[ad_1]

Ibrahim Akcengiz

Author’s note: This article was released to CEF/ETF Income Laboratory members on October 16th.

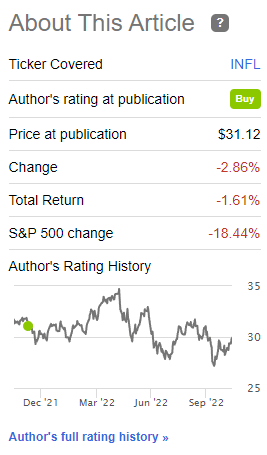

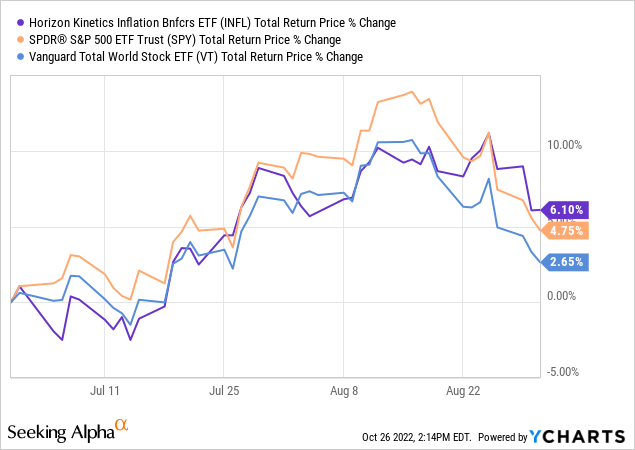

I last wrote about the Horizon Kinetics Inflation Beneficiaries ETF (NYSEARCA:INFL), an inflation-hedge equity ETF, in late 2021. At the time, commodity prices were surging, and inflation was starting to increase. Hedging against inflation seemed like a wise course of action, and INFL was meant to do just that.

INFL’s investment strategy is simple: invest in companies whose business models lead to strong revenue and earnings growth, and hence outperformance, when inflation is high and rising. INFL was a new, untested fund at the time, so I had some doubts about the effectiveness of said strategy, but settled on a buy rating.

Since last covering INFL, inflation has continued to increase, and the fund has significantly outperformed, as hoped. INFL’s strategy seems to be effective, so far at least.

Previous INFL Article

Inflation remains elevated, reaching 8.2% in September, which could potentially lead to further outperformance for the fund, and strong gains once sentiment recovers.

INFL’s strong performance track-record, proven investment strategy, and effectiveness as an inflation hedge, make the fund a buy. With a 2.0% dividend yield, the fund is not an effective income vehicle.

INFL Basics

- Investment Manager: Horizon Kinetics

- Dividend Yield: 1.90%

- Expense Ratio: 0.85%

- Total Returns CAGR Inception: 7.97%

INFL Overview

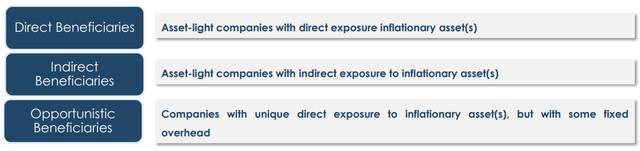

INFL is an actively-managed ETF, investing in companies with the potential to outperform as inflation rises, or in inflation beneficiaries. The fund’s strategy is quite particular, but effective, and explained in detail here.

In simple terms, the fund focuses on hard asset, capital light companies.

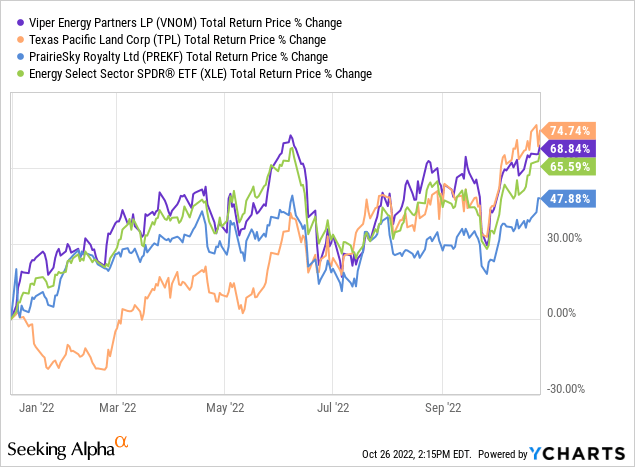

Hard asset companies are those that derive most of their revenues and earnings from a tangible asset base, hence hard asset. The Texas Pacific Land Corporation (TPL), the fund’s largest holding, is a perfect example of a hard asset company. TPL owns a lot of oil-rich land in the Texan Permian Basin, a hard asset, and earns most of its revenues from leasing said land.

