[ad_1]

Sergi Nunez

(This article was co-produced with Hoya Capital Real Estate)

Introduction

When investors buy assets denominated in a currency other than their own, they take on an extra risk/reward factor: currency rate fluctuations. While some funds attempt to hedge away that risk, they only affect the value of their portfolio. As this article by Morgan Stanley explains, currency movements affect the bottom line of the companies themselves.

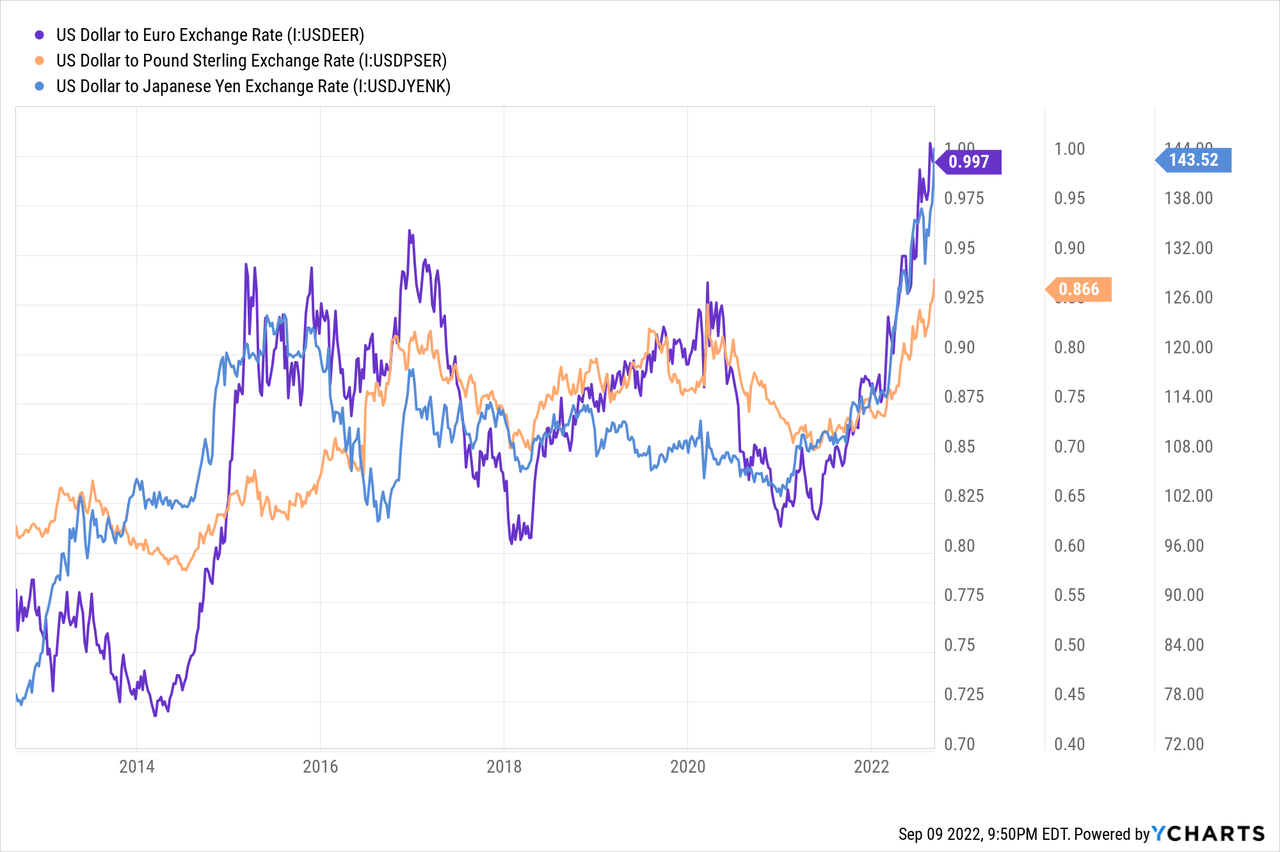

Since bottoming out post-COVID, the USD has been strong against these three major currencies, breaking “par” with the EUR in July for the first time in 20 years!

