[ad_1]

Javier_Art_Photography/iStock via Getty Images

It’s been 1 year and 50% since I wrote my article on the ARK Innovation ETF (ARKK) titled “The ARK Rhyme”. The 50% drop, even in the context of a rising market (S&P500 up 15% since then) begs the question “What Now?” I will answer it.

The dynamics of subscriptions reinforcing the (upward) price action of stocks already held by the fund, and redemptions reinforcing the (downward) price action of stocks already held by the fund, aren’t the only thing recognizable about ARK Innovation.

The fund’s approach, itself, is recognizable. It is basically an approach which seeks to buy disruptive story stocks with little or no regard for valuation. In my original article, I drew comparisons to the dotcom bubble and Janus Capital for this very reason.

Perusing ARKK’s factsheet and website in general shows this inclination, mission even. There are countless pages showing descriptions of the disruptive technologies Ark invests in, and nothing on what the valuation of what’s being bought might be – valuation (in individual stock analyses) is typically based on a rosy TAM (Target Addressable Market), rosy share of that TAM and rosy future margins.

Ark Invest Website Ark Invest

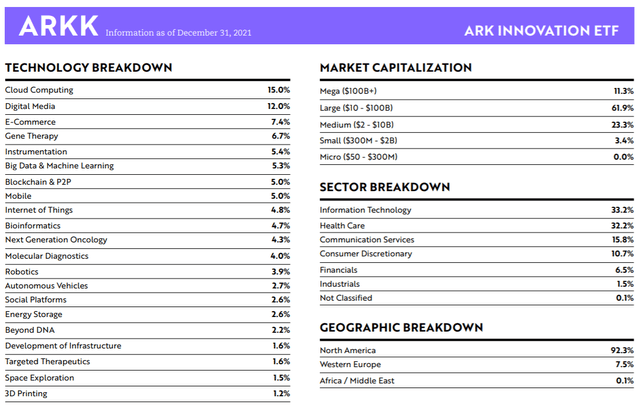

ARKK’s composition “by technology”:

ARKK Factsheet Ark Invest ARKK Top 10 holdings Ark Invest

Notice that such is the allergy to industries which might be seen as “legacy”, that while Tesla (TSLA) is the largest position at 8.3% of fund…

…“Automaking”, or even “Electric Vehicle making” aren’t found in the technology breakdown (at year-end, Tesla was 7.9% of the fund). Instead, “Autonomous vehicles” (a technology Tesla sells since 2016 but doesn’t have) and “Energy storage” (a very small part of Tesla’s business) are listed. Of course, Tesla’s success or failure as an investment continues to rest solely on its ability to make cars profitably (which it does, though not at a scale that might justify the current valuation).

Anyway, this observation on the obsession with disruptive technology alone while disregarding valuation, is both what brought us here (to minus 50%), and what explains what will happen next.

If we were simply looking at Janus Capital, as I described in my original article Janus posted the following returns:

Then the dotcom bust came, and the Janus Fund lost 15% in 2000, 26% in 2001 and 28% in 2002, for a total loss of 55%.

This could make us optimistic. If ARK is already down 50%, maybe the end of the suffering wouldn’t be too far away.

