[ad_1]

peepo/E+ via Getty Images

Investment Thesis

In my last article on the ARK Space Exploration & Innovation ETF (BATS:ARKX), I pointed out the fact that inflation will be the biggest threat to high-multiple stocks, and ultimately to ARKX. Since then, ARKX has lost ~21.5% vs. a loss of ~13.7% for the S&P 500 and has underperformed the US market.

While inflation is stickier than previously expected and continues to be an important issue, I think the main risks going forward for investors who are considering putting their money in this fund are downward earnings revisions and a potential credit event that will impact high-yield issuers the most. Given the fact that a large portion of the portfolio is invested in money-losing businesses that have a junk credit rating, refinancing risks are likely to grow higher over the next couple of months, putting downward pressure on their stock price. As a result, I continue to believe that ARKX doesn’t provide an attractive risk-reward opportunity, and investors will be better off avoiding it for now.

What Has Happened Since My Last Article

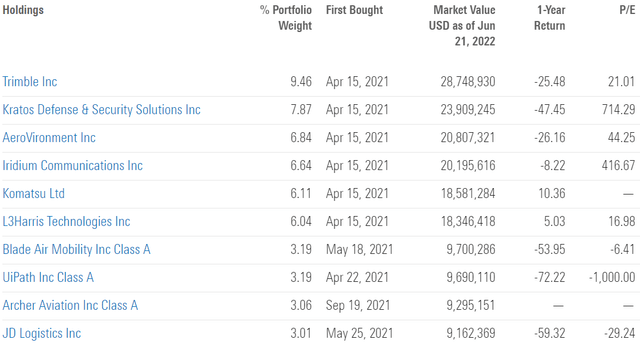

As a reminder, the ARK Space Exploration & Innovation ETF is an actively managed fund that seeks long-term capital growth by investing in companies that are engaged in the space industry. You will find below a recent breakdown of the top 10 holdings, and you can read more about the strategy in my previous article.

Morningstar

I have compared below ARKX’s price performance against the Invesco QQQ ETF (QQQ) and the Procure Space ETF (UFO) over the last 3 months to assess which one was a better investment. Since my previous article, ARKX lost ~23% and vs. a loss of ~20% and ~21% for QQQ and UFO, respectively. The fund delivered similar returns compared to UFO which invests in a similar basket of stocks in the space sector.

Refinitiv Eikon

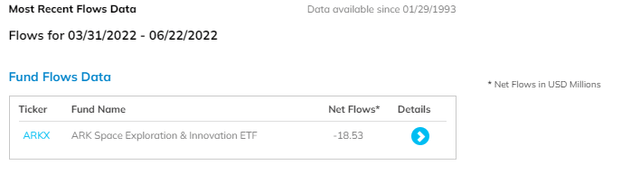

Despite disappointing returns, investors aren’t yet giving up on ARKX, and fund flows certainly don’t show any sign of capitulation for now. Since late March 2022, ARKX registered less than $19 million in outflows, despite being down nearly 30% since November 2021.

ETF.com

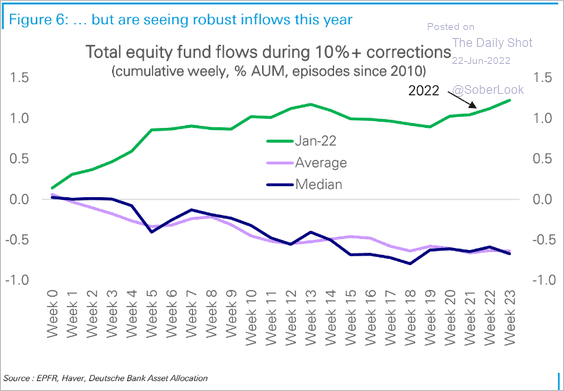

I believe this has to do with the buy-the-dip mentality which has emerged since the COVID-19 crash in March 2020. As part of it, investors are buying dips in the hope of getting a good deal and anticipating a pivot to a more accommodative monetary policy. The recent flows of capital into the market tend to validate my hypothesis. We are now in an unprecedented situation where the market keeps making new lows but equity inflows are making new highs.

