[ad_1]

The iShares MSCI Frontier 100 ETF (NYSEARCA:FM) is one of the few ETFs available to investors desiring exposure to countries that are more “emerging” than traditional emerging market funds. The iShares MSCI Frontier 100 ETF is pricey for an index fund with an expense ratio of .81% but investors, particularly in the US, have very few alternative choices. So without further ado let’s dive into what the iShares MSCI Frontier 100 ETF is and what you get with it.

What is a Frontier Market?

Finding out just how the iShares MSCI Frontier 100 ETF is constructed requires going down a bit of a rabbit hole. The fund tracks the MSCI Frontier 100 Index, which is actually a subset of the 100 largest and most liquid components of another index, the MSCI Frontier Index. The MSCI Frontier Index is itself a subset of another index. It is all of the equity markets that are not included in either the MSCI Developed or Emerging Market indices and that meet several qualitative political and economic criteria. Despite being an index fund, the iShares MSCI Frontier 100 ETF has a bit of an active component to it as it’s up to the investment team at MSCI to determine what countries are eligible for inclusion in the index.

The Frontier index includes the following countries – Argentina, Bahrain, Bangladesh, Burkina Faso, Benin, Croatia, Estonia, Guinea-Bissau, Ivory Coast, Jordan, Kenya, Kuwait, Lebanon, Lithuania, Kazakhstan, Mauritius, Mali, Morocco, Niger, Nigeria, Oman, Romania, Serbia, Senegal, Slovenia, Sri Lanka, Togo, Tunisia and Vietnam.

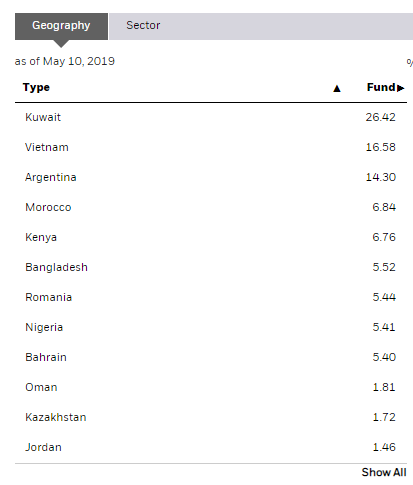

However, because the iShares MSCI Frontier 100 narrows down the list to just the 100 largest and most liquid stocks the result is an equity index that composed mostly of stocks form three countries – Kuwait, Vietnam, and Argentina.

(Graphic source: iShares website)

For investors looking for exposure to one or all of those three countries, the iShares MSCI Frontier 100 ETF is one of the few options available. According to ETFdb.com the fund is the only real option for investors looking for exposure to Kuwait. There appears to be no pure play Kuwait ETFs and FM has the largest exposure to Kuwait of all funds listed.

(Graphic source: etfdb.com)

For international investors there is a pure play Kuwait fund that is just now available this year.

For exposure to Vietnam investors have the option of a pure play Vietnam ETF from VanEck, the VanEck Vectors Vietnam ETF (VNM) which invests at least 80% of its funds in Vietnam and carries a .68% expense ratio.

For exposure to Argentina investors have a few options including two funds with lowers expenses than the iShares MSCI Frontier 100 ETF that are dedicated to Argentina.

Graphic source: etfdb.com)

Summary

Since inception, the performance of the iShares MSCI Frontier 100 ETF has been rather uninspiring although to be fair the entire emerging market sector has posted underwhelming returns. Over the past five calendar years from 2015 through the end of 2018, the fund returned a grand total of .56%. By comparison, Schwab’s Emerging Market Index Fund (SCHE) returned a cumulative 10%. It is hard to fault the fund manager or index methodology for the lackluster returns. It’s simply an index of “emerging” emerging market stocks in a time period that has been brutal for emerging markets.

For US investors who are for whatever reason looking for exposure to Kuwait, it’s one of the few options available. For investors looking for exposure to Argentina or Vietnam, there are other cheaper, pure play funds available. For investors looking for even broader emerging market exposure, the fund could fit the bill although we wish expenses were a bit lower.

Disclosure: I am/we are long SCHE. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News