[ad_1]

Main Thesis

The purpose of this article is to evaluate the iShares MSCI United Kingdom ETF (EWU) as an investment option at its current market price. While I typically invest in U.S.-based companies, I have begun to see real value within the United Kingdom (U.K.), as Brexit worries persist and investors are reluctant to buy stocks based in that region. While Brexit is indeed a very serious risk, EWU, in my opinion, offers a reasonable risk-to-reward option for a few reasons. One, investors have shunned the U.K. for some time, to the point where the broader U.K. equity index is trading at historically low levels compared to the broader, global market. Second, in part due to the lack of demand, EWU offers a dividend yield that is more than double the S&P 500. While we do not know yet what the fund’s dividend growth will be like in 2019, the top holdings of EWU have either raised or kept their dividends constant in Q1, on an individual basis, which is a positive sign. Three, while British companies certainly hold the bulk of the risk when it comes to Brexit, it is important to remember that the major holdings of EWU obtain a good deal of their revenues (and profits) from international markets. While a struggling British economy would certainly be a hindrance, it may not be as devastating to these companies as one might think based on all the headlines.

Background

First, a little about EWU. The fund’s stated goal is “to track the investment results of an index composed of U.K. equities.” The fund only offers exposure to large and mid-sized companies, which are based in the U.K. EWU is currently trading at $31.79/share and yields 4.59% annually, based on the semi-annual distributions in 2018, which are paid in June and December. This is my first review of EWU, and it may seem like an odd time to recommend this exposure given the uncertainty surrounding Brexit. However, it is primarily because of that uncertainty that the U.K. is offering such a tempting valuation, and I feel the risk/reward proposition looks quite favorable. While I am primarily a U.S. investor, I am also a “Dividend Seeker,” and my love for dividends is another reason why I am drawn to EWU, all of which I will explain in detail below.

U.K. Trading At A Large Discount To The Market

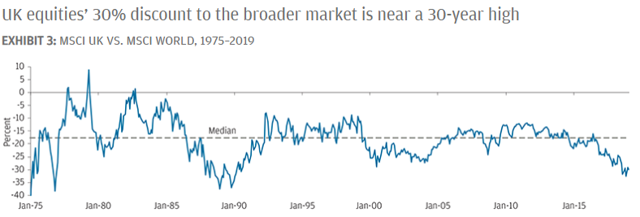

To start, I want to illustrate one of the primary reasons why I am drawn to U.K. equities right now. Specifically, the equities within the region are trading at a discount, relative to the broader market, that is at a level not seen in almost 30 years. As the chart below illustrates, the MSCI U.K. index is offering a roughly 30% discount to the entire world stock market, which is a level last seen in the early 1990s:

Source: JP Morgan Asset Management

Source: JP Morgan Asset Management

As you can see, this is a pretty wide disparity, and one that does not come around often.

Of course, there are valid reasons for this discounted price. The graph clearly shows that the discount began to widen in 2016, which is when the British referendum on leaving the European Union was held. While I certainly feel U.K. equities should be trading at some type of discount, 30% seems high, and the graph shows that it is, on a historical basis. Essentially, this makes me question how much wider this gap can get, and my takeaway from that is these are levels where investors should be building positions.

Furthermore, when looking at the U.K. compared to the U.S. equity market, a similar disparity exists. Measuring EWU against the broad S&P 500 index, as measured by the valuation and yield of the SPDR S&P 500 Trust ETF (SPY), the discounted price is clearly shown here as well:

| Fund | Current P/E | Current Dividend Yield | Number of Holdings |

| EWU | 15.1 | 4.59% | 99 |

| SPY | 20.7 | 1.97% | 500 |

Source: Multpl.com

The point of this chart is to show that the U.K. is also heavily discounted against U.S. equities, and it is not just other developed, or emerging markets, which are responsible for the widening gap.

While this exercise is fairly simple and does not guarantee U.K. equities will rally, with the on-going volatility and trade disputes impacting U.S. stocks right now, EWU’s valuation and income stream certainly have me interested.

