[ad_1]

cemagraphics

I’ve covered several commodity futures ETFs in the past, including the Invesco DB Commodity Index Tracking ETF (DBC), and the Invesco DB Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC). These funds offer investors diversified exposure to commodity prices through futures contracts, outperform when inflation is high, but underperform when inflation is low, and have extremely low long-term expected returns.

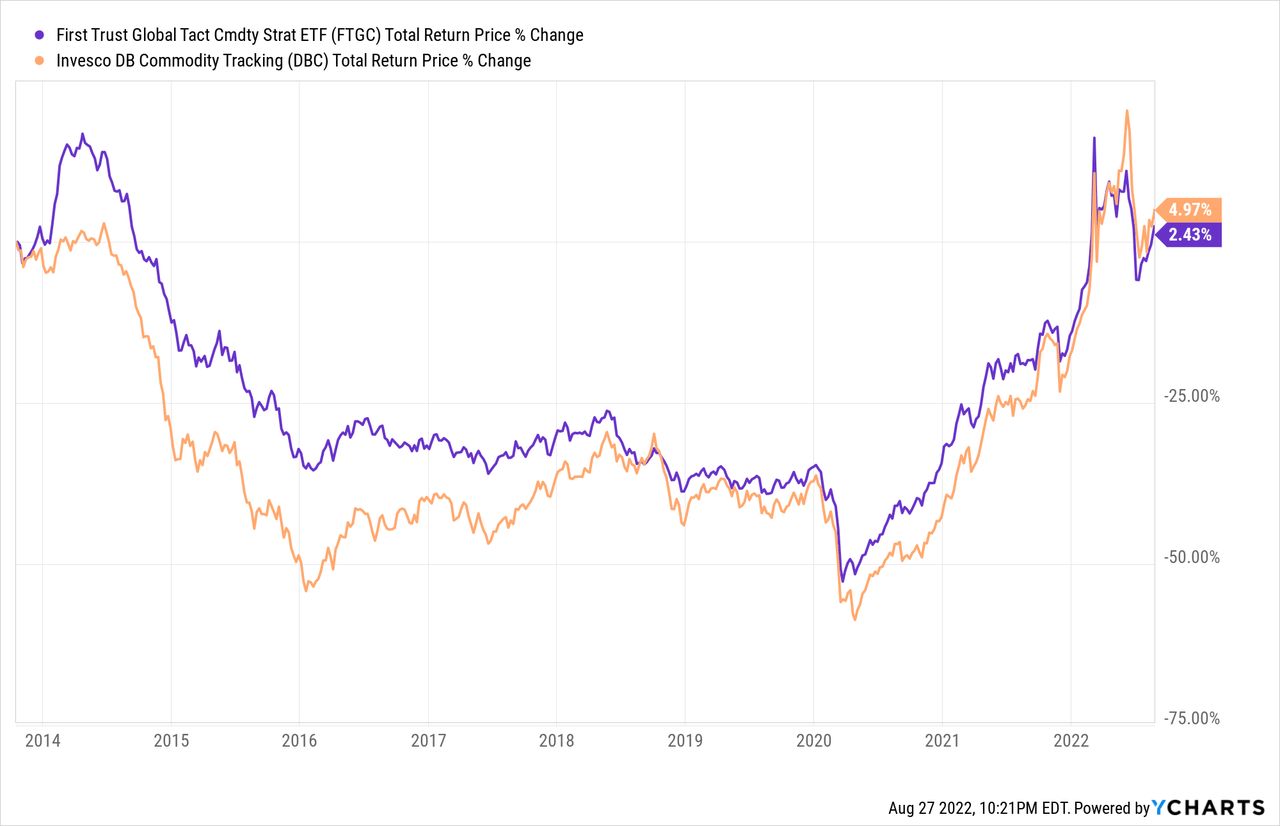

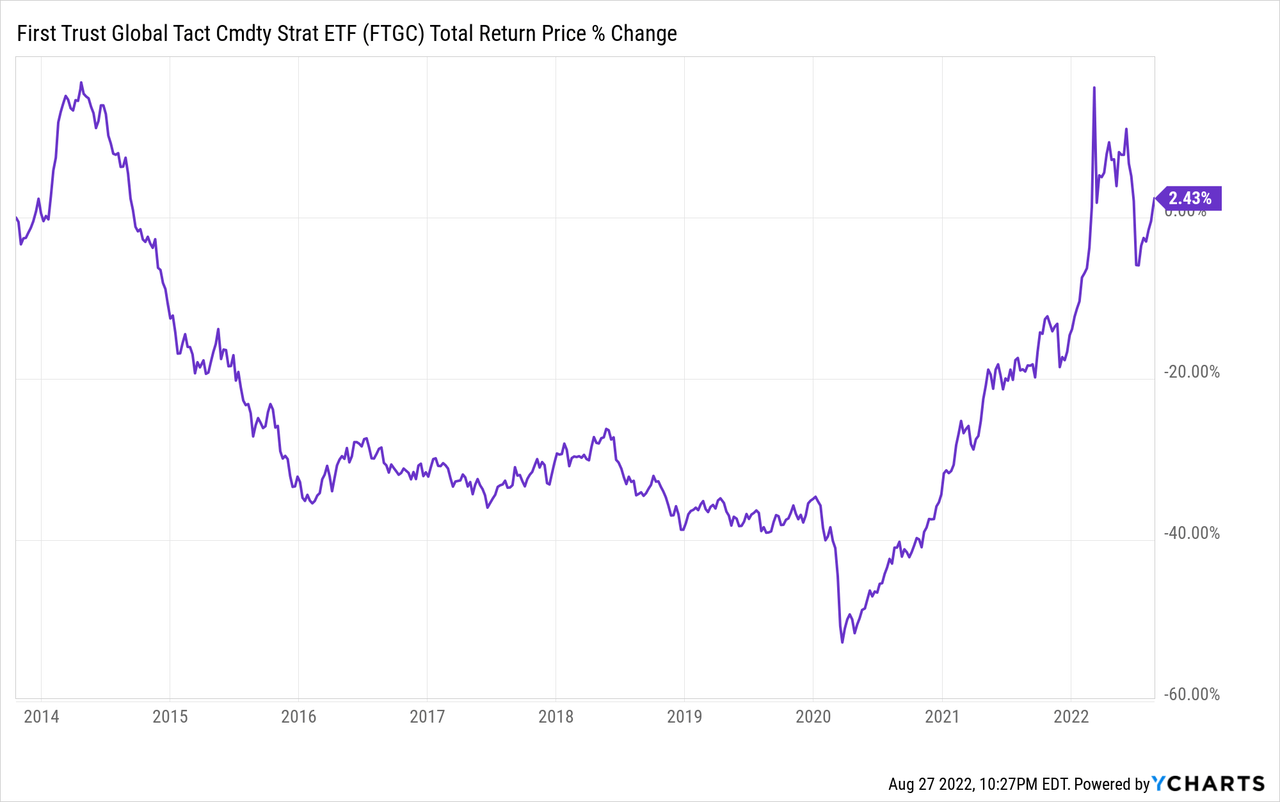

The First Trust Global Tactical Commodity Strategy Fund (NASDAQ:FTGC) is another commodity futures ETF, with similar characteristics and expected performance as DBC and PDBC. FTGC does differ from these other funds in two small ways. FTGC is actively-managed, and has successfully reduced risk, volatility, and losses during downturns through savvy investment decisions. FTGC does not issue a K-1 form, unlike DBC, nor does it issue significant, taxable distributions to shareholders, unlike PDBC. In my opinion, FTGC is very slightly superior to DBC and PDBC, although these three funds are all incredibly similar investments.

As inflation has (finally) started to normalize, commodity future ETFs are not compelling investment opportunities regardless, in my opinion at least.

FTGC – Overview and Benefits

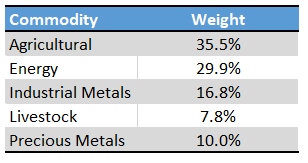

FTGC is an actively-managed, diversified, commodity futures ETF. The fund invests in several dozen commodity futures contracts, encompassing most relevant commodities, including oil, gasoline, natural gas, gold, silver, wheat, soybeans, etc. Commodity weights are as follows.

FTGC

Commodity exposure is gained through futures contracts. These are agreements to buy or sell a particular commodity on a specific date for a specific price. Said contracts are structured in such a way that buyers, including FTGC, profit from rising commodity prices, but suffer losses from decreasing prices.

FTGC’s holdings and strategy has several important benefits for the fund and its shareholders. Let’s have a look at these.

