[ad_1]

Main Thesis

The purpose of this article is to evaluate the iShares Select Dividend ETF (DVY) as an investment option at its current market price. With markets re-testing prior highs, I continue to express caution in equity positions. I see plenty of risks on the horizon, namely related to slowing economic growth and on-going trade disputes and continue to push defensive equity positions. DVY fits this bill, with heavy Utilities exposure that is almost entirely reliant on domestic revenue, while also offering an above-average income stream. Furthermore, the fund holds a composition of other sectors that trade for below-market valuations, giving the fund a discounted price compared to the S&P 500. Finally, DVY saw double-digit dividend growth in Q1, which continues a trend of strong growth that materialized last year.

Background

First, a little about DVY. The fund seeks “to track the investment results of an index composed of relatively high dividend paying U.S. equities.” The index includes companies with comparably high dividend yields that have at least a five-year track record of paying dividends. DVY is currently trading at $98.25/share and yields 3.35% annually, based on its last four distributions. My last review of DVY came in February when I recommended the fund. Since then, the fund has returned about 2.5%, which is reasonable short-term performance. While this gain is not wildly impressive, there are a few reasons why I believe the fund could head higher from here, and I will explain my rationale in detail below.

Utilities Seeing Short-Term Strength

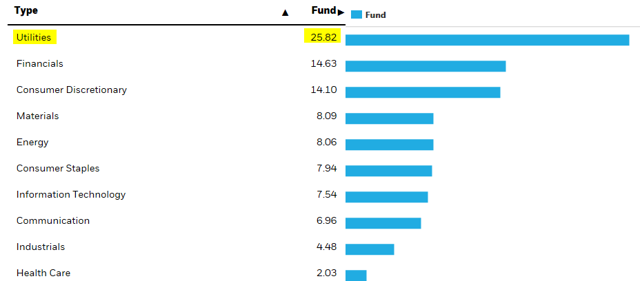

Similar to my February review, I am going to spend a large portion of the review on the Utilities sector. This is because this is an area that is of particular importance to DVY, as it has been the fund’s largest sector by weighting for a long time. In the short term, this exposure has declined a bit, as a portion of total fund assets, dropping about 7% from February. However, the weighting is still high, at almost 26%, as shown below:

Source: iShares

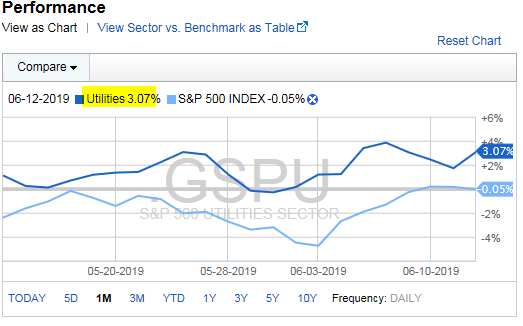

Therefore, it is important to consider how the Utilities sector has been performing and what could send the sector higher or lower going forward. Looking back, Utilities have been performing quite well, acting as a defensive play, often rising when the market is falling and vice versa. Given the recent volatility we have seen, it should not be a surprise that Utilities has been outperforming in the very short term. In fact, the sector has bested the S&P 500 by about 3% over the past month, as shown below:

Source: Fidelity

With this in mind, it is clear that this sector exposure has been benefiting DVY recently. However, given the more defensive nature of the fund, if investors expect the market to rally from here, this performance divergence would probably reverse. However, I see plenty of reasons to remain defensive going forward and expect Utilities to hold up well in coming months. This thesis rests primarily on the outlook for interest rates as well as my opinion that markets are going to face a fair amount of volatility this summer, which is telling me to get more defensive for the time being. In the following paragraphs, I will take each of these points in turn.

Interest Rates Will Support High Yielding Sectors

The market development having the biggest impact on the Utilities sector so far this year is without a doubt the interest rate outlook. After increasing rates punished the sector for most of 2018, the end of last year saw a swift reversal in sentiment, which has continued in 2019 as well. Essentially, while the Fed had previously forecasted further interest rate hikes this year, that forecast has shifted dramatically, to the point where cuts are now being considered. This has benefited income-oriented investments of all kinds, including Treasuries, high-yield debt, REITs, and Utilities. With interest rates now expected to decline, investors are looking to lock in current yields in assets that yield above the market average. This is helping to drive investor demand in the Utilities space.

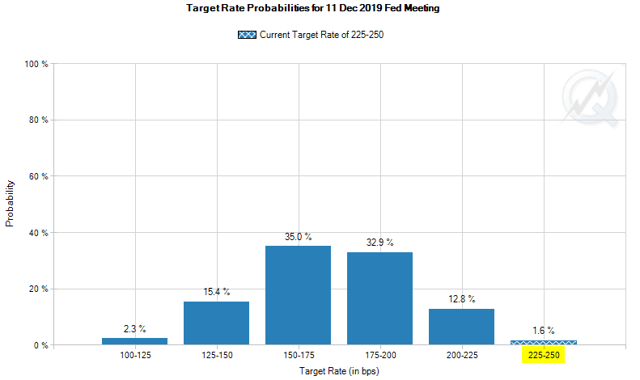

Of course, this sentiment has been the reality for some time, so investors may be concerned that buying in now is the equivalent of being too late to the party. However, while the interest rate forecast has indeed been dovish for the past 6-8 months, it is getting increasingly more dovish as the year goes on, telling me the sector still offers opportunity.