A recent story in The Wall Street Journal, reported on the USDs strength:

And the dollar has soared this year, in contrast to its declines during the inflation-plagued 1970s. The WSJ Dollar Index has gained in five of the past six months and is up nearly 13% in 2022. It has climbed past parity with the euro for the first time in 20 years, hit its strongest against the pound since 1985 and dented the Japanese yen, which traded at its lowest level since August 1998. The dollar ranked behind only natural gas among the best-performing assets in August, according to Deutsche Bank analysts.

A stronger USD is represented by upward lines. During any period when the USD rises in value relative to foreign currencies, a hedged ETF should result in higher returns in their foreign equity investments. When the USD loses value relative to foreign currencies, an unhedged ETF should do better.

Hedging ETFs use currency forwards to minimize this risk. A currency forward lets the portfolio manager lock in a specific exchange rate in the future. If the foreign currency has declined by the time that date arrives, the ETF will realize a gain on the forward contract. The reverse is true if the foreign currency rises, the value of the contract goes down by the corresponding amount. The result, then, is that most of the impact of exchange rate movements get netted out. Some studies have suggested currency fluctuations generally balance out over the long run, but more recent analysis suggests that hedged funds do outperform unhedged portfolios regardless.

Popular methods for hedging currency are forward contracts, spot contracts, and foreign currency options. Fully hedged ETFs are designed to mitigate the currency exposure from an investment, regardless of market conditions. While this may impact returns positively or negatively, it can reduce overall volatility-and that can be critical for portfolio values.

