[ad_1]

nespix/iStock via Getty Images

Recently, my wife and I decided to escape the constant barrage of bad news about war, inflation, Covid (still?), severe weather, politics, or whatever celebrity did something stupid, and just head out of town for a few days. We escaped, sort of, to Moab, Utah to visit Arches National Park (which was already fully reserved for April and packed with tourists) and Canyonlands NP, and other vast areas of the desert southwest. It gave me time to think about the state of world affairs, and with places like Dead Horse Point, Horsethief Canyon, and Island in the Sky, I began to think about the hereafter. And by that, I mean retirement.

Mesa Arch – Canyonlands NP (author photo)

Not that I believe the “end is near”, although it sure seems that way some days, but more of an inspiration for me to think about some defensive ways to plan for my financial future given the current state of the world. So, in that vein, I have come up with four funds that I feel are good buy candidates now to help prepare for a future market that is different than the recent past. I am reading forecasts indicating that equities in the technology, growth, consumer discretionary, and other market sectors that have performed well over the past 5 years are more likely to underperform in the next 5 years.

Along with a shift from growth to value, there appears to be a shift towards energy, utilities, healthcare, and commodities, as the world deals with the fallout from the Russian invasion of Ukraine along with soaring inflation, supply chain issues affecting everyone from semis to homebuilders, and increasing fears of recession. According to this recent post on SA, the most popular funds in recent days have been in defensive sectors like Healthcare, Utilities, and Consumer Staples, with record investor inflows into the ETFs associated with those sectors.

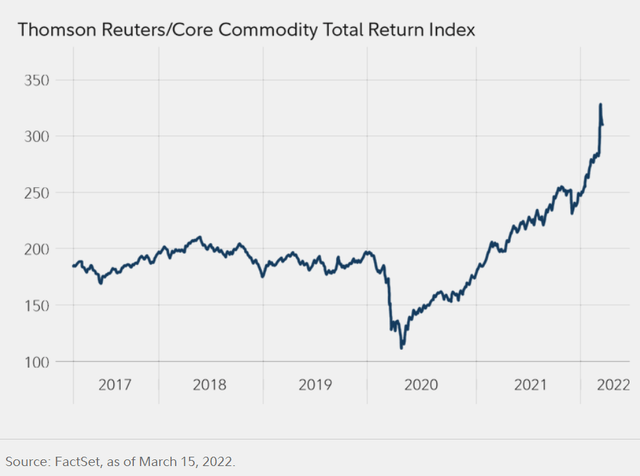

With the recent news on surging commodity prices, and the news about supply shortages and other factors driving up commodity prices, I decided to focus first on that sector of the market. There has been a lot of recent buzz about commodities such as basic materials and the timing for investing in everything from steel to precious metals, fertilizer, oil and gas, and others. In fact, from the article on surging commodity prices linked above, this chart illustrates how much the total return on commodities overall has surged in 2021 and so far in 2022.

Commodity Total Return chart (Fidelity – Commodity Prices Go Wild article)

Using a mining analogy, I began to explore some prospects for a commodity fund that could take advantage of this trend and I decided to use that sector for my defensive pick, rather than consumer staples, to supplement and complement my other investments in energy, healthcare, and utilities. In the energy sector, although it has recovered somewhat from the records lows of March 2020, there still appears to be room for much more upside in the coming several years, and especially with the impacts of sanctions on oil and gas exports from Russia into Europe. I am not considering an energy-specific fund in this analysis, although it is one commodity that could be included in a diversified commodity fund.

Commodity Funds to Consider

Without further ado, allow me to introduce you to my picks and then I will put forth some facts and figures supporting my choices. In the commodity fund category, I first started looking at some broad commodity-based funds like Invesco DB Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC).

PDBC is an actively managed ETF (exchange traded fund) that attempts to achieve its investment objectives by trading in commodity-linked futures in 14 different categories. According to the fund overview:

The Fund seeks to provide long-term capital appreciation using an investment strategy designed to exceed the performance of DBIQ Optimum Yield Diversified Commodity Index Excess Return™ (DBIQ Opt Yield Diversified Comm Index ER) (Benchmark), an index composed of futures contracts on 14 heavily traded commodities across the energy, precious metals, industrial metals and agriculture sectors.