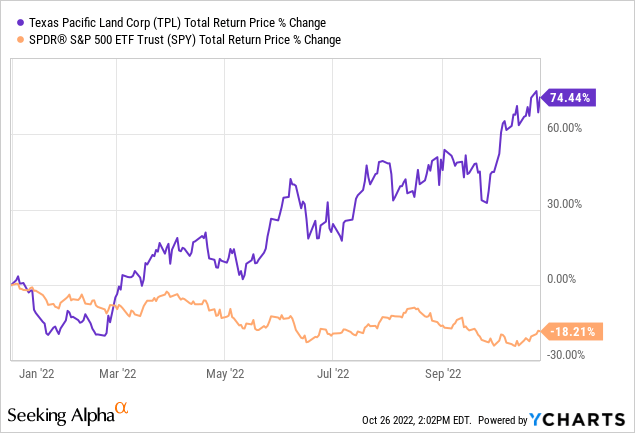

Hard asset companies tend to benefit from rising inflation, as rising prices allows them to more easily monetize said assets. TPL, for instance, earns a percentage of the market value of the oil and natural gas produced in its land. Higher energy prices means higher oil and natural gas market value, leading to higher revenues and earnings for the company. TPL directly benefits from higher (energy) prices, making it a solid inflation hedge, at least assuming inflation impacts energy prices. TPL has significantly outperformed YTD, a period of elevated inflation, as expected.

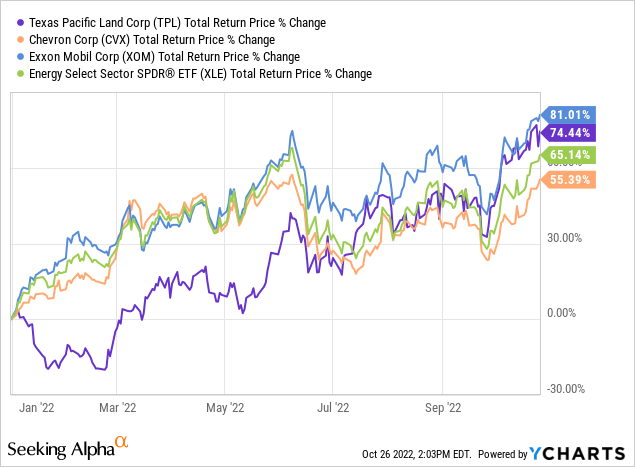

The fund further focuses on hard asset, capital light companies, defined as those with little capital needs. TPL is also a perfect example of capital light company. TPL owns the land and receives some royalties, but the actual oil and gas producers, companies like Exxon (XOM) and Chevron (CVX), handle all the operations and CAPEX. Exxon drills the well, transports the oil, pays the bills and does the necessary investment, TPL just receives a royalty check. As such, TPL’s operating expenses and CAPEX needs are very low, allowing the company to easily, and directly, benefit from rising prices. Exxon needs to worry about labor costs and financing needs, TPL does not, at least not to the same extent. Due to this, TPL benefits more, and more consistently, from rising energy prices than Exxon. In theory at least. TPL has very slightly underperformed relative to Exxon YTD, but outperformed relative to Chevron, and to the average U.S. energy company. I believe there is some merit, and some evidence, for focusing on capital light companies, as INFL does.