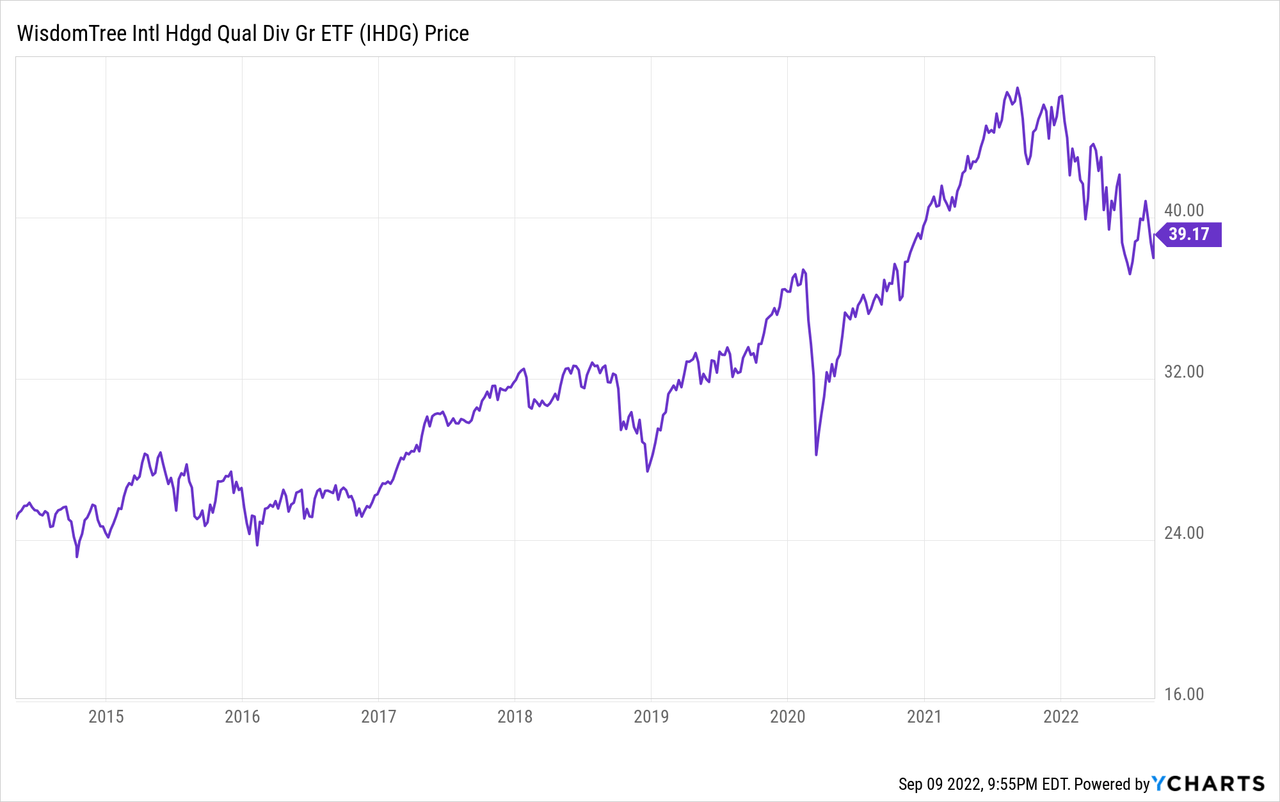

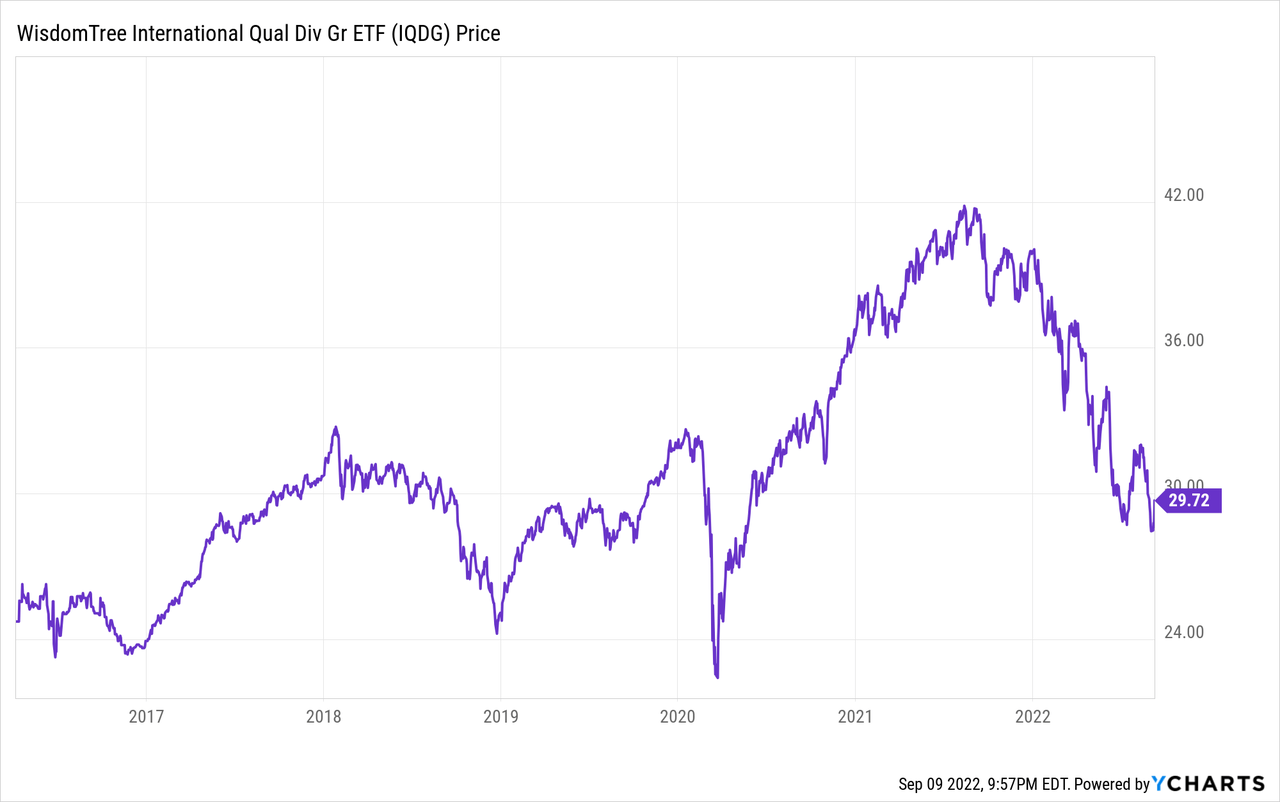

This article will compare the WisdomTree International Hedged Quality Dividend Growth Fund (NYSEARCA:IHDG) against the same strategy without hedging, as represented by the WisdomTree International Quality Dividend Growth Fund (BATS:IQDG). Since IQDG started, the hedged version has performed better, and was the case since my article in March. As the saying goes, sometime the music will stop and non-hedging strategy will outperform.

