[ad_1]

David McGowen/iStock via Getty Images

The latest jobs data was disastrous, with the household survey confirming investors’ fears following the weaker than expected ISM services data from Wednesday. While the non-farm payroll headline numbers came in hotter than expected, the household survey showed jobs were lost in April, resulting in a drop in the labor participation rate. On top of that, wages on a year-over-year basis continue to spiral higher.

Economic Weakness

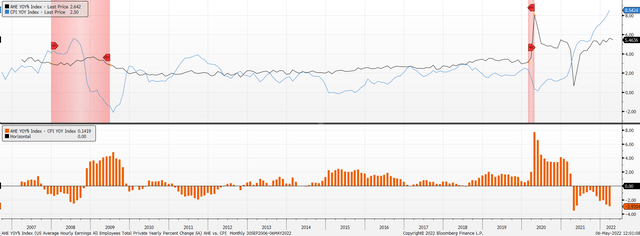

Wages rose by 5.5% year over year in April, which was in line with estimates. At its current pace, the inflation rate set by the consumer price index continues to run hotter than wage gains. Currently, analysts estimate that the CPI will rise by 8.1% in April, when the data is released on May 11. If CPI does come in at that rate, it will mark the 13th straight month that wage growth trailed CPI.

Bloomberg

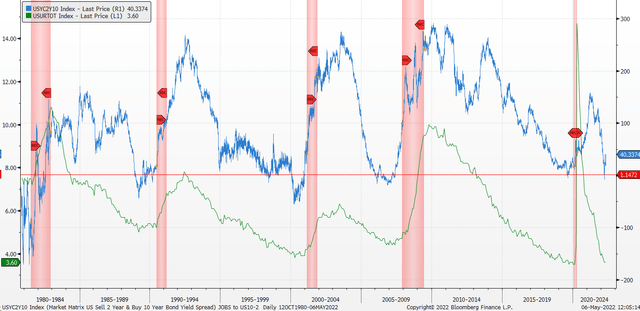

Meanwhile, the unemployment rate was unchanged at 3.6% for the second month in a row and may mark the lows for this cycle, based on how the yield curve is suddenly beginning to steepen. The 10-Year minus 2-Yr spread appears to have an incredible ability to predict a rising unemployment rate and, if correct, a recession that may follow very soon.

Bloomberg

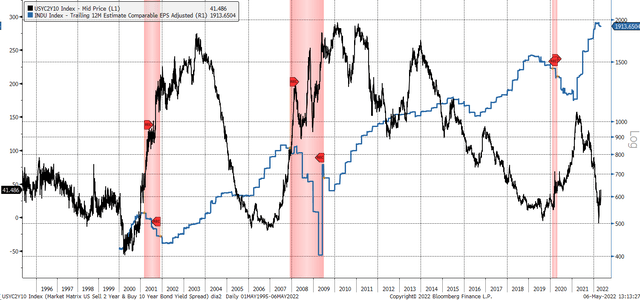

It could spell particular troubles for the Dow Jones Industrial ETF (NYSEARCA:DIA). So far, earnings estimates for the overall average have held up. However, during times when the economy was about to head into a recession, and the yield curve was steepening, earnings for the Dow plunged. It was especially true heading into the years 2000 and 2008.

Bloomberg

Earnings and Multiple Compression

There has been some minor deterioration thus far for 2022 earnings estimates, but currently, they’re still higher than when they began the year. But suppose economic growth starts to fall, and companies find it difficult to pass on higher costs to the consumer due to wages not keeping pace with inflation. Then, it may very well lead to margin erosion and lower earnings estimates.

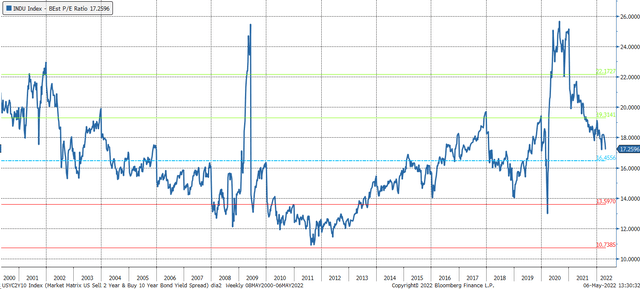

Bloomberg

Additionally, because rates are rising, we have witnessed the PE ratio in the Dow falling sharply. If rates continue to increase, the PE ratio may continue to fall. Over the past 20 years, the average PE ratio has been around 16.5, vs. its current 17.3. However, in the past, during market downturns, the PE ratio tends to bottom out around 14. That would imply there is still further downside risk in the DIA. Of course, if earnings estimates begin to roll over, that would lead to a lower PE multiple and lower earnings and, therefore, a double impact on the Dow and the ETF.

Bloomberg

For example, if the Dow’s EPS estimates fell 10% to $1,712, along with a PE of 14, the Dow would have a value of around 24,000, or nearly 27% lower. If the PE ratio were to stay at 17 and earnings fall, the Dow would fall to approximately 29,100 or 10 to 11% from its current prices. Again, this is just an example of the pain created from multiple compression and a decline in earnings.

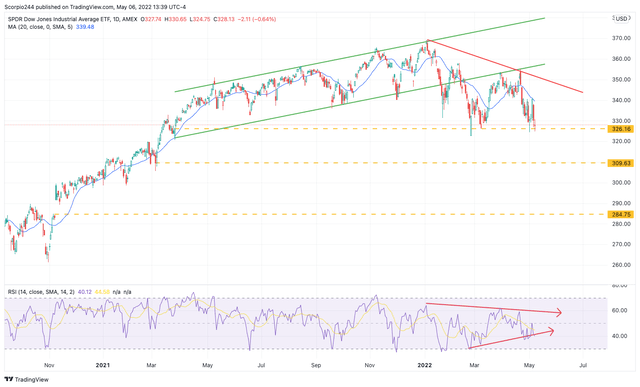

Technicals Trends Are Weak

Technically, the ETF does not look strong and is in a pronounced downtrend. The ETF is sitting on a weak layer of support at $326, and if that should break, support appears to be tough to find, with the next significant level around $310. Additionally, there is a giant gap in the chart that dates back to November 2020. That gap seems too big and obvious for the bears not to try and target at some point down the road. Yes, that seems like a long way down, but it is only 12.5% from today’s levels.

TradingView

At this point, multiples are contracting for the broader markets, and the Dow is no exception. The risk in this market is now for the other shoe to drop, which is earnings estimates. They have already started to show signs of weakness, but they are still holding up, just enough. But if the economy is indeed heading for a slow down as the latest jobs data and yield curve may suggest, things could still worsen before they get better.

[ad_2]

Source links Google News