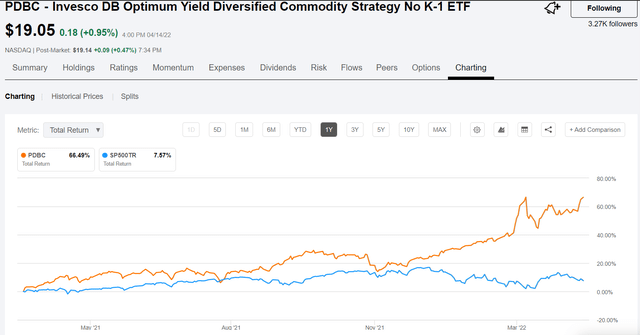

The PDBC fund has a 4-star Morningstar rating as of 3/31/22 and has returned over 66% in total returns over the past year. The inception date of PDBC was November 2014, and the net expense ratio is a low 0.62%. The fund NAV performance as of 4/14/22 was at 58% over the past 1 year. Up until 2021 the fund had been underperforming equities (compared to S&P 500, for example), however, in 2021 and so far in 2022 it has outperformed SPY by a considerable amount based on total return.

PDBC Total return compared to S&P 500 index (Seeking Alpha)

While doing my research on PDBC, that then led me to Direxion Shares ETF Trust – Auspice Broad Commodity Strategy ETF (COM), which I like because of the strategy to adjust the holdings using a long/flat strategy. In the COM fund the managers adjust holdings to be overweight the commodity futures contracts that have the greatest current upside potential, and are underweight, or “flat” the commodity components that do not have current pricing power. In doing so, it maximizes the total return by leveraging the shifts in commodity futures based on changing market conditions, while minimizing downside risk.

COM also invests in fixed income securities in addition to the commodity markets. This is a brief description from the fund profile on SA:

The fund invests in fixed income and commodity markets. For its fixed income portion, it invests directly and through other funds in treasury bills, government securities, money market, short-term bond, highly rated corporate or other non-government fixed-income securities, with maturities of up to 12 months. For its commodity portion, the fund invests through a wholly owned Cayman Islands subsidiary and through derivatives like futures and swap. It employs quantitative analysis to create its portfolio.

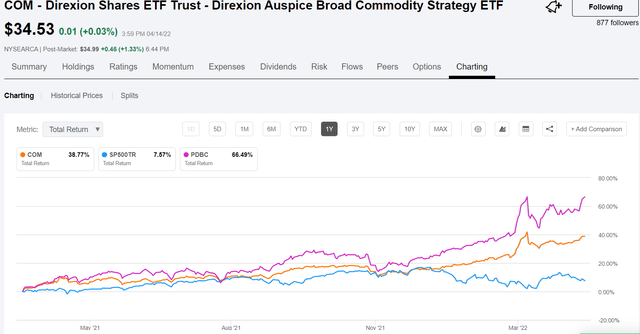

COM has an expense ratio of 0.72% and produced an annual total return of about 9% over the past 5 years through 12/31/21, and a total return of 36% in the past 1 year. The fund’s inception date was 3/30/2017 and paid an annual dividend of $3.01 in December 2021. Additionally, the fund declared another “special” dividend in March of $0.5035. The COM fund does not have the total returns that PDBC has achieved over the past year, however, the downside risk is somewhat minimized due to the long/flat strategy and fixed income component. It may be of interest to investors who have a more conservative risk profile and prefer the relative safety of the COM ETF compared to other similar funds.

