[ad_1]

bymuratdeniz/E+ via Getty Images

Thesis

This year has seen a substantial re-pricing of the yield curve on the back of an aggressive Fed and has resulted in extremely poor performances by growth stocks. Cathie Wood’s ARK Innovation ETF (NYSEARCA:ARKK) is down more than -44% this year on the back of higher risk-free yields. The Fed has indicated that it intends to front-load its interest rate hikes in 2022 and we feel the second half of the year might see a resurgence of the growth trade on the back of recessionary fears that might impact real assets first. A retail investor attracted by ARKK’s long term prospects but not ready to stomach more downside volatility by purchasing the stock outright can utilize our options strategy to capture future ARKK upside while concomitantly having a 23% downside buffer. The proposed options strategy does not involve any premium outlay on day one (i.e., it is a net zero cost strategy) and it ensures an investor benefits if ARKK goes up in price above $70/share, and only incurs a loss upon expiry if ARKK craters sub $40/share.

What is a risk reversal

A risk reversal is an options strategy where an investor concomitantly writes a put on the stock and purchases a call, usually for a net zero cost (i.e., there is no cash outlay on day one – no cost to the investor). In our proposed trade an investor would sell a put option with a $40 strike and concomitantly buy a $70 call option with the same maturity.

A risk reversal at its core allows an investor to be able to benefit from the potential upside on the stock at or above the strike price by undertaking the downside if the stock keeps falling below the put strike.

In a simple world without options an investor would need to purchase ARKK in order to gain exposure to the stock performance. However, said investor would be immediately subject to the downside and upside on the stock and would have a cash outlay on day 1 equivalent to the purchased amount. Via a risk reversal an investor does not need the entire cash in their brokerage account on day one (just the initial margin required by the broker) and would experience no losses if the stock does not go below the $40 strike upon maturity date.

What is the trade

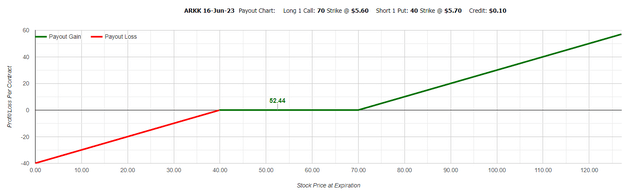

Our proposed trade is a June 16, 2023 risk reversal where an investor sells a $40 strike put for a $5.70 premium per contract and concomitantly buys a $70 strike call for a -$5.6 premium:

Payout Profile Risk Reversal (Market Chameleon)

By engaging in this trade an investor has zero cash outlay on day one (the premium received for the written put is utilized to buy the call) and exposure to ARKK.

What can the outcomes of the trade be:

1) On June 16, 2023, the ARKK stock price is at a level between $40 and $70

- both the put and the call expire without being triggered

- the investor has not incurred either a gain or a loss since the trade was a net zero cost

- the investor was immunized from any downside moves from spot to $40

2) On June 16, 2023, the ARKK stock price is at a level above $70

- the put expires without being triggered

- the investor benefits from being long the stock at a $70 strike with a symmetric profile to having acquired the shares

- without having used any cash outlay on day 1 the investor now takes advantage from the upside in the stock

3) On June 16, 2023, the ARKK stock price is at a level below $40

- the call expires worthless

- the investor will get assigned the ARKK stock at a strike level of $40

- the investor will be long ARKK at a price of $40, which is 23% below current spot levels

Why a risk reversal

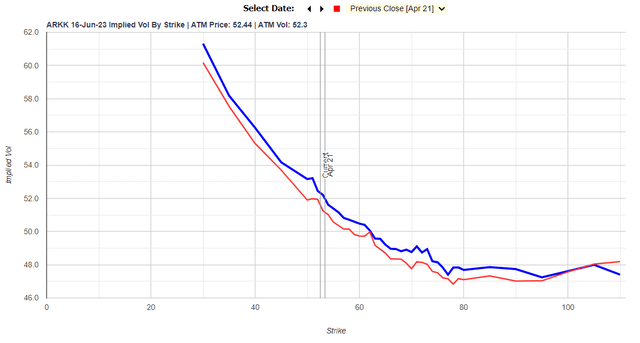

We believe a risk reversal is appropriate in the current environment due to the ARKK “volatility smile”:

Implied Volatility Smile (Market Chameleon)

The “volatility smile” or skew is a graph of the implied volatility utilized for options at different strikes. For example, we can see that the implied volatility used for a $40 strike is somewhere around 56% for the June 2023 expiry, while the implied volatility to price $70 strikes is around 48%. This simply means that when writing a $40 put an investor gets more premium due to the high volatility, premium that can be utilized to buy a lower vol option, namely a $70 strike call.

This type of skew occurs when investors continue to expect a downside move in the underlying stock hence, they try to protect their investment via purchasing puts. Purchasing a significant amounts of puts on a stock drives dealers to increase their pricing (i.e., the implied volatility used to price the puts) hence the “smirk” we can see on the vol curve.

Conclusion

In a world without options a retail investor would be bound by buying or selling a stock at spot levels. With the current increased volatility exhibited by ARKK and its volatility skew matrix we feel a risk reversal is an appropriate trade for a retail investor looking for long-term exposure to ARKK but fearing more near-term downside. Our proposed trade with a June 2023 maturity ensures a savvy investor benefits from an ARKK stock price above $70 but does not incur any loses unless ARKK depreciates another -23% below $40/share. With the Fed set to front-load all their rate hikes this year we feel that the latter part of the year will see a resurgence of the growth trade. The best way to take advantage of a constructive long-term view on ARKK is not via stock purchases but by engaging in a risk reversal options trade.

[ad_2]

Source links Google News