[ad_1]

Note: This article was released to members 1-month ago.

Investment thesis

Investors should swap from MORL to MRRL due to MORL’s rising premium, while MRRL no longer has a liquidity problem.

MORL and MRRL track the same index

With ETRACS Monthly Pay 2xLeveraged Mortgage REIT ETN (MORL) has suspended new shares of its note (see “What To Do About MORL?”) last year, it gained the ability to trade at a significant premium over its “indicative value”, which is basically its NAV.

Given that both MORL and ETRACS Monthly Pay 2xLeveraged Mortgage REIT Series B ETN (MRRL) track the same underlying index (the MVIS Global Mortgage REITs Index), there is no fundamental reason for an investor to hold MORL over MRRL since MRRL yields more than MORL at market price and also has less chance of suffering capital loss due to premium reversion.

Of course, there may be non-fundamental reasons to favor MORL, such as chasing momentum or somehow playing on investor psychology of MORL being the much more well-known of the two funds (MORL has 16K Seeking Alpha followers compared to 3K for MRRL).

MRRL no longer has a liquidity problem

Another reason for favoring MORL, which I mentioned in “What To Do About MORL?” last year was the higher liquidity of MORL versus MRRL:

Active traders may still prefer MORL because of its higher liquidity.

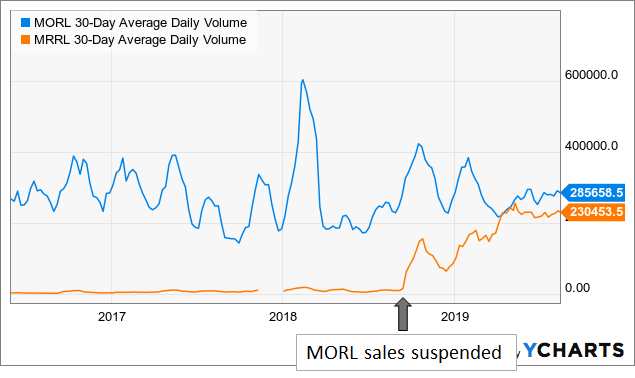

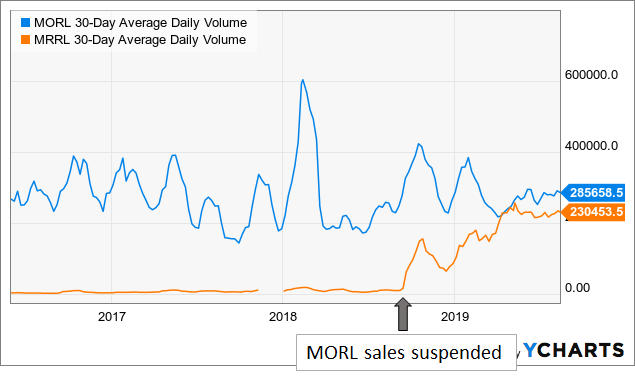

That was true when the article was written back in September of last year when MORL traded an average of 267K shares daily compared to under 10K for MRRL.

However, today, the volume difference has nearly completely disappeared, and with it, another advantage of holding MORL over MRRL.

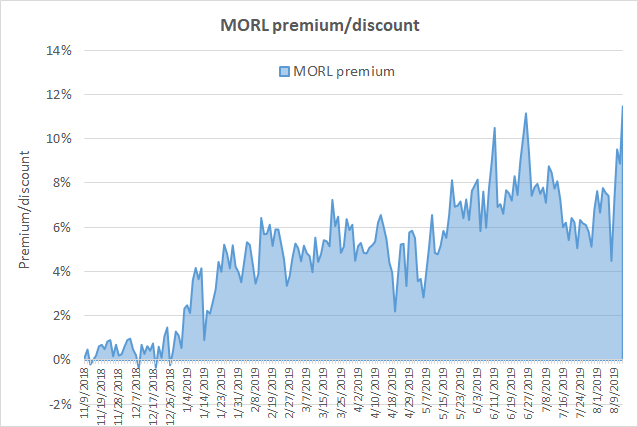

MORL’s premium is at a record high

This is why the continual presence of a premium of MORL over MRRL is puzzling. Yesterday, MORL closed at a +11.48% premium over MRRL, the highest on record.

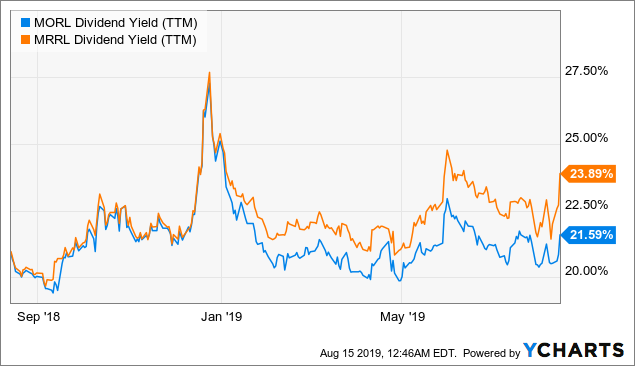

Do investors not realize that they’re getting a higher yield of 23.89% for MRRL compared to 21.59% for MORL? (Note that the yield difference with the data above may be due to differences in how the yield is calculated).

Summary

With MORL’s premium reaching a record high, while MRRL no longer suffers from a liquidity problem, my suggestion would be to swap out of MORL into MRRL, if you own it. More advanced traders could consider a long MRRL/short MRRL pair. iBorrowDesk shows 1.8 million shares of MORL available to short at a 3.1% fee, at the time of writing.

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage market-beating closed-end fund (CEF) and exchange-traded fund (ETF) portfolios targeting safe and reliable ~8% yields to make income investing easy for you. Check out what our members have to say about our service.

At the CEF/ETF Income Laboratory, we manage market-beating closed-end fund (CEF) and exchange-traded fund (ETF) portfolios targeting safe and reliable ~8% yields to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

Disclosure: I am/we are long THE PREMIUM PORTFOLIOS. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News