[ad_1]

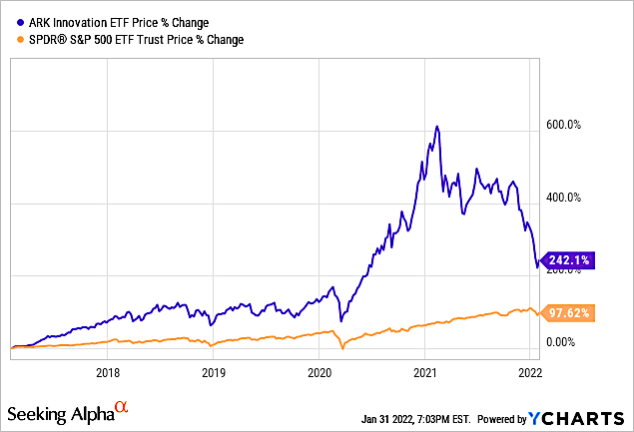

The rise and fall of ARK Innovation ETF (NYSEARCA:ARKK) is well known and documented. ARKK was created in 2014 as one of the first ETFs of ARK Investment Management LLC; founded by Cathie Wood in October 2014 after 12 years as an investment officer at AllianceBernstein. ARKK famously posted a 152% annual return in 2020.

According to Chart 1, since reaching a high of $156.58 on February 12, 2021, ARKK dropped 39.6%, closing at $94.59 on December 31, 2021. For all of 2021, the ETF was down 24.02%.

Year to date, ARKK was down another 27%, closing at $66.33 on January 28, 2022. From its high of $156.58, the stock was down nearly 57%. Since the close, ARKK has risen to close at $75.32, up 13.6% in two days. This current volatility may be a head-fake for ARKK, because similar stock increases have occurred during the continued downturn.

YCharts

Chart 1

During its famous heyday, ARKK rose and fell in tandem with COVID. The primary variant that drove COVID-19 transmission in the late Winter and Spring of 2021 was the Alpha variant. Alpha transmission subsided in the United States during the late Spring and early Summer of 2021.

The drop in Covid Alpha transmission was followed by relief by businesses and individuals that the lockdowns would soon end. Thus, purchases of tech products that benefited from Covid slowed significantly. This was reflected in quarterly earnings and guidance of the ARKK stock holdings.

When you look at the biggest winners in ARKK, they were overwhelmingly tech companies that help facilitate the stay-at-home economy, and can be viewed as Covid stocks.

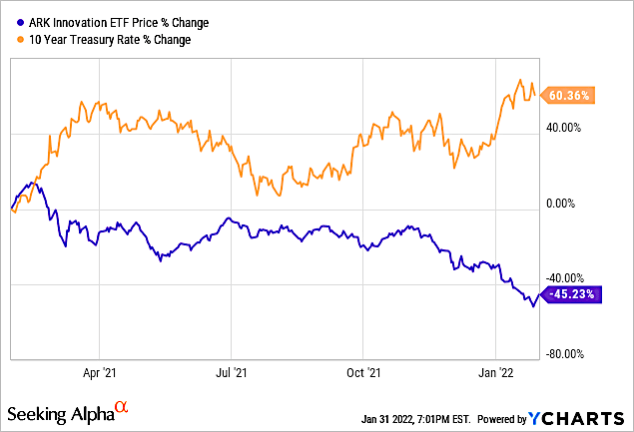

The Macro Factor

Attempting to explain the continued slide of the ETF is not as obvious. Chart 2 shows that ARKK’s Price % change is inversely proportional to the 10-Year Treasury Rate. What the U.S. Federal Reserve does in 2022 will impact the 10-Year Treasury, which could impact ARKK performance in 2022.

YCharts

Chart 2

ARKK was relatively flat between March and November 2021, but started sliding around the time the 10-year treasury started ramping up, so there is a correlation as seen in Chart 2.