Effective Inflation Hedge

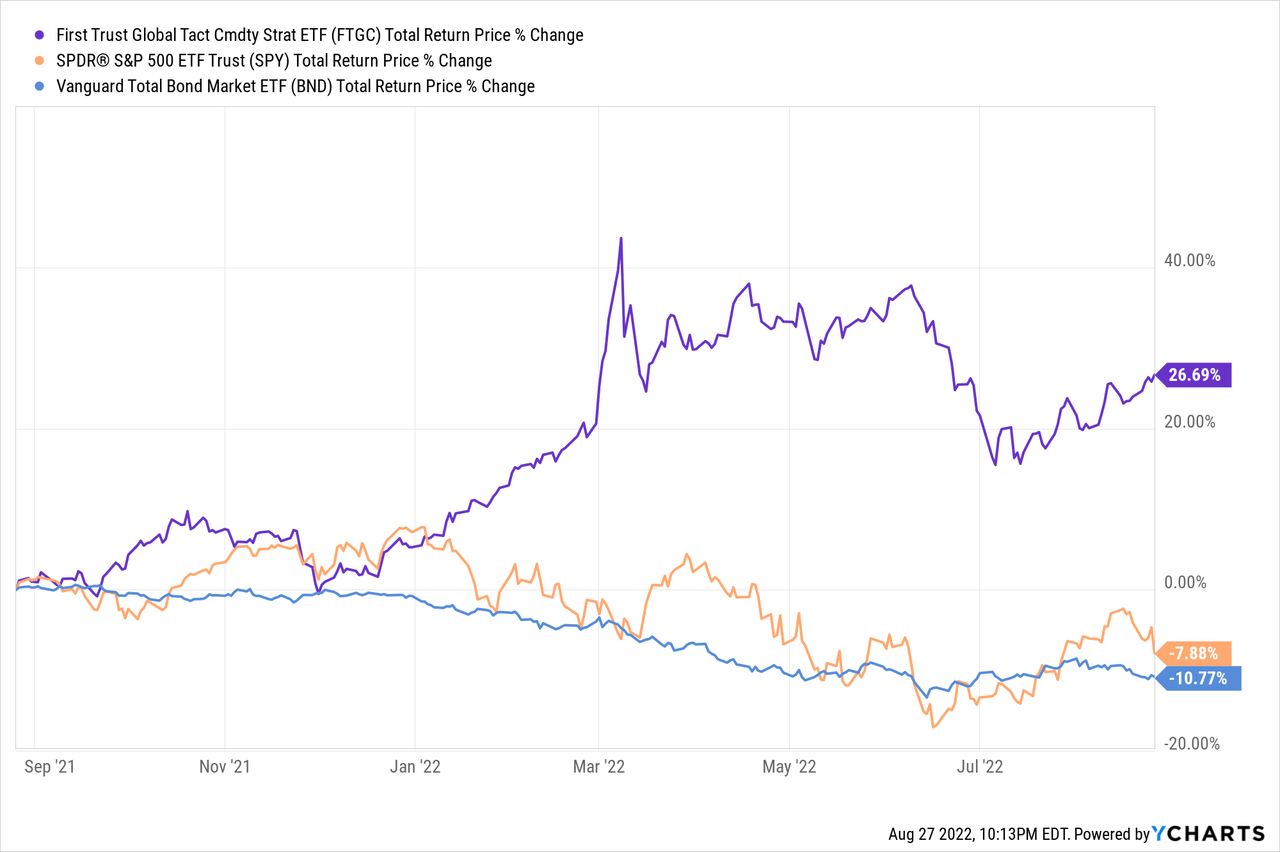

FTGC’s futures contracts ensures the fund profits from rising commodity prices, and hence inflation. The fund should outperform during periods of heightened inflation, as has been the case these past twelve months.

