[ad_1]

Leon Neal/Getty Images News

Warren Buffett warned that Bitcoin and cryptocurrencies were financial “rat poison squared.” Jamie Dimon called cryptos “decentralized Ponzi schemes,” comparing the crypto speculation with The Netherlands’ tulip bulb mania in the 1600s. Warren Buffett’s partner Charlie Munger went even further, saying Bitcoin is “disgusting and contrary to the interests of civilization.”

Meanwhile, several high-profile business icons, including Elon Musk, Mark Cuban, and Square’s Jack Dorsey embraced cryptos, putting their money where their comments have been and investing in Bitcoin and a host of cryptocurrencies. Some pro athletes, including legendary quarterback Aaron Rogers, Odell Beckham Jr., and others have insisted on Bitcoin or other cryptos for part of their massive salaries. Even the GOAT Tom Brady and his ex-wife supermodel Gisele Bundchen made equity investments in a leading cryptocurrency platform, the now notorious FTX. Many others followed these celebrities into the crypto arena.

The risk always is a function of the reward. In 2010, a $100 investment in Bitcoin at five cents per token was worth $137.8 million when the crypto reached its peak of $68,906.48 in November 2022. At the $16,950 level on Nov. 15, it was still worth a cool $33.9 million. However, most investors and market participants involved in crypto are looking down at prices at current levels and wondering if they will suffer the same fate as the crypto guru.

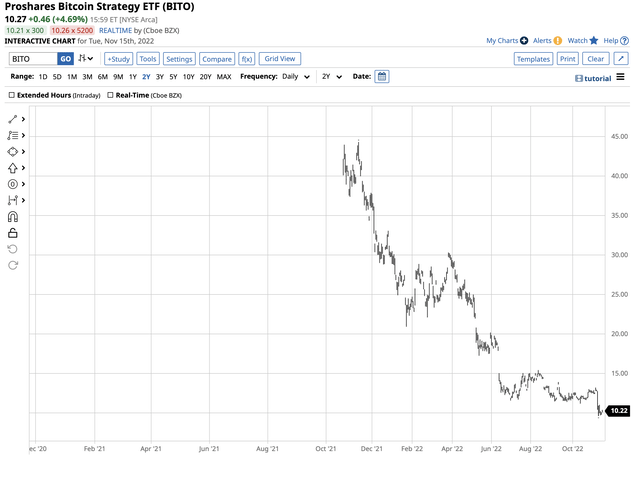

The ProShares Bitcoin Strategy ETF (NYSEARCA:BITO) is a relatively new product that came to market only days before the leading cryptocurrency peaked.

SBF watches $16 billion evaporate in the blink of an eye

Sam Bankman Fried, aka SBF, is the founder and was CEO of FTX, a leading cryptocurrency exchange. He’s also the founder of Alameda Research, a cryptocurrency trading firm. SBF reached guru status as his wealth grew to over $16 billion. With a young group of crypto entrepreneurs in the Bahamas, SBF ran into a liquidity crisis at the trading company as prices declined. Allegations of transfers from the exchange to the research firm caused the $16 billion fortune to evaporate in the blink of an eye.

Michael Lewis is an iconic American author, writing modern-day classics like Liar’s Poker, The Blindside, Moneyball, The Big Short, and many other best sellers, most of which had a financial plot. Ironically, Mr. Lewis recently spent six months embedded with SBF working on his next best-selling novel. Timing is everything as publishers and movie studios are now competing for his latest work. Michael Lewis’ timing is impeccable, considering the SBF story could be his most significant money-maker.

The crypto guru

Sam Bankman Fried is a 30-year-old who became the king of the cryptocurrency world. He graduated from the Massachusetts Institute of Technology in 2014. SBF began his career at Jane Street, a proprietary trading firm. In 2017, he left and founded Alameda Research, a cryptocurrency quantitative trading company. In 2019, he founded FTX, a cryptocurrency exchange that became the premier firm, attracting capital from well-capitalized investors to celebrities. SBF was a guru whose net worth rose to over $26 billion. Even after cryptos declined from the November 2021 highs, SBF still had a $16 billion fortune in early November 2022. The well-publicized liquidity problems at FTX and capital transfers to his Alameda trading company have decimated his fortune. US regulators are investigating the companies with management in the Bahamas. To add insult to injury for FTX customers, the company experienced a significant hack during the downfall, causing the loss of many cryptos.

The crypto ideology shuns government intervention, and the regulators were sleeping

Gary Gensler is the SEC Chairman and the former CFTC chairman who was the first regulator to approve futures trading in Bitcoin in late 2017. Ironically, Chairman Gensler taught a fintech course at MIT, where SBF studied, during his hiatus from the CFTC before President Biden nominated him as the chairman of the SEC. Moreover, while SBF was the founder, Alameda’s CEO, Caroline Ellison’s parents are MIT economists.

The SEC and regulators in Washington have been studying the regulation of the cryptocurrency asset class over the past years. Crypto devotees applauded Chairman Gensler’s appointment as they believed it would usher in an era of intelligent regulation of the burgeoning asset class. However, the wheels of the Washington bureaucracy have moved at a glacial pace. In 2021, Sen. Elizabeth Warren warned of systemic risks if cryptocurrencies or one of the leading firms imploded as more investors added Bitcoin and the other over 21,700 tokens to portfolios.

The ultimate irony is that cryptocurrencies operate under a libertarian ideology that shuns regulation and embraces a global approach to money. While governments control the money supply, crypto supplies are a function of their construction, and prices are determined by transparent bids and offers in the marketplace.

