[ad_1]

Pavel Muravev/iStock via Getty Images

The VictoryShares US EQ Income Enhanced Volatility Wtd ETF (NASDAQ:CDC) is an equity index ETF investing in U.S. equities, sometimes holding cash. Overall asset allocation is based on market conditions, with the fund attempting to time the market. Stocks are selected and weighted based on yield, profitability, and volatility. Although the fund’s strategy has mostly proven successful in the past, I’m wary about its future effectiveness. Market timing rarely works, especially so when done through simple, automated processes, and I do not believe that CDC will ultimately be an exception to the rule. As such, I would not be investing in the fund at the present time.

CDC – Basics

- Investment Manager: Victory Capital

- Underlying Index: Nasdaq Victory US Large Cap High Dividend 100 Long/Cash Volatility Weighted Index

- Dividend Yield: 3.04%

- Expense Ratio: 0.36%

- Total Returns CAGR 5Y: 12.1%

CDC – Overview and Strategy Analysis

CDC is an equity index ETF investing in U.S. equities, sometimes holding cash. The fund tracks the Nasdaq Victory US Large Cap High Dividend 100 Long/Cash Volatility Weighted Index, a relatively complicated index.

The index first selects applicable stocks based a basic set of criteria, including size, liquidity, and profitability: only companies with positive TTM earnings are included in the index. The index then selects the highest-yielding 100 stocks from applicable securities. Weights are determined by volatility, with lower volatility stocks having greater weights, and vice versa. There are industry caps meant to ensure diversification.

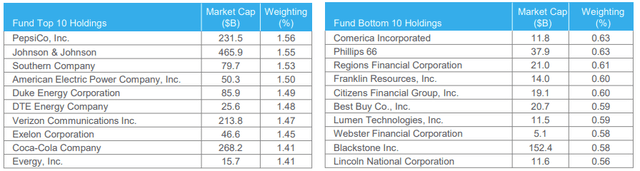

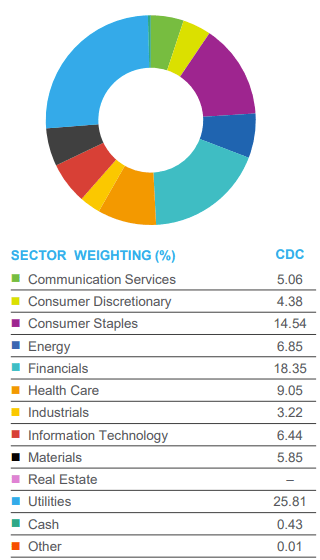

The process above results in a reasonably well-diversified fund, but somewhat overweight financials and consumer staples, while being underweight tech. These industry weights are quite standard for funds focusing on stocks with above-average yields, as these industries tend to sport comparatively cheap valuations and share prices, and hence high yields. CDC’s industry allocations and largest holdings are as follows.

CDC Corporate Website

CDC Corporate Website

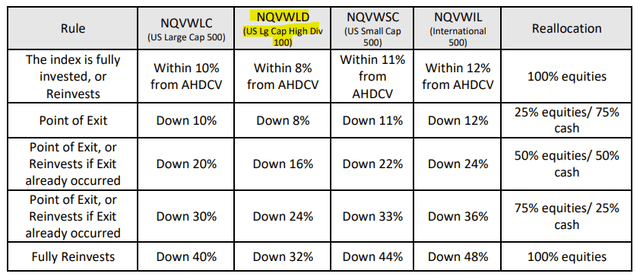

The index is generally fully invested in equities, but sometimes holds cash. Asset allocations are based on market conditions, with the index and fund attempting to time the market. The strategy is somewhat complicated, but can be summarized thus.

- The index is generally fully invested in equities

- The index switches to equities and cash once equities are down at least 8%

- The index goes back to being fully invested in equities once markets are down by less than 8%, or more than 40%

- Rebalances are done at the end of the month

Nasdaq provides investors with an infographic explaining in more detail the above. In bold, the rules for CDC’s underlying index (there are several others).