COM total return compared to PDBC and SPY (Seeking Alpha)

While investigating COM, I discovered a similar fund – iShares GSCI Commodity Dynamic Roll Strategy ETF (COMT). The COMT fund is managed by BlackRock Advisors and also uses a rotational strategy to manage the commodity holdings. From the fund fact sheet that explains why you may wish to invest in COMT:

Access to commodities, across energy, metals, agriculture and livestock sectors, through a rules-based futures strategy designed to minimize costs associated with futures investing

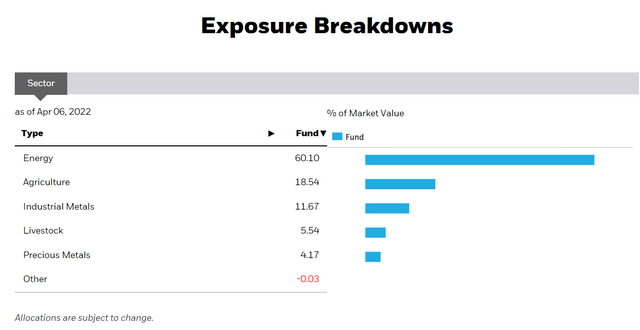

The 5-year total return for COMT as of March 31, 2022, was 11.25% and 1-year TR = 58%. The current exposure breakdown shows a heavy tilt toward energy currently:

COMT exposure breakdown (COMT fund fact sheet)

COMT also pays an annual dividend and for 2021 the amount paid was $5.494133. The fund was established in 2014 and currently holds nearly $4B in net assets. The COMT fund appears to be similar to PDBC in terms of total returns but uses a slightly different approach to its investing strategy. This is the COMT fund profile from the SA summary page:

The fund uses derivatives such as futures contracts to invest in aluminum, Brent crude oil, cocoa, coffee, copper, corn, cotton, gas oil, feeder cattle, gold, heating oil, lean hogs, lead, live cattle, natural gas, nickel, silver, soybeans, sugar, unleaded gasoline, wheat, West Texas Intermediate crude oil and zinc. It seeks to track the performance of the S&P GSCI Dynamic Roll (USD) Total Return Index, by using representative sampling technique. iShares U.S. ETF Trust – iShares GSCI Commodity Dynamic Roll Strategy ETF was formed on October 15, 2014 and is domiciled in the United States.

Comparing Commodity Funds

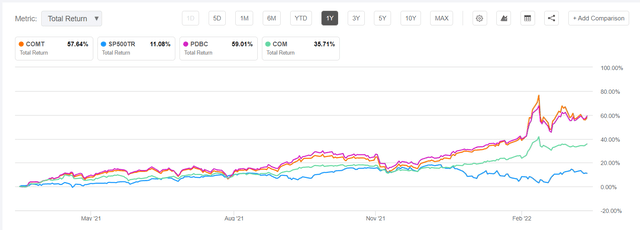

In consideration of the total return potential for each of the broad-based commodity funds I used the chart comparison tool in SA to look at 1-year total returns for COM, COMT, and PDBC. Not surprisingly, COM was the laggard because of the strategy to reduce downside risk which limits the upside return. But I was surprised to see that COMT and PDBC had nearly identical charts and total returns.

1-year total returns for COM, COMT, and PDBC (Seeking Alpha)

While reading comments in an article by author Michael Fitzsimmons, a commenter asked which commodity fund he would recommend and he suggested that he was long iShares MSCI Global Metals & Mining Producers ETF (PICK). So that got me to do some research on PICK, another BlackRock fund, and I like my initial look at it. The PICK fund has outperformed the S&P 500 based on total return over the past 5 years and has more than doubled the TR of SPY in the past 1 year, and especially in the past 3 months. Here is the fund profile:

The fund is managed by BlackRock Fund Advisors. It invests in public equity markets of global region. The fund invests in stocks of companies operating across materials, metals and mining, aluminum, diversified metals and mining, precious metals and minerals, steel sectors. It invests in growth and value stocks of companies across diversified market capitalization. It seeks to track the performance of the MSCI ACWI Select Metals & Mining Producers ex Gold and Silver Investable Market Index, by using representative sampling technique. iShares, Inc. – iShares MSCI Global Metals & Mining Producers ETF was formed on January 31, 2012 and is domiciled in the United States.

