[ad_1]

lakshmiprasad S/iStock via Getty Images

Dividend growth investing is the most effective strategy during bear markets for adding stability to the portfolio and generating market-beating returns. However, picking the right dividend growth stock or ETF is crucial to generating robust returns. The iShares Core Dividend Growth ETF (NYSEARCA:DGRO) is a highly regarded name in the dividend growth ETF category, but it doesn’t appear to be a good pick during market turmoil because the fund focuses on sectors that are getting hard hit by the broader economic environment. Low dividend yield, high volatility, and prospects for slower dividend growth make it less attractive to consider as a hedge against inflation.

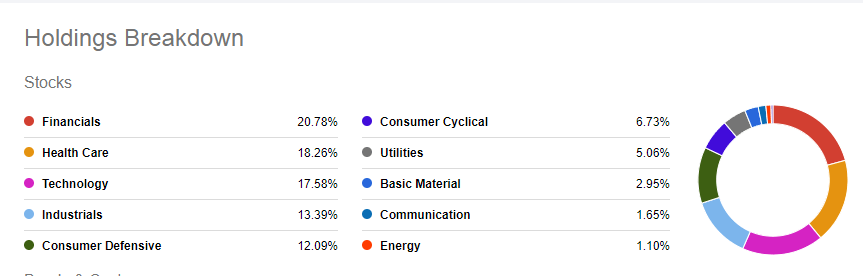

Portfolio Composition Doesn’t Match With Market Trends

Historical data proves that dividend growth investing has outperformed value and other investing strategies during bear markets. Furthermore, using dividend growth ETFs for that purpose significantly reduces the volatility and lowers the risks associated with a single stock investment. In practice, every dividend growth ETF is different, and they don’t all provide healthy returns that can be used as inflation hedges. When it comes to DGRO, its significant exposure to financial, technology, industrial, and consumer cyclical sectors seems risky, especially when interest rates are rising and economic growth is slowing

DGRO’s Sector Breakdown (Seeking Alpha)

DGRO’s stake in dividend growth stocks from the financial sector declined more rapidly than the S&P 500 index. Its fourth-largest stock holding, JPMorgan (JPM), has fallen 26% year to date, compared with the S&P 500’s 18% decline. The risk of investing in financial and banking stocks can be very high, especially if the economy enters a recession. In light of the bleak economic outlook, JPMorgan Chase CEO Jamie Dimon suggested that the bank would remain conservative on its balance sheet. Previously, he referred to economic challenges as storm clouds, but now he calls economic headwinds a “hurricane’.” The latest economic data such as the CPI of 8.6%, the significant cut in GDP forecasts, and historical lows in consumer sentiment reinforce the conclusion that a recession is imminent and the current bearish trend in stock markets will persist.

Economic uncertainty and interest rate unpredictability weighed heavily on technology stocks since the beginning of this year, which make up 17.58 percent of the DGRO portfolio. Since economic volatility is likely to increase, and interest rates are expected to grow at a faster pace, fundamentals for tech stocks appear weak. Therefore, the technology sector is expected to generate lower revenue and earnings going forward, which will hurt investors’ returns. Apple (AAPL), for instance, anticipates low single-digit growth in the quarters to come due to slowing demand, inflation, and supply chain disruptions.

Industrial stocks, which comprise 13.39% of DGRO’s portfolio, are also likely to face economic headwinds as the global GDP forecast fell to 2.9 percent for 2022, much lower than the 4.1 percent envisioned in January and the 5.7 percent forecasted in 2021. Slowing construction, infrastructure, and manufacturing activities do not bode well for industrial stocks. On the positive side, DGRO’s stake in discount retailers and health care stocks may thrive in an inflationary environment, yet their weightage is not as large as that of positions in high-risk sectors. Therefore, the portfolio composition of iShares Core Dividend Growth ETF is not a recession- or inflation-proof and carries high risk.

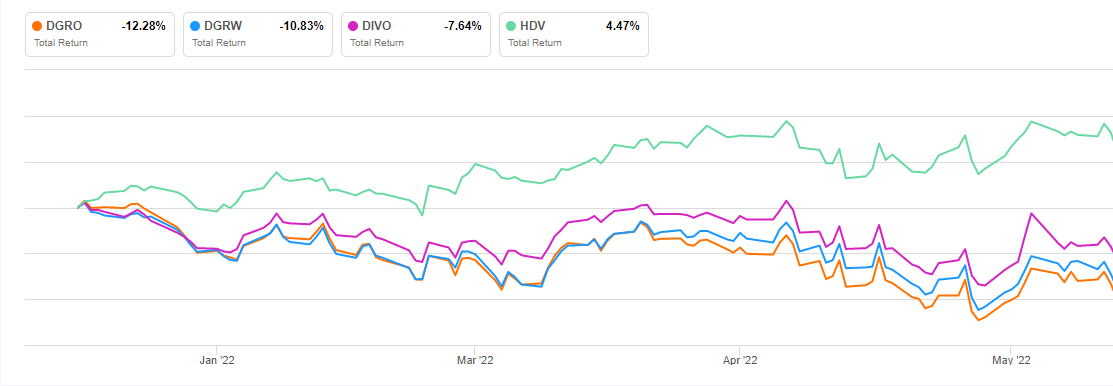

Chances are High for Low or Negative Returns

In the past three, five, and ten years, DGRO underperformed compared to the broader market index. It slightly outperforms the S&P 500 index year to date, but DGRO’s total return of -12% doesn’t qualify it as an inflation hedge. The challenging market conditions for its portfolio holdings have already begun to reflect in its recent share price and dividends. In the first quarter of 2022, the fund paid a dividend of $0.49, compared with a dividend of $0.52 in the same period last year. Dividends for the next two quarters may also decline in comparison with the past year since many of its portfolio holdings are taking a conservative approach and their profits are likely to decrease in the second half of 2022.

DGRO Returns Vs. Peers (Seeking Alpha)

Additionally, its performance appears lackluster when compared to other dividend growth ETFs including WisdomTree U.S. Dividend Growth ETF (DGRW), Amplify ETF Trust – Amplify CWP Enhanced Dividend Income ETF (DIVO), and iShares Core High Dividend ETF (HDV). DIVO, for example, offers a dividend yield of over 5%, and its shares have performed better than DGRO so far in 2022. HDV, which focuses mainly on health care and energy stocks, also outperformed DGRO in terms of both dividends and price returns. HDV’s shares are still trading in a positive territory year to date while its dividends are expected to increase considerably from last year.

In Conclusion

DGRO does not appear to be a good addition to a portfolio because it neither offers stability in a volatile market nor does it offer healthy returns that beat inflation. In addition, the fund carries a great deal of risk due to increasing interest rates and inflationary pressures. A recession will exacerbate the risks associated with growth stocks operating in the tech, financial, and industrial sectors. Investors should therefore look for dividend growth opportunities that are safe and reliable.

[ad_2]

Source links Google News