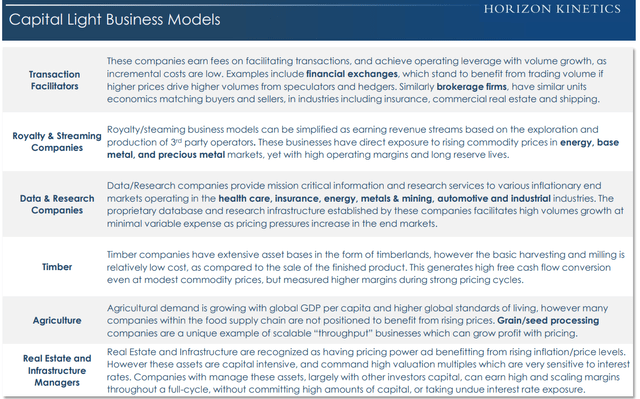

INFL invests in the following types of hard asset, capital light companies:

INFL

INFL’s management team has settled on the following six capital light business models:

INFL

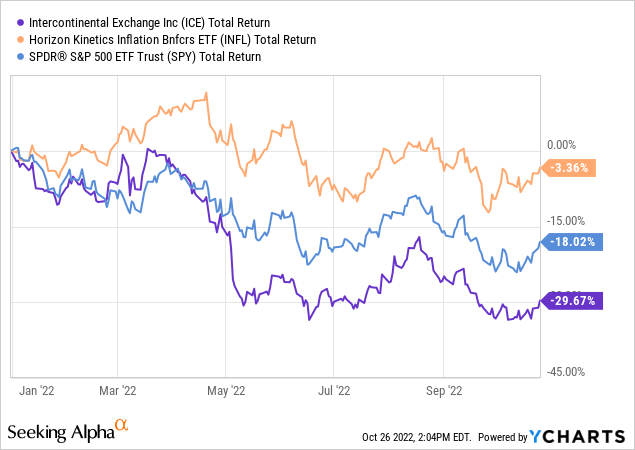

Of the above, Transaction Facilitators, including financial exchanges and brokerage firms, seem like the odd man out. Unclear to me why you would include these companies in an inflation-hedge fund, although there is some logic to this selection (read the rationale above). I said as much in my previous article on INFL, and, for what it is worth, the fund’s largest company in this classification, Intercontinental Exchange (ICE), has significantly underperformed since.

In my opinion, including Transaction Facilitators in an inflation-hedge ETF is an odd decision, but these are a relatively small portion of the fund’s holdings / value, accounting for just one of the fund’s top ten holdings, and few others. Even the best actively-managed funds will have their odd choices and underperforming investments, so these are not deal-breakers for myself. At least not considering the fund’s strong performance track-record, and clear investment strategy / rationale.

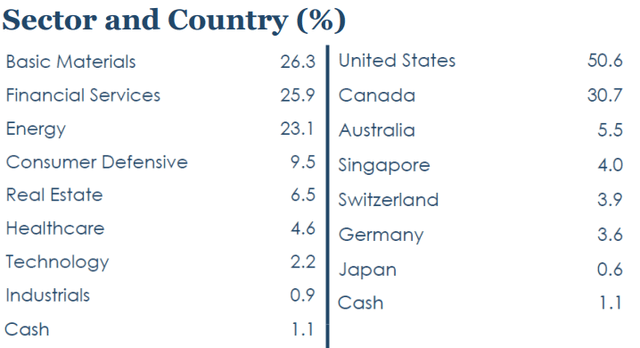

INFL’s holdings seem reasonably well-diversified, with investments in 40 different companies from several industries, and several countries. The fund is significantly overweight materials, financials, and energy, as well as U.S. and Canadian equities.

Being overweight materials and energy is natural for an inflation-hedge ETF. Financials are one of the largest equity industry segments, so it is natural for an equity ETF to include lots of financials. Finally, the fund is overweight the United States due to the large size of the country’s economy and equity market, and is overweight Canada due to the size of the country’s oil industry. INFL is a reasonably well-diversified fund, but diversification is lower than average for an equity fund.

