[ad_1]

As seen in the following table provided by Seeking Alpha, Invesco’s DB Oil ETF (DBO) has had a pretty hard month with shares falling by nearly 8%, bringing the year-to-date return to only around 11%.

It is my belief that the underlying strategy that DBO follows and the fundamentals of crude oil are currently giving very strong buy signals for the ETF. In other words, I’d suggest buying the current pullback.

The Instrument

If you’re familiar with the energy ETF and ETN space, you’re likely aware of the fact that there are lots of different types of funds and notes which give exposure to oil. Prior to investing, it is important that individuals gain knowledge of what exactly it is which they are buying because even slight differences in methodologies between funds can result in dramatically different returns.

In the case of the Invesco DB Oil Fund, it follows a methodology which gives exposure to the DBIQ Optimum Yield Crude Oil Index Excess Return. The DBIQ index is an index constructed by Deutsche Bank which essentially tries to maximize the positive effects of roll yield for index trackers.

As Deutsche Bank describes it: “Deutsche Bank Liquid Commodities Indices Optimum Yield (DBLCI-OY) are designed to maximize potential roll returns by selecting, for each commodity, the futures contract with the highest implied roll yield.” To put this into English, the methodology shifts exposure across the futures curve to maximize roll yield. This methodology shines during certain periods of time and is lackluster during other periods of time. At present, this is a very strong strategy for gaining exposure to crude oil.

The reason why this strategy is very attractive right now has to do with the nature of roll yield as well as the current shape of the forward curve. Let’s start with a discussion regarding what exactly roll yield is and why it matters.

Roll yield is the gain or loss which arises from investors holding exposure across a futures curve through time. There is a basic tendency in futures markets for the price of a contract in a later month than the prompt month to slowly approach the prompt value as time progresses. This relationship has strong implications for long or short investors depending on how market structure is actually arranged.

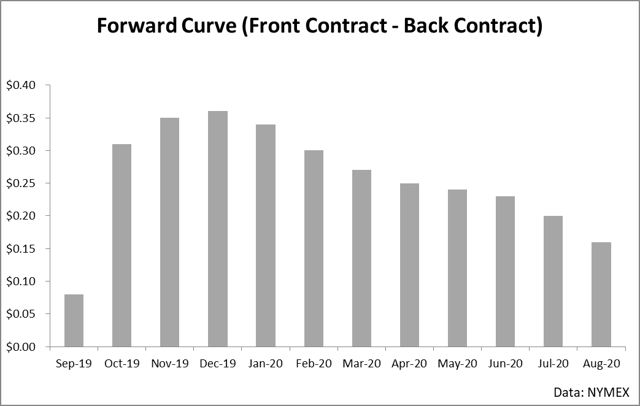

When a market is in contango (prompt contract under back month contracts), roll yield for a long investor will be negative because contracts held in later months will slowly approach the prompt month contract as time progresses by falling in value in relation to the front. When a market is in backwardation (front contract above back month contracts), long investors will experience positive roll yield as the long contracts held in later months of the forward cure will trade up in value in relationship to the front of the curve as time progresses.

This relationship is not ironclad in that there are periods of time where roll doesn’t play out as anticipated (and seasonal effects can complicate the analysis in some instruments), but the effect is strong enough and persistent enough that a number of strategies are intentionally designed to avoid, capture, or mitigate roll.

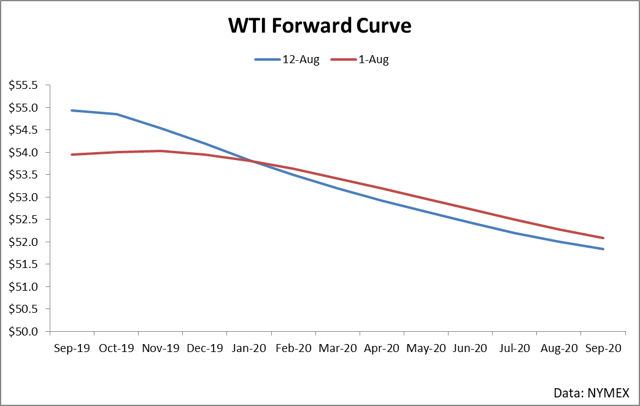

In DBO’s case, it seeks to maximize the positive possibility for roll yield. This means that when the market is in contango, it will likely roll exposure across the front two contracts since contracts in the back of the curve would be at an even steeper level of contango. When the market is in backwardation, DBO will likely hold broad exposure across the curve so as to maximize roll through large differentials between months held. Here is the current forward curve for WTI, and as you can see on the holdings page the fund is heavily exposed to back-month futures contracts (currently holding March 2020).

