[ad_1]

Klaus Vedfelt

By Rob Isbitts

Summary

The Vanguard Intermediate-Term Bond ETF (NYSEARCA:BIV) is essentially one of Vanguard’s main efforts to grab market share from another bond ETF behemoth, iShares Core US Aggregate Bond ETF (AGG). BIV is a straightforward fund that should give straightforward, bond-market-index-tracking results. That is, unless the long-brewing risk factor involving BBB bonds goes from risk to reality. Specifically, there are likely a lot of BBB bonds that should be rated lower. If that downgrade cycle hits, funds like BIV suddenly become more risky than investors likely think. We rate BIV a Sell, as we are adamant that credit risk is still a factor in today’s bond market.

Strategy

BIV aims to track the Bloomberg U.S. 5-10 Year Government/Credit Float Adjusted Index. According to the prospectus, “this index includes all medium and larger issues of U.S. government, investment-grade corporate and investment-grade international dollar-denominated bonds that have maturities between 5 and 10 years and are publicly issued.” That casts a very wide net across this particular maturity segment of the bond market, both in the Treasury and Corporate sectors.

Proprietary ETF Grades

-

Offense/Defense: Defense

-

Segment: Bonds

-

Sub-Segment: Diversified

-

Correlation (vs. S&P 500): Low

-

Expected Volatility (vs. S&P 500): Low

Holding Analysis

A more detailed look at the holdings shows a roughly even split between bonds maturing in 5-7 years, and those maturing in 7-10 years. About 60% of the fund is in Treasuries, with the remainder in Corporate bonds. That corporate allocation is a mix of AA, A and BBB-rated bonds, with A(16% of the total fund) and BBB (21%) making up most of it.

Strengths

BIV is the type of fund that in normal times, you can make it a core part of your bond exposure, and move on to other things. It is like AGG in that respect. It is large, quite liquid and has Vanguard behind it. That checks some nice boxes.

Weaknesses

However, these are not normal times. 2022 has ended what began a few years ago: a 40-year bond bull market. The knee-jerk reaction from many on Wall Street is that a brief respite occurred in 2022, and soon the bond market will go back to its old ways. That is, as a diversifier to stock portfolios, with little drama involved. We are not so sure. So, it’s the broader concerns we have about the bond market, in particular corporate bonds and the general direction of interest rates, that give us pause with many bond funds.

Opportunities

There will be an opportunity for ETFs like BIV. We are just not rushing to that. There are many other bond funds, mostly shorter-term and Treasury-focused ETFs, that we favor for the foreseeable future. Tactical moves will be available, but unless you plan to trade your way through this difficult and suspicious bond market, we are not enamored with BIV in the near future.

Threats

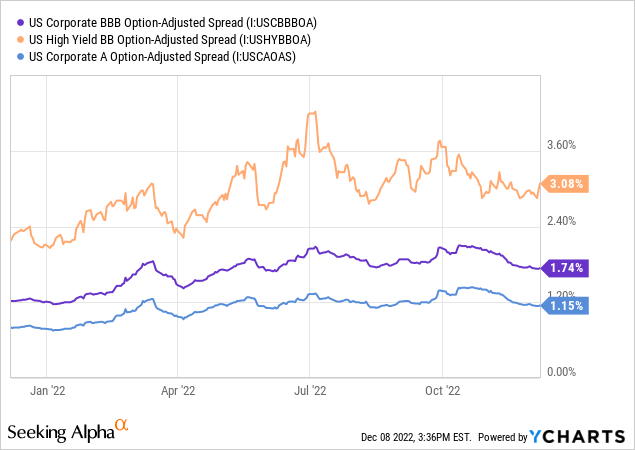

The crux our outlook and current view on BIV and ETFs like it (including AGG) are that while medium-term U.S. Treasuries are way down in price and may have near-term bounce potential, the outlook beyond that is opaque. Moreover, as the chart above shows, spreads of BBB bonds to Treasuries have not really “blown out” the way we’d hope to see in order to get more positive credit bonds (non-Treasuries). BBB bonds are one step above junk, and BIV has enough of them to concern us. The thing about the BBB market is that it is, our estimation, an accident waiting to happen. The Fed supported this market, and there are many BBB-rated corporations that probably should be junk status. If there is a wave of downgrades, that has potentially chaotic effects on any ETF that, like BIV, tracks an index that requires a slug of BBB bonds. A lot of money will be changing hands, in a market that is not liquid enough to handle that, as it might have been years ago.

Proprietary Technical Ratings

-

Short-Term Rating (next 3 months): Sell

-

Long-Term Rating (next 12 months): Sell

Conclusions

ETF Quality Opinion

Vanguard, a big asset base, and a generally high-quality-tilted bond ETF make BIV fine in terms of what we consider a quality ETF product. But that doesn’t mean we want to consider owning it anytime soon.

ETF Investment Opinion

Bottom line: there’s an argument one can make for BB (junk) as an improving reward/risk situation, and Treasuries are OK from a credit standpoint (at least, we’d better hope so!). But BBB exposure like BIV has: we say no thanks. That, plus our concerns stated above about bonds not being out of the woods yet, lead us to a Sell rating on BIV.

[ad_2]

Source links Google News