However, it wasn’t only ARKK stocks, which are primarily technology stocks, that have been dropping. And that means that the issues impacting ARKK at this time are not exclusive to ARKK. Why? After a long stretch of technology stock outperformance, stretched valuations, coupled with rising interest rates and inflation fears have been three factors responsible for the sell-off.

Many technology stocks have been hit hard as the catalysts that had helped propel stocks higher last year have switched direction and are now headwinds to further growth. A wave of consumer demand fueled by the reopening of economies pumped up corporate profits more than expected in 2021. The Federal Reserve and other central banks also helped prop up the market by keeping interest rates extremely low, after underestimating the effect of the $1.9 trillion fiscal stimulus on the economy.

That is now changing. It isn’t surprising that Treasury yields are climbing on the quickest pace of inflation in four decades. But the selloff in bonds may not because of inflation fears but that investors are betting the Federal Reserve will control prices with tighter policy.

Analyzing ARKK’s Holdings

Table 1 shows the ARKK Top 15 holdings along with 5-year, 1-year, and 1-Month stock growth. Eight stocks were publicly traded five years ago, and the average 5-year growth is 711.48%, suggesting that these stocks and probably ARKK, can be considered long-term investments and should disregard short-term stock drops.

Table 1 also shows ARKK performance as well as the S&P Technology Select Sector Index (IXT).

The Information Network

Table 2 shows Financial Metrics for the first five ARKK Holdings. In my Semiconductor Deep Dive Marketplace newsletter, I detail all 15 holdings, not just the Top 5.

The Information Network

Tesla Motors (NASDAQ:TSLA)

Tesla had a 54% gain in stock price in 2021, the only holding in the Top 10 that had positive stock growth. It was the largest holding among all ARK Invest positions. At the beginning of 2020, TSLA made up 20.31% of ARKK holdings. Instead of buying more shares, Cathie Wood dropped its percentage of holding to just 7.74%.

Tesla just delivered stellar numbers for its fourth quarter, reporting a 71% surge in vehicle deliveries and 65% jump in YoY revenue. It was a record quarter, with Tesla’s operating profit margin almost tripling YoY to 14.7%. Tesla delivered a record number of 936,000 vehicles in 2021 despite the semiconductor chip supply crunch. With the gigafactory in Austin, Texas set to open soon, Tesla will have an opportunity to increase production to meet growing consumer EV demand.

Tesla has the expertise, resources, and money to convert its big plans into reality even as demand for EVs is expected to rise exponentially in the coming years. Combined, the two factors could prove to be the biggest growth drivers for Tesla’s stock price.

According to financial metrics supplied by Seeking Alpha in Table 2, YoY revenues for FY 2022 are expected to rise 50.2%. EPS of 10.4 is another good signal. PE ratio of 81.5x is higher than the S&P ratio of 24.5x.

TSLA has a Quant Ranking of 3 out of 28 in the Automobile Manufacturing industry and a Hold rating of 3.46.

Zoom Video Communications (ZM)

When the pandemic forced more people to work or attend classes remotely, its growth accelerated to breakneck levels in fiscal 2021. However, those tailwinds waned throughout fiscal 2022 as vaccination rates rose and more people physically returned to classrooms and offices.

Zoom also faces tougher competition in that slowing market. Microsoft’s Teams (NASDAQ:MSFT), which has largely replaced Skype, is becoming a growing threat to both Zoom and Salesforce’s (NYSE:CRM) Slack. Last quarter, Microsoft said 138 organizations had more than 100,000 Teams users, and more than 3,000 organizations. Personally I’ve used Zoom and Teams and like Zoom better for ease of use and features.

Zoom’s revenue grew 35% year over year to $1.05 billion, beating estimates by $30 million. Its adjusted net income increased 14% to $338.4 million, or $1.11 per share, which also beat analysts’ expectations by $0.01.