WisdomTree International Hedged Dividend Growth ETF review

Seeking Alpha describes this ETF as:

WisdomTree International Hedged Quality Dividend Growth Fund is co-managed by Mellon Investments Corporation and WisdomTree Asset Management. It invests in public equity markets of global ex-US/Canada region. It invests directly and through derivatives in stocks of companies operating across diversified sectors. The fund uses derivatives such as futures, forwards to create its portfolio. It invests in growth stocks of companies across diversified market capitalization. The fund invests in dividend paying stocks of companies. The fund seeks to track the performance of the WisdomTree International Hedged Quality Dividend Growth Index. IHDG started in 2014.

Source: seekingalpha.com IHDG

IHDG has $1.2b in AUM and shows a 4.6% yield currently. Fees come to 58bps.

WisdomTree International Hedged Quality Dividend Growth Index Review

IHDG uses in-house index that the provider describes as:

The WisdomTree International Hedged Quality Dividend Growth Index is designed to provide exposure to the developed market companies while at the same time neutralizing exposure to fluctuations between the value of foreign currencies and the U.S. dollar. The Index is comprised of the top 300 companies from the WisdomTree International Equity Index with the best combined rank of growth and quality factors.

Source: wisdomtree.com index:wtidgh

Important construction rules for the Index include:

- The growth factor ranking is based on long-term earnings growth expectations.

- The quality factor ranking is based on three-year historical averages for return on equity and return on assets.

- Companies are weighted in the Index based on annual cash dividends paid. These modified capitalization-weighted indices that employ a transparent weighting formula to magnify the effect that dividends play in the total return of the Indexes. There are “capping rules” that come into play to limit exposure at both the company and industry level.

The Index hedges its currency exposures to the USD by applying the published one-month currency forward rate. Forward currency or futures contracts are used to accomplish this task. Hedging results in lower returns, relative to an unhedged index, when the USD weakens vis-a-vis foreign currencies and provides higher returns when the USD is strong, as has been the case in recent years.

IHDG holdings review

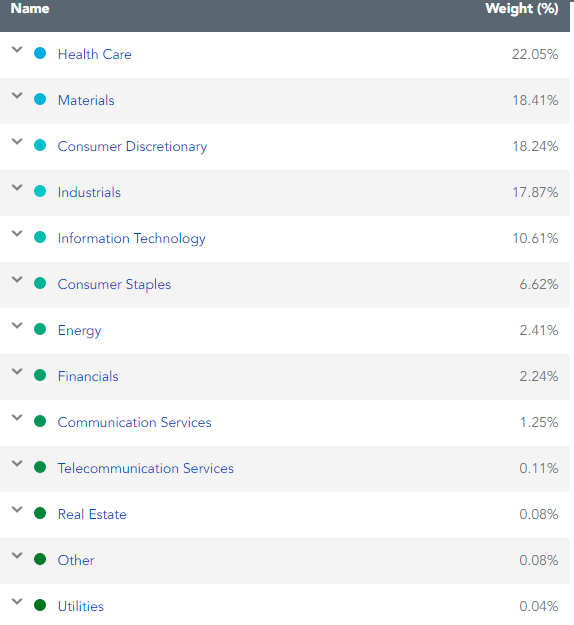

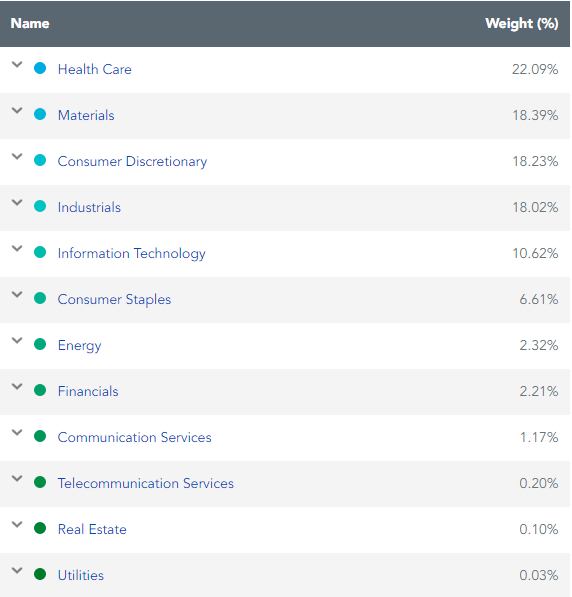

IHDG currently holds 245 stocks, broken down into these sectors.

