[ad_1]

Investment Thesis

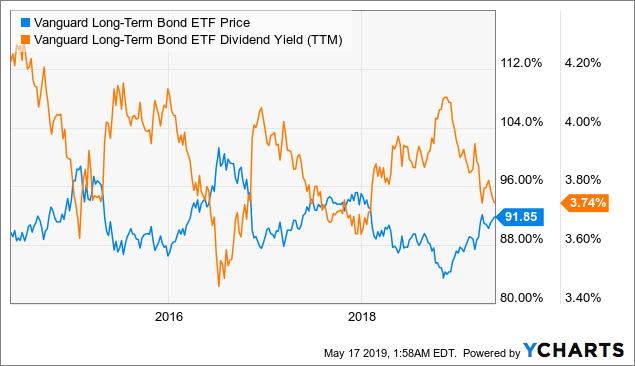

Vanguard Long-Term Bond ETF (BLV) focuses on long-term investment-grade bonds in the United States. The ETF tracks the Bloomberg Barclays U.S. Long Government/Credit Float Adjusted Index. BLV has very low credit risk as all of the bonds in its portfolio are investment-grade bonds. Hence, it offers investors good protection in an economic downturn. Unfortunately, the fund has a much higher interest rate risk due to the fact that its portfolio of bonds has a very long average duration to maturity. The ETF offers a safe 3.7%-yielding dividend as it only invests in investment-grade bonds. It is a good investment choice for investors seeking safety in an economic downturn.

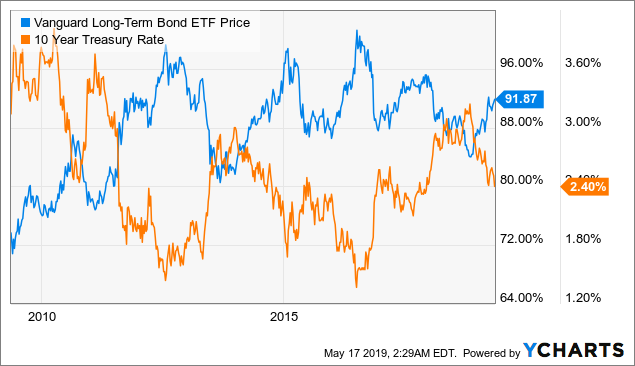

Data by YCharts

Fund Holdings

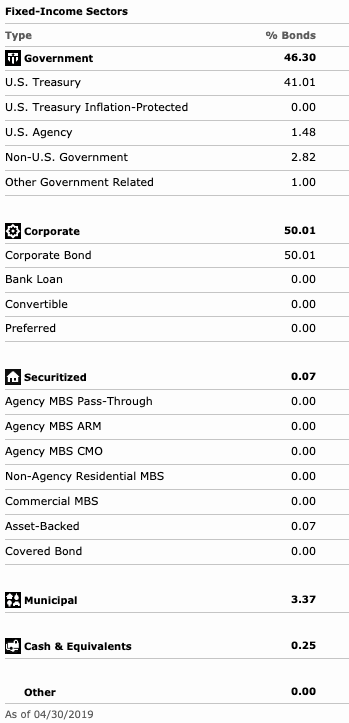

As the chart below shows, government bonds and corporate bonds represent about 46.3% and 50.0% of BLV’s total portfolio respectively. We like the portfolio mix as it is pretty much equally split between the government and corporate bonds and not overly tilt towards one over the other.

Source: Morningstar

Fund Analysis

Low credit risk

BLV only hold investment-grade bonds. We like this strategy as investment-grade bonds have much lower average default rate than high-yield bonds. In fact, investment-grade bonds’ default rate is only about 0.10% per year (based on the 32-year period measured). On the other hand, the default rate for below-investment-grade bonds was 4.22% per year. This is the major reason why BLV can perform well in a market downturn.

