[ad_1]

shihina/iStock via Getty Images

The iShares MSCI Japan ETF (NYSEARCA:EWJ) is a pretty good representation of the Japanese stock market layout. The large industrial conglomerates of course command a lot of the capital in the economy, but also the pretty significant consumer discretionary businesses, in particular automotive, are present in the EWJ portfolio. With respect to the ETF’s multiple, we aren’t so convinced of values in the Japanese economy. While relatively cheap, they are exposed to recession risks in the global marketplace. The multiple doesn’t seem to fully acknowledge that. It could get cheaper.

EWJ Breakdown

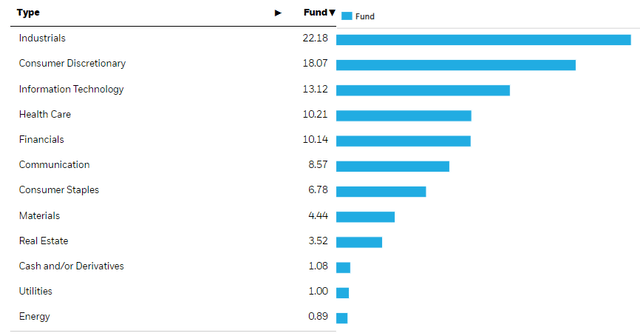

Let’s start with the sectoral breakdown.

Sector (iShares.com)

What stands out is the Industrial exposure. First among them are Mitsubishi (OTCPK:MSBHF) and later Hitachi (OTCPK:HTHIY). Together these account for less than 3% of the portfolio despite being large corporations. Ultimately 238 is a pretty large number of holdings, and no individual security is likely to account for a lot, but still the industrial exposures here are substantially these typical conglomerates that deal with industries ranging from tech hardware, telecoms, cars, construction, household appliances and electronic products. Ultimately, many of these businesses are rather levered to the economic environment, and will see pronounced declines when the global economy takes a turn for the worse – but some are much more resilient with economics that can bring them through economic troubles. Hitachi’s elevator business would be an example of a razor and blades business model that should be pretty resilient on substantial maintenance income. Other conglomerates deal in essential products to industries likely to stay relatively healthy through at least a garden variety recession. The idea is that both inflation and recession have an impact on these businesses, but there are some points of resilience in many of these product portfolios.

Next is consumer discretionary, and this is where we start to have problems because the leverage to economic cycles is much more pronounced. Besides the fact that these businesses are characterised by inherent operating leverage that positions their cost structures poorly for a downturn, the demand side is also levered as financing is a big part of what drives automotive purchases. With the globe seeing recession as a consequence of higher rates, these issues are particularly pointed. Remember that global markets matter a lot for these businesses, so even though the BoJ is dovish that won’t necessarily save these companies.

The other sectoral exposures aren’t too remarkable. The benefits of rate hikes are a little lost on the financial exposures because of the dovish BoJ, but in general, the exposures look pretty resilient and healthy.

Remarks

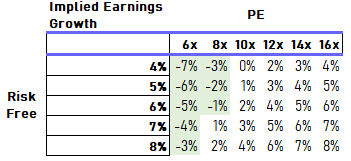

The Japanese monetary situation is important to comment on in relation to the EWJ multiple which lies above 12x. Implied earnings yields are going to stay way ahead of Japanese rates which are not rising because inflation isn’t an issue there as demographic pressures on the demand side have made the economy basically deflationary for years. This isn’t very helpful though when the Yen is collapsing and Yen denominated earnings for foreign investors are falling precipitously even where sales volumes in domestic markets might not be falling as much as elsewhere. So while some pretty significant local market exposure is present in the demand sides of these businesses, the relative calm of the Japanese monetary regime, which remains much in line with the pre-invasion paradigm, will mean FX pressures will offset the benefits of less volatile Japanese consumer markets. The pressures will worsen if the more export-oriented businesses in consumer discretionary fall sharply in a recession. Ultimately the EWJ’s earnings yield should be measured according to a global standard, and the yield looks optimistically priced in that regard where rates continue to rise. We believe they will continue a while despite the production data from the US that jumped markets this week.

Value Chart (VTS)

Consumer discretionary is a bit of a weak spot in the medium term that prejudices the earnings growth prospects. Therefore EWJ is a pass.

Thanks to our global coverage we’ve ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

[ad_2]

Source links Google News