CDC Corporate Website

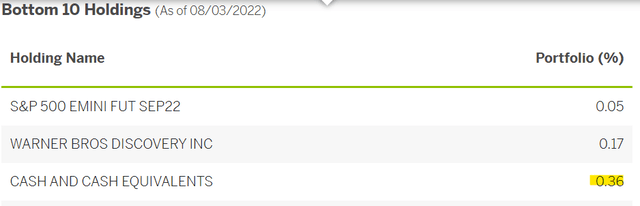

The fund is currently fully invested in equities, with a tiny allocation to cash, almost certainly due to operational expenses or rebalancings.

CDC Corporate Website

In my opinion, CDC’s underlying index has many significant negatives and shortcomings, making a buy rating impossible.

In my experience, combining dividend yield and volatility measures in the same fund, as CDC does, almost always results in moderate, but permanent, capital losses for shareholders. I’ve explained these issues in more depth here, but the situation can be summarized as follows. Focusing on stocks with above-average yields leads to concentrated portfolios with relatively risky stocks. Volatility tends to spike when stocks are going down, a frequent occurrence for riskier stocks. Focusing on stocks with below-average volatility means, in practice, selling stocks when they are down, locking-in losses. I’ve seen this process play out in several funds already, and I don’t think that CDC will prove to be an exception. On the other hand, I was unable to check if said process has actually played out for CDC in the past, due to the complexity of the fund’s strategy. Unclear if asset sales are due to changes in yields, volatility, profitability, etc. Still, this combination rarely works, and the risk of losses is there.

I’m also wary of the fund’s market timing strategy. As previously mentioned, market timing rarely works. Successful strategies are (mostly) developed by nimbler quant firms and hedge funds, rarely by slow, constrained, retail index products. Successful strategies are generally copied until alpha is exhausted: if CDC’s strategy worked, knowledgeable investors would copy it until it didn’t. In my opinion, market timing strategies will (mostly) prove unsuccessful, and CDC will be no exception.