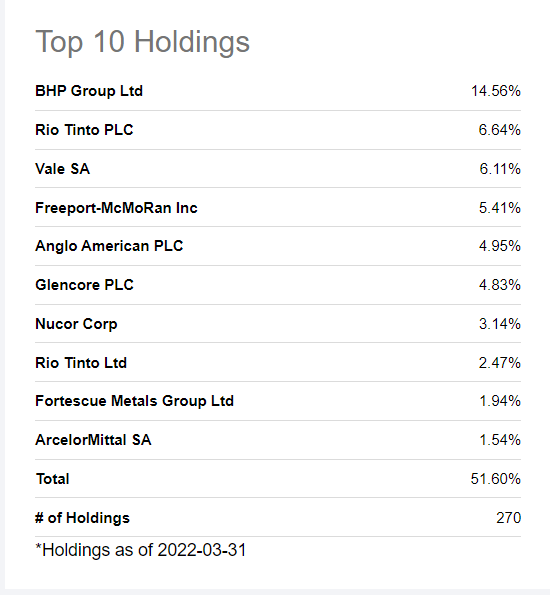

Although PICK is more mining and basic materials focused than PDBC, COM or COMT, I like the fund’s top holdings and recent past performance. It also appears to have good forward potential given the circumstances that we find ourselves in as a global consumer of basic materials at ever increasing prices.

I published a previous article on Steel stock picks for current investments and Nucor (NUE) is one of the steel holdings that I reviewed. It is a top 10 holding in PICK. Several top copper miners and other undervalued miners of basic metals are included in the top 10, and demand for those materials continues to exceed the available supply as the war rages on in Ukraine along with inflation continuing to rise.

PICK Top 10 holdings as of 3/31/22 (Seeking Alpha)

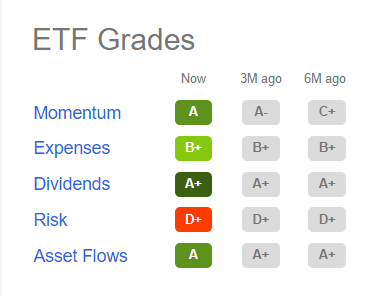

PICK gets strong ETF quant grades from SA, and in my TD Ameritrade account it shows a high return potential with relatively low risk.

PICK Quant grades (Seeking Alpha)

Because the PICK fund invests in companies that actually produce something (e.g., metals), as opposed to futures in commodities, which is purely a financial product, there is some additional risk to consider. The mining industry has had its ups and downs over the past decade, and regulatory and geopolitical issues and events may have more of an impact on future returns. But with higher risk comes higher rewards, so if you are not too risk averse in your investments you may wish to consider digging deeper into PICK.

Conclusion

In reviewing these 4 funds I decided to select one of the broad-based commodity funds, PDBC, and the PICK fund to invest in. I chose PDBC as the commodity fund, although COMT could have just as easily been my choice due to its recent performance and investing strategy that uses some predictive modeling to determine optimal futures pricing. I still believe that commodities in general have some room to run higher this year, although looking at the charts there could be a pullback or a retreat in the returns from those funds based on a purely technical perspective.

If inflation has peaked as some are predicting now, the commodity run may have less upside than other investments for the remainder of this year, however, I feel that the commodity cycle is still in the early stages of recovery and should still have more upside ahead as the global economy continues to recover from Covid lockdowns, travel restrictions, supply chain issues and other factors that have restricted global economic growth for the past two years.

The mining and metals sub-sector of the commodities market still appears to be very undervalued even after starting to recover somewhat in 2021. For many of the reasons stated above regarding commodities in general, I believe that the mining/metals sector has much more upside ahead in 2022 and probably well into 2023 as demand for copper, steel (iron ore), aluminum, nickel, and other metals are increasingly in demand for autos, construction, copper wire, infrastructure buildout, and many other products that are surging in price due to limited supply and inflationary factors.

Please do your own due diligence and if you have anything to add to the discussion, please add your comments below. I am not an expert on commodities or mining, but I do see a trend toward higher prices based on the factors mentioned and this should offer an opportunity for investors who are willing to accept the risk/reward proposition of investing in commodities in 2022.

[ad_2]

Source links Google News