INFL

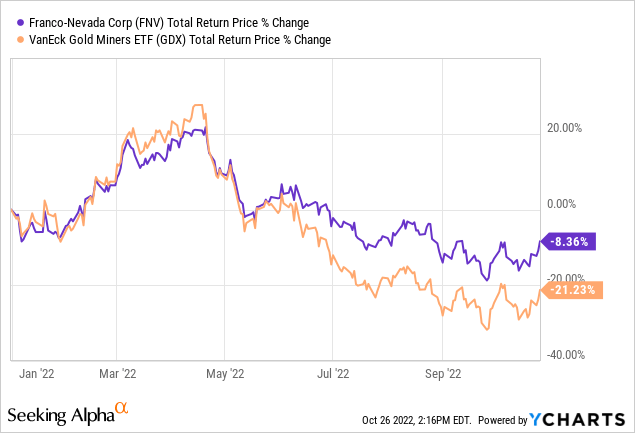

INFL’s largest holdings are generally reflective of its theme. As mentioned previously, the fund’s largest holding is TPL, which owns and leases oil-rich land in the Texan Permian Basin. TPL is a very self-evident hard asset, capital light company, and one with significant exposure to energy prices / inflation. Viper Energy Partners (VNOM) follows a similar business model. There is the Franco-Nevada Corporation (FNV), a gold royalty and streaming company. You also have Glencore (OTCPK:GLCNF), a more diversified mining company. As mentioned previously, there also is Intercontinental Exchange, which does not really fit in an inflation-hedge fund, in my opinion at least. Still, the vast majority of choices are reasonable, appropriate, and strong.

INFL

In my opinion, INFL’s investment strategy is reasonable, effective, and should lead to strong returns and outperformance during periods of heightened inflation. That has, indeed, been the case. Let’s have a look.