TheDailyShot

EPS Revisions and Credit To Drive The Next Leg Down

I concluded my previous article on ARKX with the following statement, which has been validated by today’s economic context:

That said, I believe valuations are stretched across the industry. Most of these businesses are trading at more than 25x earnings which adds a lot of risk in my opinion in the current market environment given the fact that we are at an inflection point in monetary policy and inflation is running hot. Historically, high inflation has a negative impact on P/Es, and richly valued stocks tend to suffer the most. All in all, I expect ARKX to continue to underperform the market going forward.

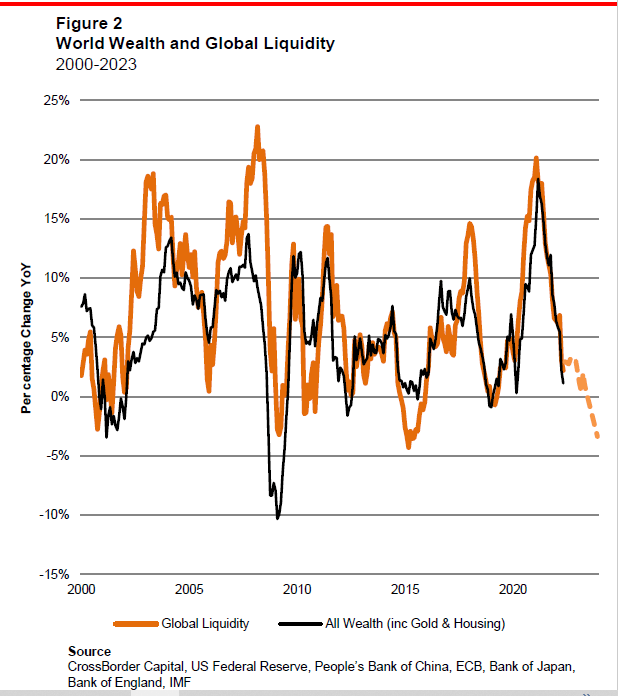

In the face of stickier-than-expected inflation, high multiple stocks had a tough time and underperformed the market so far this year. Uncertainty regarding inflation is likely to stay for a while and investors shouldn’t expect this issue to disappear suddenly. In fact, there are no examples in recent history where that happened, although there are many where inflation proved to be recurrent over several years. As a result, there is uncertainty regarding where the Fed’s neutral rate will be over the next couple of years and this ultimately impacts liquidity.

On top of the recent rate hikes, the Fed has started quantitative tightening this month which will ultimately drain even more liquidity from the system. CrossBorder Capital provides below a good estimate of liquidity flows and how that impacts global wealth. This tightening cycle is on par with what markets experienced in 2007-2008 and the result of it could mirror the 2008 financial crisis. This of course doesn’t bode well for stocks in general, but I think that ARKX is particularly exposed given its valuation and the credit quality of its issuers.

CrossBorder Capital

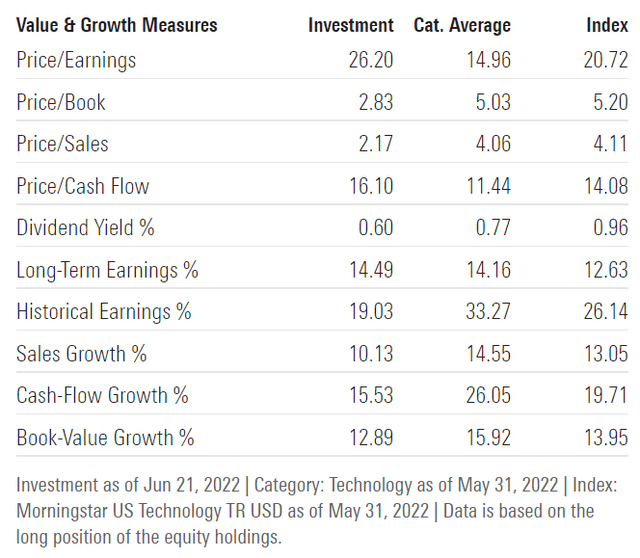

Despite the recent pullback, ARKX still trades at relatively high multiples. The fund trades at 26x earnings and 16x cash flow, which doesn’t make it cheap going into this tightening cycle and a potential recession.