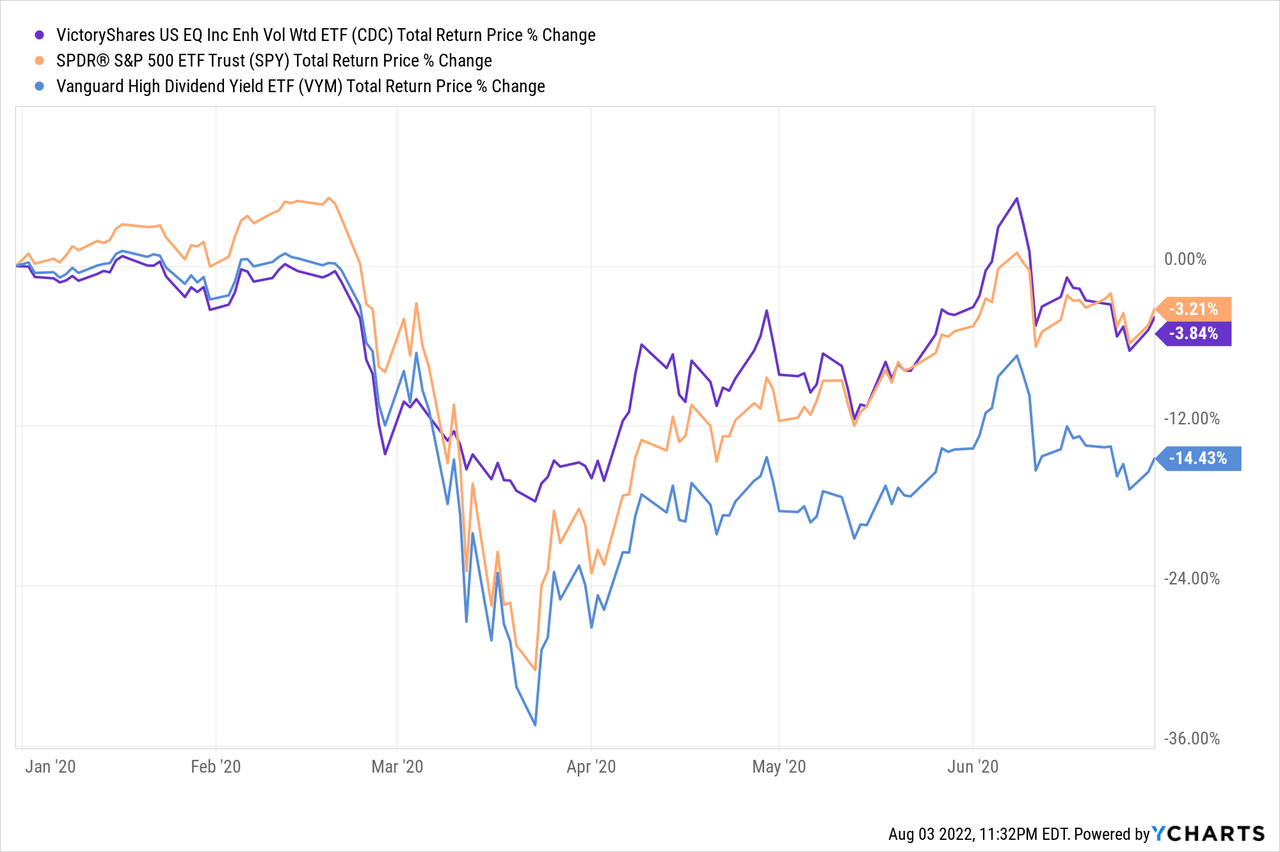

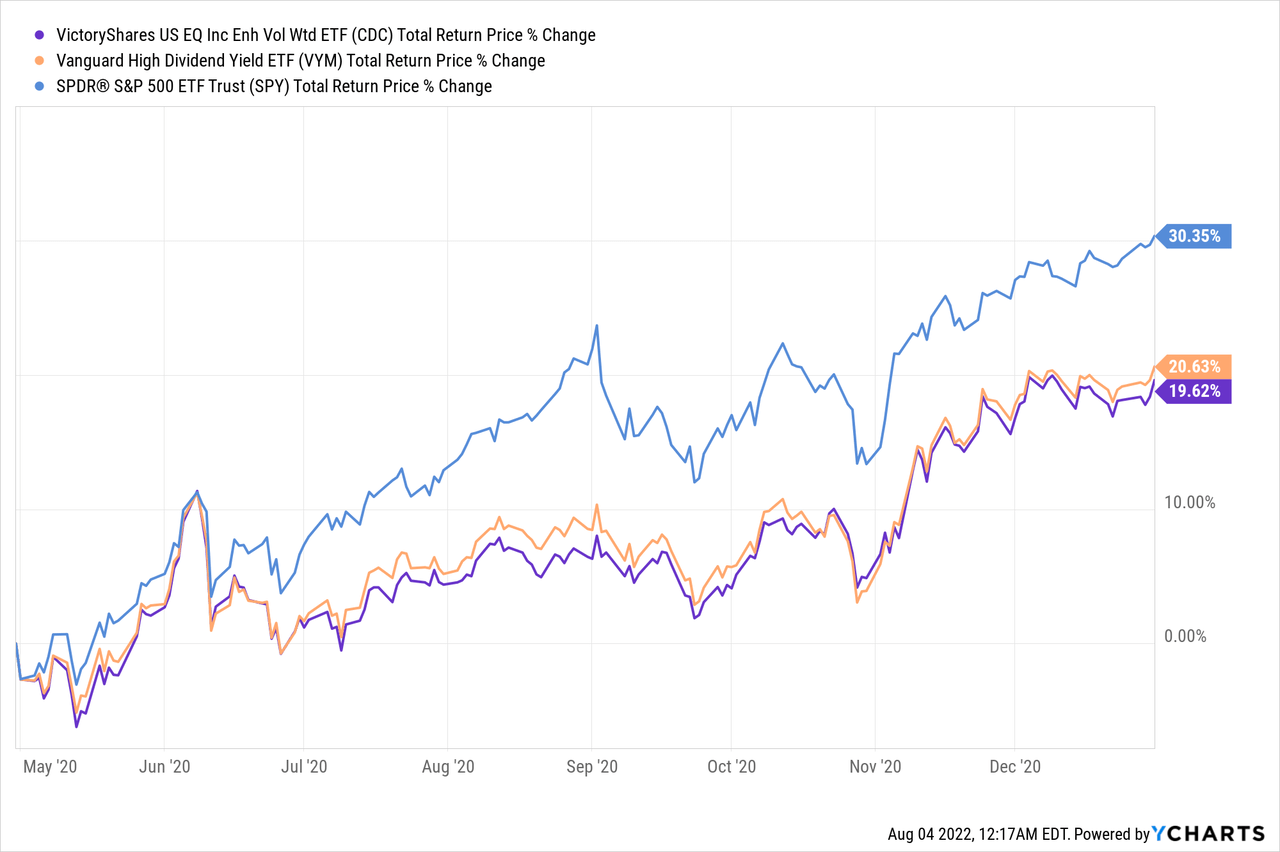

On the other hand, CDC’s strategy has mostly worked in the past. Looking at the fund’s performance during 2020, it seems that the fund sold a portion of its equities in March 2020, and went back to being fully invested in stocks in April 2020. The timing wasn’t perfect, but it was quite good, with the fund reducing losses by about 10% relative to similar funds, including the Vanguard High Dividend Yield ETF (VYM). CDC still underperformed relative to the S&P 500 during early 2020, due to a lower tech allocation, but the market timing strategy itself was effective.

CDC’s strategy is very sensitive to market conditions, including the timing of daily losses and gains. CDC’s performance could materially differ from the above if stock returns for a specific day change, and in ways which are not immediately obvious or easy to forecast.