High interest rate risk

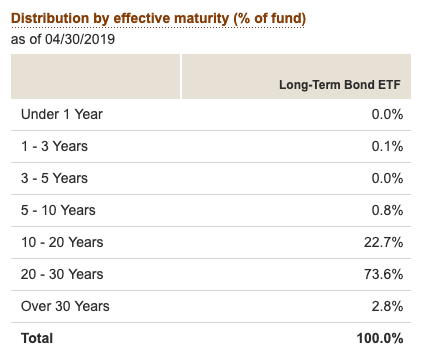

Most of BLV’s bonds are long-term bonds. As can be seen from the table below, 22.7% of its portfolio of bonds will mature about 10-20 years from now. About 73.6% of its portfolio of bonds will mature about 20-30 years from now. The average duration to maturity is about 15 years.

Source: The Vanguard Group

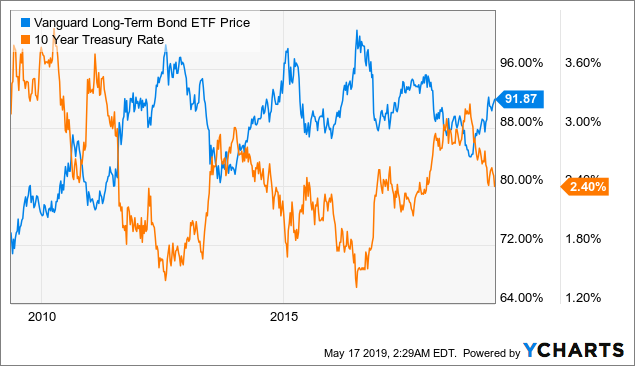

The long average maturity term means that the fund performance can be quite sensitive to interest rate. As can be seen from the chart below, BLV’s fund performance is inversely correlated to the treasury yield.

Data by YCharts

Very low management expense ratio

BLV has a very low management expense ratio of 0.07%. This MER is lower than 90% of its category peers. Other funds such as PIMCO Long-Term Credit Bond (PTCIX) charges a higher 0.55% expense ratio.

A safe 3.7%-yielding dividend

BLV investors will receive dividends with an annualized yield of about 3.7% on a trailing 12-month basis. This dividend is safe as these bonds are investment-grade bonds with very low average default rate.

Data by YCharts

Macroeconomic Analysis

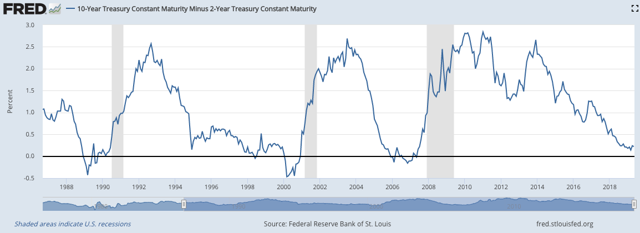

The current economic cycle has been well into its 10th year. Nevertheless, there are already many signs that we are already in the late cycle environment. For example, the Treasury yield spread (10-year minus 2-year) is now near the point of inversion (see chart below). As can be seen from the chart below, economic recessions often precede with yield inversions (when the 10-year yield minus 2-year yield falls below 0%).

Source: Federal Reserve Bank of St. Louis

Besides yield inversion, we are also seeing signs of investors rotating from riskier assets (e.g., energy, industrial, etc.) towards defensive sectors (e.g. telecom, utilities, REITs, etc.). This equity rotation is often a sign of a late-cycle environment. Since BLV holds only investment-grade bonds, it is considered a defensive fund. Therefore, its fund price has benefited from this rotation from riskier assets to defensive sectors. In fact, its fund price has appreciated by about 5% since the beginning of this year.

We think investors can continue to hold on to BLV in an economic downturn. In fact, the fund performed quite well in the last recession and actually resulted in a gain of 8.7% during that time period. In other time periods, the fund also offers investors a good. Even in another time period, BLV offers investors good decent returns. As the table below shows, its annualized return in the past decade was about 7.09%.

Source: ETF.COM

While this fund has performed quite well in an economic recession and lower interest rate environment, investors should keep in mind that rising interest rates can often result in a depreciation of its fund price as its fund performance inversely correlates with the treasury yield.

Investor Takeaway

We think BLV is a good ETF to be included in one’s portfolio as it provides downside risk protection especially during an economic recession. In addition, it provides a safe 3.7%-yielding dividend. Since we are already in the late stage of the current economic cycle, we think investors may want to increase its exposure to long-term investment-grade bond ETFs such as BLV.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.

[ad_2]

Source link Google News