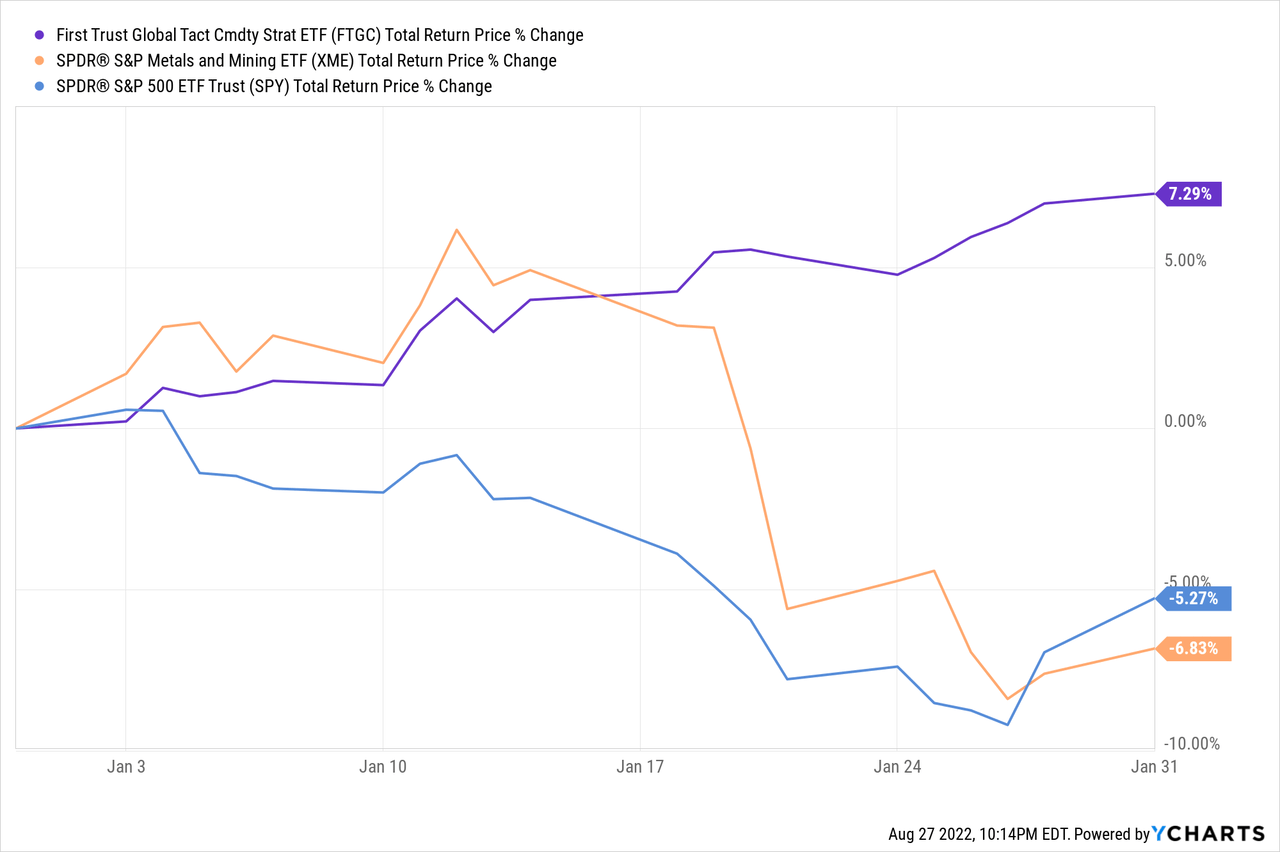

FTGC’s commodities exposure is also direct, with no exposure to other factors like valuations, investor sentiment, dividends, duration, etc. FTGC should outperform when inflation is high, with extremely few exceptions. The same is not necessarily true of other inflation hedge ETFs or funds. Reasons vary, but for ETFs focusing on equities with strong exposure to commodity prices, including energy and metals, performance is strongly dependent on investor sentiment, which might not necessarily track fundamentals. As an example, most metal equity indexes saw significant losses during January 2022, as equity markets tumbled. Commodity prices were surging, so companies focusing on metals saw improved fundamentals, but investors sold anyway. FTGC, however, still posted significant profits, as the fund is not reliant on investor sentiment for its returns.

FTGC’s holdings and strategy make the fund an effective inflation hedge, and somewhat stronger in this regard than many of its peers. DBC and PDBC have similar holdings, and are similarly as effective as inflation hedges and FTGC.

On a more negative note, the fund’s holdings suffer significant losses when commodity prices decrease. Expect significant underperformance when this occurs, as was the case from early 2014 to late 2020.

Diversified Commodities Exposure

FTGC provides investors with diversified commodities exposure, with investments in most relevant commodities. Diversification reduces risk and volatility, and reduces the possibility of losses and underperformance due to idiosyncrasies in any one specific commodity.

