[ad_1]

braclark/E+ via Getty Images

Thesis: Time To Buy Insurance Again

The saying goes that you should buy home insurance before your house catches on fire. Once the house is on fire, you either can’t buy insurance or the cost of it would be so high as to make it financially unfeasible.

Something similar holds true for a stock portfolio. Traditionally, the financial wisdom has called for a portfolio of 60% stocks and 40% bonds, where the stocks provide upside, and the bonds provide stability and income.

These days, however, investors would be forgiven for avoiding bonds. After all, bonds provide very little income (many dividend stock ETFs offer higher yields than most bond ETFs), and bond prices seem to have lots of downside risk with interest rates rising. But bonds – Treasury bonds, specifically – do still have a valuable role to play in one’s investment portfolio at times.

That role is as insurance. And there are few better forms of portfolio insurance than the Vanguard Extended Duration Treasury ETF (EDV).

Bond prices (and yields) move up or down based on the gyrations of interest rates, and 30-year bonds move the most. When interest rates rise, long-term bond prices tend to drop (and yields rise). But when interest rates fall, long-term bond prices tend to rise (and yields fall).

When the economy falters and investors get scared, the most highly sought safe haven during risk-off periods is the long-term U.S. Treasury bond. After all, the Treasury can print its own dollars, so the risk of default is zero. Naturally, then, when investors collectively get scared of losing money everywhere else, long-term Treasuries are the destination of their risk-fleeing dollars.

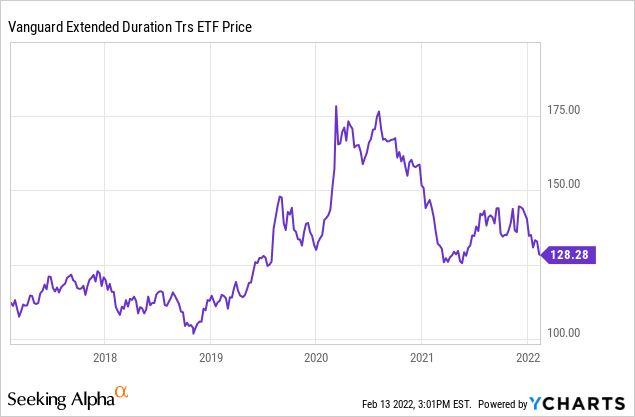

As such, EDV, which owns long-term Treasury bonds, makes a great form of portfolio insurance. And this form of insurance is cheap right now as investors bail on bonds in the face of high inflation and rising interest rates.

This makes now a great time to buy such insurance.

The Long-Term Trend

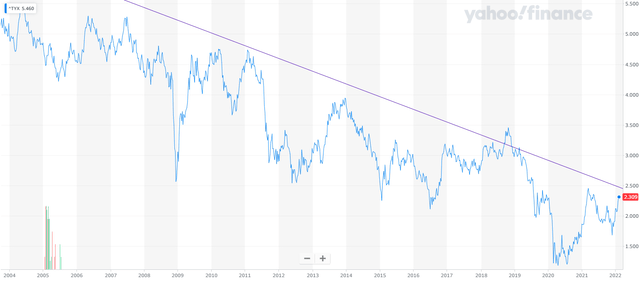

First, let’s just look at the long-term trend. How long? Well, interest rates have been in a long-term downtrend for about 40 years. So, let’s start by zooming out to the late 1980s.

This is the market interest rate on the 30-year Treasury bill since 1988:

Yahoo Finance

As you can see, absolutely nothing has broken this long-term downward trend. During that time, the US has experienced multiple foreign wars, multiple recessions, a tech bubble bursting, a housing market crash, and a pandemic that killed (or played a part in the death of) over 800,000 Americans.

And now the trend is being tested by the highest rate of consumer inflation since the early 1980s (more on that below).

Largely because of the current inflationary environment and the rising interest rates due to it, the 30-year Treasury rate has crept back up toward the top end of its trend range.

In order to reach the upper bound of the long-term trend corridor (purple line), the 30-year Treasury rate would need to reach about 2.6%. That compares to the current 30-year Treasury rate of 2.25%.

