[ad_1]

FabrikaCr/iStock via Getty Images

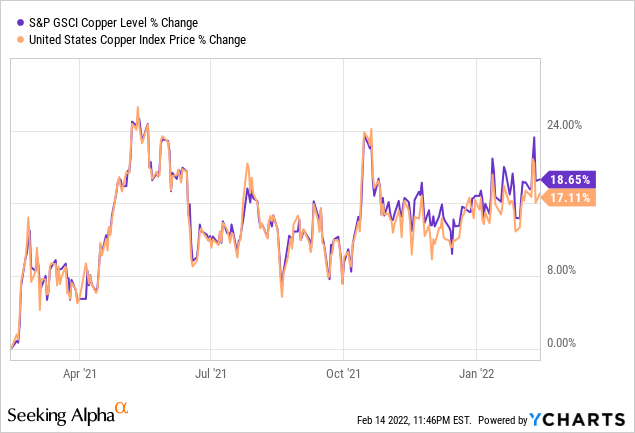

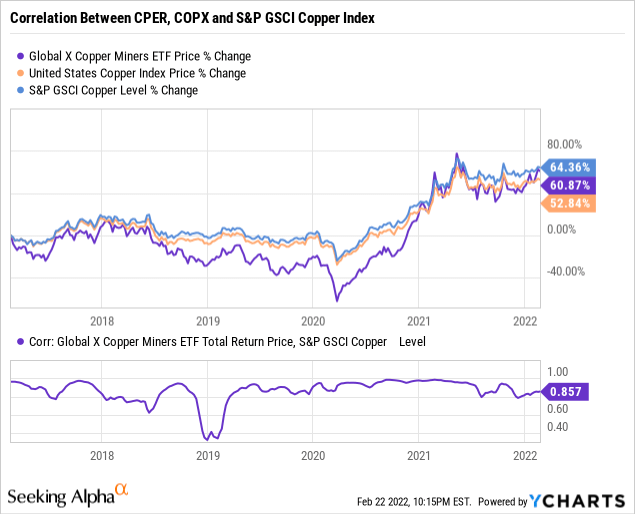

In the past months, copper prices have been rallying to record levels. Amid rising uncertainties over inflation and the subsequent rate hikes to stem down escalating costs, copper prices have shown little signs of weakening. Prices remain supported by an expanding credit market in China and concerns over a looming supply shortage due to low exchange-based stocks. While I am bullish on the long-run prospects for copper due to supply constraints and rising demand from the green transition, I believe that there will inevitably be some corrections to the current price level in the near future. Such will present attractive entry points for long investors. For investors seeking an ETF exposure to copper, the United States Copper Index Fund (CPER) offers a decent correlation with the S&P Copper Index.

Short-term Outlook

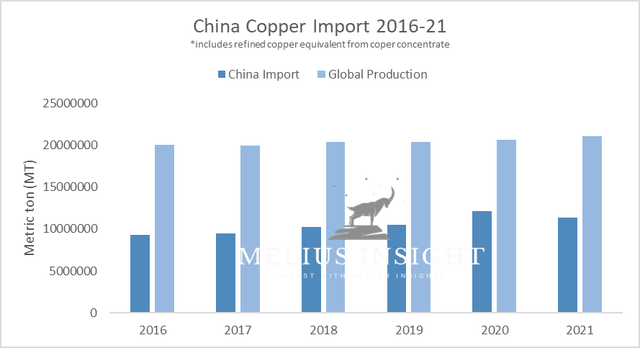

As an industrial metal, copper is inevitably tied to the stage of the global economic cycle and, to a certain degree, the Chinese economy. During the past years, China imported, on average, more than 10 million metric tons (NYSE:MMT) of copper during the past 6 years, approximately half of global mines’ output.

Author’s creation using data from GACC and Saigon Futures

Regarding China, according to data from the CRU Group, the civil and building construction sector accounts for 22% of the country’s copper consumption. The rest is used in utility, machinery, and consumer durables. Therefore, one can observe the importance of Chinese manufacturing on the copper market. Following the credit collapse of the Evergrande Group, there have been talks of a contraction going into 2022 for the Chinese economy.

In an effort to reinvigorate its economy and prevent further economic deceleration, the PBOC previously announced that it would expand its monetary tools to avoid a “credit slump” in the market, sending a clear signal on the Central Bank’s stance. This resulted in a number of measures, such as the recent cut to 1Y and 5Y loan prime rate, and the required reserve ratio cut in December. January credit data released from PBOC showed that the policy has resulted in a significant liquidity influx into the economy. For the first month of 2022, Chinese financial institutions originated loans totaling 3.98 trillion yuan ($626 billion), tripled from the December’s level of 1.13 trillion yuan.