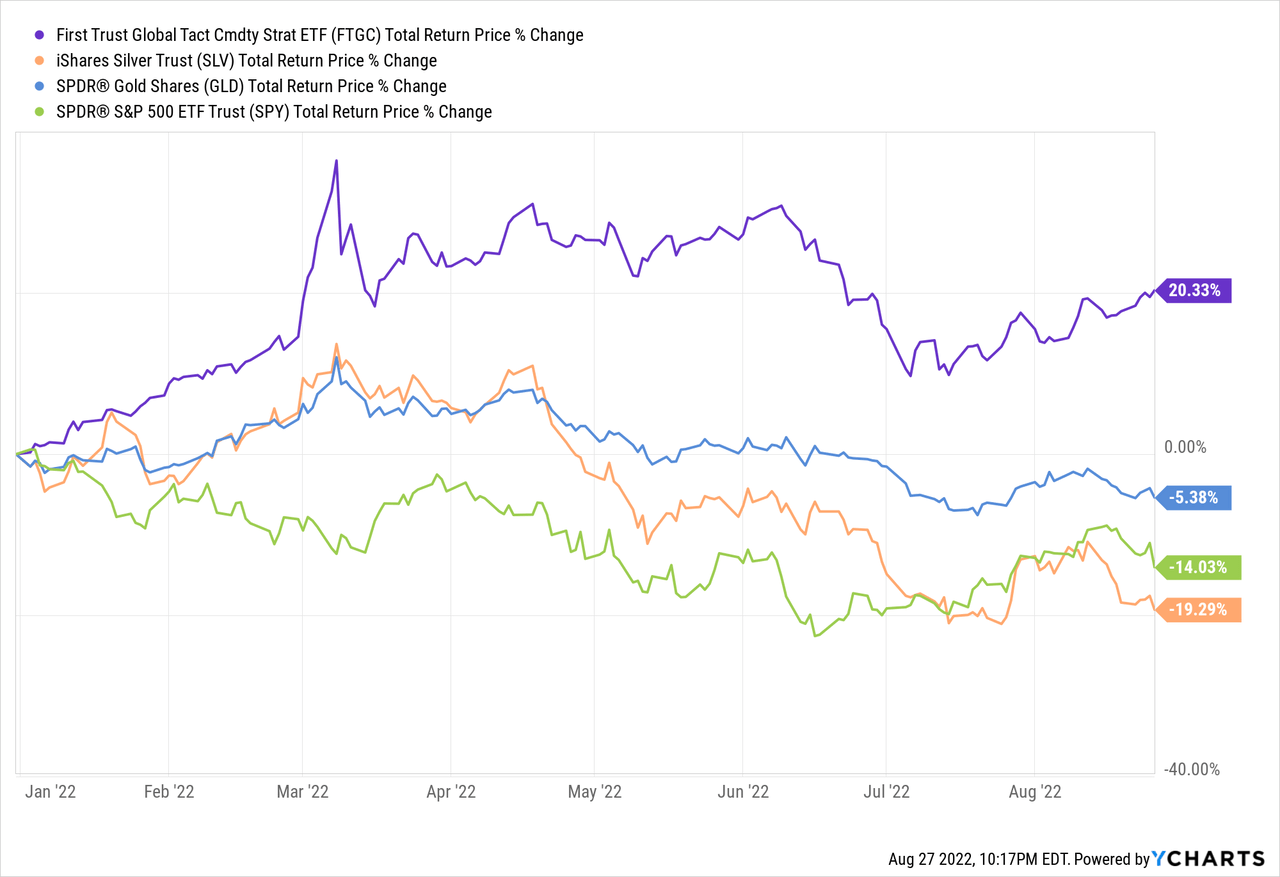

As an example, gold and silver prices have stagnated YTD, even as inflation and commodity prices skyrocket. More or less everything is up except gold and silver. In most cases, two commodity seeing flat prices is not a significant issue, but gold and silver are two of the most popular inflation hedge investments in the market, and both have seen lackluster returns, even losses, during the current inflationary environment. FTGC invests in gold, silver, and other commodities, so has seen strong returns YTD as these other investments more than make up for stagnating precious metal prices.

FTGC’s diversified commodities exposure effectively ensures strong returns during most relevant inflationary periods or scenarios. Insofar as inflation is high the fund should perform quite well, even if a couple specific commodities are stagnating.