To illustrate why, consider that during my February review, investors were predicting interest rates would remain at current levels by year-end. While there was a greater probability of a rate cut than an increase, the majority opinion was a neutral policy for the year. The current sentiment represents a remarkable shift in thinking, with investors now forecasting between 2 and 3 rate cuts by the December Fed meeting, as shown below:

Source: CME Group

My takeaway here is the market remains largely favorable for Utilities given this outlook. Again, while low rates have been benefiting the sector for a while, the odds of declining rates keep going higher, telling me there is still value in buying now. As long as this sentiment remains in place, income-oriented investments are likely to perform quite well.

A Better Trade-War Hedge Than Real Estate?

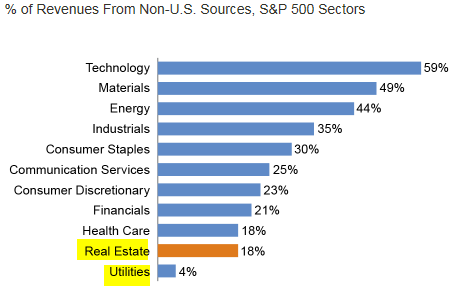

I want to start this section by stating I am currently bullish on both the Utilities and Real Estate sectors and have been advocating buying into funds and stocks with exposure to both over the past few months. While the complete investment thesis for each does differ in some aspects, there are two overlapping reasons for liking both. The first has to do with interest rates, which I discussed above, as both sectors offer above-average yields and generally benefit from declining rates. The second has to do with current trade concerns. While we have seen progress on this front over the past few weeks, namely with the avoidance of tariffs on Mexican imports, trade headlines continue to dominate the news. Outstanding issues with China remain unresolved, and the impact on the global growth outlook is notable. With this in mind, I have been shifting to funds and sectors with less foreign reliance and have been trying to invest in revenue streams that are predominately domestic. This includes both the Real Estate and Utilities sectors, which generate a small portion of their revenues from abroad.

To get a sense of the disparity between these sectors and the broader market, consider the chart below, which displays the percent of revenue from foreign sources for each sector in the S&P 500:

Source: Cohen and Steers

As you can see, the two sectors least exposed to foreign markets are Utilities and Real Estate, providing evidence for my recent bullish sentiment. While every sector, except Technology, generates the majority of its revenue within the U.S., it is clear some of the more cyclical sectors are also most exposed to international trade. While the ongoing volatility certainly presents opportunity within those sectors, I am choosing to get more defensive now because I see the trade dispute with China dragging on for some time and am adapting to that reality by seeking some relative safety.

My overall point here is that while both sectors represent an appropriate hedge against trade concerns, in my view, Utilities is probably the best for that particular investment thesis. The sector has very little international exposure and is much more domestically focused than Real Estate, which is the second least foreign exposed sector out there.

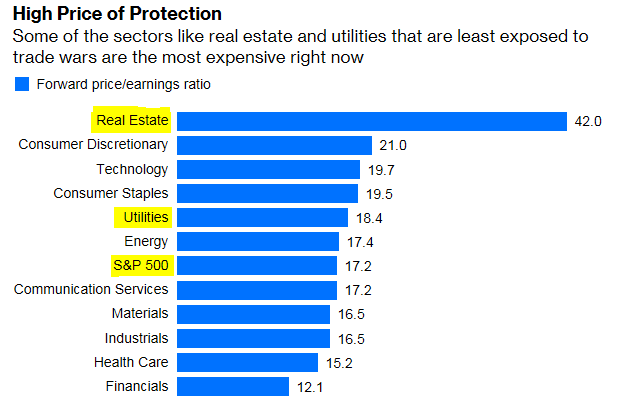

A second point has to do with each sector’s valuation. As I mentioned, the low interest rate thesis and the trade shelter thesis are not new. These are market developments that investors have been coping with for all of 2019. Because these themes are well known, investors have already been shifting into these sectors, which is driving up the cost to own them. In fact, according to data compiled by Bloomberg, the Real Estate sector is the most expensive sector, based on its forward P/E, with the Utilities sector also more expensive than the broader S&P 500, as shown below:

Source: Bloomberg

Again, my takeaway here is to generally favor Utilities. While both sectors are clearly pricey to own compared to the market, the valuation of Real Estate is leaps above every other sector. Utilities seem to offer the better balance here, exposing investors less to foreign revenue and costing less to own. Considering DVY has heavy Utilities exposure, I feel comfortable recommending this fund to shield investors from further trade-driven volatility.

