[ad_1]

Global X MSCI Pakistan ETF (PAK), an ETF that tracks the performance of the MSCI All Pakistan 25/50 Index through full replication, has declined sharply in the past two years. We foresee some further pressures ahead for the ETF as Pakistan’s federal budget announced June 11 has several provisions that may keep corporate earnings subdued. Furthermore, the threat of further interest rate hike remains, albeit at a lower level.

Budgetary Measures to Negatively Affect Corporate Earnings

We expect the market to come under further pressure in the next one year as the Federal Budget’s negative effect on corporate earnings becomes visible. To summarize, the following measures have been proposed in the budget for tax year TY20, which we believe will reduce corporate earnings and consequently restrain PAK’s price.

- Financials, which carry the biggest weight in PAK, stand to be negatively affected by three Federal Budget proposals. (1) The Finance Ministry has proposed to tax income from government securities at the rate of 37.5% as opposed to the previous rate of 35% (see page 25 of the Federal Budget document linked above). Please note that not all of the income will be taxed at a higher rate, and only that above 20% of a bank’s profit after tax will be subject to the higher rate. (2) Banks will now have to pay taxes on recoveries of provisions made for non-performing loans (for reference see page 25 of the Federal Budget document linked above). (3) There is also a lot of uncertainty regarding the Finance Ministry’s proposal to shift Pakistan Government’s deposits in commercial banks to a central Treasury Single Account. PAK’s top holdings in the banking sector include Habib Bank, MCB Bank and United Bank, all of which have around 10% of their deposits sourced from the government. In case the government withdraws its deposits from commercial banks, the banks will have to liquidate some of their earning assets, which in turn will result in a reduction in income.

- The previous government had announced a cut in corporate tax rate for this year, but the current government has decided to hold the tax rate at the current level for two years. This measure will hurt corporate earnings prospects of all the sectors that PAK holds, with the exception of banks and oil and gas exploration and production companies. These two sectors were heavy-weights in PAK’s portfolio as of the end of last month.

- Lucky Cement, which was PAK’s sixth largest holding as of May end 2019, is likely to suffer an earnings contraction due to measures announced in the federal budget. (1) Federal Excise Duty on cement bags have been increased to PKR 2/kg from PKR 1.5/kg, which will result in either reduction of retention price for the company or a reduction in demand for its product. For reference see point 24, page 10 of the federal budget document. (2) Reduction in tax credit available for new investments has been slashed from 10% to 5% for TY19 (for reference, see page 16).

- Pakistan State Oil, a downstream oil marketing company, will see a hit to its earnings as the budget has proposed to increase minimum turnover tax from 0.5% to 0.75%. Pakistan State Oil was among the top 10 holdings of PAK, according to latest disclosures. For reference please see page 15 of this federal budget document.

- The finance ministry has proposed several negative measures for textiles as well, but this sector appeared to have an inconsequential weight in PAK as of the end of May 2019. Therefore PAK is mostly unaffected in this case.

Threats of Further Rate Hikes Remain, Albeit at a Lower Level

After improving in 3QFY19, Pakistan’s current account deficit resumed to widen in April and May of 2019, thereby increasing market’s fears that the central bank will opt for further monetary tightening. However, we feel that chances of further rate hike have substantially declined. One justification for our thesis is that IMF’s board is likely to approve Pakistan’s request for a new program, which may result in the first tranche flowing in to the country in a few months’ time. This will ease the pressure on Pakistan’s foreign exchange reserves and currency, and consequently lower the pressure on central bank to raise rates to protect the value of Pakistan’s Rupee (PKR).

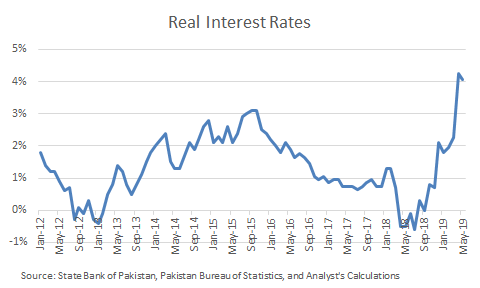

Recent PKR devaluation will result in a lagged upward pressure on inflation, which may result in further inflationary threats in the coming months. However, we feel that the central bank has already dealt with this threat proactively by raising its target policy rate by 150bps in the last monetary policy announcement. Consequently, the real interest rate is already at a very high level compared to its historical average; thereby reducing the need for further rate hikes in the coming months. The chart below shows the history of the real interest rate.

(Note: (1) we have used the ceiling of the central bank’s interest rate corridor to calculate the real interest rate. The ceiling is 50bps above the target policy rate. (2) We have used the core non-food non-energy (NFNE) component of inflation to calculate the real interest rate because monetary policy can mostly control NFNE. Food and energy prices are mostly out of monetary policy’s control).

If international crude oil prices decline further then they will cool inflation, and consequently reduce chances of further interest rate hike. But this positive effect will be partly negated by the fact that PAK’s top holdings include two oil and gas exploration and production companies, both of which are sensitive to crude oil prices (meaning fall in oil prices results in fall in earnings, and consequently stock prices, of the two companies, as oil prices are mostly left unhedged).

Conclusion: maintaining bearish stance on PAK for the next six to nine months

We believe that PAK is still not ready to move into the recovery phase because of the high likelihood of depressed corporate earnings ahead. Moreover, threats of further interest rate hike remain, albeit at a low level. As a result we expect PAK to further decline in the next six to nine months. Short term correction may, however, be visible in the coming weeks, especially if the new IMF program gets approved by their board. We advise investors to not take these short-term corrections as positive signals, and to not go long PAK for at least the next six to nine months. We advise holders of PAK to reduce their exposures to it. (We do not give short recommendations due to the high risk involved).

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News