[ad_1]

Finding the best ETFs is an increasingly difficult task in a world with so many to choose from. How can you pick with so many choices available?

Don’t Trust ETF Labels

There are at least 47 different Technology ETFs and at least 233 ETFs across eleven sectors. Do investors need 21+ choices on average per sector? How different can the ETFs be?

Those 47 Technology ETFs are very different. With anywhere from 18 to 323 holdings, many of these Technology ETFs have drastically different portfolios, creating drastically different investment implications.

The same is true for the ETFs in any other sector, as each offers a very different mix of good and bad stocks. Consumer Non-cyclicals rank first for stock selection. Real Estate ranks last. Details on the Best & Worst ETFs in each sector are here.

How to Avoid Paralysis by Analysis

We think the large number of Technology (or any other) sector ETFs hurts investors more than it helps because too many options can be paralyzing. It is simply not possible for the majority of investors to properly assess the quality of so many ETFs. Analyzing ETFs, done with the proper diligence[1], is far more difficult than analyzing stocks because it means analyzing all the stocks within each ETF. As stated above, there can be as many as 323 stocks or more for one ETF.

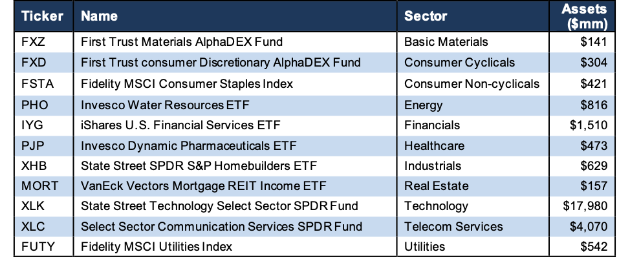

Anyone focused on fulfilling the fiduciary duty of care recognizes that analyzing the holdings[2] of an ETF is critical to finding the best ETF. Figure 1 shows our top-rated ETF for each sector.

Figure 1: The Best ETF in Each Sector

* Best ETFs exclude ETFs with TNA less than $100 million for inadequate liquidity

* Best ETFs exclude ETFs with TNA less than $100 million for inadequate liquiditySources: New Constructs, LLC and company filings

Amongst the ETFs in Figure 1, Fidelity MSCI Consumer Staples Index (FSTA) ranks first overall, State Street SPDR S&P Homebuilders ETF (XHB) ranks second, and VanEck Vectors Mortgage REIT Income ETF (MORT) ranks third. Fidelity MSCI Utilities Index ETF (FUTY) ranks last.

How to Avoid “The Danger Within”

Why do you need to know the holdings of ETFs before you buy?

You need to be sure you do not buy an ETF that might blow up. Buying an ETF without analyzing its holdings is like buying a stock without analyzing its business and finances. No matter how cheap, if it holds bad stocks, the ETF’s performance will be bad. Don’t just take my word for it, see what Barron’s says on this matter.

PERFORMANCE OF FUND’S HOLDINGS = PERFORMANCE OF FUND

Analyzing each holding within funds is no small task. Our Robo-Analyst technology enables us to perform this diligence with scale and provide the research needed to fulfill the fiduciary duty of care. More of the biggest names in the financial industry (see At BlackRock, Machines Are Rising Over Managers to Pick Stocks) are now embracing technology to leverage machines in the investment research process. Technology may be the only solution to the dual mandate for research: cut costs and fulfill the fiduciary duty of care. Investors, clients, advisors and analysts deserve the latest in technology to get the diligence required to make prudent investment decisions.

If Only Investors Could Find Funds Rated by Their Holdings

Our ETF ratings leverage our stock coverage. We rate ETFs based on the aggregated ratings of the stocks each ETF holds.

Fidelity MSCI Consumer Staples Index (FSTA) is not only the top-rated Consumer Non-cyclicals ETF, but is also the overall top-ranked sector ETF out of the 233 sector ETFs that we cover.

The worst ETF in Figure 1 is Fidelity MSCI Utilities Index ETF (MORT), which gets a Neutral rating. One would think ETF providers could do better for this sector.

This article originally published on February 7, 2019.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, sector, or theme.

[1]Ernst & Young’s recent white paper “Getting ROIC Right” proves the superiority of our holdings research and analytics.

[2]Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

Get our long and short/warning ideas. Access to top accounting and finance experts.

Deliverables:

1. Daily – long & short idea updates, forensic accounting insights, chat

2. Weekly – exclusive access to in-depth long & short ideas

3. Monthly – 40 large, 40 small cap ideas from the Most Attractive & Most Dangerous Stocks Model Portfolios

Both Ernst & Young and Harvard Business School demonstrate the superiority of our research in recent white papers.

See the difference that real diligence makes.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News