[ad_1]

Drew Angerer

The iShares U.S. Infrastructure ETF (BATS:IFRA) is a relatively low maintenance ETF with a solid yield and a set of attractive exposures. Within it are lots of natural monopolies, and companies with stable, government mandated economics. The portfolio is highly diversified, with the largest allocation accounting for 1.04% of the portfolio. The yield is likely to be very solid, and the ETF has quite low management fees. If you’re unsure about the economic environment, IFRA might be one to look into for yourself.

Brief Breakdown of IFRA

IFRA is about 50:50 allocated to companies that operate or own infrastructure and those that provide services to infrastructure companies. The latter is maybe later in the cycle, but ultimately the infrastructure markets are still pretty attractive for a lot of market actors. On the private side there continues to be a lot of sponsor interest, and on the public side it’s an uncontroversial interventional lever that the US might want to pull, and might be better able to do it now that money has a better reason to rush into treasuries and dollars and finance the deficit. Overall, from a market direction perspective, IFRA isn’t on a terrible foot at all.

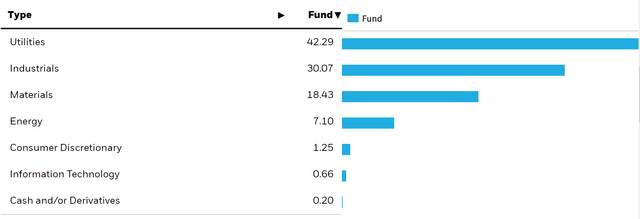

Sector Breakdown (iShares.com)

The breakdown on a sector basis is unsurprising. A lot of utility exposures, including water utilities but also other utility companies, present a safe set of markets. Firstly, in many cases, companies are operating government concessions, and usually, a portion of the income if not all is based on a fixed remuneration scheme. Often the incentive for operators of these concessions is to provide as good of a service as possible and to maintain the assets, in some cases, there is scope for operators to propose capacity increases to grow their responsibilities and income. Regardless, the money needed to operate is relatively stable and compensated for by the government if they’re a regulated utility. In cases where the exposures are more traditional utilities, they are selling into households that while able to somewhat curb energy use, still need to use energy to live. Moreover, the reinvestment economics of utilities are interesting, with the scope to develop assets into the renewable energy transition that could claim nice multiples.

There are also industrials, which includes railway companies but also other logistics as well as the companies that make the 50% allocated to enablers of the infrastructure, including component manufacturers and construction companies. In general, mandates continue to grow internationally in various markets where capacity buildouts are happening at high rates. In the pulp industry, for example, world capacity could expand as much as 10% by 2024 thanks to investment happening as a consequence of the pandemic-related goods boom. Finally, materials companies represent 15% of the portfolio. This is the most volatile part of the portfolio and probably the most subject to cycle risks.

Conclusions

The yield is at 2% and the fee is at 0.3% which is below what you’ll typically see of iShares ETFs which average around 0.5%. The ETF is low maintenance from an ETF management point of view, and with the stability, it is likely to be low maintenance as part of your portfolio. Another nice thing about the overweight on infrastructure and utilities comes from the funding side: a lot of fixed income debt. With rates hiking and general macro concerns rising, there’s a lot defending this portfolio.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

[ad_2]

Source links Google News