[ad_1]

demarco-media/iStock via Getty Images

As you already know, the global transition to renewable energy and EVs is going to require a lot of copper. That’s because copper is used for everything from windings for electric motors in EVs and wind turbines, to electric power transition lines, to copper etchings on printed circuit boards – among many other uses. As a result, global copper demand is expected to double by 2035. Today, I’ll take a close look at the Global X Copper Miners ETF (NYSEARCA:COPX) to see if it might make sense for some capital allocation within your portfolio.

Investment Thesis

A CNBC report published in July quoted S&P Global estimates that an EV requires 2.5x as much copper as an ICE-based vehicle and that solar, wind, and battery backup farms also rely heavily on copper. As Daniel Yergin – VP of S&P Global – told CNBC:

There’s just been the assumption that copper and other minerals will be there … Copper is the metal of electrification, and electrification is much of what the energy transition is all about.

I agree 100%. The report goes on to forecast that copper demand is expected to nearly double to 50 million metric tons by 2035 and to reach more than 53 million metric tons by 2050. To put those numbers into perspective, S&P Global noted that that’s “more than all the copper consumed in the world between 1900 and 2021.”

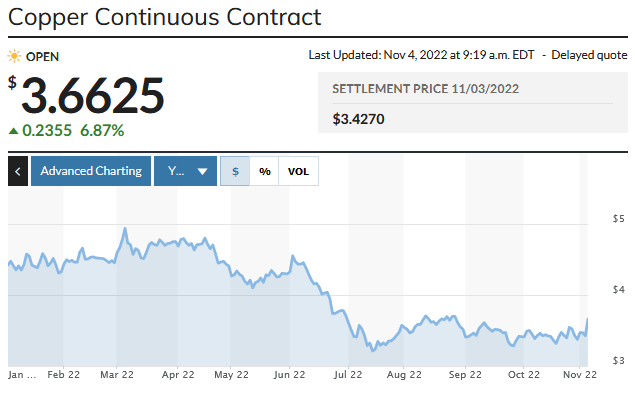

As can be seen in the graphic below, the price of copper has tanked this year – reflecting slower global economic growth, COVID-19 restrictions in China, and the strength of the U.S. dollar:

MarketWatch

However, investors should consider that the time to buy commodities is during down-cycles. Also, note the U.S. dollar is declining today (at pixel time, -1.2%) and that the chart above shows copper trading +6.87%. What this indicates is that the copper market is, at least currently, very much levered to the direction of the U.S. dollar. Longer term, it is my belief that copper will be much more levered to global demand-pull due to all the fundamental factors discussed earlier.

With such a bullish fundamental backdrop, investors should consider allocating some capital to invest in copper. Today, I’ll take a look at COPX, a diversified ETF to see if it might be a viable option to invest in the copper thesis.

Top-10 Holdings

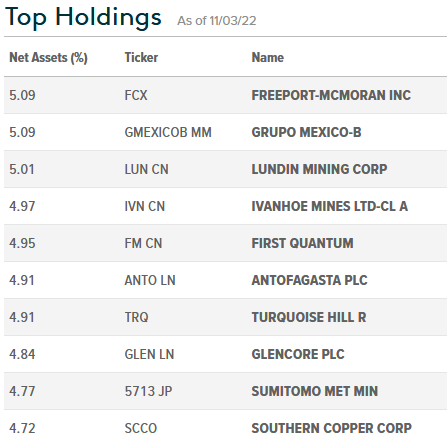

The Global X COPX ETF homepage can be found here. The top-10 holdings are shown below and equate to what I consider to be a relatively concentrated 49% of the entire 40 company portfolio:

Global X

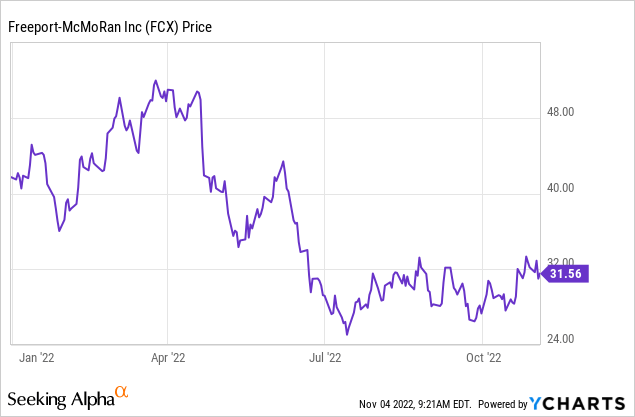

The #1 holding with a 5.1% weight is Freeport McMoRan (FCX). FCX is based in Phoenix, AZ and is a global leader in copper production with assets in North America, South America, and Indonesia. The company also produces gold, molybdenum, and silver. These commodities typically trade globally in U.S. dollars and, partly as a result of the strength in the U.S. dollar (among other factors), the stock of FCX has followed the price of copper downward this year (-23% YTD):

The stock currently yields 0.93%. Please consider reading my recent Seeking Alpha article for more details on the company.

Canada-based Lundin Mining Corp (OTCPK:LUNMF) (LUN:CA) is the #3 holding in COPX with a 5% weight. Lundin has mining interests in Brazil, Chile, Portugal, Sweden, and the United States and produces copper, zinc, nickel, and gold, as well as lead, silver, and other metals. Lundin stock is down 38% over the past year, currently yields 4.86%, and trades with a forward P/E of 11x.

The #5 holding is another Canadian company – First Quantum (OTCPK:FQVLF) (FM:CA) – also with a 5% weight. First Quantum has operating mines in Zambia, Panama, Finland, Turkey, Spain, Australia, and Mauritania. In Argentina, the company is exploring the Taca Taca copper-gold-molybdenum project and also has a development project at the Haquira copper deposit in Peru. The stock is down 16% YTD and trades at a forward P/E=13x.

Glencore PLC (OTCPK:GLCNF) (OTCPK:GLNCY) is the #8 holding with a 4.8% weight. Glencore has actually bucked the metals market trend and is trading up 20% over the past year. The company produces, refines, processes, transports, and markets metals, minerals, and energy products in the Americas, Europe, Asia, Africa, and Oceania. Glencore also engages in oil E&P, and markets coal, crude oil and oil products, refined products, and natural gas (the fossil fuels exposure is why the stock is actually up this year). Glencore yields 4.5% and trades with a forward P/E=5x.

The #10 holding is Southern Copper (SCCO) with a 4.7% allocation. Southern’s stock is down 11% over the past year but at pixel time is rallying 8% today (Friday, Nov. 4th). SCCO is also based in Phoenix, AZ and engages in mining, exploring, smelting, and the refining of copper. The company has assets in Peru, Mexico, Argentina, Ecuador, and Chile and is involved in the mining, milling, and flotation of copper ore to produce copper and molybdenum concentrates. Southern also engages in smelting of these copper concentrates to produce anode copper and the refining of anode copper to produce copper cathodes. Anodes and cathodes are obviouly key components of batteries. SCCO yields 4.1% and trades with a forward P/E=16.9x.

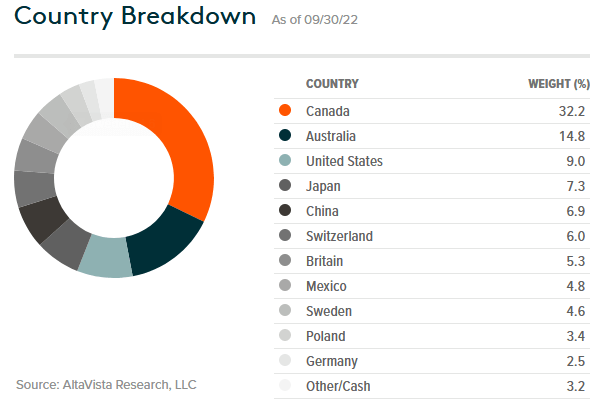

The portfolio is most exposed to Canada, Australia, and the U.S – with only 6.9% invested in China:

Global X

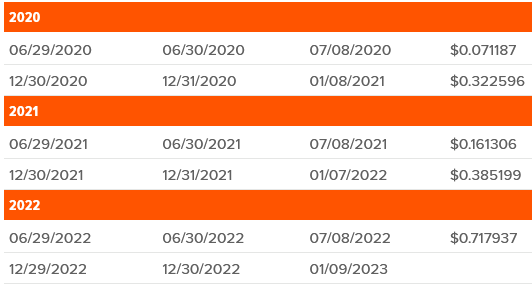

Distributions

The COPX ETF has a history of making two annual distributions per year:

Global X

The last TTM distribution yield is 5.0% based on COPX’s current price of $31.69 (it is rallying strong today – currently +8.5%). It yielded 5.4% based on yesterday’s close.

Performance

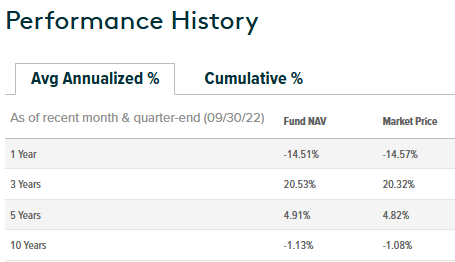

As the graphic below clearly shows, the 10-year performance of the COPX ETF has been nothing less than horrible:

Global X

However, note that the ETF has delivered an average 20%+ return over the past three years as the renewable energy transition has emerged as a much larger source of fundamental demand-pull. I believe the last three years is likely much more indicative of the next three years, except that – given the current copper commodity price down-turn, combined with the expected growth in demand – the next three years are likely to be much better.

Risks

As with any commodity, the risk is that global economic weakness could lead to demand destruction causing the price of copper to drop. The strong U.S. dollar is also a primary impact on the companies in the COPX portfolio. Also, note, these miners are not just exposed to copper, but also to gold, silver, and molybdenum, as well as other metals.

With an expense fee of 0.65%, the COPX ETF is quite expensive in my opinion. That being the case, investors should consider simply picking one (or more) copper miners and take individual stock ownership. Freeport McMoRan is my favorite choice in the space.

Summary & Conclusion

Global demand for copper is set to double by 2035, yet the price of copper has tanked this year and is currently under $3.70/lb. It reminds me of the oil market a couple years ago and, in my opinion, is a great opportunity for investors to make a counter-cyclical investment in the metal. While the COPX ETF is rather expensive, and I wish its stake in FCX was considerably higher, I still think it will outperform the broad S&P500 over the next year and rate it a BUY. That said, I have a STRONG BUY on Freeport McMoRan as a viable total-return alternative.

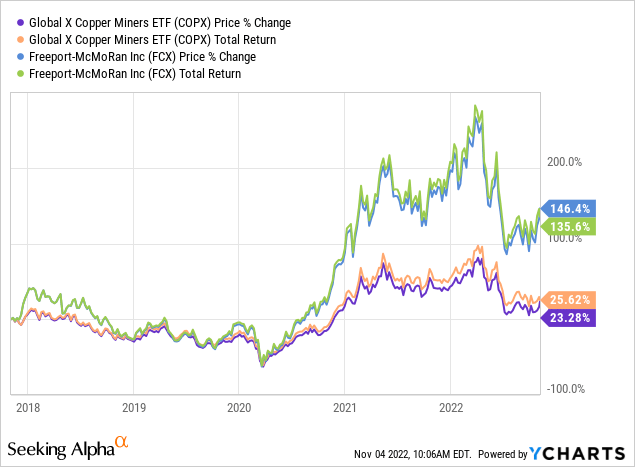

I’ll end with a 5-year price and total returns chart of COPX versus FCX and note that Freeport certainly appears to be the superior investment of the two:

[ad_2]

Source links Google News