wisdomtree.com IHDG sectors

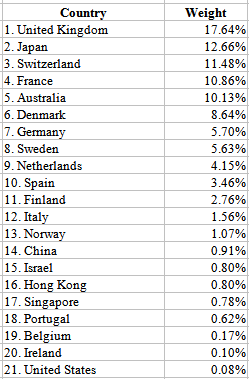

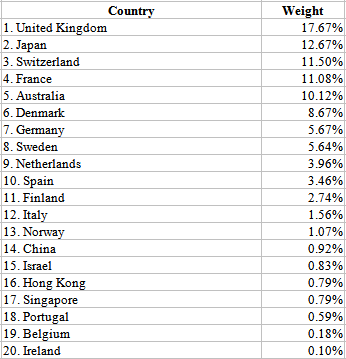

Country allocations provided are:

wisdomtree.com IHDG countries

The top 5 countries account for almost 63% of the portfolio. The largest currency exposure is to the Euro (29%), then the GBP. Along with the stocks held, IHDG has 44 currency hedges against 11 different currencies; all expire in early October.

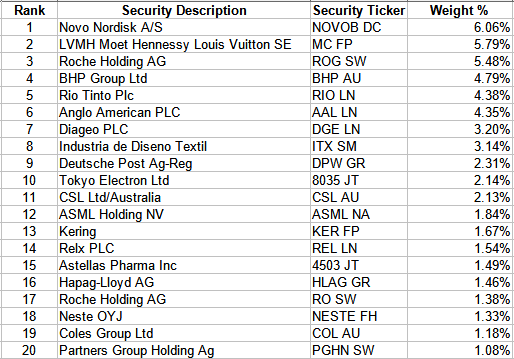

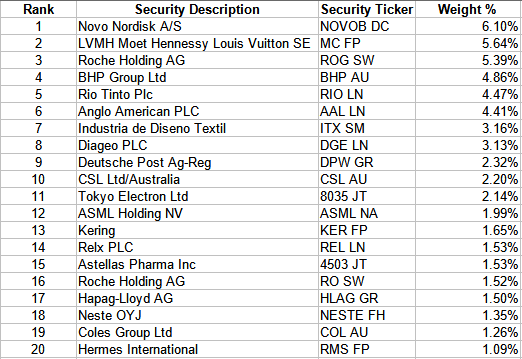

Top 20 holdings

wisdomtree.com; compiled by Author

Despite holding nearly 250 stocks, these stocks account for 56% of the portfolio.

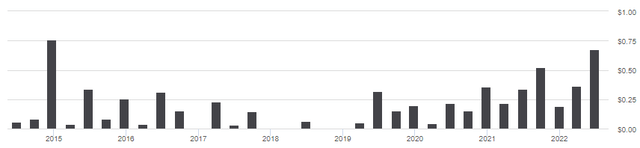

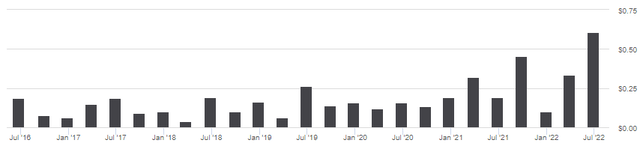

IHDG distribution review

seekingalpha.com IHDG DVDs

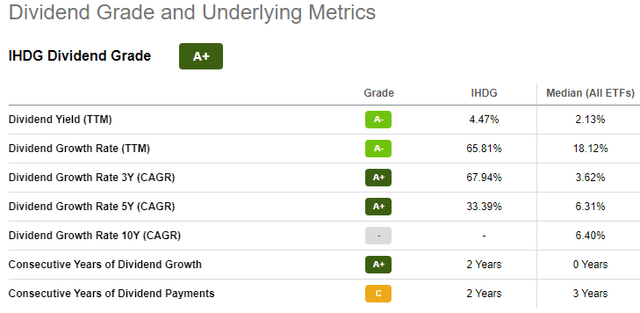

While showing improvement, IHDG’s payout history is very choppy so the current 4.5% yield isn’t set in stone for sure. Despite this pattern, Seeking Alpha giving the ETF an “A+”, probably based on the high payout growth numbers.