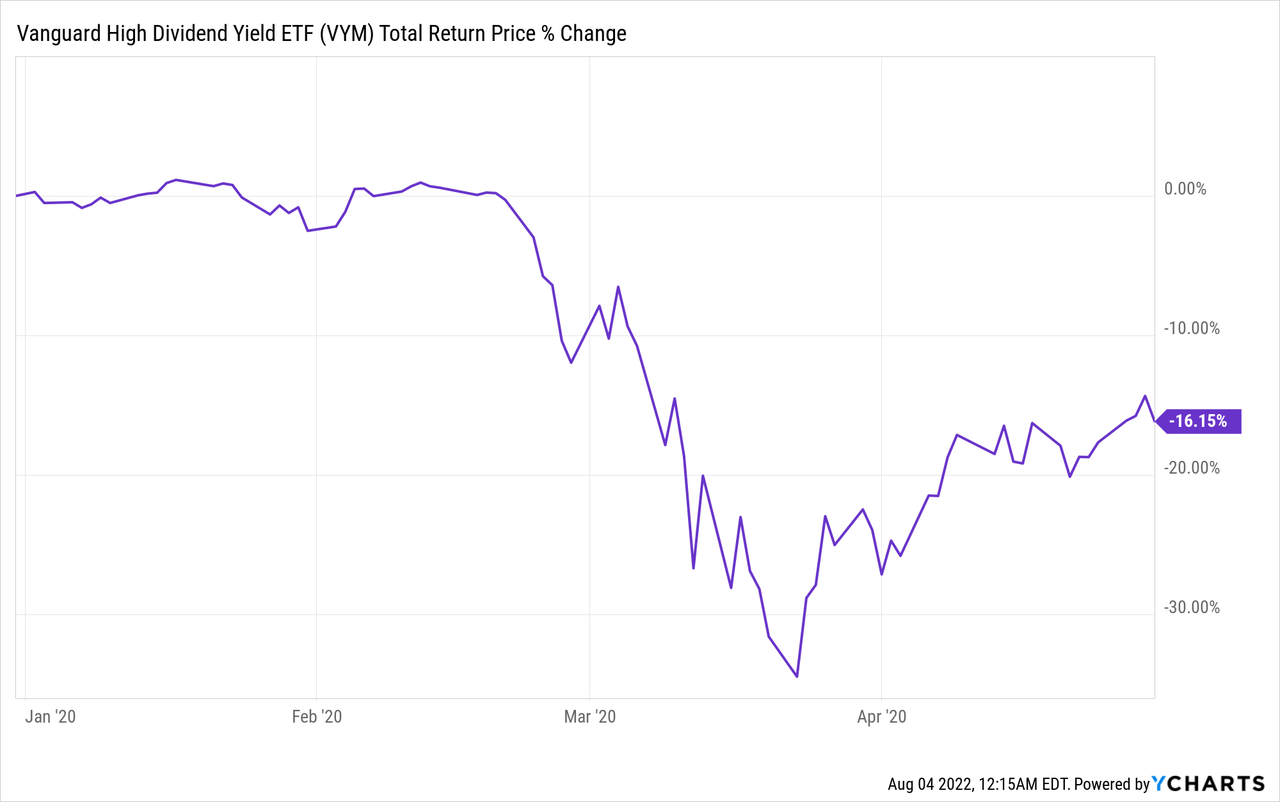

Let’s use April 2020 as an example. At the beginning of the month, the fund was invested in cash and equities. At the end of the month, the fund switched to 100% equities, as stock market losses exceeded 16%. From what I’ve seen, stock market losses barely exceeded 16%. VYM, which is very similar to CDC, suffered losses of 16.15% during said time period, barely above 16%.

If the stock market had recovered a tiny bit faster, CDC would have retained its significant cash holdings. Doing so would have led to a significant reduction in shareholder gains, as markets saw large gains after April. Looking at monthly performance information, it seems that CDC would have retained its cash holdings until November 2020, during which markets rallied by more than 20%.

