[ad_1]

The iShares U.S. Home Construction ETF (NYSE:ITB) and the SPDR Homebuilders ETF (NYSEARCA:XHB) are the two leading homebuilder equity ETFs. They hold large national construction companies such as D.R. Horton (NYSE:DHI) and Lennar (NYSE:LEN), and we believe they are an excellent value play for a long-term investor. Further, we have reason to believe that the U.S. housing market will show surprising resilience in case of an economic recession due to strong global comparative fundamentals and continuous large housing shortages in much of the country. This is not to say that a short-term decline is impossible, as this bull market is long in the tooth; it is simply that we expect long-term outperformance in the sector.

For the purposes of simplicity, we will focus on ITB and its holdings, though the analysis would be nearly identical for XHB. The primary difference is that XHB includes more weight toward retailers like Home Depot (NYSE:HD).

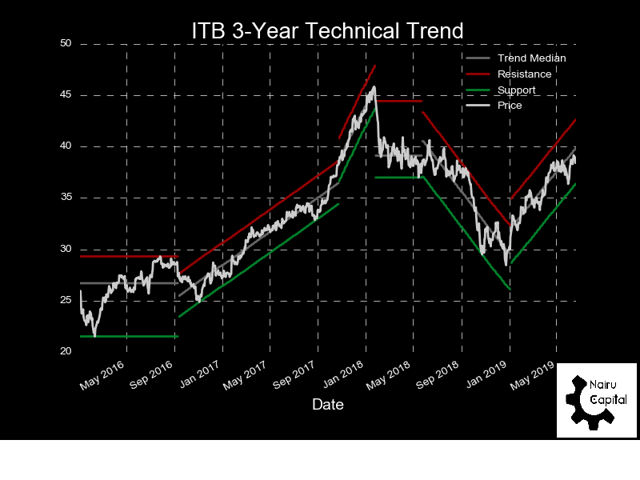

Technical Setup

Over the past three years, ITB has had quite a choppy ride. It saw a very large melt-up that culminated at the beginning of 2018; an extreme 33% decline in an overreaction to last year’s recession worries. Since its trough, it has rallied around 30% in a strong upward trend that lacks the excessiveness as seen in 2017. It is also just slightly below its short-term trend midpoint, so we would not be surprised by a strong, short-term move barring a very poor New Home Sales read next Tuesday (June 25th).

Date Source: Yahoo Finance

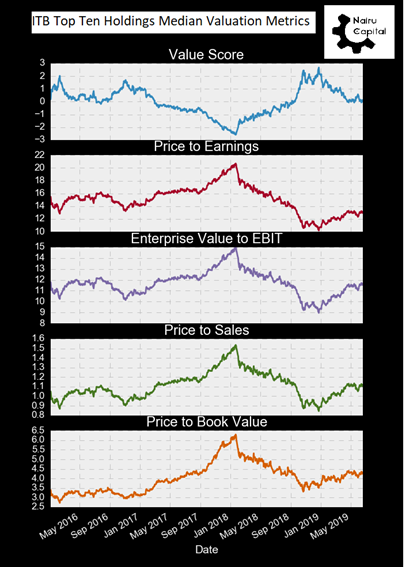

Excessive Undervaluation

Our primary reason for our bullish stance on homebuilders is the fundamentals of the firms within the ETFs. We will look exclusively at the median financial data across the top 10 holdings of ITB, all of which are in generally similar financial circumstances that are reflective of ITB as a whole.

The current typical price-to-earnings ratio is an extremely low 12, while the enterprise value to EBIT (usually a better metric) is also floating around 12. The PE topped out in January 2018 at 20, while its EV/EBIT topped at 15. Purely, from a valuation standpoint, we expect at least a 25% increase in price. The shares are currently priced as if a recession is not only imminent but also that it will hit the housing sector particularly hard. We believe a recession may happen (unless the Fed continues to turn dovish), but unlike in the past recession, it will not hit homebuilders particularly hard. We believe these low valuations are primarily a knee-jerk reaction from investors who got burned in real estate in 2007-2009.

