[ad_1]

Luis Alvarez/DigitalVision via Getty Images

Fidelity MSCI Health Care Index ETF (NYSEARCA:FHLC) has had something of a joyride for a staid, old-world ETF. When I last covered it on 10th March, 2022, it was trading around $62. Then it rose by more than 10 percent by April 8th, and then again dropped by almost 15 percent by May 12th. Now it is back to where it was in March. Composed of large cap defensive stocks, FHLC seems to be quite stable in terms of its price.

ETFs of Defensive Stocks are Safe Bets in Uncertain Markets

As this source says:

Wall Street has been on edge lately, with financial markets roiled by a host of factors: yield curve inversion, rising inflation, rate hikes, a possible recession and geopolitical tensions. In this environment, it’s no surprise that exchange traded funds focused on defensive stocks have become popular, pushing several to all-time record highs.

A defensive stock demonstrates relatively stable performance regardless of the current market condition or the state of the economy. These stocks are non-cyclical in nature, as they are relatively less impacted by economic boom or recessions. Defensive stocks generally pay a steady dividend that is less volatile. When you expect a recession, it is good to add defensive stocks to your portfolio.

In the case of Fidelity MSCI Health Care, more than 88 percent of its portfolio consists of large caps, mostly defensive in nature. During my last coverage, I found that all the top 10 holdings of FHLC generated positive returns during the year 2021. These stocks were – UnitedHealth Group Incorporated (UNH), Johnson & Johnson (JNJ), Pfizer Inc. (PFE), AbbVie Inc. (ABBV), Eli Lilly and Company (LLY), Thermo Fisher Scientific Inc. (TMO), Abbott Laboratories (ABT), Merck & Co., Inc. (MRK), Danaher Corporation (DHR), and Bristol Myers Squibb Company (BMY).

In the past three months, barring ABT and DHR, all other stocks have generated a growth in excess of 3 percent. So, we can see that some larger holdings of this ETF have been able to record stable growth despite the poor market condition and despite seeing huge price growth for almost two years. Another interesting factor to note here is that Fidelity MSCI Health Care has consistently invested in defensive stocks, as all these stocks have been inducted in this ETF at least five years ago.

Various other highly diversified healthcare ETFs that comprise defensive stocks such as Vanguard Health Care ETF (VHT), iShares U.S. Healthcare Providers ETF (IHF), Health Care Select Sector SPDR ETF (XLV), and Invesco S&P 500 Equal Weight Health Care ETF (RYH), performed much better than those healthcare ETFs concentrating in cyclical stocks.

Stable and Average Price Multiples Suggest Stability in Price

Fidelity MSCI Health Care is one of the best performing healthcare ETFs. Though it is a diversified healthcare fund, more emphasis is given to the equity shares of companies engaged in healthcare equipment and medical devices. As these two segments have performed much better than other healthcare segments, this ETF has been much more stable than other healthcare indexes, especially ones which are concentrated in biotechnology and life sciences segments.

During the past one year the companies included in FHLC have recorded an average cash flow growth of 20 percent. On average the sales and earnings of those companies grew by almost 10 percent. Its stable and average (compared to the category/industry) price multiples suggest that the stock has now become stable and expecting an excessively high growth rate will not be a wise idea. Price/Earnings (P/E) of 15.79, Price/Book of 3.77, and Price/Cash Flow of 12.56, are also almost similar to that of March 10th. In my opinion, the stable price multiples also indicates that the price volatility will be quite low for this ETF.

What Lies Ahead?

In my last coverage, I said that the “Healthcare sector as a whole had seen a steep fall in March 2020, and then some of the stocks bounced back, and some are still recovering. Fidelity MSCI Health Care has suffered a very minimal loss during this pandemic. FHLC was also a rare fund to generate positive returns every year in the past five years. More than 73 percent price growth during the past five years makes it a standout performer.”

The healthcare equipment and medical devices segments have recorded significantly higher price growth in 2021, as a result of which this ETF also performed quite well. But the growth in 2022 has been poor. Also the price grew by almost 100 percent between mid-March 2020 and end-December 2021. The stock dropped to near $35 on 20th March 2020 due to the covid-19 pandemic related market crash, and then rose to almost $70 on 27th December 2021.

Without major upheavals ahead, $70 may be the upper range for some more time, at least for another quarter, and the stock will trade somewhere in between $60 to $70. The stock has already dropped by around 7.5 percent during this year, and 15 percent from the April 8 high, and I don’t foresee much downside potential. However, in order to protect myself from an unlikely market slump, I’d like to hedge myself with a put option of $60. As I expect the stock to have a lower range of $60 for another three months, I’d prefer to buy a September 16 (3.5 months forward) $60 put option for a premium of less than $1 (preferred premium).

About the TPT service

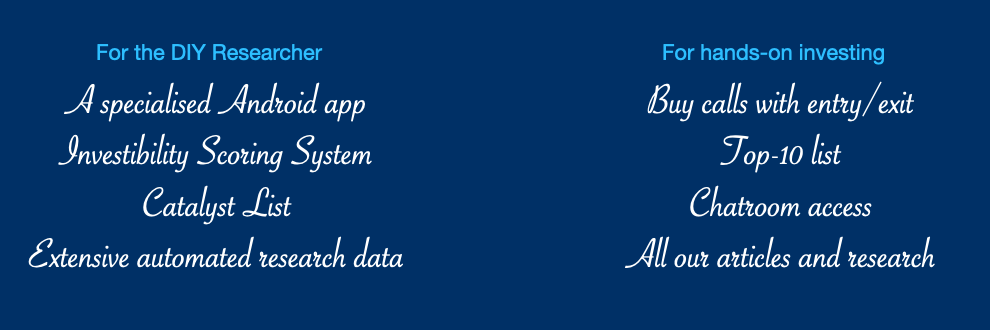

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

[ad_2]

Source links Google News