Despite Sen. Warren’s warnings and the concerns of other legislators in Washington, DC, and Europe, the regulators were asleep at the wheel when FTX came tumbling down.

Cryptos have experienced a significant correction over the past year as even the greatest bull markets do not move in straight lines.

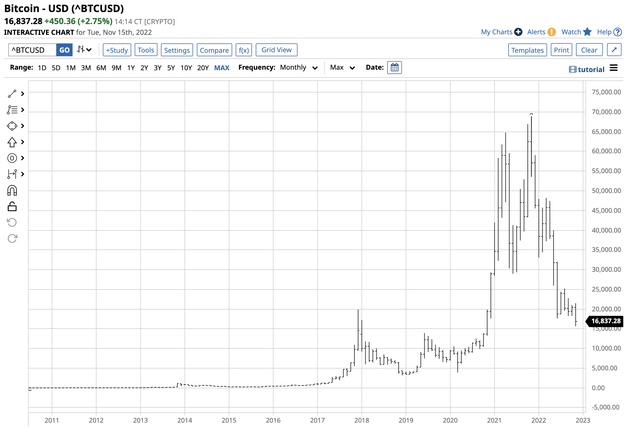

Long-term Bitcoin Chart (Barchart)

The chart highlights the volatile nature of the leading cryptocurrency, Bitcoin, and the over 21,700 others that follow the leader.

In 2014, a hack and scandal at Japanese crypto platform Mount Gox sent Bitcoin from $1,135.45 per token to below $175 in early 2015, an 84.8% decline as it shook confidence in the asset class. As the chart shows, Bitcoin fell from $19,862 in December 2017 to a low of $3,158.10 in December 2018, an 84% correction. The most recent selloff took the leading crypto from $68,906.48 in November 2021 to $15,613.01 this month, a 77.3% drop. The most recent decline came as the FTX scandal was unfolding. The bottom line is explosive, and implosive price moves are nothing new for cryptocurrencies. However, any systemic impacts of the FTX debacle may push Bitcoin and the asset class’s market cap lower. In November 2021, the asset class rose to over $3 trillion and was below the $850 billion level on Nov. 15, 2022.

Blockchain and cryptos – A chicken and egg dilemma

In a 2008 white paper, the elusive Satoshi Nakamoto created blockchain as the publicly-distributed ledger for Bitcoin and cryptocurrency transactions. Blockchain is an advanced database mechanism that allows transparent information sharing within a business network. Blockchain is a financial, technological innovation that creates databases that store data in blocks linked together in a chain. Blockchain improves the efficiency and speed of settling transactions, warranting an embrace from the financial sector.

Satoshi Nakamoto launched the crypto market, which became a speculative frenzy over the past few years. Detractors believe cryptos have no intrinsic value because they have no backing and compare cryptos to tulip bulb mania that gripped the Netherlands from 1634-1637. Supporters argue that fiat currencies that depend on the full faith and credit of the governments issuing legal tender also have no intrinsic value, and confidence in governments is declining. In the wake of the FTX collapse, the detractors’ voices will rise. On Nov. 15, the never-shy Charlie Munger said, “This is a very bad thing. There are people who think they’ve got to be on every deal that’s hot. I think that’s totally crazy. They don’t care whether it’s prostitution or Bitcoin. You are seeing a lot of delusion. Partly fraud and partly delusion. That’s a bad combination. Good ideas, carried to wretched excess, become bad ideas. Nobody’s gonna say I got some s$%& to sell you. They say—it’s blockchain!”

Blockchain and cryptocurrencies are the modern-day chicken-and-egg dilemma. After FTX’s collapse and the mounting losses that have wreaked havoc with the crypto asset class, the egg and chicken may decouple over the coming weeks and months.

BITO- A lotto ticket as the risk is a function of the potential reward

Time will tell if the FTX situation will spell the end of the crypto asset class or if it will be another Mount Gox-type opportunity that leads to higher highs for Bitcoin and other tokens. Anyone surprised by the current volatility is delusional based on past performance. Most of the future debate surrounding SBF and his posse will be if they were ethically delusional or worse.

When considering an investment in any crypto, the advice I have suggested over the past years remains the same. Only invest capital you are willing to lose, as the potential for huge rewards comes with enormous risks. SBF watched a $16 billion fortune turn into dust in the blink of an eye. Need I say more?

Charlie Munger believes that any brave souls looking for crypto exposure are delusional. Still, the price history suggests another explosive move could be on the horizon after the current implosion ends. The fund summary for the ProShares Bitcoin Strategy ETF states:

Fund Summary for the BITO ETF (Barchart)

Since futures are the only genuinely regulated crypto market, the ETF could be an excellent choice for those looking for a rebound. At $10.27 per share on Nov. 15, BITO had $531.445 million in assets under management. BITO trades an average of over 13.3 million shares daily and charges a 0.95% management fee. BITO is a liquid ETF.

Chart of the BITO ETF Product (Barchart)

In November 2021, nearby Bitcoin futures reached $69,355 and were at the $16,655 level on Nov. 15, a 76% decline. Over the same period, BITO fell from $44.29 to $10.27 per share or 76.8%. While the ETF has done an excellent job tracking Bitcoin futures on the downside, the difference is the management fee. The downside risk on BITO is zero, but the potential reward may justify the delusional risk in the current environment.

[ad_2]

Source links Google News