Date Source: Yahoo Finance

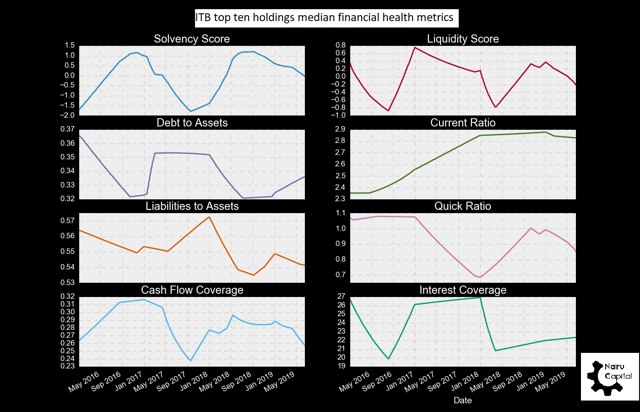

Strong Financial Management

To further illustrate this point, here is a chart of the financial health of these homebuilding firms.

Date Source: Yahoo Finance

As shown above, solvency and short-term financial liquidity are at their midpoints over the historical period (see “score”), but are still very strong. Debt to assets for most firms is roughly 1/3, while their current ratio has been rising to a very high value of three. The only red flag is the declining quick ratio that is also below one. This signifies that these firms do hold considerable inventory that must be sold by the end of the summer to ensure the short-term obligations are met. That said, back before 2008, these firms typically had debt to assets around 50% and often had much lower current ratios. Considering most stocks today have much more leverage and less liquidity, we believe homebuilders could command valuations considerably higher than we currently see.

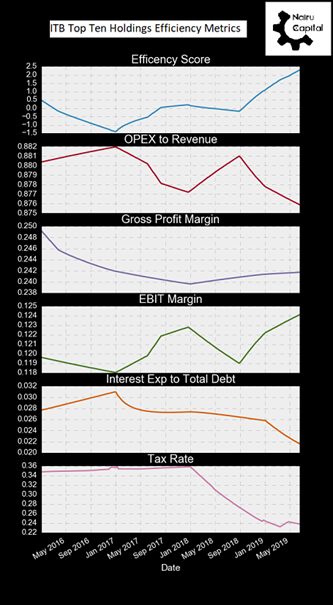

Lastly, these companies have seen great efficiency improvements over the last three years. They have benefited greatly from declining interest rates and the tax bill as shown below. Further, management has done an excellent job decreasing operational expenses and improving EBIT margins. If this trajectory continues or at least remains at their current level, we expect shareholders to be rewarded greatly in the future.

Date Source: Yahoo Finance

Risks and Rewards

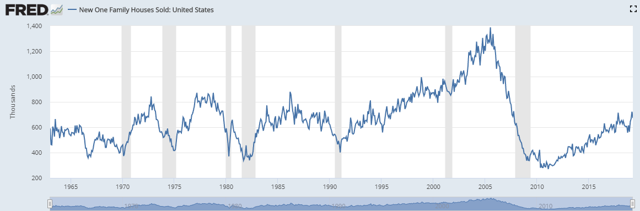

While their fundamentals and technical are strong, macroeconomic risks do exist, and with this bull market being so long, we see a recession as the greatest risk to ITB. To us, the best forward indicator of the housing market is new home sales.

As you can see, they have been on a strong upward trend throughout this bull market. In fact, this trend looks to be the most linear uptrend since at least 1965. It is entirely possible for this trend to reverse, but the fact of the matter is people will always want to live in homes and homes will always need to be rebuilt. Further, while baby boomers may be downsizing, the millennial generation is finally beginning to start families and generation Z is moving out of their homes and will soon be pushing the older generation out of their apartments.

All said, an investor who is looking for a short-term investment (around a year or less) may want to wait until a recession begins. We believe the secular trend will largely offset a shorter-term cyclical one, but still, everything goes down in a recession, and one bad year for a homebuilder can take years to repair.

Bottom Line

As we hope to explain in further articles, it seems clear that the next recession will primarily affect government-related investors and hurt real asset investors the least. Thus, now is the time to start allocating toward real assets that still pay dividends and can gain from potential late-cycle economic growth. We believe homebuilders are an excellent investment that fits this mold. Not only should they gain from secular housing trends but also from their strong financial management and comparative undervaluation. If an investor wants to fully maximize returns, they may want to look at smaller home builders that build single-family residence “starter homes” in regions excluding the Pacific Coast and North East where young people are beginning to move away from.

If we were to make this investment, which we may in the next few days depending on economic data, we would allocate 10% of our equity portfolio and have a 10-year time frame. We would also consider rising this allocation to 20% in the case of a recession or a large correction.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in XHB over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News