[ad_1]

gremlin/E+ via Getty Images

Investment Thesis

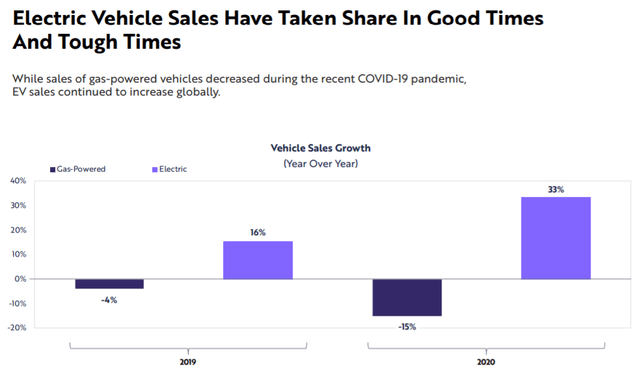

While still early in their development and adoption, autonomous and electric vehicles are rapidly advancing and appear poised to trigger the transportation industry’s largest shakeup in over a century. If we take electric vehicles, for example, they are not only more environmentally friendly than internal combustion engine (ICE) vehicles but they also seem to provide lower operating costs. EVs are currently more costly than ICEs, but many analysts anticipate this will change over the next decade as battery costs continue to fall significantly. Between 2014 and 2016, battery costs declined by more than half due to technology advancements and scale effects, putting EVs much closer to parity with ICE costs. This is reflected in the vehicle sales growth of the past 3 years.

ARK Invest

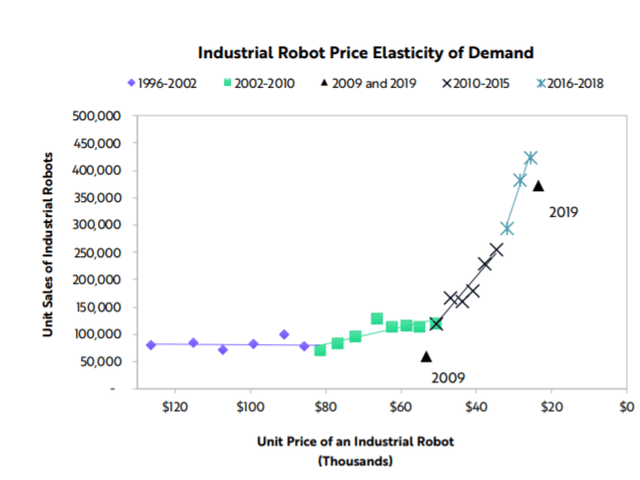

If we now turn to industrial robots, industrial robot demand hit an inflection point following the great recession in 2008/2009. In recent years, trade tensions between the US and China may have added to the momentum before COVID-19 created a headwind in 2020. According to ARK’s research, short-term obstacles will not prevent a rebound in industrial robot sales and could encourage companies to automate and cut costs more aggressively. Automation could add 5%, or $1.2 trillion, to US GDP during the next five years. ARK believes automation will boost US real GDP growth by 100 basis points on average per year to 3.4%.

ARK Invest

The ARK Autonomous Technology & Robotics ETF (NYSEARCA:ARKQ) provides exposure to a basket of leaders in the field of autonomous driving and robotics. The strategy (along with the other ARK strategies) was a real success in the past 2 years, compounding at more than 20% annually over that period. However, investors have become increasingly nervous recently as ARKQ is now down 21% YTD and they are starting to pull out their money from the fund. In this article, we will try to understand if the recent pullback has created a buying opportunity or if it’s better to stay away from this investment.

Strategy Details

The ARK Autonomous Technology ETF is an actively managed ETF. Companies within ARKQ are focused on and are expected to substantially benefit from the development of new products or services, technological improvements, and advancements in scientific research related to, among other things, energy, automation and manufacturing, materials, artificial intelligence, and transportation. These companies may develop, produce, or enable:

- Autonomous Transportation

- Robotics and Automation

- 3D Printing

- Energy Storage

- Space Exploration

If you want to learn more about the strategy, please click here.

Portfolio Composition

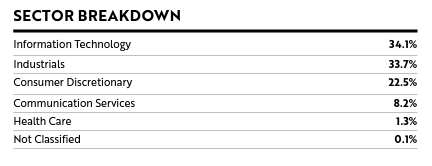

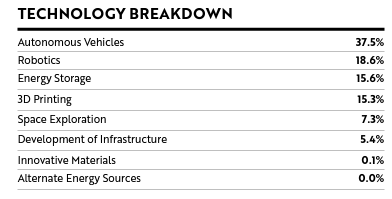

From the sector allocation chart below, we can see the fund places a high weight on the information technology sector (representing around 34% of the index), followed by industrials (accounting for ~34% of the index) and consumer discretionary (representing around 22.5% of the fund). The largest three sectors have a combined allocation of approximately 90%.

ARKQ Factsheet

In terms of technology, the top three segments are autonomous vehicles (37.5%), followed by robotics (18.6%), and energy storage (15.6%). In total, ARKQ is ~72% invested in the top three technologies.

