[ad_1]

One fundamental concept in Chinese philosophy is the principle of Yin and Yang. According to Taoism, Yin and Yang mean that all things exist as inseparable and contradictory opposites, for example, female and male, strength and weakness, and boom and recession.

The Direxion Daily FTSE China Bull 3X ETF (YINN) and Bear 3X ETF (YANG) are exactly a pair of inseparable opposites, as YINN seeks daily investment results of 300% of the FTSE China 50 Index performance, and YANG seeks 300% of the opposite of the index performance. Their prices are deeply impacted by investors’ view towards the economic outlook of China. Due to the deteriorating China-US trade relationship, the price of YINN has been volatile since May.

Data by YCharts

Data by YCharts

The Trump-Xi meeting in Osaka last weekend brings strong positive sentiments into the market. What are the reasons behind the US concessions this time? Going forward, how should investors set expectations about China’s economic performance and make investment decisions accordingly?

About YINN

The top five holdings in YINN’s portfolio are Tencent Holdings (9.15%), China Construction Bank (8.58%), Industrial Commerce (6.83%), Ping An (6.57%), and China Mobile (6.38%). The sectors that have the heaviest weights in the portfolio are financials (45.61%), communication services (19.47%), and energy (11.20%).

For investors interested in the Chinese stock market, another ETF to choose from is iShares MSCI China ETF (MCHI). Compared with MCHI, the biggest advantage of YINN is that it magnifies investors’ short-term returns with daily 3X leverage if the direction of the bet is correct. Of course, on the other hand, this means that YINN is riskier than ETFs like MCHI which do not use leverage.

Chimerica After The G20 Summit

Scottish historian Niall Ferguson describes the China-US relationship as a symbiosis called Chimerica. When these two countries failed to reach a trade deal in May and the US raised tariffs to 25% on $200 billion Chinese goods, a lot of people feared that the symbiotic relationship is quickly turning into a new Cold War.

Fortunately, the G20 summit in Osaka gives a break to the ongoing fight and partially restores investors’ hope. We see significant progress of the China-US trade negotiations, with Trump halting the plan to add more tariffs and allowing US companies to sell to Huawei.

The US is making concessions right now because they have to. First, there is strong evidence showing that American consumers are the ones who bear the most of tariff costs. According to the IMF report released in May, tariff revenue collected from levies on Chinese goods “has been borne almost entirely” by U.S. importers. The bilateral trade deficit between China and the U.S. remains “broadly unchanged” even with the tariffs, except that US consumers and the US economy get badly hurt.

Besides real economic costs which he does not care about, Donald Trump faces a bigger challenge, loss of support among the business community and farm-belt states. Heading into an election year, Trump must contend with restiveness among his supporters who have been hit by the tariffs imposed by both China and the US. If Trump cannot get a deal done, it will be seen as a failure by most people. That is why Trump is willing to change his tone in G20 and the situation gradually shifts to China’s advantage. Boosted by the truce, the Chinese and US stock markets are sure to have a good start in July. Furthermore, the positive investors’ sentiments are very likely to continue as China and the US begin another round of trade talks.

Fundamentals Of China’s Economy

According to the National Bureau of Statistics of China, China’s first quarter GDP grew by 6.4 percent, topping expectations. The stimulative fiscal and monetary policies implemented by the central government play an important role in that satisfactory performance. Those include fast-tracking infrastructure projects and cutting taxes and banks’ reserve requirements, which are effective measures to avert the trend of a further slowdown.

Besides, it is true that China’s economy takes a hit from the US tariffs. However, the negative impact may not be as severe as many people imagine. China maintains a significant presence in the global market, not just the United States. Ever since the trade war, it has been actively strengthening relationships with trade partners in other countries. According to PIIE’s report in June, China just lowered its tariff towards countries like Canada, Germany, and Japan. This means that American companies now are at a considerable cost disadvantage relative to both Chinese firms and firms in other countries. The strong trade partnership that China now builds with the global market outside the US provides a cushion for its slowing economic growth.

Investor Implications

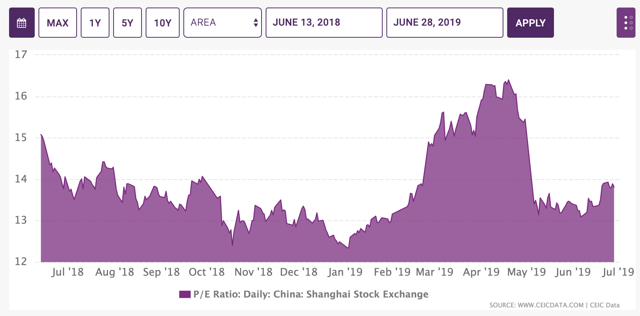

Hit by the escalating trade war, Chinese assets are currently at a very low valuation. The P/E ratio of Shanghai Stock Exchange has declined by 16% since early May, as can be seen from the following graph. At the same time, Chinese concept stocks in NYSE and Nasdaq have also suffered from huge selloffs.

Data source: CEIC Data

Data source: CEIC Data

At the current valuation, there is plenty of space for a valuation rebound. The G20 Summit provides a strong catalyst for that, and such a positive impact is very likely to continue at least for the next several months. Compared to MCHI, YINN amplifies returns that investors can gain from this immediate macro trend. As a result, investors are recommended to buy and hold YINN, the China bull ETF.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News