[ad_1]

Over the last month, shares of the Direxion Daily Energy Bull 3x Shares ETF (ERX) have fallen by about 27% bringing the year-to-date return in the fund to roughly flat. Since this is a leveraged ETF, the extreme volatility seen in this instrument is likely not a surprise to followers and investors in the fund, with many such moves seen in its past history. It is my belief, however, that the decline in energy shares has stopped, and that holding ERX makes for an excellent trade at this key inflection point in fundamental data.

The Instrument

Before buying an ETF, the first thing you should do is look under the hood and see what it is you actually are buying. Many losses in the traded fund and note space can be attributed to not fully understanding the instrument as well as the underlying strategy, so let’s dive in.

In the case of ERX, it is a leveraged ETF which gives three times the daily return of the Energy Select Sector Index. The Energy Select Sector Index essentially takes all the energy stocks in the S&P 500 and weights them by market cap (with an upper limit on exposure) to form an index. This index basically gives broad exposure to the large energy firms across the entire industry, allowing investors to make bets on the sector itself rather than on specific companies. A list of the current holdings can be seen here, and these holdings are highly concentrated on oil and gas production, oil refining, and firms which profit when the activities in E&P and refining are on the rise.

Since the Energy Select Sector Index gives broad exposure without too much weight put in a single stock, it makes the overall analysis of the fund much easier. Rather than going company to company and doing comparative analysis or discounting cash flows, we can take the sector at large, isolate key revenue and earnings drivers, and study those drivers. Specifically, to understand ERX and why is it likely to rally, we simply need to walk through the fundamentals of the underlying commodities and industries which drive overall earnings to get a feel for where the sector is headed.

Crude Fundamentals

Let’s start our analysis with crude oil, since crude oil production is the leading driver of earnings in the top 3 holdings of the ETF (which are nearly 50% of the weight of the fund).

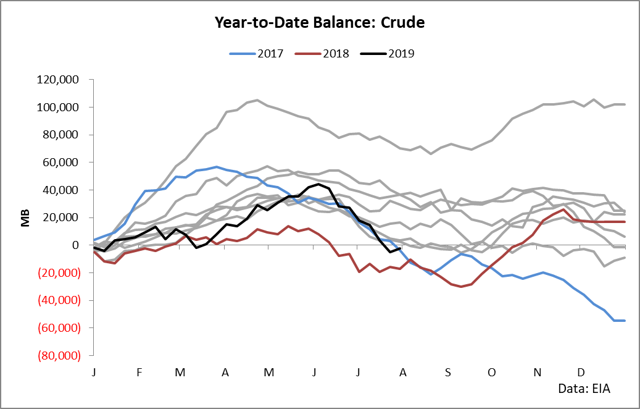

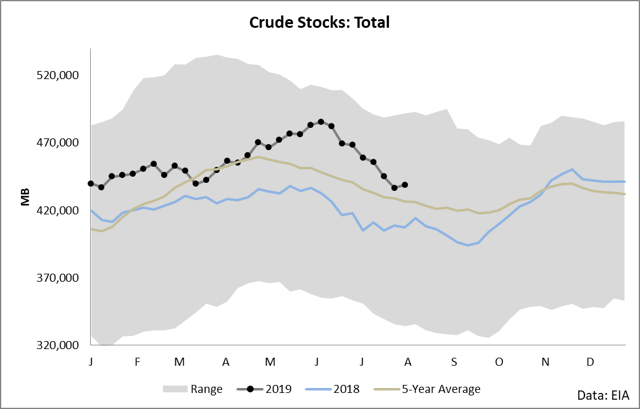

The crude markets this year have been fairly strong, with the year-to-date draw seen in inventories coming in at the second-largest in over a decade for a few weeks over the past month.