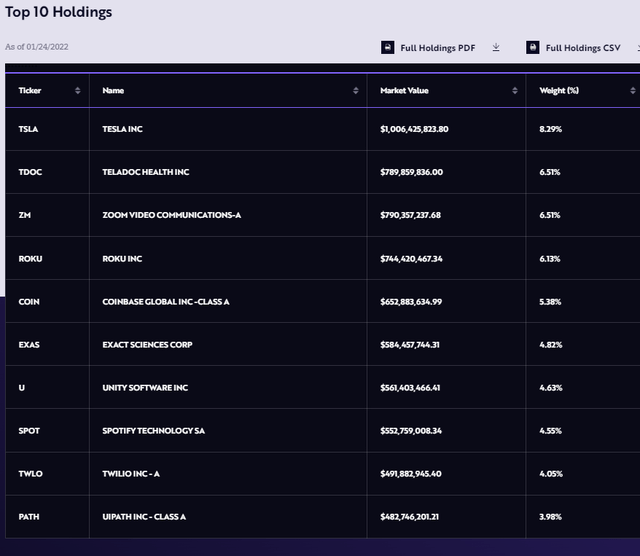

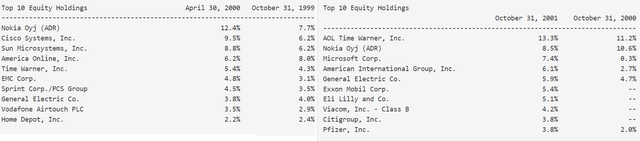

However, with all its fame, Janus was perhaps not as conceptual as ARK. For instance, a look at the Janus Twenty fund’s top holdings in April 2000 (right after the top of the dotcom bubble) and then in October 2001 shows two things:

Janus Twenty Top 10 Holdings, 2020, 2021 SEC

- First, Janus Twenty was never as conceptual as ARKK is now. Its major holdings were initially more focused on tech, but literally, all that tech was profitable. Those holdings were still massively overvalued, so Janus still suffered, of course.

- Second, and most importantly, Janus shifted away from the tech focus, except in as much as it welcomed punished, but again profitable, tech – Like Microsoft (MSFT). This shift was also observed at the time.

ARKK contrasts with this. One year into its massacre, it’s still holding mostly concept tech stocks in its top 10 holdings – even if some lean profitable now, too (like Tesla). We can see from the technologies ARKK lists, though, that such seems incidental. For instance, what makes Tesla profitable is car making, which isn’t something that’s listed.

In ARKK there hasn’t been much of a shift away from these concept stocks, and these concept stocks by objective measures remain very expensive. The reason is structural, Janus was into managing funds and didn’t put all its eggs into seeking innovation or disruptive technologies.

ARK is different. ARK defines itself, as I showed, by investing solely in disruptive innovation. It puts all its eggs there. As a result, ARKK can’t pivot, even if it finds other industries with potentially higher returns. Said another way, ARK simply cannot pivot to banks. Or to drug companies. Or to energy companies. Unlike Janus did.

This inability to pivot is what takes me to the gist of this article. A prediction on where this will lead ARKK. ARKK, by design, will suffer the full extent of losses which the underlying concept stocks will suffer.

The End Result

Now, during the dotcom years:

- The S&P500 lost ~45% from 1999 year-end to the eventual bottom in 2002.

- The Nasdaq, a much better proxy for concept stocks, lost ~72% from 1999 year-end (notice, not the top) to the eventual bottom in 2002.

However, even the Nasdaq was not a perfect proxy for concept stocks. There were many large profitable companies which participated in the 2000 bubble and which eventually made the drop softer than it would have been if we restricted ourselves mostly to concept stocks.

Hence, it’s likely that if we could measure a “concept stocks only” index, the dotcom drop would have “far” exceeded 72%. Also, notice that to go from a 45% drop on the S&P to a 72% drop on the Nasdaq, you need to add another 50% drop on top of the initial 45% drop.

Hence, drawing a parallel to today, while Janus managed to shift to an “S&P-like” loss due to its shifting strategy, ARK won’t enjoy such a benefit. Notice I don’t actually expect a 45% S&P drop this time, but concept stocks will certainly enjoy a dotcom-like drop no matter what happens to the S&P.

This leads me to predict that ARKK’s resting place will be significantly lower than the current -50% return. Indeed, I’d go as far as to say that there’s potential for another 50% drop from here, when all is said and done (and Quantitative Easing is over), just drawing a parallel to the Nasdaq after the dotcom bust (as a proxy for concept stocks today – but without the softening effect brought about by large, very profitable, companies).

I should however add a constraint to this opinion. It’s not expectable that things will just head straight down without rebounds, and the current sell-off in these conceptual names is already quite long and sharp. As a result, a severe rebound can happen at any time (indeed, maybe even in the next couple of days if we go by Friday’s high equity Put/Call ratio). But still, considering historical precedent and ARKK’s “structural cage”, my opinion remains: Unless ARKK changes investment philosophy, and it likely won’t, then when all is said and done, there’s still substantial downside from here.

[ad_2]

Source links Google News