[ad_1]

Freer Law

As you know, the 2022 bear market has played havoc on growth stocks and their valuations have contracted significantly. That, along with the higher interest rate and higher inflationary environment, has caused a market rotation from growth to value. If you’re of the belief that the recent bounce in the market it’s nothing but a classic “bear market rally,” and that the value thesis is likely to continue for a significant longer period of time, you might consider allocating some capital to the Fidelity Blue-Chip Value ETF (BATS:FBCV). The ETF has significantly outperformed the broad S&P 500 over the past year and appears to be a solid addition to any well-diversified portfolio that is built to hold throughout the market’s up-n-down cycles.

Investment Thesis

In my opinion, and in view of my long-term perspective, desire for quality, and my interest in dividends, it’s always a good time to hold (and add) high-quality blue-chip stocks. Blue-chip companies are typically large well-established companies with strong global brands that run financially sound businesses and deliver consistent earnings and free cash flow for shareholders. These companies typically reward ordinary shareholders by returning cash to them through a combination of dividends and share buybacks. They also tend to deliver solid capital appreciation over the long term.

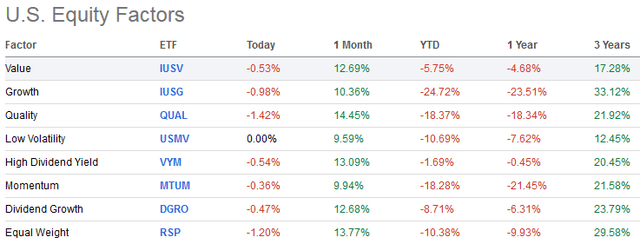

When it comes to the “value” sub-sector within the blue-chip companies, note that over the past year “value” has outperformed all other equity factors except “High Dividend Yield”:

Seeking Alpha

However, the three-year returns in the far right column easily prove that holding a well-diversified portfolio (including “growth”…) is the key to long-term wealth accumulation.

That being the case, let’s take a closer look at Fidelity’s FBCV ETF to see if it might be a good addition to your portfolio.

Top-10 Holdings

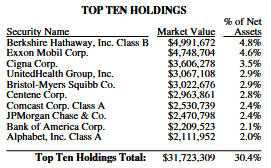

For some reason, the latest up-to-date holdings in the Fidelity Blue-Chip Value ETF are currently unavailable from the FBCV’s homepage, but here are the top 10 holdings (all the holdings can be found from clicking on the previous link) as of Q3 quarter end. I believe these holdings are still relatively accurate as this is likely not a high turnover type portfolio:

Fidelity

As you can see from the list, the top-10 holdings equate to what I consider to be a relatively well-diversified 30.4% of the entire portfolio.

As mentioned earlier, the fund has 9.4%, and is over-weighted, in its holding in two companies: Berkshire Hathaway (BRK.B) and Exxon Mobil (XOM).

You likely are already relatively well acquainted with both companies and know that Berkshire’s largest stock holding is currently Apple (AAPL) with a 39.6% weight. Berkshire also has significant stakes in O&G: 9.1% in Chevron (CVX), and 4.1% in Occidental Petroleum (OXY). More recently, Berkshire made big news when it bought a 60.1 million share position (~$4 billion) in Taiwan Semiconductor (TSM) – see my recent article SMH: Buffet Takes Big Stake In ETF’s #1 Holding.

TSMC is a large semiconductor supplier to Apple and the stock was cut in half from its high prior to Berkshire buying shares. The stock was up ~10% Monday after Berkshire filed its quarterly SEC Form 13-F and revealed the large new stake in TSMC.

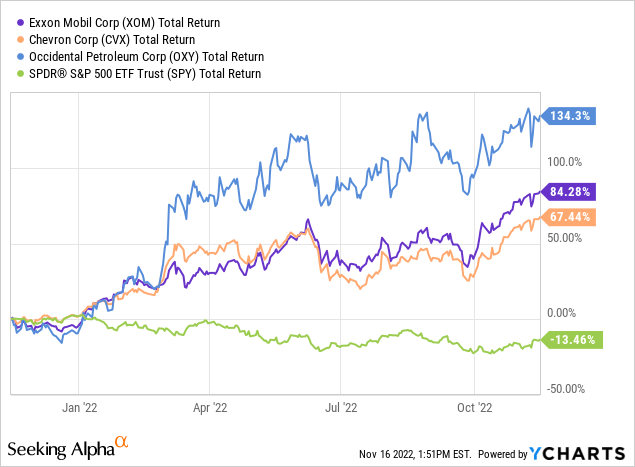

Exxon has been enjoying a great year as the company has reduced spending – arguably under the influence of new Engine #1 board members to increase shareholder returns after what many investors have considered years of over-spending (which forced the company to take on significant debt during the global pandemic) on growth projects – and, combined with high O&G prices, have enabled XOM to deliver record free cash flow. See my Seeking Alpha Editor’s Choice article: How Tiny Engine #1 Was Able To Turn Exxon Around. The following chart shows Exxon’s one-year performance along with Berkshire’s other top O&G holdings – all of which have significantly outperformed the S&P500 as represented by the (SPY) ETF:

Not surprisingly, healthcare also is well represented in the top 10 holdings. UnitedHealth Group (UNH), Bristol-Myers Squibb (BMY), and Centene (CNC) equate, in aggregate, to 8.6% of the portfolio. With yields of 1.3% and 2.8%, respectively, UNH and BMY deliver decent income and both are up strongly this year. Centene pays no dividend and is a multi-national healthcare company that provides programs and services to under-insured and uninsured individuals in the United States. It operates a Managed Care segment that offers healthcare plans to individuals through government subsidized programs like Medicare, Medicaid, and the States’ children’s health insurance programs. The stock is up 6% over the past year.

The fund also has 4.5% allocated to banks: JPMorgan Chase (JPM) and Bank of America (BAC), which yield 3.01% and 2.33%, respectively.

The top-10 is rounded out by Alphabet (GOOG) with a 2% weight. Call me old school, but this company will always be “Google” to me. To learn more about what is my current favorite mega-tech company – which continues to deliver strong free-cash-flow and ended Q3 with $116.26 billion of cash and cash equivalents (an estimated $8.88/share) – consider reading my popular Seeking Alpha article: Q3 Surprise: Google Generated $3.7 Billion More FCF Than Chevron.

Performance

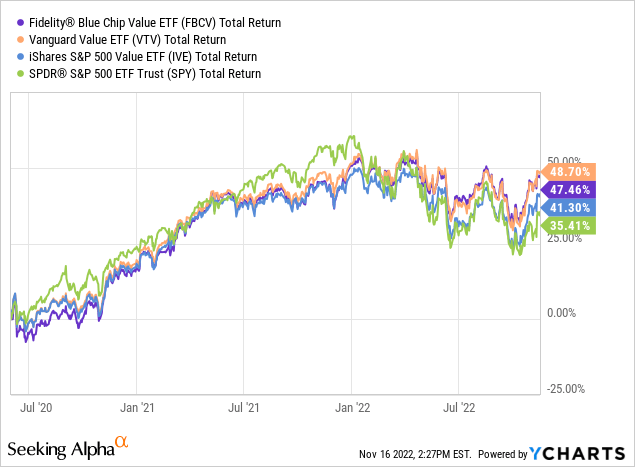

As mentioned in the bullets, the FBCV ETF has only been around since June of 2020. That being the case, there’s no long-term performance track record. The chart below shows the fund’s total returns performance since inception vs. the S&P 500 as represented by the SPY ETF, as well as compared against peers like the Vanguard Value ETF (VTV) and the iShares S&P 500 Value ETF (IVE):

The Fidelity ETF has delivered an admirably strong 47.5% total return since June 2020, trailing the ultra low-cost (expense fee 0.04%) Vanguard VTV Value fund by only ~1.3% while beating the returns of IVE and the S&P500 by significant margins.

Risks

In my opinion, the risks of owning the Blue-Chip Value FBCV ETF are considerably less than owning, say, the S&P 500 or the Nasdaq-100 triple Q’s. That said, the ETF is not immune to the overall macro environment and its headwinds: global pandemic related shutdowns and supply chain challenges, higher inflation, higher interest rates, and the impact of Russia’s war-of-choice on Ukraine. Any or all of these factors could lead to a slowing global economy and a potential global recession (or severe recession).

That being the case, I would advise investors who want to establish a position in the FBCV ETF to average-in over time. That way, you won’t have gone “all in” at the top of a “bear-market rally,” and you would have taken advantage of down-cycles to dollar cost average and add to your position.

Summary and Conclusion

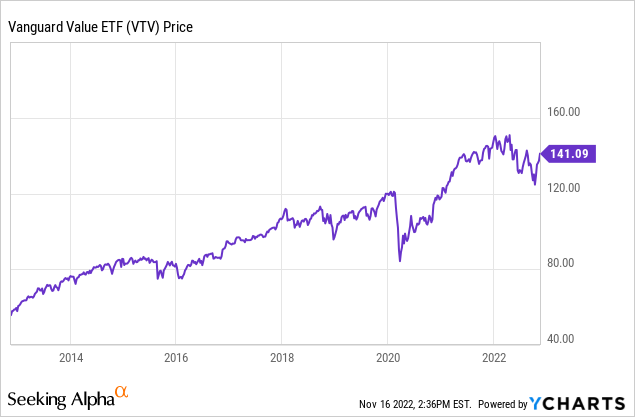

Other than the relatively high expense fee, the FBCV ETF holds a relatively attractive portfolio. That said, I don’t see much of a reason to hold the FBCV ETF over the much lower-cost, and better performing, Vanguard VTV ETF. The VTV is not only lower-cost, but it also has a very impressive and proven long-term performance track record (the 10-year average annual return is 11.8%):

[ad_2]

Source links Google News