ARKQ Factsheet

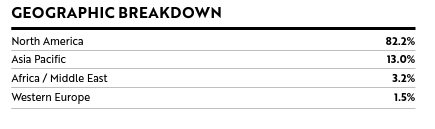

In terms of geographical allocation, North America has the highest allocation with ~82% invested in that region, followed by Asia-Pacific with 13%. It is interesting to see that some regions such as Western Europe seem to be underrepresented given the low weight (only a 1.5% allocation to Western Europe). All in all, the ETF invests ~97% of the funds in developed countries and ~3% in emerging countries.

ARKQ Factsheet ARKQ Factsheet

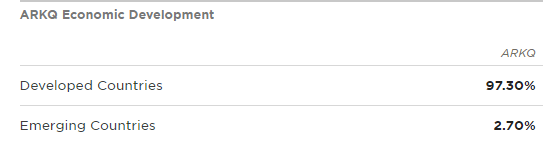

The fund is currently invested in 37 different stocks. The top ten holding account for ~57% with the highest weight in Tesla Inc. (NASDAQ:TSLA). All in all, I would say the fund is pretty concentrated in a few high conviction names. I think it is important to see if that fits your investment goals or if you need more diversification.

ARK Invest

Since we are dealing with equities, one important characteristic is the valuation of the portfolio. According to data from Morningstar, the fund currently trades at a price-to-book ratio of 3.12 and a price-to-earnings ratio of 29.94, which is in line with the category’s average of 30.43. I generally consider a company trading at a forward price-to-earnings ratio above 20 to be richly valued. Moreover, I think it is hard to justify holding stocks with a P/E above 20 when the FED is preparing to tighten and raise interest rates.

Is This ETF Right for Me?

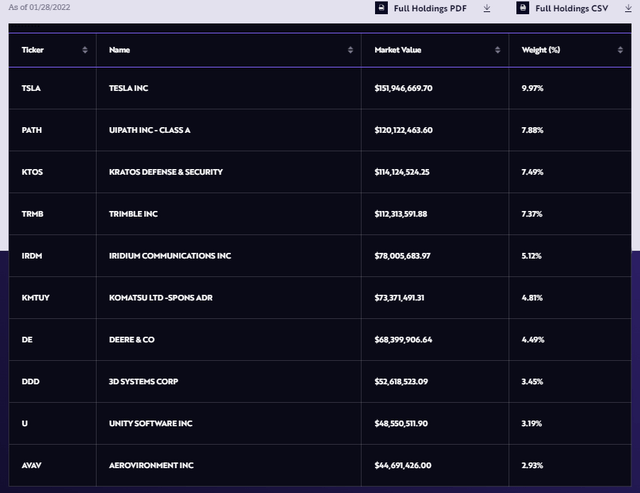

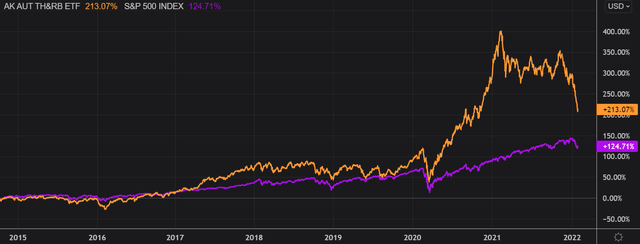

I have compared below the price performance of ARKQ against the price performance of the SPDR S&P 500 Trust ETF (SPY) over 5 years to assess which one was a better investment. Over that period, ARKQ outperformed the S&P 500 by more than 70 percentage points. To put it into perspective, a $100 investment in ARKQ five years ago would now be worth $263.37. This represents a CAGR of 21.4%, which is a great absolute return.

Refintiv Eikon

If we take a step back and look at the performance of the strategy since its inception in September 2014, the results don’t change much. ARKQ finished once again on top, and clearly outperformed the S&P 500. It is interesting to see that most of the gains relative to the S&P 500 were made in 2020 and 2021 when the FED was running a loose monetary policy that benefited tech stocks with high P/Es. In my opinion, past performance is not a good indicator of future returns for ARKQ given the fact that we are at an inflection point in monetary policy and inflation is running hot, which generally has a negative impact on equities.

Refinitiv Eikon

Key Takeaways

To sum up, I understand the growth potential coming from these new technologies. That said, a huge growth runway will not necessarily turn most of the constituents into great investments. These businesses are not cheap since most of them are trading at more than 25x earnings which adds a lot of risk in my opinion in the current market environment given the fact that we are at an inflection point in monetary policy and inflation is running hot, which generally has a negative impact high P/E stocks.

In the near future, I expect a lot of volatility and I wouldn’t exclude the fact that ARKQ might continue to underperform the market. In the long term, however, I think it is pretty hard to pick the winners. If we draw some comparisons with the dot-com era, which was also marked by unprecedented innovation, many of the so-called leaders back then were simply crushed by a few winners that managed to capture a large share of the market. For these reasons, I think the potential return provided by ARKQ at the moment doesn’t compensate investors for the potential risks.

[ad_2]

Source links Google News