INFL – Performance Analysis

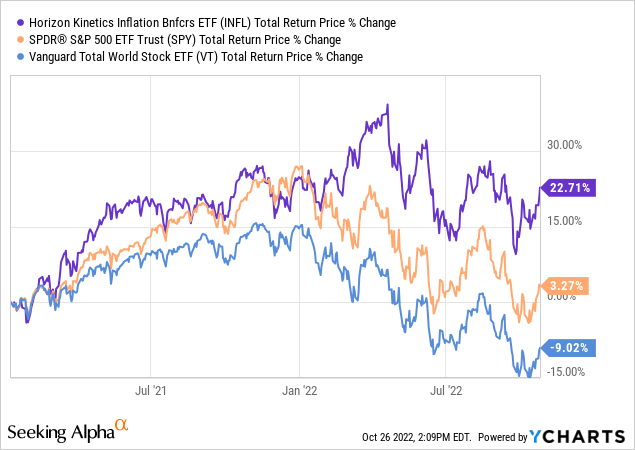

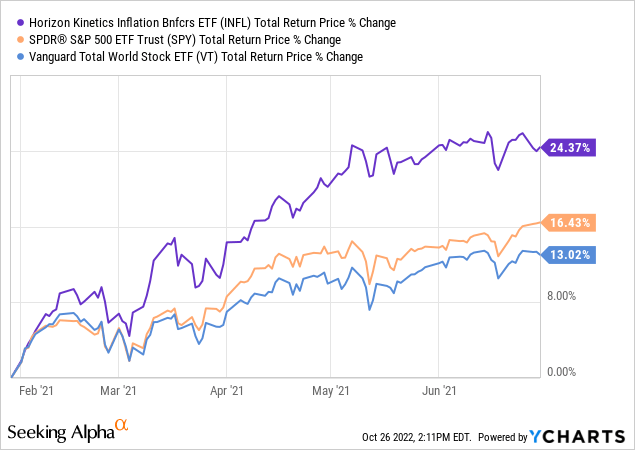

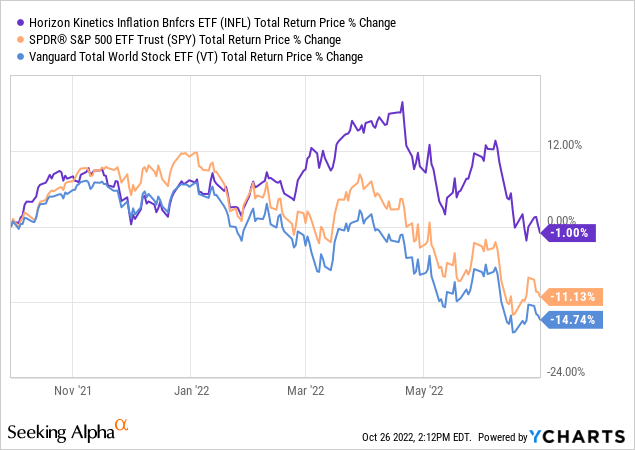

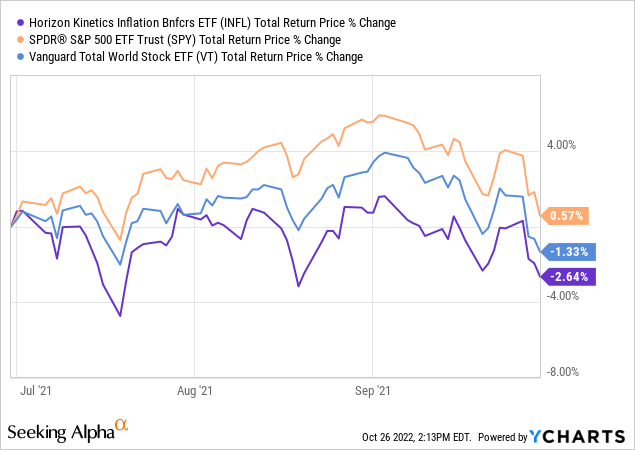

INFL’s performance track-record is quite strong, with the fund significantly outperforming relative to broader equity indexes since inception.

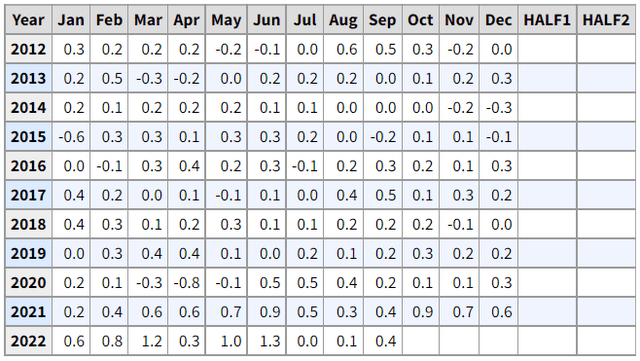

Importantly, the fund’s performance track-record is strongly correlated to inflation. As per the U.S. Bureau of Labor Statistics, inflation rates are as follows.

BLS

As can be seen above, inflation was elevated from February 2021 to June 2021, during which INFL outperformed, as expected.

Inflation was also elevated from around October 2021 to June 2022, during which INFL also outperformed.

Inflation was relatively low from July 2021 to September 2021, during which INFL underperformed.

Inflation was also relatively low from July 2022 to August 2022, during which INFL slightly outperformed. The fund did exceed expectations here, but only slightly so.

As should be clear from the above, INFL’s performance is correlated to inflation, as expected. The correlation is not very tight, especially when looking at individual months, but it definitely exists, and has an impact on the fund’s performance.

INFL’s outperformance was mostly driven by strong energy industry returns, but there seems to have been some alpha as well. By my calculations, INFL has outperformed the S&P 500 by around 20% since inception. Energy has outperformed the index by around 100% for the same. INFL was about 15% overweight energy in prior months, so said position accounts for around 15% of the fund’s 20% outperformance. Security selection should account for the rest. From what I’ve seen, this is the case. As an example, of the fund’s three largest energy holdings, two have outperformed relative to the index YTD.

INFL’s largest gold miner also outperformed relative to the index.

From what I’ve seen, INFL’s security selection is generally good, with many exceptions. This is the case for most actively-managed funds, even the best of the best, so is not all that concerning.

INFL’s strong performance track-record appears to be partly due to elevated inflation, CPI has averaged 7.6% since the fund’s inception in early 2021, and partly due to the strength and effectiveness of its investment strategy. Insofar as inflation remains elevated, the fund should continue to outperform, at least if the past is any indication.

Conclusion

INFL’s strong performance track-record and effectiveness as an inflation hedge make the fund a buy.

[ad_2]

Source links Google News