[ad_1]

FooTToo/iStock via Getty Images

Flip on financial TV, and you will probably eventually hear a guest pundit utter the all-too-famous words, “we prefer to invest in high-quality stocks.” That sounds great, but how is that so-called strategy actually doing this year? We can answer that question by looking at several market “factors.”

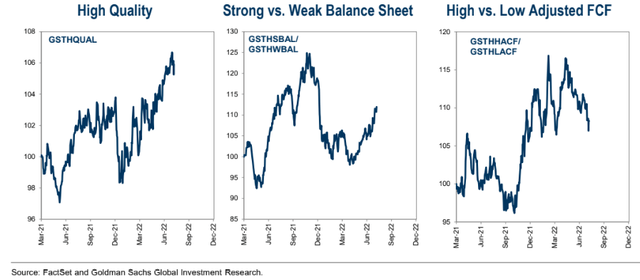

I like to review the weekly macro situation report distributed by Goldman Sachs (GS) Investment Research. Catching my eye in this week’s edition is a set of high-quality factor charts.

According to Goldman, the “high quality” factor has indeed performed well relative to the S&P 500 this year, though it has pulled back in the last couple of weeks. Moreover, strong vs weak balance sheet equities are up nicely in the last four months after a big drubbing in Q4 of 2021. Finally, high vs low adjusted free cash flow (‘FCF’) stocks are down big since the middle of the second quarter – much to the disappointment of investors owning companies that spit off a ton of cash (which is then often used for shareholder accretive activities like dividends and share repurchases). As a reminder, FCF is the cash remaining after a company has paid expenses, interest, taxes, and long-term investments. It is the source from which dividends are paid, according to Pacer ETFs.

Factor Performances

Goldman Sachs Investment Research

So, it’s a mixed bag within these factors. Let’s dig into what’s happening with the FCF factor from a global perspective. There is an ideal ETF to play that investment thesis.

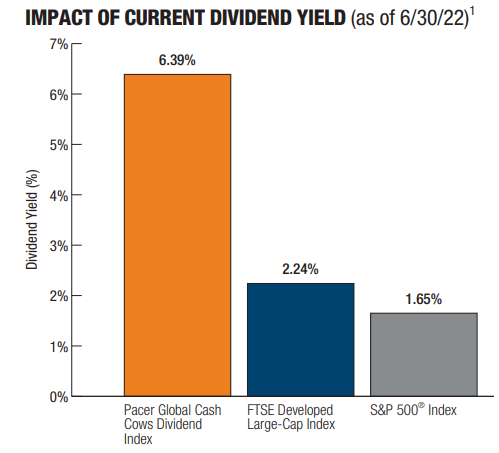

According to the issuer, the Pacer Global Cash Cows Dividend ETF (BATS:GCOW) is a strategy-driven exchange-traded fund that attempts to provide a continuous stream of income and capital appreciation over time by screening for companies with a high FCF yield and a high dividend yield. Pacer says that GCOW sports a whopping 6.39% current dividend yield as of the end of 1H22.

GCOW’s Big Dividend Yield

Pacer ETFs

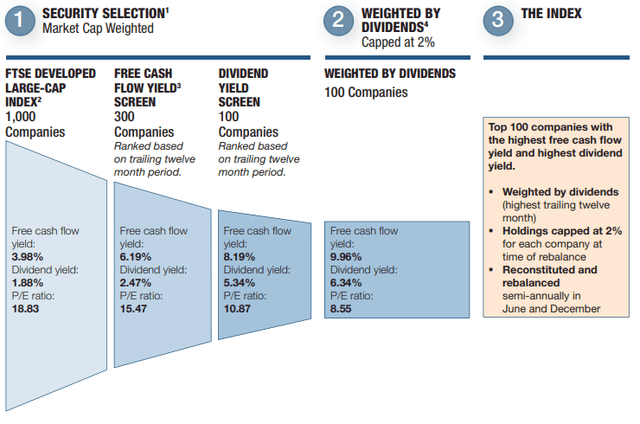

The ETF launched in early 2016 and features a 0.60% expense ratio and 0.13% average bid/ask, spread according to ETF.com. Assets under management is $660 million with more than $10 million of daily volume. It is a large-cap ETF given that the weighted average market cap is more than $73 billion. The typical P/E ratio within the 100 stock portfolio is a cheap 8.55, as of June 30, 2022, per Pacer. Investors can also have similar exposure through the cheaper, though underperforming, Fidelity High Dividend (FDVV) fund.

GCOW Investment Screening Process

Pacer ETFs

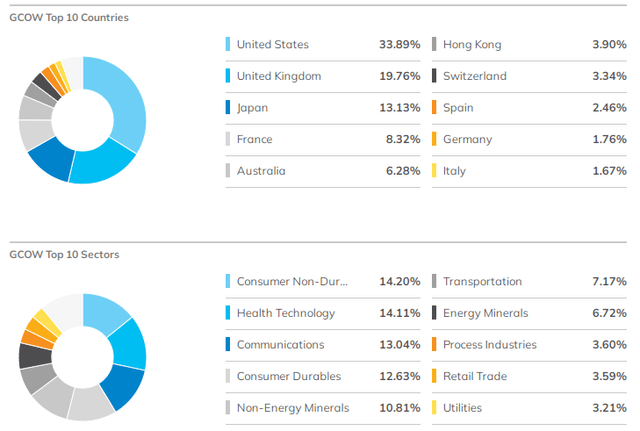

GCOW’s Top Country Weights and Sector Positions

ETF.com

The Technical Take

The chart below is a total return look since the ETF pays out a big yield. What I like here is that volume has really surged in 2022, so that leads me to believe that the ETF is here to stay. That does not make it a great investment right now, however.

Notice how there was a sharp price drop in June of this year. Combing price action and volume analysis, it appears that investors turned very bullish and excited about strong global FCF stocks in early 2022, but then just as everyone positioned themselves that way, the market turned. I would avoid the ETF based on this current action. I want to see better momentum both on an absolute price basis and relative to non-FCF factor stocks before investing in GCOW.

Big Volume This Year, But Poor Performance Since June

Stockcharts.com

The Bottom Line

The GCOW ETF is a good fund to gain exposure to strong FCF global developed stocks. I like the quantitative nature of the product and its process. Strong volume this year is also a positive aspect from a liquidity perspective. Unfortunately, though, price action suggests investors got too bullish on this niche earlier this year. Negative absolute and relative momentum make me hold off on GCOW for now.

[ad_2]

Source links Google News