Buy When Others Aren’t

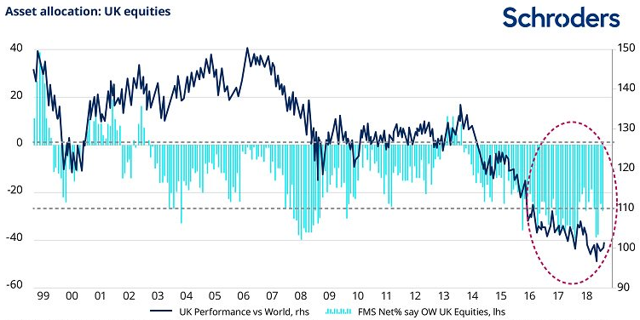

My second point is related to the first and helps explain why U.K. equities are trading at such a large relative discount. Not surprisingly, it is because investors have been shunning this asset class over the past couple of years, reducing their exposure and, therefore, pushing down the valuation of British companies. According to data compiled by Schroders, global fund managers have been underweight U.K. equities since the referendum resulted in a “Leave” vote. This is defined by determining the historical norms of exposure, and by surveying fund managers to gauge their future investment intentions. As the graph below illustrates, the underweight exposure by the broader market has correlated directly with the downward pressure on share prices, compared against the performance of equities in the rest of the world:

Source: Schroders Asset Management

Source: Schroders Asset Management

As you can see, similar to this discount, this underweight metric is also near multi-year lows. While it has been fairly consistent over the past three years, it is well below the historical average and represents a very sharp drop from 2013, when fund managers said they were overweight U.K. equities.

My takeaway here is this represents another reason to put the contrarian hat on and bet the opposite way from the pack. Again, while going underweight was clearly a strategy that paid off over the past few years, the extreme level of it raises eyebrows. Coupling this with the widening valuation discount, mentioned in the preceding paragraph, and I have to conclude that a lot of the downside risk is already priced into the equity prices, which is precisely what value investors are looking for.

Dividend Seekers Have Some Comfort

A third point on EWU has to do with the dividend. On the surface, the yield looks attractive, at over 4.5%. As I mentioned earlier, this handily bests the S&P 500 and, with interest rates remaining low, investors could be drawn to this above-average income stream.

Of course, given the state of the U.K. economy, investors could be concerned that yield is too good to be true. If the British companies within the fund are struggling, or would be expected to struggle with the on-going Brexit negotiations, there is a real risk that the income stream could be cut, or at least not grow. While I would certainly not expect rapid dividend growth from major British companies, or EWU in particular, I can take some comfort in the fact that the dividend has so far held up fairly well, even with all the market volatility. In fact, despite all the fear of Brexit wreaking havoc on revenues and profits, EWU managed to grow the dividend last year, as illustrated below:

| 2017 Distributions | 2018 Distributions | YOY Growth |

| $1.40/share | $1.46/share | 4.4% |

Source: iShares

As you can see, the dividend growth was not large by any means, but it was respectable considering the market climate these companies are operating in.

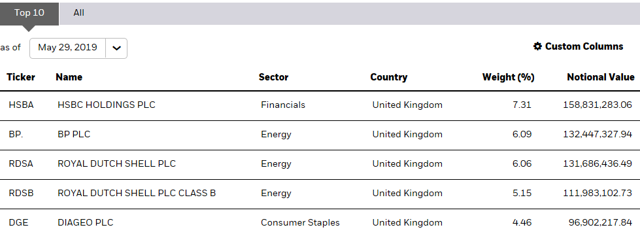

Looking forward, we don’t know yet what the dividend growth for the fund will be this year, if there is any at all. Since the fund pays out its distributions semi-annually, the first one is not set to be paid until June, so we cannot use Q1 as a guide in the same way we could for other funds. However, we can examine the Q1 distributions for the underlying holdings of EWU, assuming they have made payments already in 2019. To get a better sense of the dividend direction, I reviewed the Q1 distributions for the top five holdings of the fund. While it may not sound like a lot, these tickers make up roughly 29% of the fund as a whole, as the chart below illustrates:

Source: iShares

Source: iShares

Therefore, what is going on with these companies is of critical importance to EWU. To monitor the 2019 dividend growth in Q1 for these companies, I reviewed the Q1 distributions for their U.S. stock listings, HSBC Holdings plc (HSBC), BP p.l.c. (BP), Royal Dutch Shell plc (RDS.A) (RDS.B), and Diageo plc (OTCPK:DGEAF), and compared it against the Q1 distribution paid in 2018, which are all listed in the chart below:

| Company | Q1 Distribution | YOY Gain |

| HSBC | $1.05/share | Flat |

| BP | $.615/share | 2.5% |

| RDS.A/RDS.B | $.94/share | Flat |

| DGEAF | $.3462/share* | 16.3% |

Source: Seeking Alpha

*DGEAF pays a semi-annual dividend

As you can see, the result is mixed, but slanting positive. While the flat dividend growth of both HSBC and DGEAF is certainly a concern, the fact that none of the top five holdings has cut their dividend during the current volatility is a testament to the sustainability of their businesses. Therefore, while I would anticipate a single digit dividend growth rate for EWU this year, similar to 2018, I am comfortable with that, considering the yield is quite high to begin with.

Real GDP Growth Continues

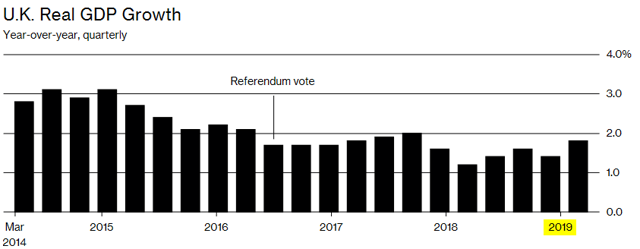

My final point has to do with the U.K. economy as a whole, and why things may not be as bad as they seem. While there is no doubt that the impact of Brexit has been negative on the financial markets, the headlines would have us believe the nation has fallen off a cliff. To be sure, jobs and people have left, the currency has depreciated tremendously, and the outlook is uncertain. However, the broader economy has actually held up fairly well and remains one of the most important in Europe. In fact, while GDP growth has certainly slowed post-referendum, it has picked up in the short term, as illustrated in the chart below:

Source: Bloomberg

Source: Bloomberg

Specifically, the British economy grew 1.8% (year-over-year) in Q1 this year, which bests each quarter last year, individually. While a far cry from the near 3% growth in 2014, the chart shows at least some growth for each quarter after the Brexit referendum. Seeing this uptick is certainly welcome news, and shows that there have been both winners and losers in this Brexit saga, and not all losers as the headlines might have us believe. Specifically, British exporters have benefited from the weaker pound, which has made their goods cheaper overseas. Furthermore, consumer spending and wages have held up reasonably well. According to data from the Office for National Statistics, compiled by The Guardian, wages are up 3.3% for the year (through March), while the unemployment rate actually dropped from 3.9% to 3.8%. Both of these developments are helping support household spending, a key reason for the continued GDP growth.

My takeaway here is that, while clouds certainly loom on the horizon, there are positive underlying conditions in the British economy. Considering how beaten-up the equities market is, one may not expect such relatively solid economic numbers. This does not appear to be an economy on the brink of disaster.

Bottom Line

I rarely recommend buying non-U.S. driven ETFs, but sometimes the value is simply too tempting to ignore. I see this currently playing out in the U.K., as British equities are one of the most “unloved” asset classes right now, based on investor exposure. Furthermore, equities are valued at a discount to the world market at a level not seen in almost thirty years, which is quite a telling statistic.

What this tells me is, there is plenty of bad news baked into British equities. However, the British economy continues to grow, wages are up year-over-year, and the unemployment rate is actually dropping. In addition, the dividends offered by major British companies are quite competitive, even though dividend growth is lacking. With Brexit continuing to remain a headwind going forward, that has been the case for three years, yet the underlying economy is performing reasonably well. While it will take some time for the U.K. to see “business as usual,” I see an equity market that is quite undervalued, considering the positive metrics I just discussed. Therefore, I view EWU positively by extension, and recommend investors take a look at the fund at this time.

Disclosure: I am/we are long SPY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News