According to financial metrics supplied by Seeking Alpha, YoY revenues for FY 2022 are expected to rise 54%. EPS is just 4.87. PE Ratio (29.5x) is lower compared to the US Software industry average (40.8x).

ZM has a Quant Ranking of 104 out of 155 in the Application Software industry and a Hold rating of 2.70.

Teladoc (TDOC)

Teladoc was a first-mover in the industry and is now the world’s largest telehealth company. Importantly, Teladoc doesn’t just offer virtual primary care but also specializes in chronic disease management, an area it entered after its acquisition of Livongo in 2020. Expanding its reach, Teladoc is now partnering with large health plan carriers and recently struck a partnership with the National Labor Alliance of Health Care Coalitions, the largest alliance of labor unions.

Teladoc continues to post increases in revenue and patient visits. In the most recent quarter, revenue soared 81% and patient visits climbed 37% to more than 3.9 million. About 24% of Teladoc’s chronic care members now are enrolled in more than one program, up from 8% in the year-earlier period. Teladoc says whole person care represents a $75 billion opportunity within the company’s current client base. Teladoc estimates the U.S. total addressable market equals more than $261 billion.

According to financial metrics supplied by Seeking Alpha, YoY revenues for FY 2021 are expected to rise 85%, but EPS is a negative 2.93. PE Ratio is a negative 24.0 and is currently unprofitable and not forecast to become profitable over the next three years. There has also been significant insider selling over the past three months.

TDOC has a Quant Ranking of 17 out of 31 in the Health Care Technology industry and a Hold rating of 2.64.

Roku (ROKU)

Roku and its subsidiaries operate a TV streaming platform. The company operates in two segments, Platform and Player. Its platform allows users to discover and access various movies and TV episodes, as well as live sports, music, news, and others. During Covid shut downs and people were stuck at home, Roku benefited greatly.

The company’s fast-growing, high-margin platform segment, which includes subscription and advertising revenue, saw sales jump 82% in the most recent quarter. And the continued success of The Roku Channel, a big part of this segment, is what shareholders should be focusing on.

Consumers are increasingly turning to streaming services when it comes to video entertainment. While the streaming industry is close to maturity in the U.S., the rest of the world is still far behind. Roku’s ongoing penetration in Europe and Latin America should propel its business as the world continues transitioning from linear TV to streaming entertainment.

According to financial metrics supplied by Seeking Alpha, YoY revenues for FY 2021 are expected to rise 57%. EPS is just $1.57. PE Ratio (96.0x) is higher compared to the US Entertainment industry average (30.8x).

ROKU has a Quant Ranking of 23 out of 31 in the Movies and Entertainment industry and a Hold rating of 2.66.

Coinbase (COIN)

Coinbase is one of the largest cryptocurrency exchanges in the world. Coinbase generates nearly all of its revenue from cryptocurrency trades, and its growth is pegged to the market’s unpredictable interest in Bitcoin, Ethereum (ETH-USD), Dogecoin (DOGE-USD), and other major cryptocurrencies.

Over the past three months, cryptocurrencies have waned as rising inflation and interest rates caused investors to be cautious about speculative investments. Regulators are also closely monitoring the crypto market. In September 2021, the SEC forced Coinbase to cancel Lend, a planned feature that would have enabled its users to lend out their USD Coins (a stablecoin tethered to the U.S. dollar) for interest.

Coinbase is also gradually diversifying its business with subscriptions (for commission-free trades, prioritized customer support, and account protection for up to $1 million), an upcoming NFT marketplace, new blockchain-based reward programs, and other decentralized finance products. That expansion could diversify its revenue streams and lock in more users.

According to financial metrics supplied by Seeking Alpha, Coinbase’s revenue surged 144% to $1.28 billion in 2020, then soared 671% year over year to $5.34 billion in the first nine months of 2021. It generated a net profit of $322 million in 2020, and that figure jumped to $2.78 billion in the first nine months of 2021. EPS is $14.34, higher than any Top 5 ARKK holdings. PE Ratio is 12.4.