As you can see, there is backwardation across the forward curve through at least the next year. With DBO holding exposure in March 2020, it has over $2 per barrel of backwardation between the prompt month and its holdings which means that there is strong positive roll to be had by the ETF. For holders of DBO, this in and of itself could be a strong reason to hold the ETF but I believe the fundamentals for the underlying crude oil contracts are strongly indicative of higher prices in the near future as well.

Crude Fundamentals

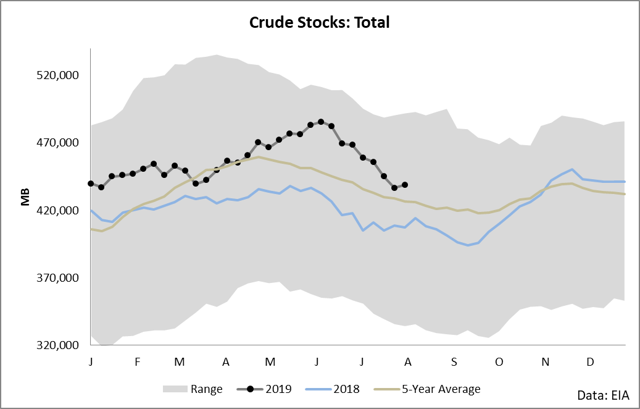

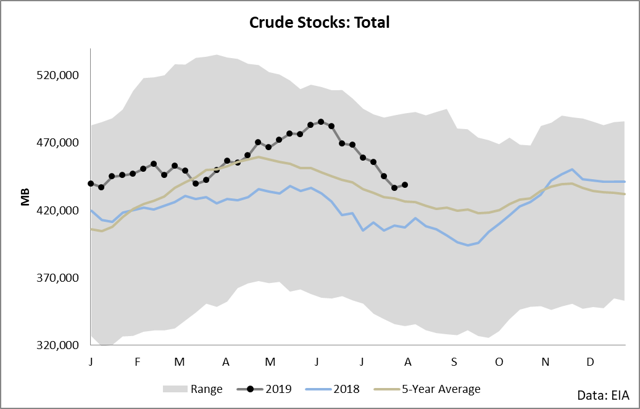

If you haven’t watched crude oil over the last few months then you’ve likely missed out on the fact that crude inventories are currently collapsing. As seen from a 5-year range perspective, the distance between inventory levels and the 5-year average have frankly fallen off a cliff over the last two months.

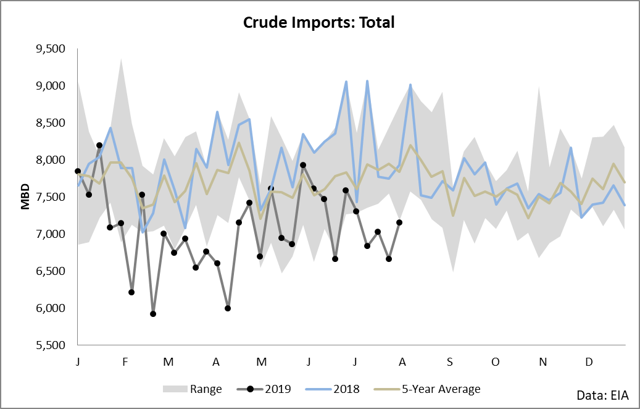

Sometimes it can be difficult to determine exactly what the drivers in inventory levels are but in this situation, the case is very clear: imports have fallen once again after a brief recovery in late May.