Effective Active-Management Strategy

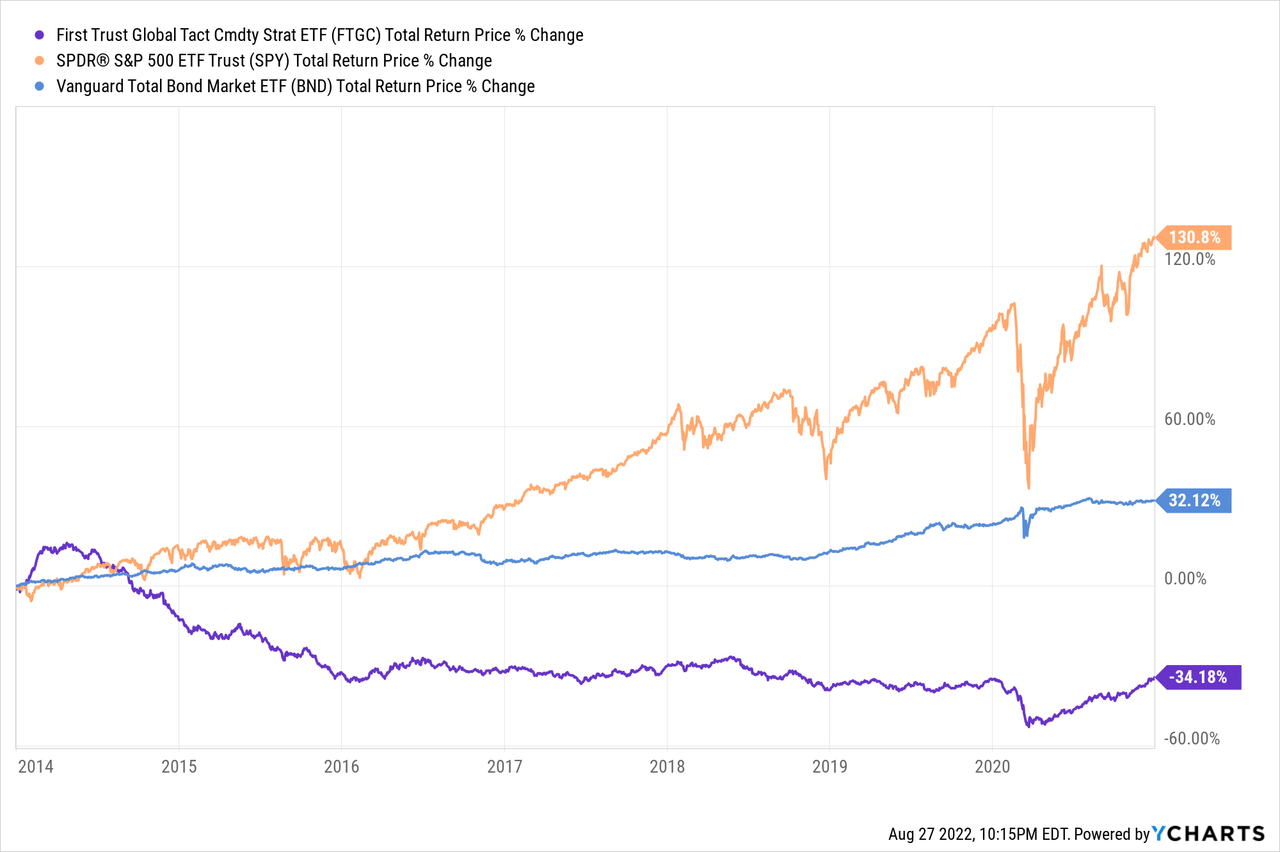

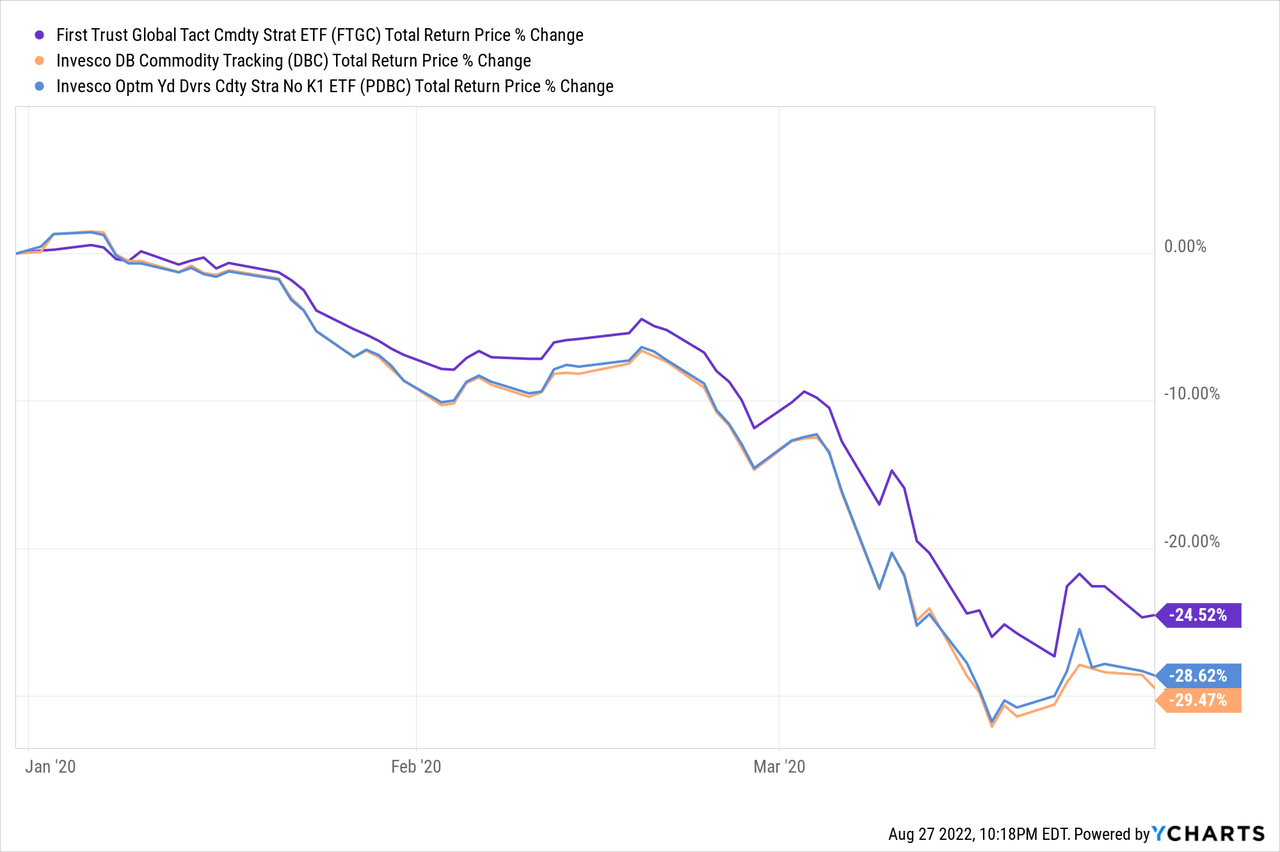

FTGC is actively-managed, so commodity and contract selection / weights are dependent on management decisions and expectations. As per fund documentation, active-management centers on risk-reduction measures, intended to reduce commodity exposure during commodity price crunches, downturns, and recessions. The strategy seems to be working, with the fund suffering somewhat fewer losses than DBC and PDBC during 1Q2020, the most recent downturn. Losses were still quite high, however.