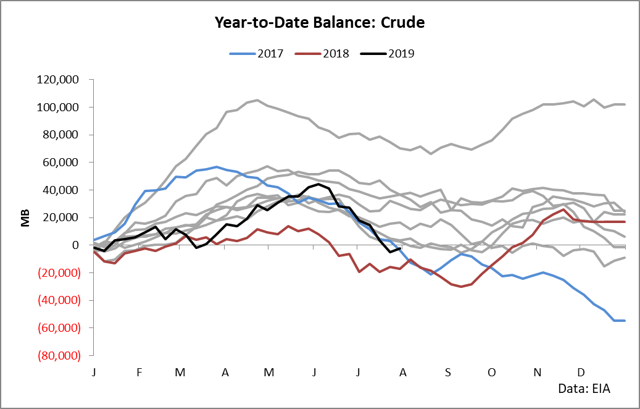

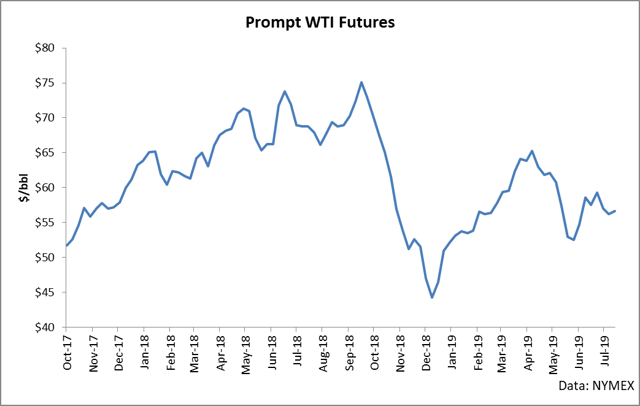

The reason for this draw is very simple and straightforward: OPEC. In the face of falling crude prices at the end of 2018, OPEC agreed to production cuts. This agreement led to an almost immediate rally in the price of crude and marked the end of the downtrend in prices which had been in force for several months.

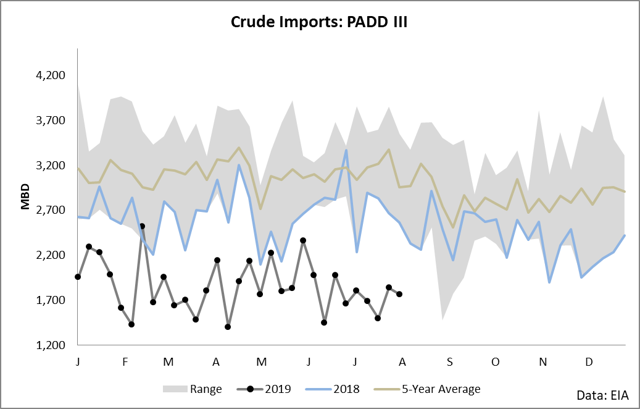

In the face of a pullback in price during the middle of this year, OPEC agreed to maintain its cuts through March 2020, ensuring that the decrease in imports into the key pricing centers for crude (U.S. Gulf Coast) would remain low.

As long as OPEC cuts continue, the supply and demand balance for crude oil will, in all likelihood, continue to contract. As seen in the following chart, the impact of OPEC’s cuts on this year’s balance has resulted in the trend of inventories lagging the seasonal 5-year average trend in inventories in almost every month of this year, with a traumatic acceleration seen over the past two months.

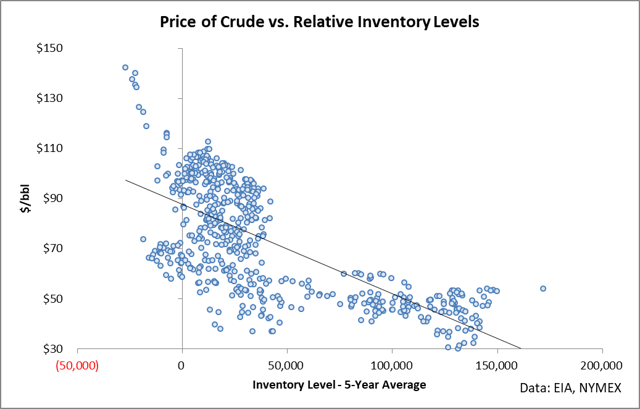

The reason why this is important for crude oil markets is that within a few weeks, we are likely to see crude inventories below the 5-year average. When inventories are below the 5-year average, the price of crude tends to rise, as seen in the following chart.

Sometimes, it can be incredibly difficult to read the fundamental landscape, but as long as OPEC stays the course, the picture is very clear: crude is bullish. Fighting OPEC is like fighting the Fed in that OPEC has tremendous power and sway over the market – in the long run, they tend to get what they want. As long as OPEC cuts remain in force (through at least March 2020), I believe crude oil fundamentals should be considered strongly bullish.

Refining

The second-largest industry represented by ERX’s holdings is refining. Refining is a very interesting industry in that it is largely impartial to the outright price of crude and the outright price of products. Rather, it is highly responsive to the differential between the prices of gasoline and distillate versus the price of crude (the “crack”). In particular, gasoline (which makes up about 45% of the typical refinery’s production) and distillate (which makes up about 30% of a typical refinery’s production) represent the lion’s share of knowledge needed to assess refining (to see the other components of yield, click here).