According to Reuters, on 02/18, China’s National Development and Reform Commission (NDRC) and other regulators announced 18 measures in a notice involving fiscal, financial and environmental policies to stimulate the country’s industrial sector. Specifically, the NDRC said that it would guide the financial system to transfer profits to the real economy, encouraging state-owned banks to lend more to manufacturers and back carbon-reduction projects. In addition to that, the Commission would also seek to develop large-scale wind and solar power projects in the Gobi desert regions. Consequently, the above combination of fiscal and monetary policies could help to buoy the country’s copper demand for 2022.

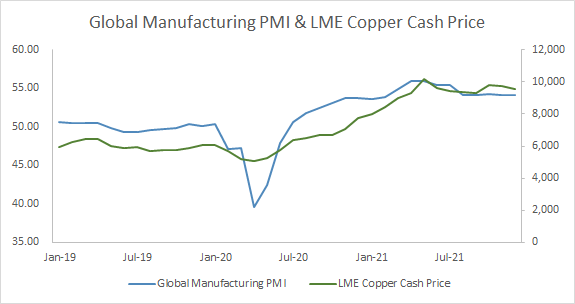

IHS Markit, LME

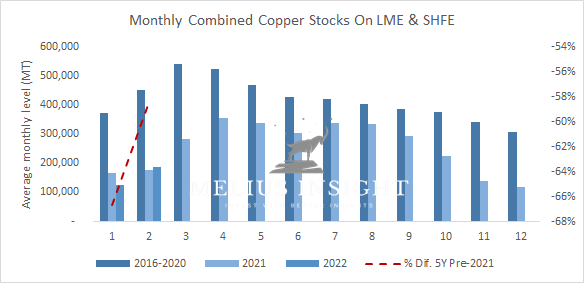

Though there will be a number of major mines coming online in the next few years, current stock levels across major exchanges such as LME and SHFE are very tight compared to their historical averages. Observing from the chart below, one can see that the months in Q1 and early Q2 are the build-up periods to satisfy downstream demand in Q3 and Q4. During the first two months of 2022, the build-up of exchange-based stocks has been much lower than that of the pre-2021 period. As of 02/18, the combined monthly average stocks on the LME and SHFE stood at 199,270 MT for February, less than 56% of the average level recorded between 2016-2020. As such, even with the prospects of stable demand, it appears that supply will remain tight for the rest of this year.

Author’s creation using data from SHFE, LME

Longer-term Outlook

Within the 2022-24 period, there will be major mines going online to ease the global thirst for copper. Among these, some noticeable ones are Kamoa Kakula (Congo), Quellaveco (Peru), Udokan Copper (Russia), Zafranal (Peru), and Chalcobamba (Peru). Details are provided in the table below.

| Mine | Location | Estimated Production Time | Owner | Capacity (MT of copper equivalent) |

| Quellaveco | Peru | 2022-2023 | Anglo America | 300,000 |

| Udokan copper | Russia | 2022 | Udokan Copper | 135,000 |

| Kamoa-Kakula Phase II | Congo | 2022 | Ivanhoe Mines, Zijin Mining Group, Crystal River Global Limited, Congo Government | 400,000 |

| Zafranal | Peru | 2025-2026 | Teck Resources Limited, Mitsubishi | 75,000 |

| Chalcobamba | Peru | 2022 – 2025 Awaiting permits | MMG | 145,000-152,250 |

Source: Anglo America, Financial Times, Institute of Mining Engineers of Peru, Bloomberg, MMG

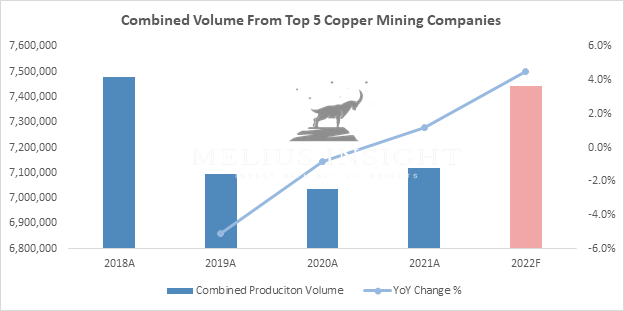

The combined capacity of Kamoa Kakula and Quellaveco alone is already more than 3% of the current global mine output. Furthermore, combined production forecasts from the top global copper miners – Glencore (OTCPK:GLNCY), Southern Copper (SCCO), Freeport-McMoRan (FCX), BHP (BHP), and Codelco – support a higher output for this year than in 2021. Most of this increase will come from Freeport, whose 2022 output is expected to be 4.3B lbs. Hence, with new projects on the near horizon, it appears that the current supply deficit will soon be alleviated, thus limiting further upside potential for copper within this time period.

