[ad_1]

Ibrahim Akcengiz

There is no denying that inflation has been a prominent theme for investors this year. And not only in New York. We have seen investors and traders reacting to the record CPI levels in Amsterdam, Frankfurt, London, Paris, Mumbai, and the list goes on. Even in Tokyo, which was relatively immunized against soaring prices, investors had to reinvent their strategies to cope with inflation – not at home but elsewhere.

There is a broad consensus that some asset classes do have unique capabilities to reap benefits from soaring prices. Commodity-producing companies immediately spring to mind when we talk about the equity universe. Identifying those players requires a lot of patience and guesswork, and if made correctly, could reward generously.

Unsurprisingly, considering investor attention, in recent years, fund managers responded with a few ETFs designed to benefit from periods of rising inflation by combining different asset classes or sticking with equities only. This is what the Fidelity Stocks for Inflation ETF (BATS:FCPI) is trying to do.

How Does FCPI Attempt To Leverage Inflation Bets To Maximize Returns?

FCPI targets equities with a solid potential for outperformance when the economy is burdened by omnipresent rising prices. As of writing this article, the fund had 100 stocks in its portfolio.

The index it tracks is built around a proprietary strategy mindful of size, value, quality, and momentum. As the index page tells us, the benchmark is tilted towards “sectors that tend to outperform in inflationary environments.” It is rebalanced semi-annually.

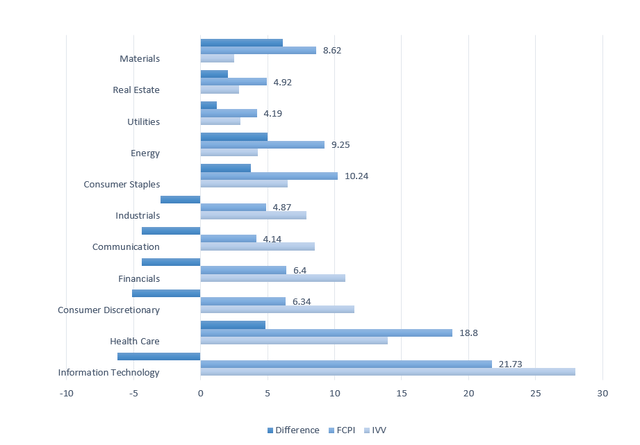

After reading this, one might expect oil & gas, forestry, agricultural commodities, and other inflation beneficiaries to occupy the leading spots in the FCPI basket. The surprise is that Apple (AAPL) and Microsoft (MSFT) are in first and second positions, sporting weights of 5.5.% and 4.5%, respectively, which makes the ETF oddly similar to the iShares Core S&P 500 ETF (IVV). Sectors it favors are IT (close to 22%) and healthcare (about 19%), which again reminds me of the IVV portfolio, yet there are differences in weights as shown on the chart below.

Created by the author using data from the funds. Weights are in %

This makes it almost antithetical to the Horizon Kinetics Inflation Beneficiaries ETF (INFL), which favors foreign equities (close to half of the portfolio), allocating most of its net assets to the ICB basic materials and energy industries. This more likely resulted in INFL’s much stronger performance, even despite FX headwinds this year.

Speaking of the factor exposure, I should note that FCPI does have a mix that I would appreciate. I see around 45% allocated to stocks with the Seeking Alpha Valuation grades of B- or better, while over 99% boast a Profitability rating of B- or higher.

Was Its Strategy Working In The Past?

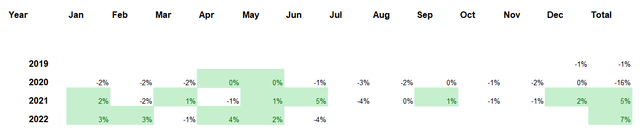

The best answer to that question is in the table presented below. Green cells indicate periods when FCPI outperformed IVV.

