[ad_1]

Concerns over trade wars, inverted yield curve, political struggles in Italy and England, and increased market volatility have many investors in search of relatively safe places to park their money. For the Lipper fund-flows week ended August 21, 2019, equity mutual funds and ETFs handed back some $12.2 billion – their second week of outflows in three. However, money market funds (+$22.6 billion), taxable bond funds (+$2.8 billion), and municipal bond funds (+$1.7 billion) all took in net new money for the week.

Even with lowered interest rates (the Federal Reserve Board cut its prime lending rate by 25 basis points in July-its first rate cut since 2008), investors continued to pad the coffers of Treasury bond funds (+$1.9 billion for the current fund-flows week). Year to date, government-Treasury funds have attracted some $26.9 billion of net inflows.

While the average equity fund is down 3.23% for the four-week period ended August 21, year to date, it still sports a handsome 13.58% return. Yet, equity funds have witnessed the largest net outflows of any given full-year going back to 1992, handing back some $114.7 billion year to date. The next largest full-year outflow was seen in 2016 (-$112.9 billion). That said, equity mutual funds have been the primary pariah thus far for outflows, handing back a net $127.2 billion, while their equity ETF counterparts have attracted a net $12.6 billion.

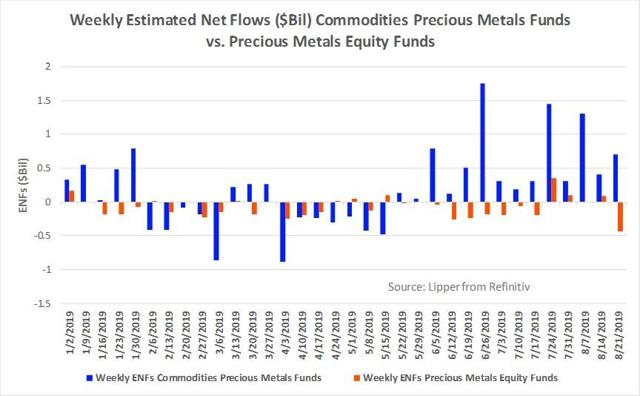

Some fund investors have turned their attention to other traditional safe-haven plays during this round of increased market volatility. Gold has traditionally been one of those safe-haven asset classes. However, the two related Lipper classifications: Precious Metals Equity Funds (AU, funds that invest in traditionally precious metal mining, exploration, or distribution companies) and Commodities Precious Metal Stocks (CMP, funds that invest primarily in precious-metal commodity-linked derivative instruments or physicals) have not seen equal interest by investors.

While the AU funds have posted a 32.39% year-to-date return, they have experienced net outflows of $2.8 billion for that period. At the same time, CMP funds have returned 13.64%, while witnessing net inflows of $6.2 billion year to date. Investors appear to be favoring, from a flows perspective, the physical ownership of gold (or at least the claim on the commodity offered via funds and ETFs) over the ownership of gold and precious metal mining companies (the commodity producers). Each has its own risk-return tradeoff that investors need to evaluate given their investment goals.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

[ad_2]

Source link Google News