payments to investors. The level of uncertainty, therefore, is higher in this case. Still, it does not hurt that equity valuations have pulled back considerably in the past few months, which bodes well for future returns.

Seeing more opportunity than risk

After the closing bell on Thursday, I caught some expert commentary that made sense to me. A day of weakness in both stocks and bonds tends to happen towards the end, not the beginning, of a bear period. This is the case because investors are more likely to panic after failing to deal with losses for a while, not when the markets are hovering near all-time highs and overdue for a correction.

To confirm the hypothesis, I decided to check the data. Over the past three to four decades (as far back as I could find reliable daily performance information), a simple 50/50 portfolio of stocks and long-term treasuries returned an average of 9.9% per year. However, the one-year forward gains were much higher following days in which stocks and bonds tanked at the same time, as they did on May 5.

The following bullet points summarize my observations, and support the idea that stock-and-bond portfolios could be facing a period of outperformance in the next 12 months:

- Aside from May 5, stocks and bonds sold off by more than 2.5% on the same day only twice since the mid-1980s: March 2020 and March 1996. In those two cases, forward one-year gains in a 50/50 portfolio were a rich 30% and 18%, respectively.

- Stocks and bonds sold off by more than 2.0% on the same day four times since the mid-1980s: both dates mentioned above, plus July 1996 and August 1990. Forward one-year gains in a 50/50 portfolio averaged 24% in these cases.

- Stocks and bonds sold off by more than 1.5% on the same day 22 times since the mid-1980s, including in early 2009 (end of Great Recession bear). Forward one-year gains in a 50/50 portfolio averaged 14% in these cases, with maximum of 30% in 2020 and minimum of -4% in 1987.

Final words

I have not been this hopeful about investing in a multi-asset class strategy in a while. The 2020 pandemic caused market distortions that put into question the feasibility of a stock-and-bond portfolio — namely, historically low yields and historically high stock valuations. Now, the market landscape seems to be normalizing from a period of lavish but unsustainable liquidity in the system.

Does this mean that AOK will skyrocket from current levels? It is hard to tell, since timing bottoms with any consistency is nearly impossible. This is why, to the title of this article, I added the phrase “buy this dip and the next“. That is: if AOK dips further from here, I believe that owning shares of the ETF becomes even more compelling.

[ad_2]

Source links Google News