Morningstar

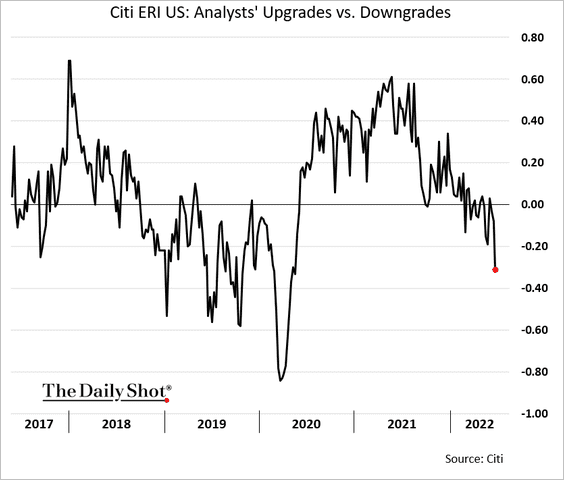

On top of that, the estimated EPS for 2023 and 2024 might be very different than what analysts were expecting a few months. While we haven’t seen massive downgrades yet, analyst expectations are likely to come down over the next couple of quarters in my opinion. Downgrades are already growing since May 2022 – now exceeding the number of upgrades – and I expect this trend to accelerate going forward. Despite the tremendous opportunities and growth prospects of the space sector, the lack of profitability of many constituents can become their weakness during an economic downturn where investors prioritize companies that are already able to generate cash.