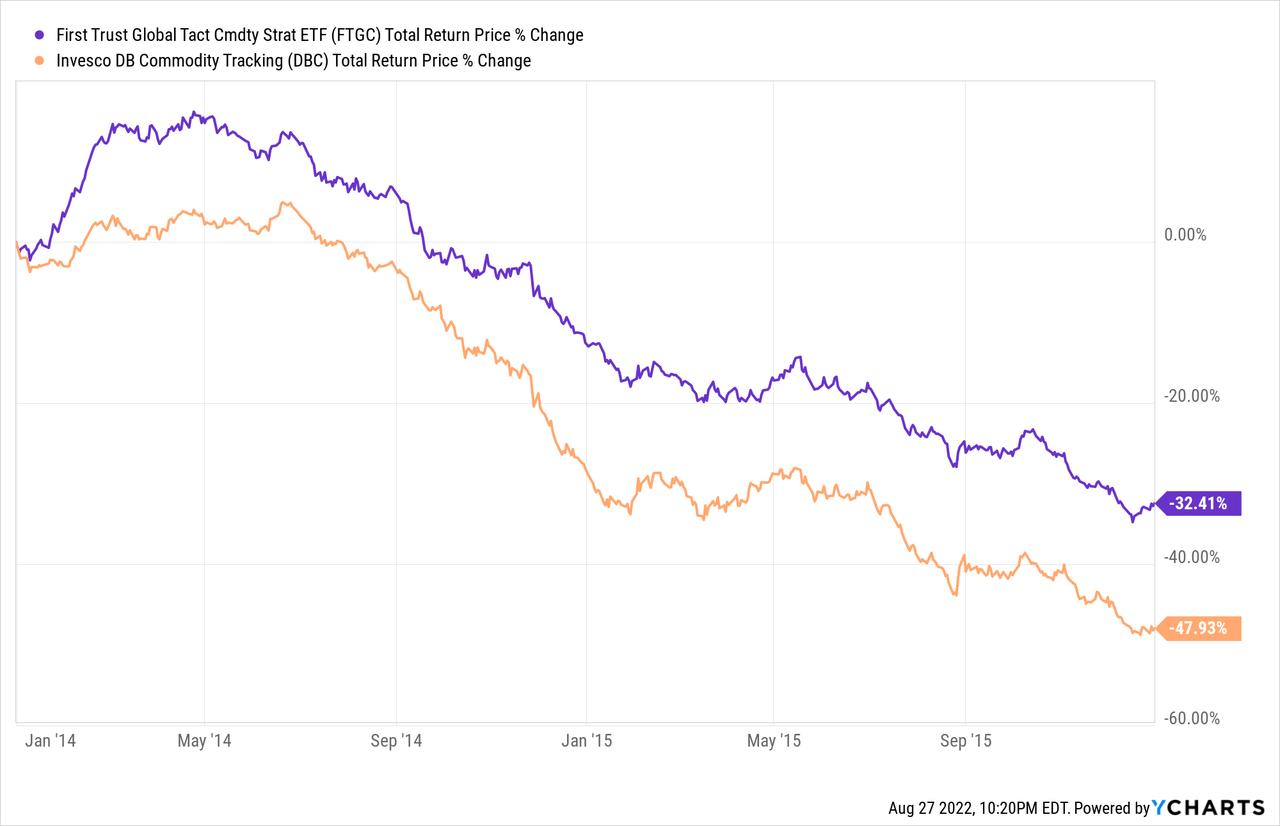

FTGC also suffered fewer losses between 2014 and 2016, another significant commodity price crunch.

FTGC’s investment strategy is effective at slightly reducing risk, volatility, and losses during downturns, a benefit for the fund and its shareholders.

As an aside, currently the fund seems somewhat underweight energy. Although management rarely provides detailed rationales for specific investment decisions, it seems plausible that the fund is underweight energy as these commodities have outperformed YTD, and so the fund is pairing back exposure to these commodities / taking profits. It is unclear to me if being underweight energy has been a net positive or negative for the fund, as we lack detailed information concerning the timing of these positions.

Distributions and Tax Reporting

Finally, a quick discussion on issues concerning distributions and tax reporting.

For regulatory reasons, investors in commodity funds must sometimes file K-1 tax forms. These forms are something of a hassle, and deal-breakers for many investors. FTGC’s investors must not file a K-1 form. So, there are no complicated tax reporting issues or forms with FTGC, a benefit for the fund and its shareholders. Investors in DBC, the largest, most popular commodity futures ETF in the market, do have to file a K-1 form.

For regulatory reasons, commodity funds sometimes make significant, taxable distributions to shareholders. Said distributions might expose investors to significant, unwanted taxes, so some investors might wish to avoid these. FTGC has mostly managed to avoid excessive distributions to shareholders, although the fund did make a special distribution in late 2021, roughly equivalent to a 6.0% yield. As a comparison, PDBC did a massive distribution in late 2021, equivalent to about 1/3 of the fund’s share price.

In my opinion, the above are benefits for FTGC and its shareholders, and make the fund a slightly superior investment to both DBC and PDBC.

FTGC – Risks and Drawbacks

FTGC is an effective inflation hedge ETF, but it does have two significant drawbacks, both centered on the fund’s futures contracts.

