[ad_1]

Nattakorn Maneerat/iStock via Getty Images

Thesis Summary

Tech stocks, tracked closely by the Invesco QQQ ETF (NASDAQ:QQQ), have been selling off since the beginning of the year. Many expect more pain, and continued underperformance of the tech sector. However, I am much more optimistic about the outlook for tech stocks and the market in general. In the following months, we should see further evidence of inflation easing, and the Fed will start to turn back on its tightening talk, which will be a boon for tech and growth.

Tech Takes A Breather

Tech stocks outperformed all other sectors over 2020 and most of 2021. A combination of an accelerating transition to digital, pushed by the pandemic, and unprecedented stimulus, favors risk assets and makes growth stocks more attractive. This took the Nasdaq to almost 16,500 points.

All was well and good until inflation started to show its ugly head, and the Federal Reserve had to begin the inevitable taper talk. Since its ATH, the Nasdaq is down close to 20%, and many market darlings have come down over 60% since their peak.

However, just as the Fed announced a 25 bps rate hike, the market, led by the Nasdaq, has had one of its best days in months.

Why Tech Will Come Roaring Back

Last week we got the latest inflation numbers, with CPI coming in at a 7.9% YoY increase, as expected. Comparisons are being made to the 1970s runaway inflation, but if you are familiar with my work, I don’t think we will see this materialize over the next few months.

For inflation to spiral out of control, the economy has to be growing, and this has to be reflected in wages. I already pointed out to my subscribers how the most recent employment data showed a very modest monthly increase in wages. On top of that, the Fed is fighting an inverting yield curve, which could be signaling the beginning of a recession. Most importantly though, I don’t believe inflation can be sustained in the long run.

First off, there are concrete reasons why inflation has been so high. All this YoY data is comparing inflation to last year when the world was amid a global pandemic, which also prompted unprecedented fiscal stimulus. On top of that, inflation has been pushed much higher by energy prices and housing, both of which could come down quickly in a recession.

Energy, while probably heading higher in the long term, is overstretched, and the US and other countries are already accessing their reserves. Housing prices have also come up significantly, and could quickly pop down with higher rates.

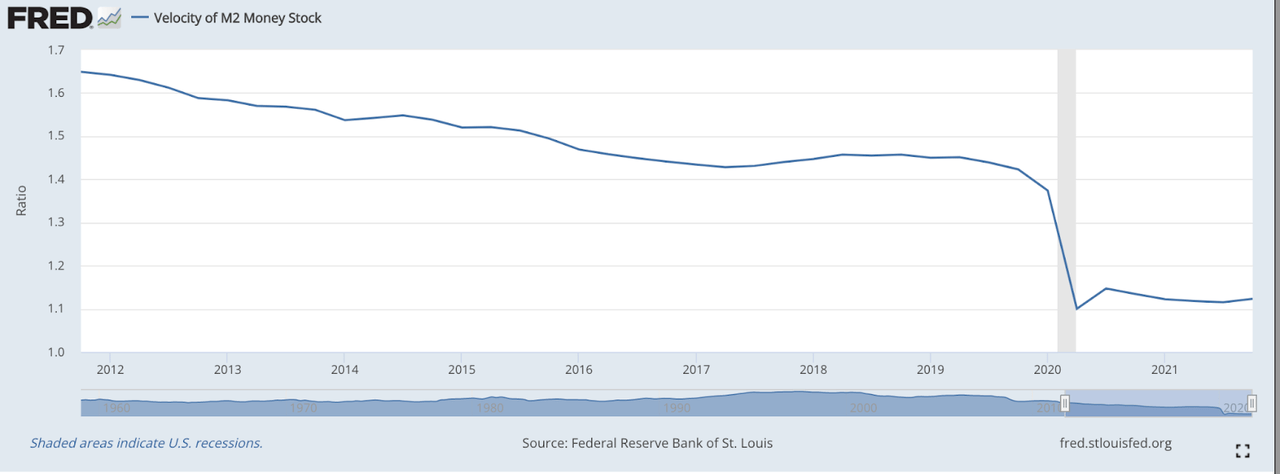

Ultimately though, the most important factor that the Fed continues to fight is a falling velocity of money:

Money Velocity (St. Louis Fed)

The Fed can control the quantity of money, but not where it moves. There is abundant liquidity, but it isn’t going to be spent, as entities and people are already trying to deleverage. The economy has been “stuck” like this since 2008. By lowering rates, the Fed has prevented the natural deleveraging cycle, which frees up new capital for investment.

Instead, we have a “zombie economy” that is incapable of producing meaningful growth. This happened in Japan, the USA, and we can now see evidence of a growth slowdown in China.