This year, imports have been the key balancing factor for North American inventories in that basically every period in which imports were above its seasonal range, inventories lagged its 5-year average and every period in which imports were below its seasonal range, inventories gained against its 5-year average.

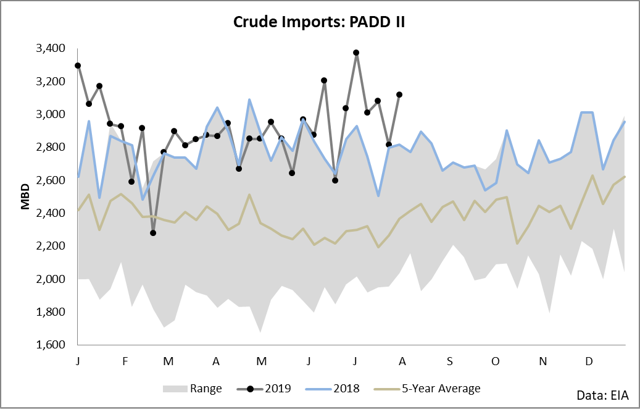

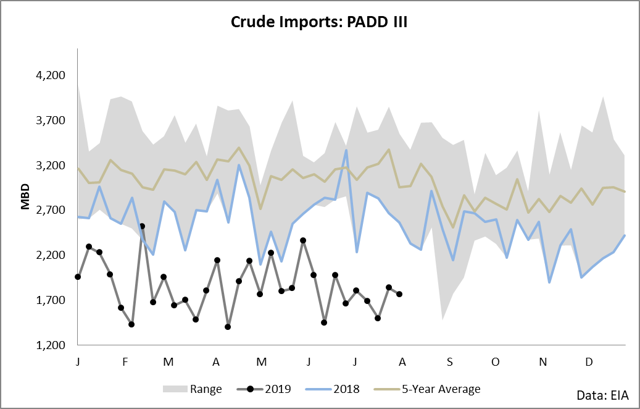

If you were an investigative journalist trying to determine the cause of why imports are so weak, a simple look at the difference between PADD 2 and PADD 3 imports would show the culprit. PADD 2 imports represent barrels coming into the Mid-Continent (largely from Canada) and PADD 3 largely represents waterborne barrels coming to the Gulf Coast.

As you can see in the charts above, Canadian imports into the United States have been very strong this year whereas waterborne imports have only seen a single week with the figure coming even remotely inside the 5-year range. In other words, the balancing factor for North American crude this year has come almost entirely from a lack of barrels coming to the Gulf Coast.

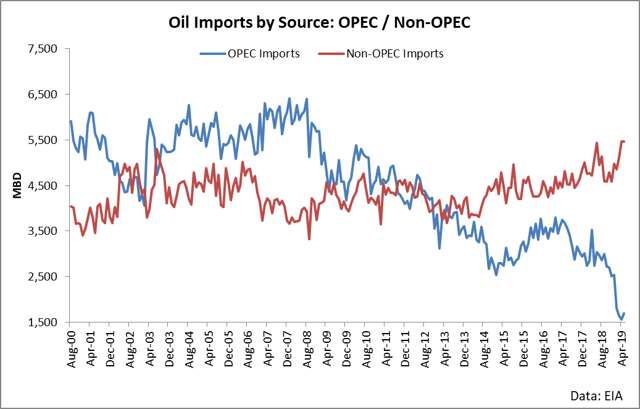

When you look at who is actually sending the United States barrels, the picture becomes immediately clear.

At the end of last year, OPEC agreed on production cuts. This agreement led to the price of crude bottoming within a few days and the subsequent rally which lasted through April/May of this year. In the June/July timeframe, OPEC agreed to extend these cuts through at least March of 2020 and in recent days Saudi Arabia has indicated that it will take any measure necessary to balance the oil market (in other words, make prices increase).

On the back of OPEC cuts essentially directing the balance of North American crude, which in turn influences the price of crude through simple supply and demand, it makes little sense to consider a short position in crude oil at this time. I believe the best returns will be found in buying and holding crude oil for at least the next 6-9 months to capture the draining of inventories and DBO makes an excellent high-roll yield investment to capture this theme.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News