[ad_1]

Patrick Chu/E+ via Getty Images

(This article was co-produced with Hoya Capital Real Estate.)

As I write this article, it is the afternoon of Friday, May 20. It was yet another wild ride for the market. Per this tweet from Bob Pisani, if the S&P index had closed at 3,837.24 or below, S&P Dow Jones Indices would have classified 1/3/2022 as the ending date of the bull market and the start of the bear. During the market session, the market traded down to a low of 3,810.32 before recovering to close at 3,901.36, skirting the official declaration of a bear market for at least one more market session.

Other asset classes are down even more for the year. As just one example, the Nasdaq index closed at 11,354.62, down some 30% from its 52-week high.

The ETF we are going to take a look at in this article has also had a difficult year. Hoya Capital Housing ETF (NYSEARCA:HOMZ) closed today at $34.45, some 23.74% off its 52-week high of $45.18. However, while the start of the year has proved challenging for this ETF, the current price may offer an attractive entry point, particularly if one has a long-term investment horizon.

Before we go any further, there are a couple of important details that I should share, in a spirit of full disclosure. As can be seen from the standard disclosures that come with this article, I hold this ETF in my personal portfolio. Additionally, Hoya Capital Real Estate, whose marketplace service I am affiliated with, is the issuer of this ETF. It is also one of the ETFs included in the ETF Reliable Retirement Portfolio, which I manage for this service.

Hoya Capital Housing ETF – A Brief Overview

As it happens, I was among the first ETF-focused authors to review this ETF shortly after its launch in March 2019. At the time that article was written, HOMZ’s AUM was a mere $6.72 million. Today, despite not being on any of the major “wirehouse” platforms (Merrill, JPMorgan, Morgan Stanley, etc.), its AUM has grown to right around the $45 million mark. Further, in August 2020, its expense ratio was lowered from the previous .45% to .30%.

What makes HOMZ unique? In a word, its laser focus on residential real estate or, put another way, housing. The word “housing” is embedded right in the name of the ETF itself. And its website refers to it as The Housing ETF.

Why might that be of interest? Let’s quickly break it down. Likely, if you have had an interest in including real estate ETFs in your portfolio, you are familiar with the venerable Vanguard Real Estate ETF (VNQ). As it turns out, though, residential REITS only comprise 15.2% of this ETF as of this writing. To focus more specifically on housing, two other alternatives would be SPDR S&P Homebuilders ETF (XHB) and iShares Residential and Multisector Real Estate ETF (REZ). For purposes of this article, I won’t get into a detailed discussion of these two ETFs. Of the two, REZ is perhaps the closest in character to HOMZ. However, even this ETF has almost half its allocation in areas other than housing.

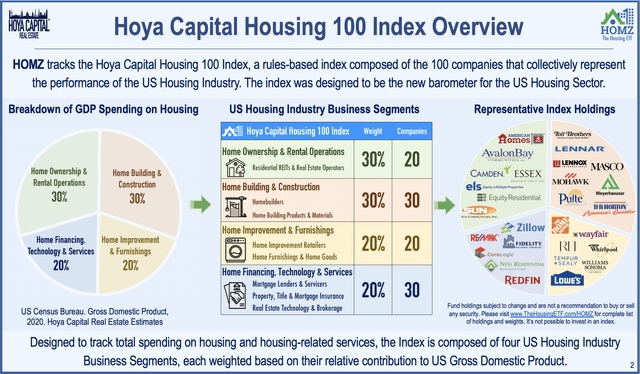

How does HOMZ zero in on just the housing market? Have a look at the graphic below, from Hoya’s investment case document.

HOMZ – Graphic Overview (Hoya Capital – Investment Case Document)

Starting on the left, the graphic displays a high-level breakdown of GDP spending on housing. As can be seen, this breaks down broadly into four sub-categories. In the center panel, this breakdown is translated into the basis for assembling the 100 companies in HOMZ’s underlying index. Finally, as can be seen in the right panel, samples of related companies are featured, ranging from well-known residential REITS such as Equity Residential (EQR) and AvalonBay Communities (AVB) to homebuilders such as Lennar (LEN) to home retailers such as Home Depot (HD) and Lowe’s Companies (LOW) and even newer “upstarts” such as Zillow (Z) and Redfin (RDFN) that have literally redefined the way homes are bought and sold.