seekingalpha.com IHDG scorecard

WisdomTree International Quality Dividend Growth Fund review

Seeking Alpha describes this ETF as:

WisdomTree International Quality Dividend Growth Fund is co-managed by Mellon Investments Corporation and WisdomTree Asset Management, Inc. It invests in public equity markets of global ex-US/Canada region. The fund invests in stocks of companies operating across diversified sectors. It invests in growth stocks of companies across diversified market capitalization. It invests in dividend paying stocks of companies. It seeks to track the performance of the WisdomTree International Quality Dividend Growth Index. IQDG started in 2016.

Source: seekingalpha.com IQDG

IQDG has $313m in AUM and sports a higher yield than IHDG at 5.2%. Fees are better too at only 42bps.

WisdomTree International Quality Dividend Growth Index Review

IQDG also uses in-house index that the provider describes as:

The WisdomTree International Quality Dividend Growth Index is a fundamentally weighted Index designed to provide exposure to dividend paying developed market companies. The Index is comprised of the top 300 companies from the WisdomTree International Equity Index with the best combined rank of growth and quality factors. The growth factor ranking is based on long-term earnings growth expectations, while the quality factor ranking is based on three year historical averages for return on equity and return on assets. Companies are weighted in the Index based on annual cash dividends paid.

Source: wisdomtree.com index:wtgdxg

IQDG holdings review

For this ETF, the sector allocations are:

wisdomtree.com IQDG sectors

I will compare these against IHDG later. The country allocation is:

wisdomtree.com IQDG countries

Except for France (.22%), the other countries vary by less than .002%.

Top 20 holdings

wisdomtree.com; compiled by Author

Almost matching IHDG, the Top 20 equal 57% of the portfolio for IQDG. There are slight differences in the weights and order compared to IHDG, which is interesting since the only difference is supposed to hedging.

IQDG distribution review

seekingalpha.com IQDG DVDs

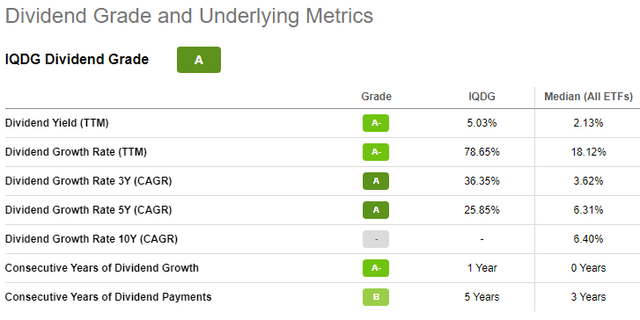

Despite a more stable picture, IQDG only gets an “A” rating from Seeking Alpha.

seekingalpha.com IQDG scorecard

Comparing IHDG Vs. IQDG

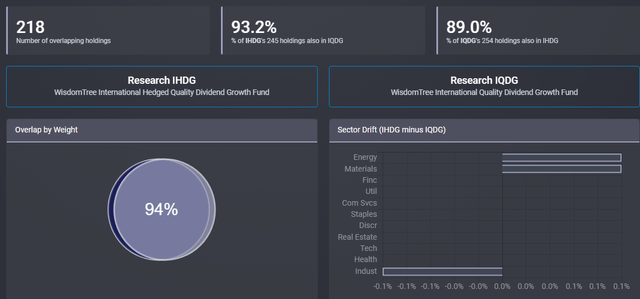

ETFRC.com

This provided another surprise except for the fact that most ETFs that follow an Index do not own the whole index. Despite that fact, sector allocations differ little between the two ETFs. That also shows in the stocks owned.