Granted, the upper bound of the long-term trend is about 15% higher than today’s 30-year interest rate, so this may not be the exact top in rates or bottom in prices. But compare this to the bottom in the 30-year rate in 2020 of around 1.2%. The current rate is about 88% above the low from 2020.

If we zoom in further, it’s easier to see that anytime the 30-year Treasury rate has reached this close to the upper bound of the long-term trend, it has been a good time to buy.

Yahoo Finance

Personally, I am not buying EDV all at once, but over the past week I have purchased a little bit each trading day. Calling the exact bottom is not my specialty. But I would rather buy near the bottom than try to time the exact bottom and miss it.

Tried And True Portfolio Insurance

The term “portfolio insurance” has negative connotations for those who were investing in the 1980s when a financial instrument by that name became so widely used as to create instability in the market. What happens when all homeowners use the same insurance company to insure their homes and a forest fire burns them all down at once?

For the insurance business model to work, it requires some policyholders to be net payers while others are net beneficiaries. What happens when all policyholders are beneficiaries all at once?

Long-term Treasuries work a different way. When no one wants to own them, they are cheap. And when everyone wants to own them, the price goes up and gives those who bought cheaply a nice gain.

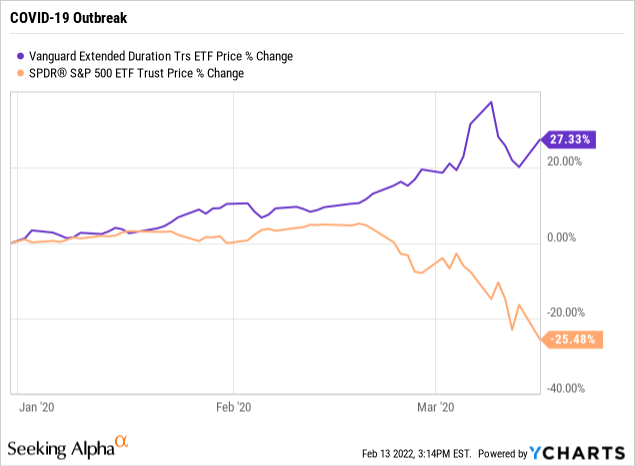

This is exactly what one wants from portfolio insurance. Stocks are the source of long-term gains, but when all stocks are selling off at once, one wants their “insurance” to provide a cash infusion in order to buy stocks at lower prices. That is exactly what EDV accomplishes.

Just take a look at some recent instances of rapid stock selloffs.

During the initial COVID-19 outbreak at the beginning of 2020, EDV’s performance was nearly the mirror opposite of stocks (SPY):

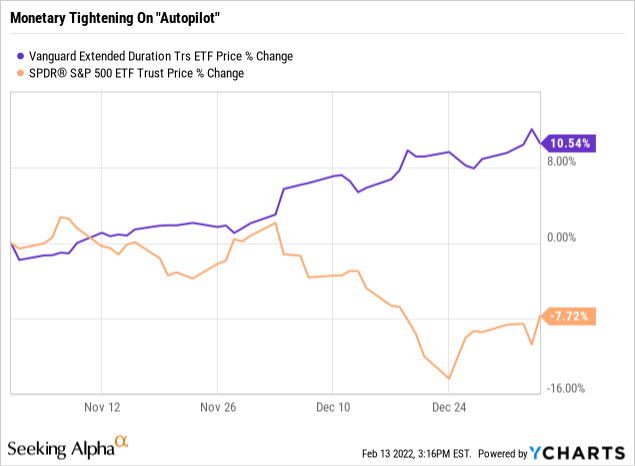

Similarly, when Federal Reserve Chairman Jerome Powell stated that monetary tightening was on “autopilot” in late 2018, stocks sold off hard. Meanwhile, EDV gained over 10%.

