[ad_1]

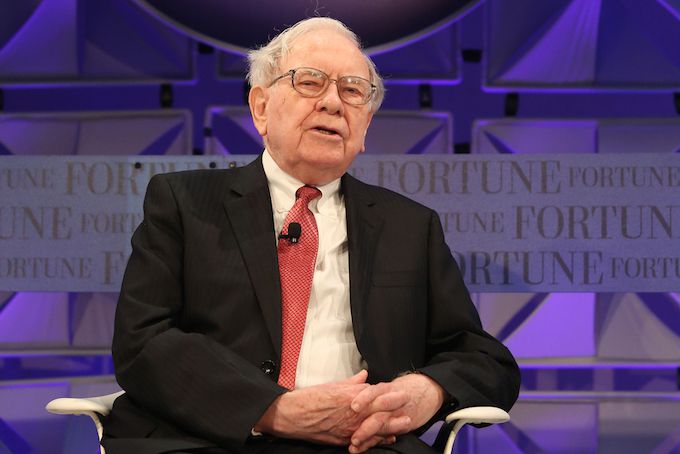

Under CEO Warren Buffett, Berkshire Hathaway Inc. (BRK.A) has been betting heavily on financial stocks, which now represent about 20% of its roughly $481 billion market capitalization as of Aug. 14, 2019, up from about 12% at the end of 2010, The Wall Street Journal reports. Given that banks are widely viewed as a proxy for the U.S. economy as a whole, this indicates to some observers that Buffett is rather more optimistic about growth potential in the U.S. than other analysts who anticipate either a slowdown or a recessionary contraction.

The market values of Berkshire’s 8 biggest positions in financial stocks as of the close on Aug. 14 were, per calculations by CNBC: Bank of America Corp. (BAC), $25 billion, American Express Co. (AXP), $19 billon, Wells Fargo & Co. (WFC), $18 billion, U.S. Bancorp (USB), $6.7 billion, JPMorgan Chase & Co. (JPM), $6.2 billion, Goldman Sachs Group Inc. (GS), $3.6 billion, Bank of New York Mellon Corp. (BK), $3.4 billion, and credit rating agency Moody’s Corp. (MCO), $5.1 billion.

Significance for Investors

The 8 stocks above account for $87 billion out of the $93.5 billion that Berkshire has bet on the financial sector, based on Aug 14 closing prices. Add in payments processors Mastercard Inc. (MA) and Visa Inc. (V), both officially classified as information technology stocks, and the total investment in financials rises to $96.5 billion. CNBC bases its calculations on Berkshire’s holdings as of June 30, per its SEC Form 13F filing on Aug.14. The exception is Bank of America, the data for which is as of July 17.

Berkshire has been a notable market laggard in recent years, and its share price was down by 3.6% year-to-date through the close on Aug. 14, during which time period the S&P 500 Index (SPX) rose by 13.3%. The S&P 500 Financial Sector Index also has underperformed, but was up by 8.8% YTD, per S&P Dow Jones Indices.

For the month-to-date through Aug. 14, the S&P 500 Financial Sector has dropped by 8.2% and the KBW Nasdaq Bank Index (KBX) has plunged by 12.1%, while the full S&P 500 has slid by 4.7%. Among the factors contributing to the recent pullback in financials have been falling interest rates, rising worries about a worldwide economic slowdown, and political unrest in Hong Kong, a major financial center, per another Journal report.

Another attraction for Buffett is that financial stocks, banks in particular, are paying above-average and rising dividends. This, in turn, supplies more cash for him possibly to deploy on new acquisitions and investments, the Journal observes. Among the 8 stocks listed above, the biggest winners for Buffett YTD through Aug. 13 have been Moody’s and American Express, with total returns, dividends included, of 53% and 34%, respectively, per FactSet.

In July, Berkshire raised its stake in Bank of America to more than 10%, per the Journal. For the other 7 financial stocks listed above, Berkshire’s ownership interests were, as of June 30 per CNBC: American Express, 18%, Moody’s, 13%, Wells Fargo, 9%, Bank of New York Mellon, 9%, U.S. Bancorp, 8%, Goldman Sachs, 5%, and JPMorgan Chase, 2%.

Looking Ahead

Buffett is notable for taking a very long term view in making his investment choices. In February, he told CNBC that financial companies are “very good investments at sensible prices, based on my thinking,” per the Journal. He added, “And they’re cheaper than other businesses that are also good businesses, by some margin.” He also noted that the 2017 federal tax reform bill was favorable to banks, and that some large banks continue to generate large returns, despite the fact that low interest rates tend to constrain their profit margins.

[ad_2]

Source link Google News