[ad_1]

Julio Ricco/iStock via Getty Images

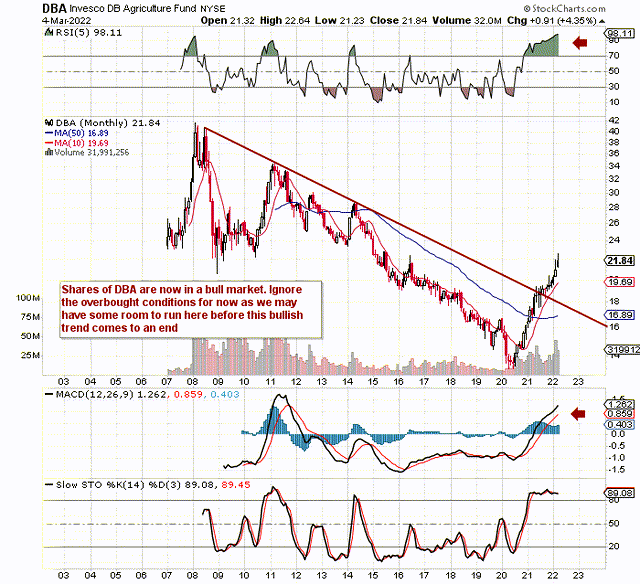

If we look at a long-term chart of Invesco DB Agriculture ETF (DBA), we can see that shares have broken out above their multi-year cycle trend-line. Although shares look overbought on the RSI due to the sustained rally which has taken place over many months now, this is not a sign in itself that a top is near. The reason being is that the fund’s MACD indicator which is now well above the zero line should attract new investors to the fund here. Furthermore, there isn’t any significant divergence with respect to the indicator’s moving averages which means the probability is high that this bullish trend will indeed continue.

DBA fund in bullish mode (StockCharts.com)

The momentum on the technical chart has been fueled by strong asset flow growth which still is outperforming the asset class average. AUM grew by almost 27% over the past 30 days alone whereas the average fund in this asset class grew its inflows by just over 22%. Although investors may bemoan the fact that DBA does not pay a dividend and has an above-average expense ratio of 0.85%, this fund has significantly more assets under management (Now, well over $1.1 billion) compared to other funds in this area.

Suffice it to say, we continue to place the fund’s liquidity of more importance over competing funds for the following reason. For example, the cost of selling and buying the ETF is directly correlated to the width of the bid/ask spread. If the spreads are not tight, one is essentially paying more for the shares because getting filled at the mid-point is practically impossible. Sometimes dividend growth investors can forget this in that every time capital is reinvested back into an illiquid fund, profit is essentially being lost because of the price being paid for the shares.

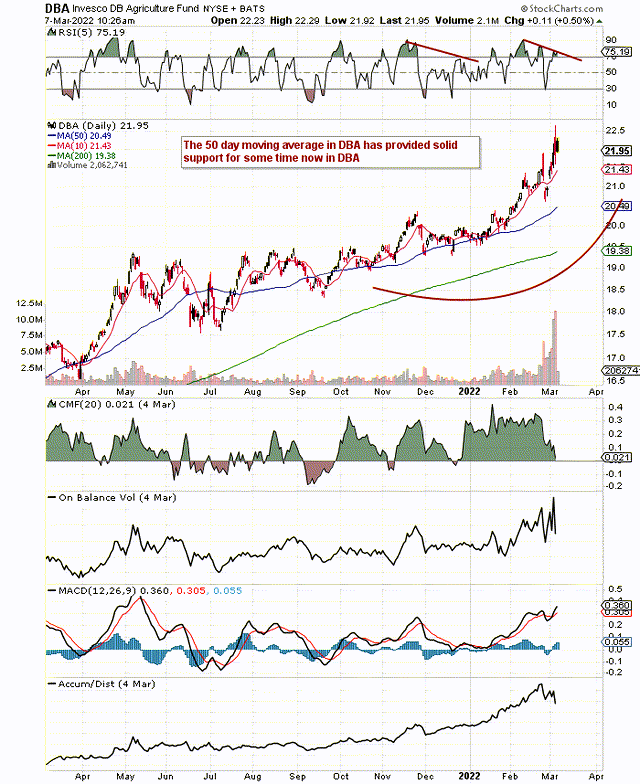

If we go to the daily chart, we can see that DBA’s recent rally has spiked shares well above their principal moving averages. Although volume trends, as well as money flow, remain in bullish mode, the fund’s momentum indicator may be insinuating (where we have a divergence) that a short-term down move may be at hand. Late last year, however, we had a similar set-up but the fund’s price did not act on the momentum divergence. Suffice it to say we can use the fund’s liquidity and more specifically in its options to improve our probabilities here from a long perspective.

Strong upmove in DBA (StockCharts)

What we would be looking at here would be the sale of the $22 at-the-money puts in the July cycle which currently trades for approximately $1.50 per contract. This would give us a cost basis of roughly $20.50 per share of the ETF which brings us right in line with the fund’s 50-day moving average. Some investors may question why we would go to a cycle (July) which is 130 days to expiration when the derivatives industry, in general, is built on more short-term strategies. Options are usually sold over a monthly if not a weekly basis to take advantage of theta decay, so here are some points to the contrary:

- The most obvious reason is that it lowers our breakeven. Longer-dated options have more extrinsic value which means the option seller receives more premium when the position is initially opened.

- Furthermore, the longer time frame gives the investor more time to defend the position. Here is where extrinsic value helps us in that the value of the option decays at a slower rate compared to near-term contracts. This is what we want if indeed we have to roll those options (by buying them back as inexpensively as possible) to a further cycle out in time.

- All things remaining equal, longer-dated at-the-money options have a higher vega than near-dated options. With the July cycle currently reporting IV of close to 30% (above average for DBA), a contraction in implied volatility will earn more money (vega) on a relative percentage basis over near-dated contracts. Suffice it to say, the investor always has the option to take off the contract early if indeed a vol contraction leads to a significant reduction in the price of the put contract.

Therefore, to sum up, Invesco DB Agriculture ETF attracts us for a number of reasons. The fund has more liquidity compared to its counterparts and momentum remains strong on the back of robust AUM growth. Furthermore, the recent spike in implied volatility enables investors to put long deltas to work here at a favorable cost basis. We look forward to continued coverage.

[ad_2]

Source links Google News