Liquidity Is On its Way

The stock market has been reflecting this new reality over the last few months, with indexes and individual stocks both down significantly from their ATHs. However, remember that the market is forward-looking. In the next 2, 3, 4 or 6 months, what now seems like headwinds will provide tailwinds for stocks.

As inflation eases, rate hike talks will be wound down, and we may instead get more stimulus. China is already cutting rates to bolster its economy, and this liquidity will be felt around the world. With falling inflation and slowing rates, the Fed will have no choice but to turn the printing press back on.

On top of that, the Ukraine-Russia conflict adds another excuse for the Fed to ease monetary policy, or at least not raise rates. Alternatively, if things get better soon, as could be the case, with Russia and Ukraine already engaging in peace talks, the market will react well to this.

Ultimately, the worst seems to have been priced in already. Less stimulus, war and lower growth. Moving forward, even less bad news will be good news.

The QQQ is a wise choice

The QQQ provides a good vehicle to go overweight tech while keeping a diversified portfolio and getting exposure to some of the best companies in the world.

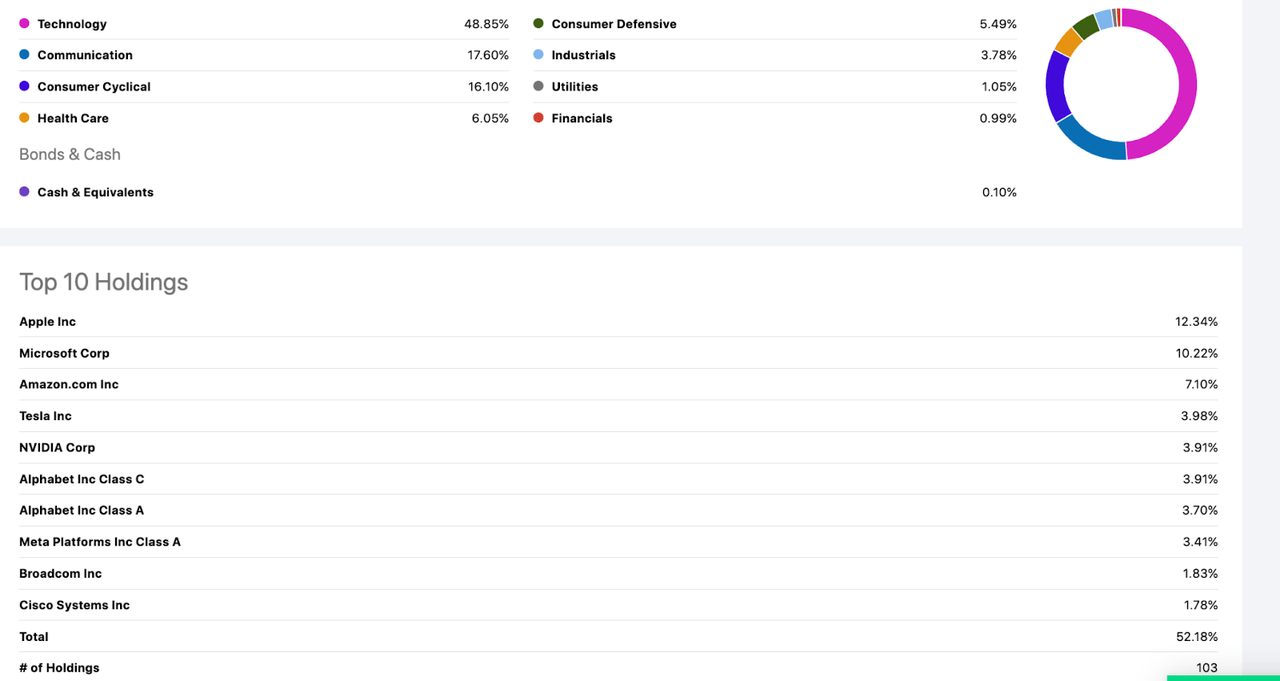

QQQ Holdings (Seeking Alpha)

Almost 50% of the stocks in the QQQ belong to the tech sector, and 17% are communications, which can also be seen as tech. This allows investors to dip their feet back into tech, without suffering from the wild volatility that we have seen in individual stocks.

Most importantly though, the QQQ has a healthy exposure to the mega-cap FAANGs, which are still great investments. Many of these stocks have come down significantly from their ATHs, making their valuations much more reasonable. Stocks like Apple Inc. (AAPL), Microsoft Corporation (MSFT) Meta Platforms (FB), and Alphabet (GOOGL) have strong balance sheets and growing cash flows. Even in a tighter monetary environment, these are good investments.

Takeaway

Technology will continue to outperform in the long run, regardless of monetary conditions and macroeconomic factors. The world is moving in a clear direction, and it is being led by new technologies. Things like AI, data and robotics will change the makeup of our economy in the next decade, now is the time to get in on the ground floor.

[ad_2]

Source links Google News