Investor Takeaway

Chart 3 shows the Stock Price % Change for the ARKK Holdings #1 to #5 and is compared to the stock price of the S&P Technology Select Sector for the 1-year period. There are two takeaways: (1) Holding #1, Tesla and IXT had the only positive stock growth and (2) Holdings #2 to #5 all were negative with stock price among them separated by only 15% at the close on January 30, 2022.

YCharts

Chart 3

Chart 4 shows the Stock Price % Change for ARKK Holdings #6 to #10 and is compared to the stock price of the S&P Technology Select Sector for the 1-year period. There are also two takeaways: (1) Holding #6, Unity Software, Holding #9, Intellia, and IXT had the only positive stock growth and (2) Holdings #7, #8, and #10 all were negative and stock price among them were separated by only 17% at the close on January 30, 2022.

Despite their positive stock performance at the close on January 30, both Intellia and Unity Software had significant price losses within the year. Intellia dropped 54% from a high of $177 on September 3. Unity Software stock decreased 52% from a high of $201 on November 18, 2021.

YCharts

Chart 4

Chart 5 shows the Stock Price % Change for ARKK Holdings #11 to 15 and is compared to the stock price of the S&P Technology Select Sector for the 1-year period. There are also two takeaways: (1) IXT had the only positive stock growth and (2) Holdings #11 to #15 all were negative but in this grouping stock price among them were separated by 50% at the close on January 30, 2022.

YCharts

Chart 5

Seeking Alpha’s current ETF Grades are shown in Chart 6. As I said above, ARKK was relatively flat between March and November 2021, and the ETF Grades were higher during that time. With the stock drop in the past three months, there has been a degradation in Momentum (from an A+ to F) and Dividends (from A+ to D-). Asset Flows are the only A Grade due to more than $1.3 billion in daily dollar volume.

Seeking Alpha

Chart 6

In the past three days, ARKK stock price is up 8.5% – rising 9.3% on Tuesday and falling 5.1% on Wednesday February 2, 2022. But remember that ARKK is a compilation of individual stocks, and on January 31, Unity Software was up 10.78%, Intellia Therapeutics was up 9.94%, Tesla was up 10.68%, Spotify was up 13.46%, Ulipath was up 9.24%, Twilio was up 9.5%, Block was up 10.79%, and Shopify was up 10.55%.

This raises an important question. Since seven of the Top 15 Holdings of ARKK beat the ETF growth of 9.30%, is it a better choice to buy the individual stocks and avoid the ARKK fees?

On a 1-year basis, ARKK stock is -45.33%. Comparing that stock performance with Holdings #1 to # 15 in Charts 3 to 5, ARKK outperformed only five of 15 stocks, as shown in Table 1. But also shown in Table 1 on the bottom row, the average stock performance is -34.49%, which is 10 points higher than ARKK,

On a 5-year basis, ARKK is up 210.75%. According to Table 1, the average holding of the eight stocks is up 711.48%. However, this average is skewed because of Tesla and Shopify. Of the eight stocks listed, ARKK outperformed zero stocks.

In fact, even the S&P Technology Select Sector Index outperformed ARKK. This underperformance of ARKK is a clear indication that long-term investors are better served by investing in an Index like IXT instead of ARKK. Stock performance is better, there is little volatility, and there are no high ARKK fees.

This strategy is for those investors who are comfortable with investing in an ETF as a basket of technology stocks with a fund manager to make decisions. Two viable alternatives to ARKK are VanEck Vectors Semiconductor ETF SMH (NASDAQ:SMH) up 21.5% for the year and Invesco QQQ ETF (NASDAQ:QQQ), up 15.42% for the year.

For those investors that are comfortable with individual “disruptive” stocks, that are the basis of ARKK, there are several to choose from based on metrics I’ve presented in this article. One stock that is a favorite of mine that is a play in the long term is Crispr.

[ad_2]

Source links Google News