Futures contracts are expensive securities. Expenses related to these can be quite significant, leading to lackluster returns and even losses. Significant losses are possible, but somewhat unlikely.

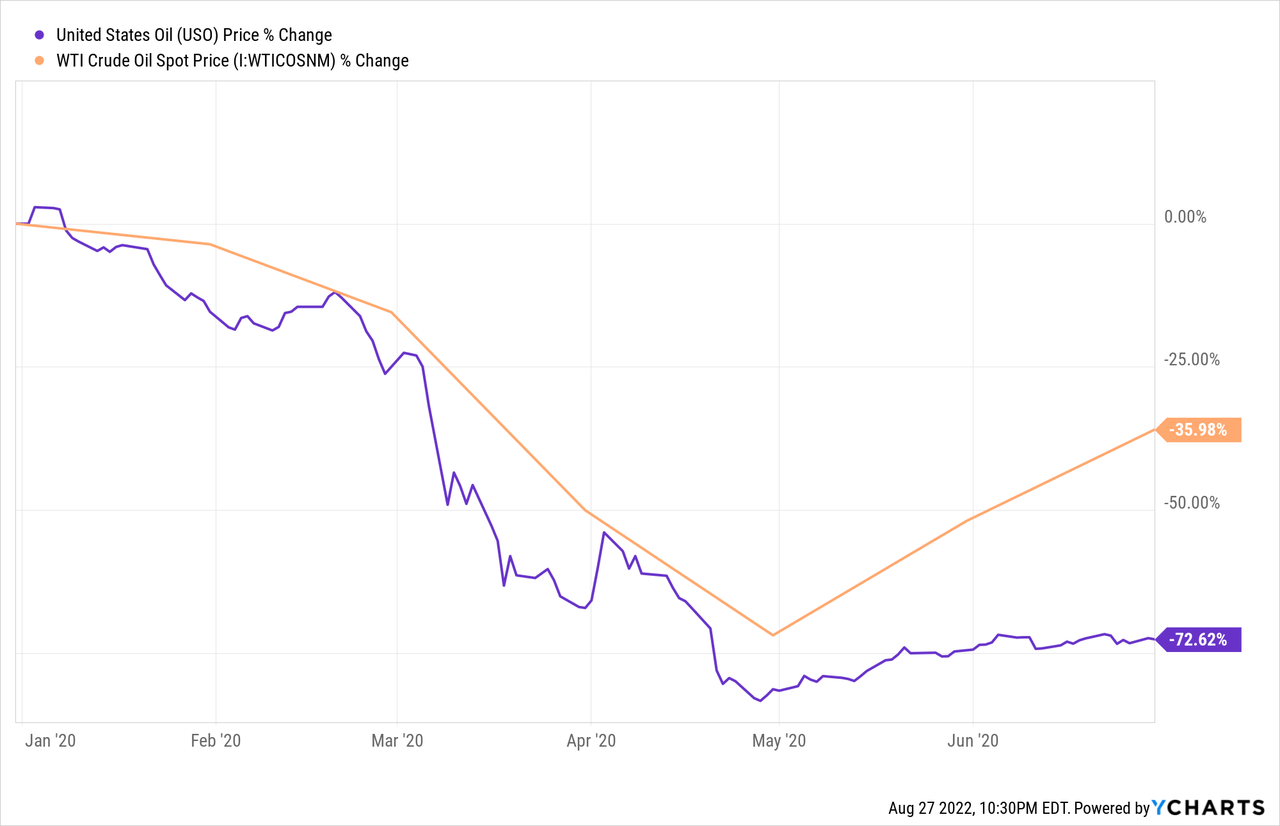

As an example of the above, we have the United States Oil ETF (USO). USO is meant to track the price of WTI oil, but significantly underperformed / failed at its objective during 1H2020. USO’s strategy / futures contracts were exceedingly expensive during a period of heightened market volatility, leading to significant losses and underperformance.

On a more negative note, futures contracts have extremely low long-term expected returns, as these securities don’t entitle shareholders to any underlying cash-flows, earnings, dividends, or similar. Equities have earnings, bonds have interest rate payments, while futures contracts have, well, nothing. Futures are purely speculative securities. Speculation can be quite profitable, but long-term returns should be more or less non-existent. Considering FTGC’s expenses, returns should very likely be very slightly negative, at least in the long-term. FTGC is roughly flat since inception, slightly outperforming expectations, almost entirely due to skyrocketing commodity prices these past few months.

FTGC’s low long-term expected returns are a significant negative for the fund and its shareholders, and make FTGC a broadly inappropriate choice for long-term investors. In my opinion, only short-term traders should consider a short-term position in DBC, with few exceptions.

Conclusion – Strong Inflation Hedge

FTGC’s diversified commodities exposure make the fund a strong, effective, inflation hedge ETF. The fund is appropriate for aggressive, short-term traders wishing to profit from higher inflation, but generally inappropriate for more risk-averse investors, or as a long-term portfolio holding.

[ad_2]

Source links Google News