Author’s creation from companies’ filings and production reports

Of course, there will be factors that prevent major price corrections, given the time needed to ramp up production, it will probably be until late 2023 for these mines to meaningfully enter the market. Other factors such as the political and social uncertainties in South America, and long-term demand from the global shift to green energy will help to keep copper prices elevated.

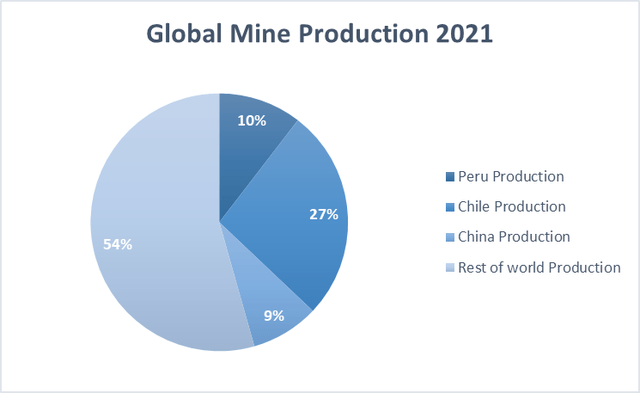

U.S. Geological Survey, Mineral Commodity Summaries, January 2022

In Chile and Peru, where more than one-third of the world’s copper is mined, the recent election of President Gabriel Boric and Pedro Castillo in 2021 marked a leftish political shift in these two countries. Even though Peru recognizes the importance of its copper industry, the government of President Pedro Castallio has emphasized improving social benefits for local communities. Potential projects like Tia Maria from Southern Copper Corporation (SCCO) and Chalcobamba from MMG are still awaiting permits to initiate construction.

In Chile, the new government of President Gabriel Boric is also expected to increase taxes, social spending and reform the welfare system. More specifically, a proposed copper royalty bill that passed the Chilean Senate last November could introduce a variable tax rate to the country’s mining tax. If it passes, the bill could increase the tax rate to more than 75% once copper prices reach $4.50/lb. Currently, the copper tax rate in Chile is at 40%, similar to Peru and other countries. As of December 2021, this bill is still under discussion. Nevertheless, major mining companies such as BHP are wary of this new tax system. The company has indicated that the tax regime risks damaging the country’s copper industry. Consequently, this may drag out the anticipated timeline for new mines in these countries, thus keeping the supply side tight in the upcoming years.

Numerous literature has been published on the inevitable trend of electrification and EVs. A recent article published last year by EIA forecasted that global EV sales could reach between 35.3 – 58.8 million vehicles by 2030, which represents 16% – 34% of the number of vehicles sold globally. In 2020, this number stood at 4.4 million vehicles. According to data from the Copper Development Association, on average, EVs consume 3x more copper than conventional vehicles, which use 22.5kg. Crunching the numbers, this means that the EV sector, by itself, will consume an additional 2 – 3.7 MMT of copper by 2030, equivalent to 8 – 15% of current global copper demand.

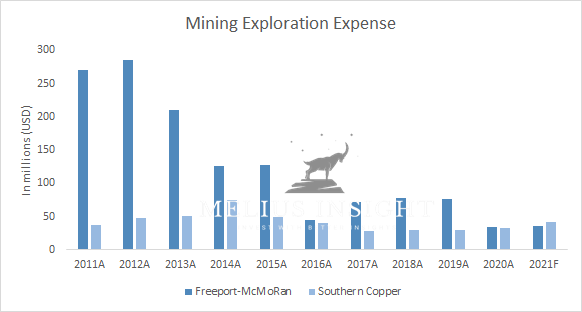

Another factor to consider is that most of the current copper supply comes from old mines, whose ore grade degrades as they come near the end of their production life. S&P Global expects that production from existing mines will fall at a CAGR of 4.7% after 2025, declining down to 15.90 MMT in 2030 from the current level at 20.53 MMT. Though there will be new projects coming online to supplement this fall, the long-term supply outlook still appears very tight for the copper market. Additionally, exploration expenses from top miners have been piecemeal in recent years. For example, exploration expenses of Freeport-McMoRan have been consistently less than 1% of the company’s total revenues in the past several years.

Author’s creation from SCCO & FCX’s financial statements

Conclusion

Therefore, this combination of growing demand and tightening supplies make for a convincing copper bull case in the long run. Though there could be some weaknesses in the upcoming months due to a rising dollar and the mid-term supply surplus, I don’t expect such corrections to be significant.

For investors who seek to benefit from the long-term uptrend, CPER and to a certain extent, Global X Copper Miners ETF (COPX) will allow a close mirroring of copper returns. COPX’s top 10 holdings are evenly distributed between top copper miners such as BHP, Glencore, Southern Copper, Freeport-McMoRan, Sumitomo (OTCPK:SSUMY), etc., with a 4-5% distribution each.

[ad_2]

Source links Google News