Despite Utilities Exposure, DVY Is A Good Value

A final point I want to make with regards to the Utilities sector is also related to valuation. While I just mentioned how the sector is defensive, but expensive, it is important to remember that is for the sector as a whole, and not for DVY. While DVY does have some companies with high P/E ratios, the overall fund is actually attractively priced. The utility stocks the fund does own are not overly expensive, and the sector is balanced out by the other holdings.

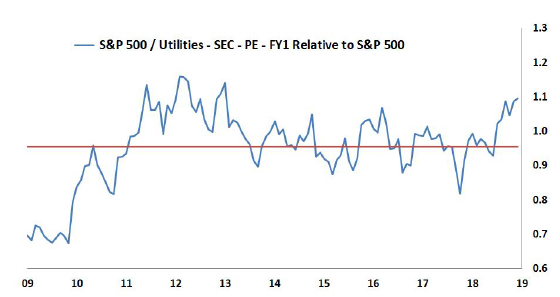

I am not debating that Utilities have a premium price. Aside from being priced higher than the S&P 500 right now, the valuation spread between the two is wide by historical standards, as shown below:

Source: Edward Jones

However, rather than focusing on this metric, I want investors to consider DVY’s valuation. When comparing DVY’s actual P/E and yield against the S&P 500, buying this defensive exposure suddenly appears much less expensive than when looking at the top sector in isolation, as shown in the chart below:

| Benchmark | Current P/E | Current Yield |

| DVY | 14 | 3.4% |

| S&P 500 | 21 | 1.9% |

Source: iShares; Multpl.com

My takeaway here is the DVY is nicely balanced out by its broad asset allocation. Sectors priced below the market average, such as Financials and Materials, which make up about a quarter of DVY, are helping drive down the cost to own the fund. Furthermore, investors are buying into an income stream almost double what the market offers. All in all, I view this as a very reasonable entry point to a fund with a lot of positive attributes.

Dividend Growth Continued in Q1

Another point on DVY specifically has to do with the fund’s dividend. Considering where we stand with interest rates, a yield above 3% looks pretty attractive. However, a metric that really excites me is the fund’s dividend growth, which has continued in 2019. This is a metric I always monitor with dividend funds, as I look for both high yield and growth. To get a sense of how DVY is performing in this regard, review the chart below:

| 2017 Distributions | 2018 Distributions | YOY Gain |

| $2.96/share | $3.20/share | 8.1% |

| 2018 Q1 Distribution | 2019 Q1 Distribution | YOY Gain |

| $.78/share | $.87/share | 11.5% |

Source: iShares (Calculations by Author)

As you can see, DVY has started the year off strong, with double-digit dividend growth. On top of that, the growth is an acceleration from what we saw in 2018, which is a characteristic I am not seeing in most of the dividend funds I invest in and analyze.

What Could Go Wrong?

I feel I have laid out a fundamental case for buying DVY at this time. However, I am not suggesting this investment presents no downside risk. Equity funds always have pros and cons. Therefore, I want to discuss the conditions under which DVY could decline, or at least under-perform, going forward.

First, is the interest rate story, which I discussed at length earlier. While I feel the current sentiment is bullish for DVY, sentiment can, and often does, change quickly. If global and/or U.S. growth beat expectations in the second half of the year, or if the U.S. see a marked uptick in inflation, the Fed will be unlikely to cut interest rates. In fact, that may even prompt them to re-start their policy of raising rates. If this were to happen, DVY would be particularly hit, as I would expect the Utilities sector to face a marked reversal.

The second point coincides with the first, which is valuation. These points are highly related right now because of the interest rate outlook. Investors have been buying defensive income positions all year, such that the cost to own the Utilities sector is above its normal trading range. A change in sentiment (such as due to interest rates) will disproportionately hurt the sector simply because the cost to own is so high. Investors will likely rotate out of the sector at a faster pace than normal, and that would cause short-term pain.

A third risk has to do with my trade-related point for owning DVY, which was for a shield from foreign revenue concerns. While trade-oriented sectors, such as Technology and Industrials, have been struggling due to the impact of U.S.-led trade disputes, there is certainly the possibility this headwind could subside. President Trump recently backed off implementing Mexican tariffs, and the U.S.-China dispute constantly seems to shift tones. If further progress is made between those two important trading partners, the risk-on trade will likely resume, making DVY’s domestic exposure much less important.

In summary, there are plenty of reasons to buy DVY at the current moment, but investors need to be aware of the market conditions that would likely cause the fund to falter going forward.

Bottom line

DVY remains on my buy list, after coming off it a year ago. With the interest rate outlook shifting dramatically, I am heavily recommending the Utilities sector, even though it is currently priced at a premium. DVY offers investors a great way to buy this exposure because the fund is balanced by both less expensive sectors, as well as individual utility holdings that trade at reasonable prices. With global trade impacted by slowing growth and sudden shifts in trade policy, I believe DVY’s make-up offers the right mix for investors looking for exposure that is largely domestic. Finally, the fund’s yield, while already attractive, is likely to grow going forward, as Q1 was a positive indication in this regard. Therefore, I continue to recommend DVY and urge investors to take a look at the fund at this time.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in DVY over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News