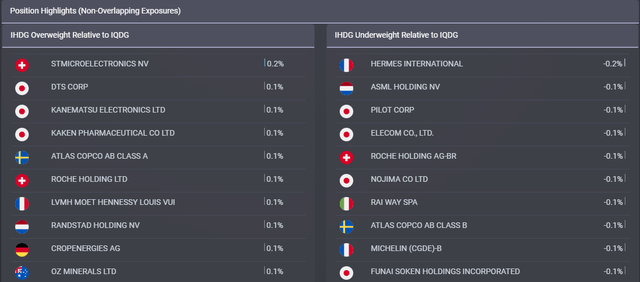

ETFRC.com

In either direction, the largest weighting difference is .2%. From reviewing both set of holdings, this only refers to stocks held by both ETFs.

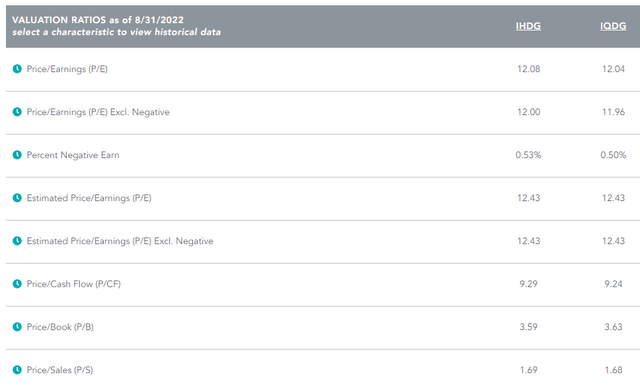

WisdomTree provides an ETF comparison tool from which the next chart was taken. As expected, their equity ratios are very close.

wisdomtree.com comparison tool

Portfolio strategy

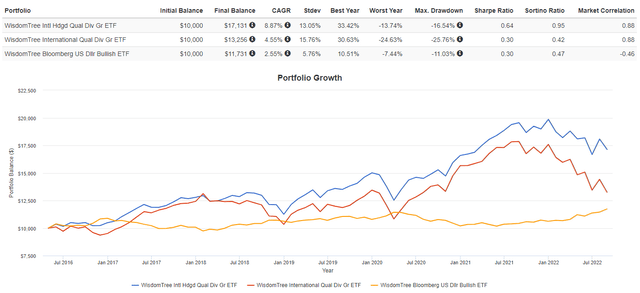

PortfolioVisualizer.com

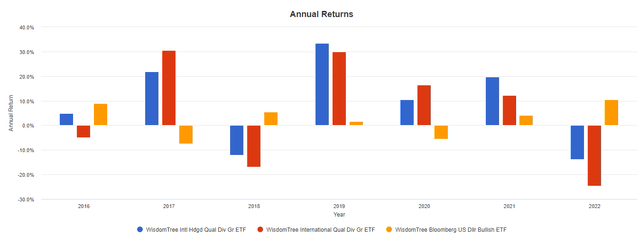

Along with the two ETFs, I included the WisdomTree Bloomberg U.S. Dollar Bullish Fund (USDU) to give an idea of the USD’s movement. When looking at data by year, we see the following.

PortfolioVisualizer.com

In theory, IHDG should outperform IQDG when USDU is up, and visa-versa, which indeed happened. The monthly data isn’t so clean.

Final thoughts

How do you think the USD will perform against the currencies it is heavy exposed to, the EUR, GBP, JPY, and CHF? Recent inflation number are:

| Country | Last | Prior | Month |

| United States | 8.5 | 9.1 | JUL |

| United Kingdom | 10.1 | 9.4 | JUL |

| Euro Area | 9.1 | 8.9 | AUG |

| Japan | 2.6 | 2.4 | JUL |

The rate of inflation and what that country/area is doing with interest rates to fight it heavily influence how exchange rated adjust to each others as investors attempt to earn the best return. Inflation and interest rates are two of the six factors mentioned in 6 Factors That Influence Exchange Rates

Just published from Fred Piard, IHDG: A Global Dividend ETF Mitigating Currency Risks, compares IHDG to other International dividend growth or high-yield ETFs, as opposed to this article using IQDG as the offset.

[ad_2]

Source links Google News