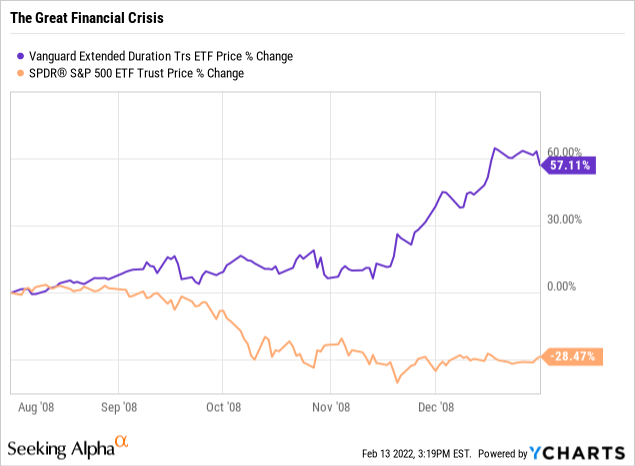

Likewise, during the market meltdown surrounding the financial crisis in 2008, EDV gained over 60% even as the S&P 500 shed ~30%.

Will the current rising rate environment be different than the last several? Will the Fed be able to engineer the “soft landing” that has evaded them in every rate hiking cycle since the early 1990s?

I doubt it. Rather, I am of the same view that was recently articulated by bond guru Jeff Gundlach: “My suspicion is that they’re going to keep raising rates until something breaks, which is always the case.”

Indeed, 100% of rate hiking cycles since 1990 have ended with a stock market selloff and/or a recession.

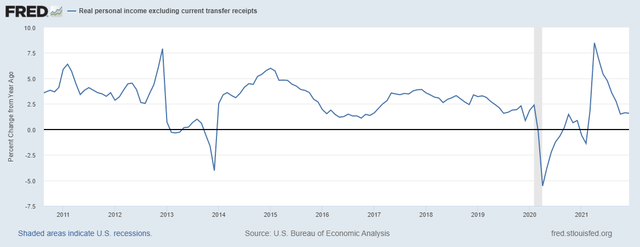

Moreover, consider also that real personal income excluding transfer payments diminished to around 1.5-1.6% in the latter months of 2021.

St. Louis Federal Reserve

This anemic growth in non-transfer real income does not signify a robust economic backdrop to support rising long-term interest rates. What’s more, government transfer payments (for the most part) do not drive consumer inflation but rather follow inflation. After all, cost of living adjustments (“COLAs”) only come after prices have gone up.

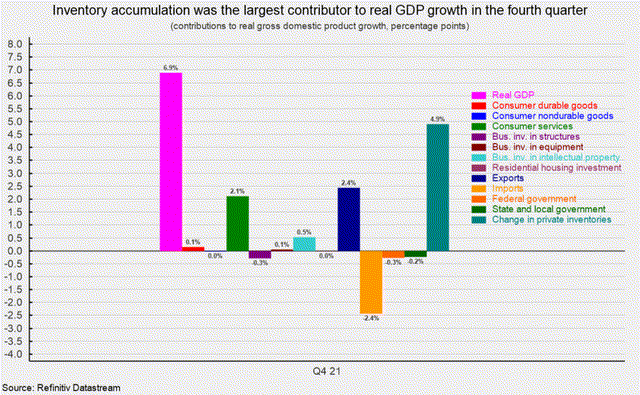

And though real GDP grew 6.9% in Q4 2021, most of that gain came from accumulation of private inventories. Spending on consumer services was the only other sign of strength in the economy.

Robert Hughes – AIER

Again, this is not a strong backdrop to support rising long-term interest rates.

Bottom Line

Often, the best asset classes to buy are the ones that look the weakest or ugliest at the time they are bought.

With rates of inflation currently over 7%, a 30-year Treasury yield of 2.25% sounds incredibly unappealing. But by the time it gains a widespread appeal among investors, long-term Treasuries will no longer work as portfolio insurance. You can’t buy insurance when your investment portfolio is already on fire.

With the Fed on the verge of hiking interest rates and aggressively tightening monetary policy, now is the time to buy long-term Treasuries as a hedge. EDV is a great vehicle to do that.

[ad_2]

Source links Google News