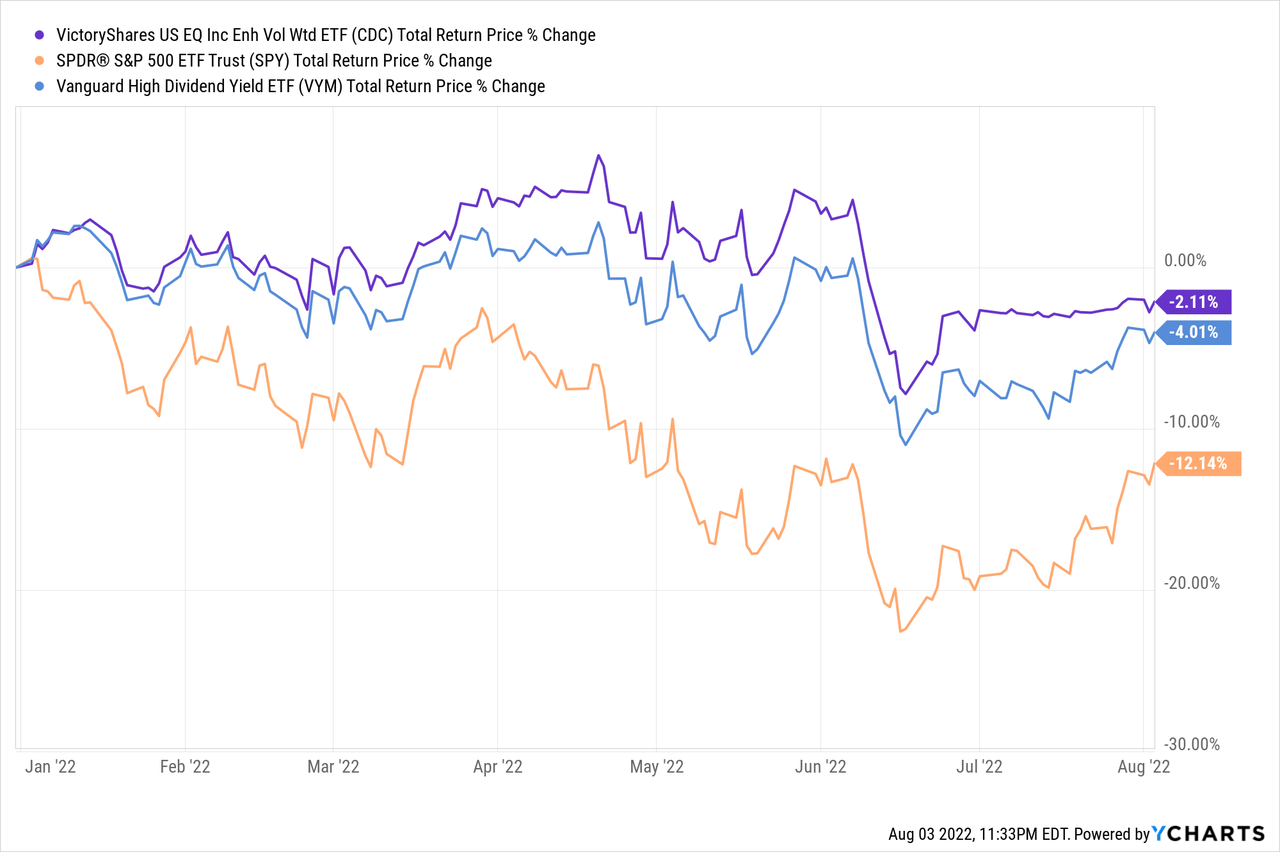

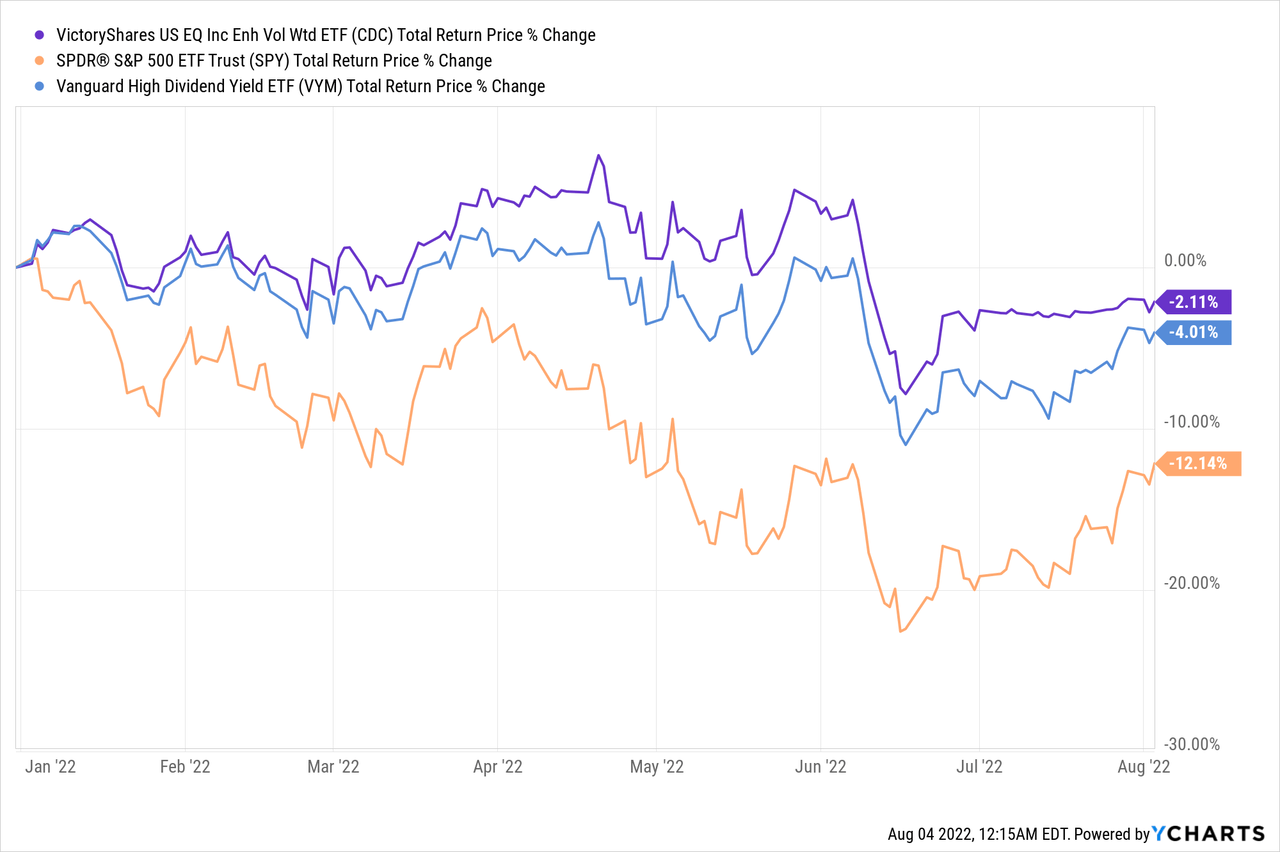

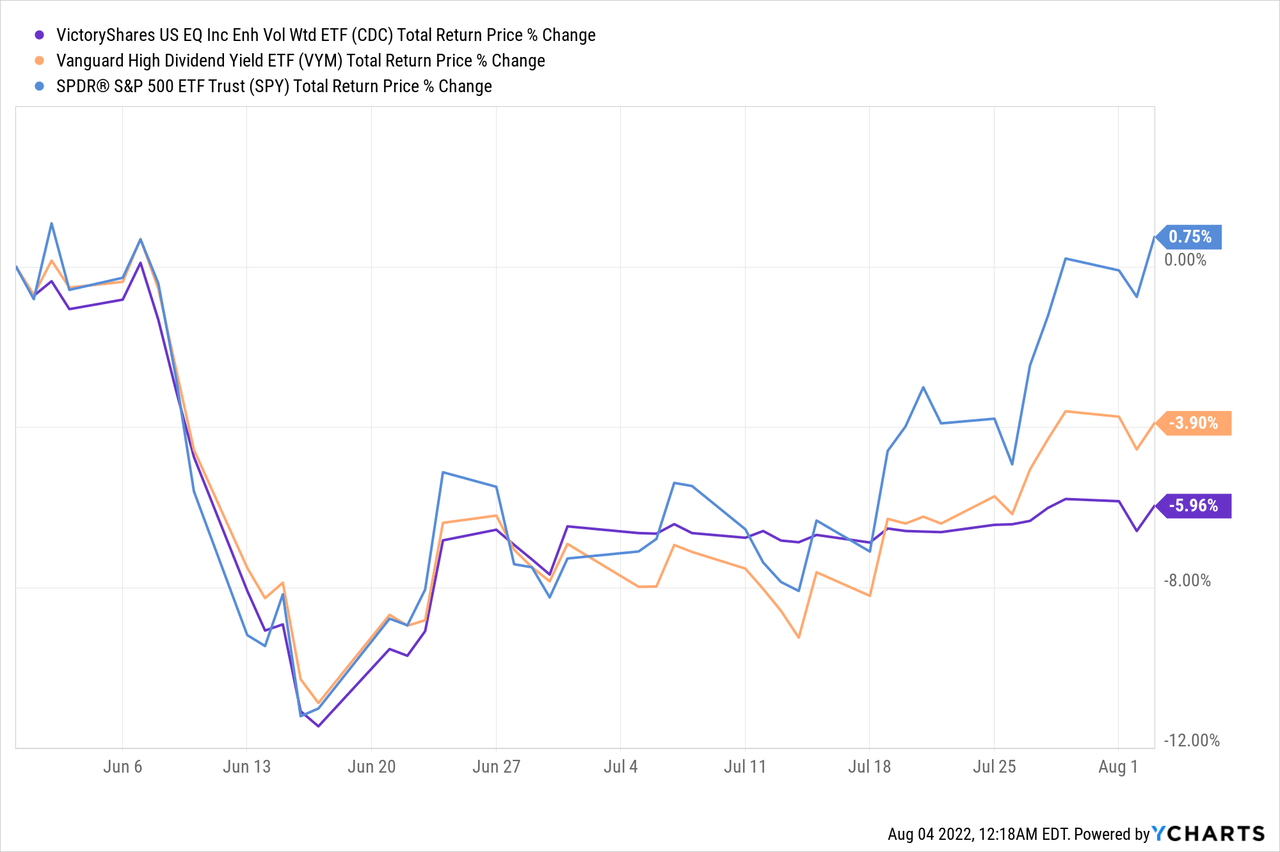

CDC’s strategy has also not been all that effective in the most recent (small) bear market. Stocks went down double-digits in June, during which the fund was fully invested in stocks. Said drop triggered a move towards in July, during which equities recovered. CDC had sizable cash holdings during said month, so did not fully participate in the recovery. CDC’s strategy does not always work, and I have no reason to believe that it will work in the future.

In my opinion, the issues above make for an ineffective investment strategy, and could result in significant losses for CDC and its shareholders. I do want to emphasize that this has not been the case in the past, but I do think that it could be the case moving forward.

Conclusion

CDC’s underlying index suffers from several negative issues, centered on attempting to time the market through a simple quantitative process. In my opinion and experience, these processes rarely work, at least consistently so. As such, I would not be investing in the fund at the present time.

[ad_2]

Source links Google News