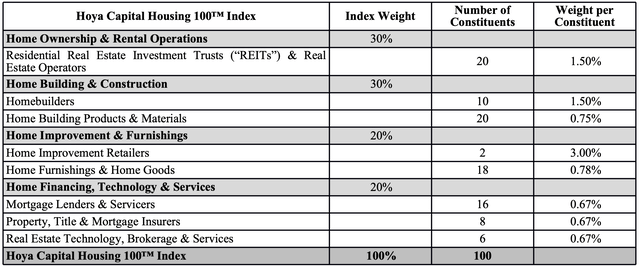

Next, let’s dive just a little deeper. The graphic below, from the fund’s summary prospectus, offers a more detailed breakdown of the index’s construction.

HOMZ – Detailed Overview (HOMZ – Summary Prospectus)

Starting with the 4 business segments outlined in the first graphic, the index is then further divided into 8 subsectors, weighted by their respective contributions to U.S. economic output. Within each subsector, the selected components are then equally-weighted

As a result, HOMZ is relatively equally-weighted. As of today’s market close, only 4 companies have a weighting greater than 2%, and the Top 10 holdings comprise 20.44% of the fund, quite reasonable for a fund with 100 holdings.

Performance – And Potential Opportunity

Overall, since its inception date of 3/19/2019, HOMZ has been a strong performer. In fact, from that date through January 2022, HOMZ outperformed the S&P 500! No doubt, when you ponder the extremely hot housing market, and particularly stocks that married real estate and technology, such as Zillow and Redfin, you can see where these strong gains came from.

As it happens, perhaps some of these stocks got just a little too hot. I got curious to see how HOMZ’s Top 10 holdings have performed of late. Here’s a quick peek, using GOOGLEFINANCE formulas in Google Sheets.

HOMZ – Recent Performance of Top 10 (Author-Created Spreadsheet)

As can quickly be seen, Lowe’s and Home Depot, HOMZ’s top two holdings, are both down roughly 30%. Other home-focused retailers have fared even worse. Continuing on in the above list, we see that several REITS, such as Public Storage (PSA) have also been hit to the tune of roughly 25%. Finally, while they hold far lower weightings in HOMZ, Zillow and Redfin have cratered by 67.15% and 84.05%, respectively!

In its most recent annual report for HOMZ, Hoya Capital summarized things this way:

Leading detractors during the current fiscal period were the Real Estate Technology, Brokerage & Services and Home Furnishings & Home Goods sectors. For the Real Estate Technology, Brokerage & Services sector – which was among the leading contributors to performance in the prior annual period – performance was negatively impacted by multiple compression across many technology-related equities during the period and by company-specific operational challenges. Notably, Zillow closed its Zillow Offer home-buying business – citing operational challenges and high capital intensity of the iBuying strategy – and noted that it intends to focus on its core property technology business.

For the Home Furnishings & Home Goods sector, performance was negatively impacted by global supply chain disruptions resulting from the lingering effects of the coronavirus pandemic. Furniture, major appliances, mattresses, and cabinetry were among the products facing the most severe shortages, higher prices, and delivery delays, which prompted some consumers to defer these purchases. Despite these shortages and operational challenges, retail spending at Furniture and Home Furnishings Stores still rose 26.9% in 2021 – the highest on record.

At the same time, from the rubble may spring opportunity. Some of the headwinds noted in those two paragraphs will likely dissipate over time, the clouds may clear, if you will. In that same annual report, here is how Hoya Capital addresses this potential opportunity.

Amid this intensifying housing shortage, demographic trends over the next decade are highly supportive of significant growth in housing demand, which we believe will necessitate significantly higher levels of new home construction activity. Additionally, we believe that home-centric behavioral changes resulting from the pandemic – and the increased value and attention that consumers dedicate towards their homes – will exhibit a high degree of persistence, resulting in higher sustained levels of investments on home improvement and physical space upgrades.

We continue to see a compelling long-term investment case for HOMZ over the next decade and beyond as the combination of historically low housing supply, the continued aging of the U.S. housing stock, and strong secular demand provide a favorable long-term macroeconomic backdrop for companies across the U.S. housing industry.

Certainly, it appears that certain headwinds remain. Mortgage interest rates have risen sharply over the past few months. The possibility of recession exists. At the same time, might HOMZ be “on sale” at this point in time as a result of those uncertainties?

Summary and Conclusion

Given everything I have shared in the article, I believe HOMZ may present an intriguing opportunity at its current price point, particularly for investors with a long-term time horizon.

For those interested in income, I should also note that HOMZ pays dividends on a monthly basis. This ETF is also designed to pair nicely with Hoya Capital High Dividend Yield ETF (RIET), with HOMZ focusing more on long-term growth and RIET on a fairly high level of current income.

I hope you have found this material of interest. Whatever your personal decision when it comes to HOMZ, I wish you…

Successful investing!!

[ad_2]

Source links Google News