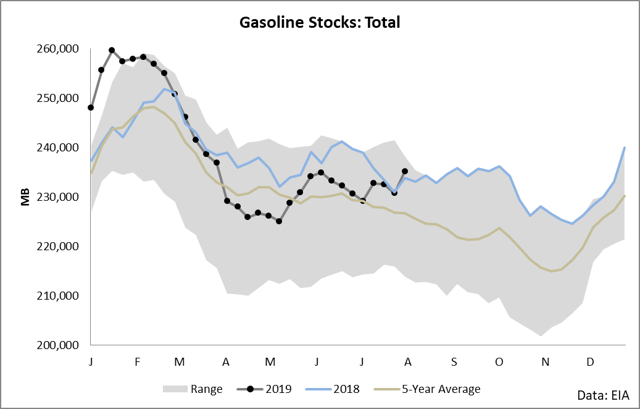

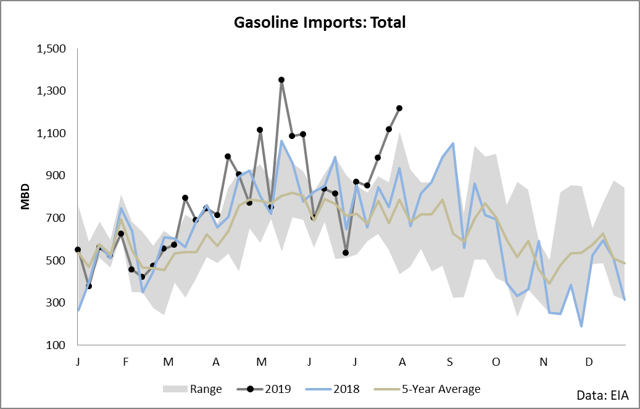

Let’s start with gasoline. Gasoline has seen a bit of volatility this year, with an initially very bearish overbuild in stocks followed by an incredibly strong drawdown in inventories.

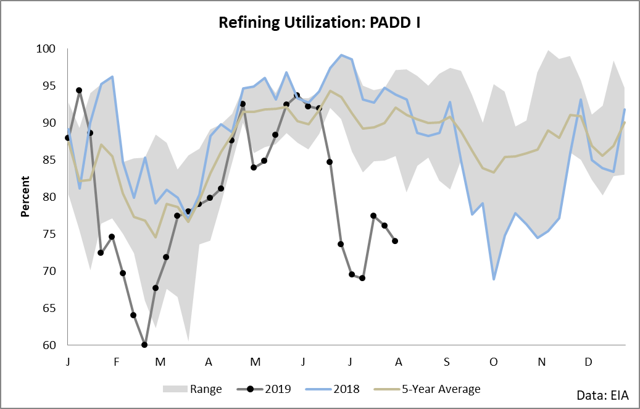

At present, inventories are shooting up towards the top of the 5-year range once again, which would typically be considered strongly bearish the commodity. However, there has been a key structural shift in the refining industry over the last few months in which a large refinery essentially blew up and shut down in the Northeast. This situation has resulted in the refining utilization of PADD 1 falling off a cliff and imports surging to supply the markets.

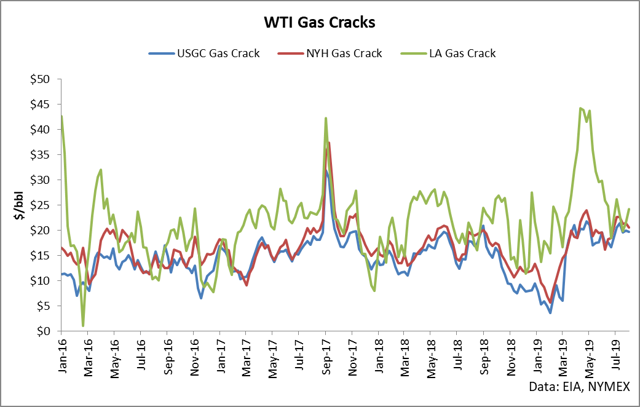

At present, the logistics constraints don’t seem to be fully resolved or worked through by the market, but when they do, I see gasoline stocks falling back towards the 5-year average and general bullishness in the commodity. Regardless, gas cracks still are strong across the country, which means that refining is likely to report higher earnings in the next quarterly releases.

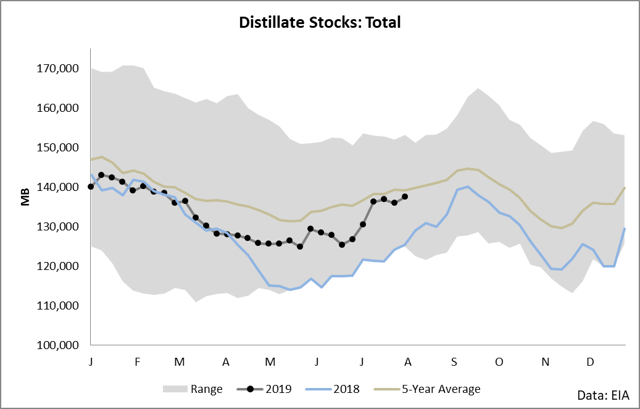

Distillate has been fairly mild this year, with inventories largely trending with the 5-year average for most of the year.