The Daily Shot/Citi

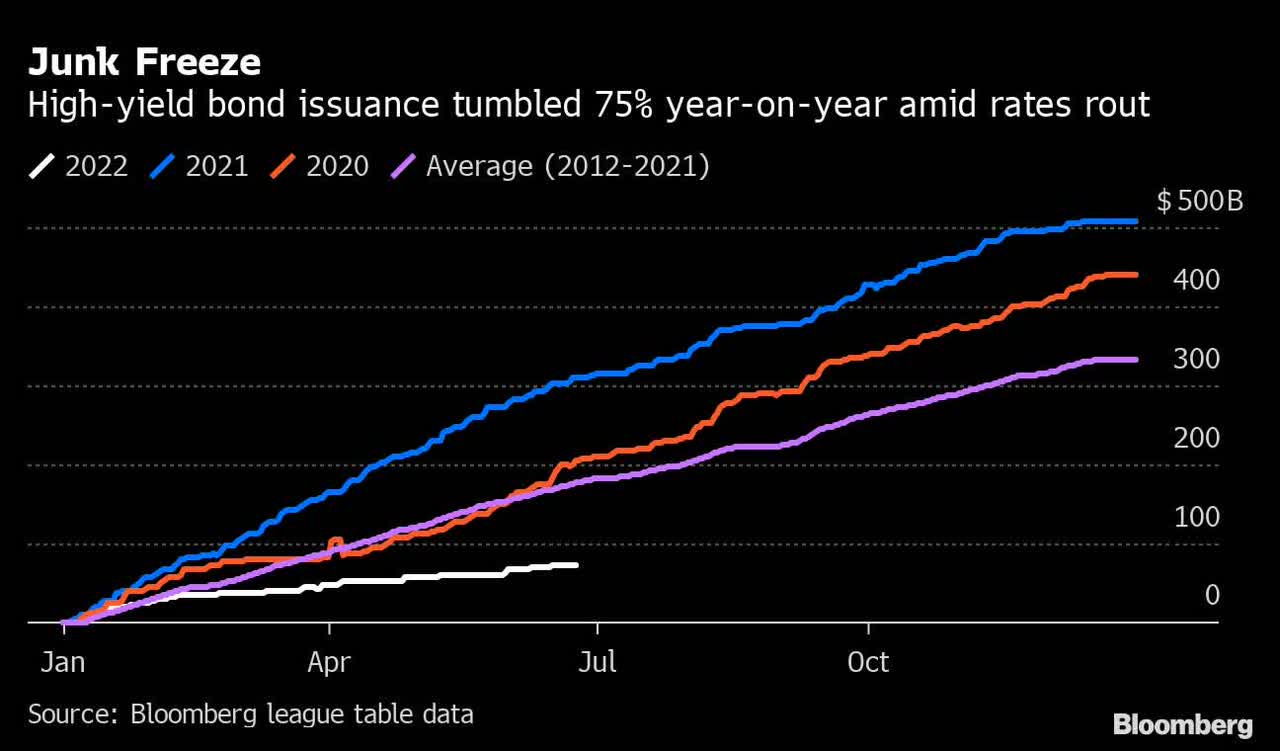

A credit event could also negatively impact the performance of the fund. Several issuers have negative operating cash flows, meaning they mostly rely on equity and bond issuance to finance their operations. As a result, nearly half of the top 10 holdings in the fund have a junk credit rating (below BBB). The high-yield market gives a bleak signal to companies in need of credit as it has been running at the slowest pace over the last 3 years. The importance of counterparty risk is growing, which will make the task of financing money-losing businesses through the credit market increasingly difficult.

Bloomberg

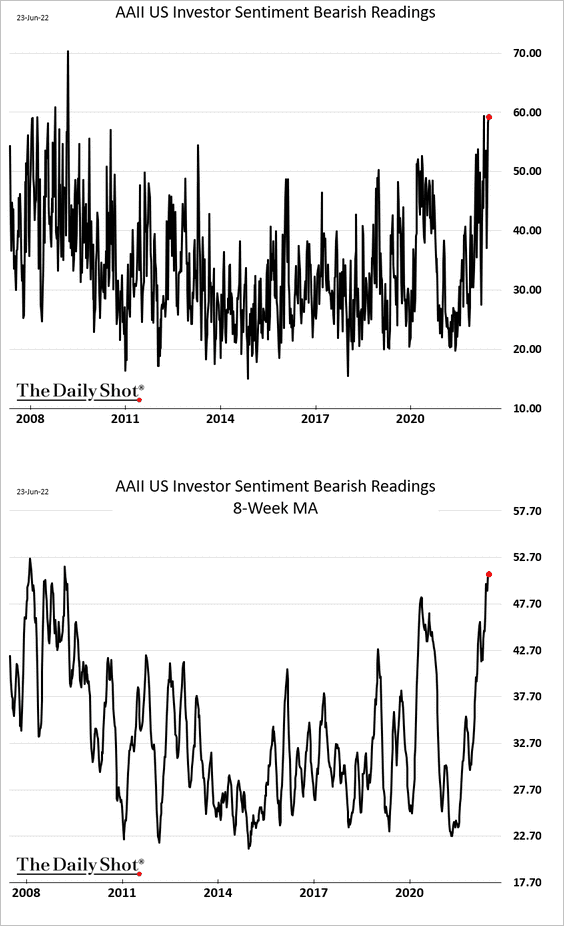

Lastly, investors’ sentiment remains extremely negative towards the economy and the stock market. The percentage of US investors who are bearish is now the highest since the 2008 financial crisis. I believe this could ultimately have reflexive power. In other words, as a growing number of investors expect more pain ahead, bearish positioning increases leading to further selling in risk assets such as equities. Despite the fact that ARKX is up ~6.3% over the last five days, I think this will ultimately turn out to be a bear market rally and the fund will be trading again below $14.00 per share in the near future. As a result, I continue to believe that ARKX still has room to go lower.

The Daily Shot

Key Takeaways

The strategy performed poorly since my previous article, in line with what was expected to happen in a rising rate environment. While inflation is likely to be around for a longer period of time and remains a concern, I believe the main risks for ARKX investors going forward are downward earnings revisions and a potential credit event that will primarily affect high-yield issuers. Given that a large portion of the portfolio is invested in money-losing companies with a junk credit rating, refinancing risks are likely to increase in the coming months, putting downward pressure on their stock price.

[ad_2]

Source links Google News