IVV and FCPI returns comparison (Created by the author using data from Portfolio Visualizer)

Data to make reservations about future performance is certainly insufficient as the ETF is comparatively novel, incepted in November 2019, but in fact, during most of its history inflation in the U.S. was gradually climbing to historical highs amid ultra-loose monetary policy and supply disruptions. In 2020, however, a different narrative dominated Wall Street, and it was the short-lived recession and the gradual post-coronavirus recovery; as a reminder, tech-heavy funds saw meteoric gains, while inflation-centered FCPI expectedly failed to keep pace, underperforming the S&P 500 ETF by massive 16% and ending the year with a measly gain of 2.2%.

Yet despite a somewhat peculiar strategy and fairly strange IT tilt that looks anything but a pro-inflation bet especially since tech names bore the brunt of higher interest rates designed to quell inflation by balancing supply and demand by increasing the cost of capital, it did outperform IVV in 2021 and 2022 YTD, periods when inflation in the U.S. and globally evolved from something ‘temporary’ to a gnawing concern.

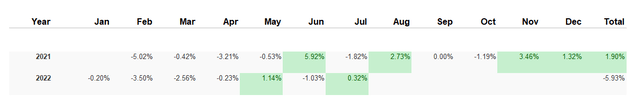

Nevertheless, FCPI does not have a strong edge over INFL, which has an even shorter trading history. The table below provides a context:

Created by the author using data from Portfolio Visualizer

In 2021, it did outperform it delivering 31.86% in February – December vs. INFL’s 29.96%, yet 2022 returns barely speak in its favor, instead illustrating the successes of INFL’s active strategy that I discussed in February.

Should It Continue Delivering Upbeat Results Going Forward? Risks Abound

I see little reason for FCPI to continue to outperform the market in the near term. With the recent CPI and PPI reports seemingly assuaging the fears of investors, there is a good reason for the broad market to regain lost ground, which can be played using plain-vanilla funds like IVV or the Nasdaq 100 (QQQ). That is to say, maintaining large exposure to inflation-centered strategies, even those oddly IT-heavy, no longer makes sense.

I see two reasons why investors are reacting exultantly to the fresh inflation data. First, it means there is no need to price a hefty terminal rate in the cost of capital, thus compressing trading multiples as inflation is perhaps approaching its peak or has already passed it and much more aggressive moves from the Fed look less likely. Investors are desperately searching for reasons for optimism, and this one looks sufficient enough after the first-half stock market rout.

And second, this also implies that engineering a recession is no longer an inevitable option to remove excess demand from the market. Hence, bets on a recession to arrive any time soon are also likely dialed back.

The ETF has a large allocation to IT, with quality characteristics being supportive should the rebound last into September. However, owning a fund with a 29 bps expense ratio solely because of its quality characteristics and IT exposure is wrong. As I illustrated numerous times in my notes, bellwether ETFs by definition manage portfolios with profitability characteristics close to excellent as they overweight mega-caps, while charging just a few basis points in fees.

Final Thoughts. Is FCPI Still A Buy?

Solid performance delivered since inception demonstrates the obvious strength of the strategy, though the much pickier active peer INFL did far better despite a much higher expense ratio of 85 bps and FX headwinds like the Canadian dollar volatility.

But with U.S. inflation seemingly faltering, the allure of FCPI and similar plays wanes. That is by no means to say inflation globally is no longer a concern. Contrarily, there are regions where prices are yet to peak, with the UK being one of the examples as the Bank of England forecasts the rate to rise to 13% “over the next few months.” However, I do not regard this as a strong reason to buy into U.S.-focused inflation plays right now.

As I said above, FCPI has a nicely balanced mix of factors, value supported by quality, but I see little reason for paying 29 bps for it in an environment where inflation slowly but steadily creeps back to a 2% target. On a side note, from an income standpoint, a 1.5% dividend yield looks suboptimal. The ETF also does not have a consistent distribution growth story, for two reasons: it is comparatively nouveau, and its strategy is not dividend-oriented.

[ad_2]

Source links Google News