[ad_1]

metamorworks/iStock via Getty Images

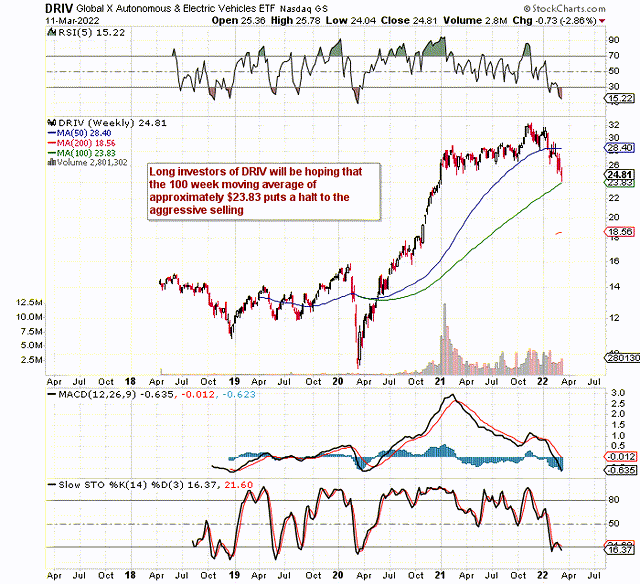

It will be interesting to see if the 100-week moving average of the Global X Autonomous & Electric Vehicles ETF (DRIV) will put a halt to the aggressive selling we have seen this year. DRIV is a fund comprised of companies that are involved in the development of electric vehicles and autonomous technology whether the companies be tech companies, chip companies, or indeed car manufacturers. Shares of the fund are down close to 20% this year and are currently trading just under $25. The 100-week moving average is located approximately $1 lower at the $23.83 mark at present.

Shares of the DRIV ETF coming up against support (Stockcharts)

DRIV

Despite the clear tailwinds that companies in the electric/hybrid/autonomous space clearly are availing of, fear always sets in when shares of the respective fund do not perform as expected. For example, competing funds could easily make the argument for the higher expense ratio of 0.68% as well as the ultra-low dividend yield of 0.40% as reasons why DRIV may continue to struggle at least against its peers.

However, experienced ETF investors will be well aware that you pay for what you get in any respective fund. For example, DRIV‘s average daily dollar volume of $13.40 million exceeds the daily volume of competing funds by quite a distance. Furthermore, the fact that DRIV is more diversified (27% of holdings in top 10 positions) than competing funds in effect brings smaller players into the frame here and solely doesn‘t focus on the established large-cap names. Suffice it to say, this has to bring more potential to this fund, in the long run, taking the fund‘s strong liquidity into account. The number of holdings at present in Global X Autonomous & Electric Vehicles ETF comes to 80 companies.

Top 5 Holdings

In terms of minimizing downside risk, investors solely need to monitor the valuations and profitability trends of the big players in the fund. The longer the big players grow, the more time the smaller players in the fund have to come good. The prime reasons for purchasing the top 5 holdings in DRIV, which are Alphabet Inc. (GOOG), Apple (NASDAQ:AAPL), QUALCOMM Incorporated (QCOM), Toyota Motor Corporation (TM) & NVIDIA Corporation (NVDA), are the company‘s profitability trends and valuations.

Alphabet

Alphabet for example continues to go from strength to strength having grown its sales by over 40% in 2021 and its operating profit by over 90% over 2020. The company‘s operating margin now comes in at 30.6%, which is a number substantially ahead of the range (22% to 26%) we have become accustomed to in recent times. On the valuation side and because of the firm‘s substantial improvement in profitability, the stock‘s forward earnings multiple of 22.8 does not look expensive by any matter of means.

Apple

Apple‘s near-term profitability also is much better than its long-term averages. The fact that growth in the company‘s operating profit is also outperforming sales growth means that margins in the tech company are also on the rise. Operating profit grew by 64% in the company‘s latest fiscal year and by almost 24% in its first fiscal quarter of 2022. Apple‘s valuation is higher than Alphabet‘s relative to its historic averages but still trades with a respectable price-to-earnings ratio of 25.9.

Qualcomm

Qualcomm, like Apple, finishes its fiscal year in September. Again, we see the same trend here with respect to growth in Qualcomm’s operating earnings outperforming top-line sales growth. Operating profit grew by 56.5% in fiscal 2021 and by almost 53% in the first fiscal quarter of fiscal 2022. Qualcomm‘s operating margin now comes in at almost 31% over a trailing twelve-month average which again is a rising trend. Furthermore, Qualcomm‘s growth is expected to continue this year due to the sizable difference in the company‘s forward earnings multiple of 13.1 and current earnings multiple of 17.5. Qualcomm continues to collaborate with companies in the autonomous space in terms of software development.

Toyota

The first car manufacturer in DRIV‘s holdings is Toyota. From a valuation standpoint, the Japanese manufacturer continues to trade very close to book value and profitability trends remain very strong. For example, the company‘s operating margin (TTM) of 10.41% remains well above average in this sector and operating cash flow of almost $24 billion offers ample protection to the manufacturer in the event of more volatility entering this sector. Toyota will undoubtedly be a key player in the rollout of autonomous technology in the years to come.

Nvidia

Profitability trends in Nvidia are even more impressive. Operating cash flow of $9.11 billion is almost twice the company‘s 5-year average sum, and the company‘s operating margin comes in at a very lofty 37.31% (TTM). Although investors are citing Nvidia‘s high valuation and poor momentum (Down 27% Over the past three months) as reasons for concern here, the company is still expected to grow its earnings by over 26% in this present fiscal year. Land Rover recently announced that Nvidia‘s Drive Computers will be standard in its models within 3 years.

Conclusion

Therefore, to sum up, it is clear to see that the autonomous driving space will continue to gain traction in the quarters and years to come. By combining the above trends in DRIV‘s major holdings with DRIV‘s liquidity and diversification, we believe this fund is an intelligent way to play this trend higher. We look forward to continued coverage.

[ad_2]

Source links Google News