[ad_1]

Sanjog Mhatre

Overview

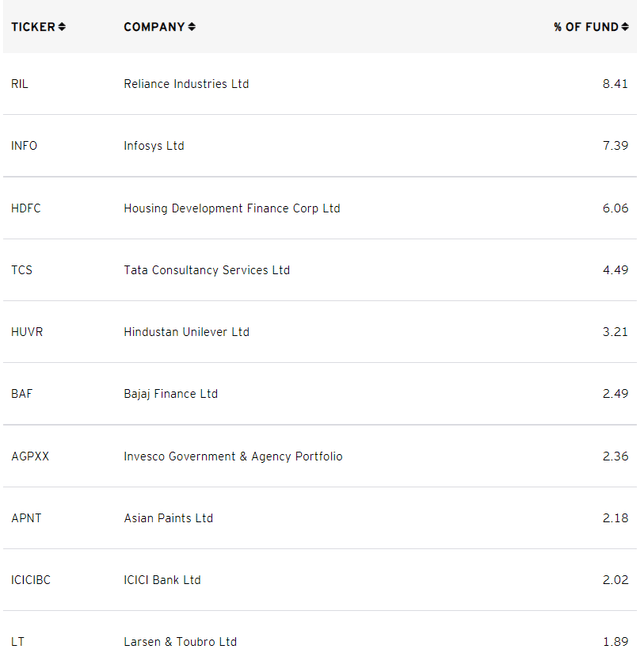

The Invesco India ETF (NYSEARCA:PIN) provides single-country exposure to the Indian stock market. As of the 14th of September 2022, the fund was invested in approximately 150 different stocks which includes popular names such as Reliance Industries and Infosys.

Reliance Industries is the crown jewel in the Indian stock market and is the largest holding of the fund at 8.41%. Reliance is one of the most profitable companies in India and is led by Mukesh Ambani, a popular Indian billionaire.

Top 10 Holdings (Invesco)

The fund has a high total expense ratio of 0.78% per annum which is more expensive than the iShares MSCI India ETF (0.65% per annum) and the Franklin FTSE India ETF (0.19% per annum) which provide similar offerings.

The iShares MSCI India ETF is managed by BlackRock which is one of the largest asset managers in the world. BlackRock is known for providing better liquidity than other asset managers due to higher assets under management and therefore higher trading volume in its ETFs.

Franklin Templeton is a specialist in emerging markets and can provide the service at a cheaper total expense ratio than other ETF providers.

BlackRock and Franklin Template are both good alternatives to Invesco when considering their total expense ratios.

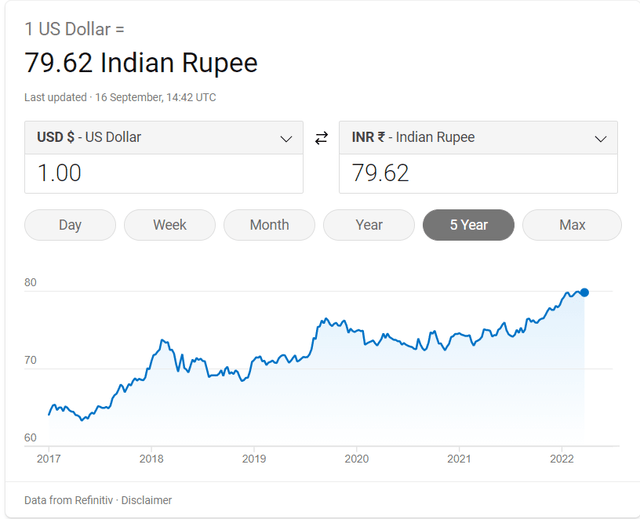

A strengthening dollar will remain a drag on returns

The fund’s NAV is reported in U.S. dollar and therefore an appreciation of the US dollar (USD) against the Indian Rupee (INR) will reduce the value of securities denominated in INR.

Currency risk is a key factor to consider when investing overseas. If you are interested in learning more about this, the fund’s annual report provides some detail on currency risk here.

Now we can see that USD has appreciated considerably against the INR over the last 5 years and especially in the last year.

USD/INR exchange rate (Google)

Back in 2017, the USD/INR exchange rate was 64.11 and has increased to 79.62 at today’s exchange rate representing a near 25% increase in USD.

The strength of the US dollar in recent months is partly a function of monetary policy tightening by the Federal Reserve but it’s also a function of the US economy’s greater resilience.

In times of macroeconomic uncertainty, US investors will generally sell their foreign investments and keep their cash in USD – a safe-haven currency. This capital outflow trend is expected to continue until the Federal Reserve stops tightening and will remain a drag on the fund’s return.

That said, the appreciation of the dollar can have some benefits too. For international companies in India, a depreciation of the INR means two things.

First, the sales and profits from their overseas business, when translated back to INR, will be inflated. Second, exporters to the US (and other dollar markets), should become more cost competitive.

For instance, a company such as Infosys (INFY) (the 2nd largest holding in the fund) generated more than 60% of its annual revenue in FY 2022 from North America. An appreciation of USD against INR is beneficial for Infosys as its USD revenues will be translated into higher INR revenues.

Importers are likely to be the biggest losers of US dollar appreciation as it will increase input costs and squeeze margins.

Having said that, India’s largest import in 2021 was mineral fuels at 30% which includes coal, oil and gas. There have been some reports that India has buying Russian oil and gas on the cheap which is likely to protect the fund’s holdings from the energy crisis plaguing western economies.

Conclusion

The Invesco India ETF provides single-country exposure with a high total expense ratio. Other ETF providers might be a better bet. The strengthening of the US dollar against the Indian Rupee will remain a drag on returns as capital outflows continue. However, an appreciation of the dollar will benefit some international companies in the fund.

[ad_2]

Source links Google News