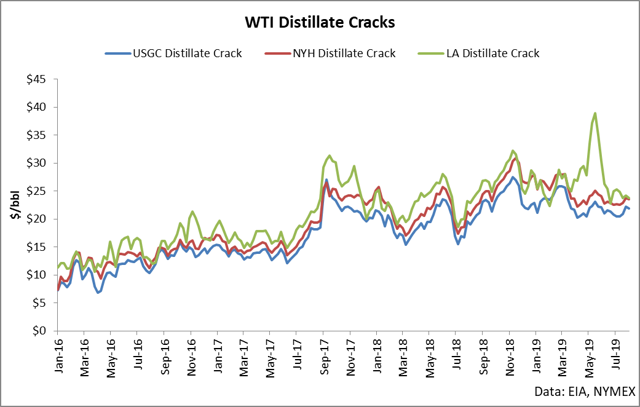

From an overall perspective, however, refineries still are enjoying healthy distillate margins, with cracks remaining elevated after the run-up in 2017.

The refining industry is likely to report higher earnings in the near future, due to elevated cracks and a product slate which is shifting towards further bullishness, as gasoline cracks likely travel higher when the market fully adjusts to a large refiner taken from the Northeast.

Natural Gas

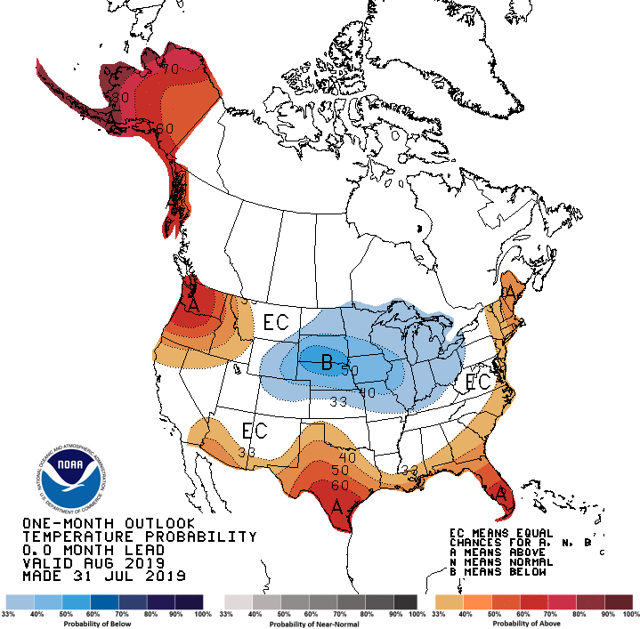

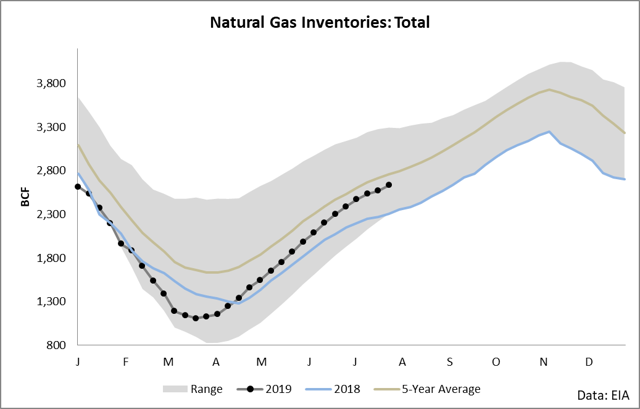

The other key commodity which ERX is exposed to is natural gas, and that seems to have finally caught a break in terms of demand, with higher power burn expected in the key demand regions.

If we see the forecast actually materialize with heat throughout August in the key demand regions (Gulf Coast, East Coast), then we will likely see the price of natural gas reverse its downwards trend and inventories begin to lag the 5-year average.

When inventories lag the 5-year average, it is a sign that demand is surpassing supply and prices tend to rise.

Conclusion

We’ve covered a lot of territory, but the key drivers of ERX can basically be reduced to three points:

- Crude – Crude is bullish because OPEC cuts are drawing down inventories in North America. This has driven up the price and will continue to do so.

- Refining – Refining is enjoying healthy margins across both gasoline and distillate in relation to recent years, and the loss of refining capacity in the Northeast will likely drive prices higher in the medium to long term.

- Natural Gas – Power burn is finally entering the forecast due to above-average temperatures expected in the key demand centers.

In light of the fundamentals strongly suggesting bullishness in the key industries which ERX tracks, I suggest buying the ETF to capture the upside potential.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News