[ad_1]

courtneyk/E+ via Getty Images

Thesis

Cambria Tail Risk ETF (BATS:TAIL) is a vehicle that aims to protect an investor’s portfolio from significant downside market risk. As per the ETF’s literature:

The Fund intends to invest in a portfolio of “out of the money” put options purchased on the U.S. stock market. TAIL strategy offers the potential advantage of buying more puts when volatility is low and fewer puts when volatility is high. While a portion of the fund’s assets will be invested in the basket of long put option premiums, the majority of fund assets will be invested in intermediate term US Treasuries. As the fund is designed to be a hedge against market declines and rising volatility, Cambria expects the fund to produce negative returns in most years with rising markets or declining volatility.

The aim of the fund’s manager is to protect an investor’s portfolio during times of market declines and rising volatility. The stated aim should translate into a higher price for TAIL during times when the S&P 500 (SPY) declines or experiences higher than normal volatility. The ETF tries to achieve this goal by holding a portfolio of intermediate duration treasuries and puts on the S&P 500.

With a significant negative performance in 2022, TAIL fails to achieve its goals, and moreover adds volatility and negative returns to an investor’s portfolio during a rising rates environment. When digging into the fund’s composition and holdings an analyst actually finds out that the amount of S&P 500 put options is limited, TAIL essentially being a long treasuries fund. The fund managers admit as much in the annual report:

We believe that a suitable benchmark for TAIL is the Bloomberg Barclays Short Treasury Index (“Short Treasury”). TAIL is not an aggressive hedging strategy, and as such, an index of short‐term Treasuries which approximates a conservative money‐market fund is a suitable benchmark. Short Treasury tracks the market for treasury bills issued by the US government. The table below shows the performance of the Fund (NAV) vs. Short Treasury for the three‐month, 12‐month and since inception periods ended April 30, 2021

Being essentially a long intermediate treasuries fund (~90% treasuries, ~10% S&P 500 puts), TAIL does not represent a hedge in a rising interest rate environment. Rising rates produce lower treasuries prices and a lower NAV for TAIL. The ETF is down more than -5% in 2022 and has failed to deliver a positive result to mitigate the substantial losses in the equities markets. Moreover, given its structure, the fund bleeds carry in the long term when the cash spent for put options is not recouped when said options expire without being triggered.

We fail to see value in TAIL during a rising interest rates environment since it will always produce negative results. Moreover, we fail to see why an investor would want to hold TAIL long term since due to its structure it is NOT a buy and hold vehicle (it will always produce negative results on holding periods of 3+ years). We would much rather see a retail investor use traditional long treasury ETFs such as the iShares 7-10 Year Treasury Bond ETF (IEF) and the iShares 3-7 Year Treasury Bond ETF (IEI) combined with individual choices on S&P 500 put options (or just hold cash outright for that matter) rather than purchasing a fund which is only to be used via an active strategy (TAIL is not a buy and hold hedging tool). We therefore rate TAIL as a Sell and feel there are more appropriate portfolio construction tools to be used to hedge an investor’s portfolio, tools that directly address individual risk factors and provide an actual hedge (i.e., a positive result when the rest of the portfolio is losing value).

Holdings

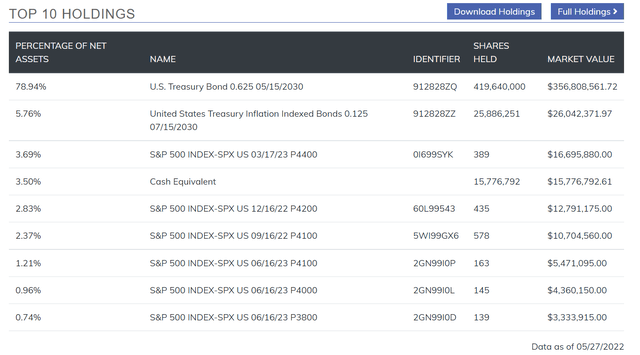

The fund holds a mix of treasuries and S&P 500 put options:

Top Holdings (Fund Fact Sheet)

The treasuries component is split between regular bonds and inflation protected treasuries (i.e., TIPS). We can see from the holdings report that the amount of S&P 500 put options is actually very small, accounting for only 7.3% of the portfolio.

On the fund’s website we can actually find the exact bond split for the underlying portfolio:

Top 10 Holdings (Fund Website)

Surprisingly, the vehicle holds only one regular treasury issuance, namely an 8-year maturity treasury, the 0.625% 5/15/2030 bond. On the TIPS side the story is similar with only one bond held. In terms of put options the fund holds a ladder, with strikes that are 3% to 8% out of the money.

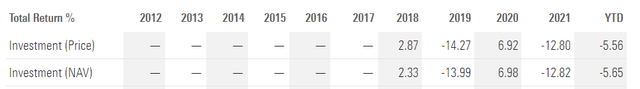

Performance

For a fund that is supposed to provide a downside hedge, TAIL has had an abysmal performance in 2022:

YTD Performance (Seeking Alpha)

The fund is down more than -5% in 2022, with the S&P 500 down more than -12% at the time of writing this article. TAIL is supposed to provide a POSITIVE return when the S&P 500 is down. It has not. The reason for this performance is the fund’s composition, which is overweight treasuries. When rates rise treasuries fall in value and TAIL falls in value as well. We would be looking for a composition that exhibits a 50/50 split between treasuries and puts in order to get the performance needed to move the fund to positive territory for 2022.

Since inception the fund has lost a significant amount:

Performance since Inception (Seeking Alpha)

Fully expect TAIL to have a negative performance in the long term due to the premiums it pays on the underlying put options. If the strikes are not triggered the cash that goes out the door to pay the premiums is lost. Hence by design the fund is going to bleed carry. The fund itself highlights this structuring issue:

Cambria expects the fund to produce negative returns in most years with rising markets or declining volatility.

From an annual performance standpoint, we can note that in the years with normalized treasury yields TAIL did produce a positive result when the equity markets sold off:

Annual Returns (Morningstar)

We can see that TAIL produced positive results in 2018 and 2020, which were years when we had violent equity sell-offs. The reason behind this positive performance lies in the starting yield environment – yields were normalized on treasury securities, and when the equity market sold-off yields declined, and treasury prices rose. 2022 has been very different, with yields rising on the back of a very aggressive Fed, and the equity market collapsing on the back of high valuations driven by a low interest rate environment. TAIL does not work in a rising interest rate environment.

Conclusion

Cambria Tail Risk ETF is supposed to represent a portfolio hedge when equity markets sell off. The ETF has failed to deliver on its aim in 2022 due to its structure. The fund is essentially a long treasuries fund with less than 10% of the portfolio composed of S&P 500 put options. When rates rise TAIL loses value, with the put options not being able to provide enough positive profit due to their small proportion in the portfolio. Long term TAIL will always lose value due to the premium it pays on un-exercised options, hence it is not a buy and hold vehicle. We therefore rate TAIL as a Sell and feel there are more appropriate portfolio construction tools to be used to hedge an investor’s portfolio, tools that directly address individual risk factors and provide an actual hedge (i.e., a positive result when the rest of the portfolio is losing value).

[ad_2]

Source links Google News