[ad_1]

izzzy71

By Rob Isbitts

Summary

VanEck Vectors Fallen Angel High Yield Bond ETF (NASDAQ:ANGL) gets a Sell rating from us. While we can envision a time in the future where it could be an attractive ETF to consider, this is hardly the time. The high-yield bond market has been ruined by a combination of toxic issuance and Fed overreach. That makes nearly any ETF in this category one to pause on, until the air clears. That could be a while. We are fans of Van Eck, the innovative mutual fund specialist-turned-ETF firm, but this offering from them can’t get over the high hurdle that is high yield bond investing today.

Strategy

ANGL aims to track the ICE US Fallen Angel High Yield 10% Constrained Index (the “Fallen Angel Index”). That index contains bonds that were investment grade (rated BBB or higher) at the time they were issued, but have fallen below that higher status into high yield (“junk”) bond status. That means they are rated no higher than BB.

Proprietary ETF Grades

-

Offense/Defense: Offense

-

Segment: Bonds/Cash

-

Sub-Segment: High Yield Bonds

-

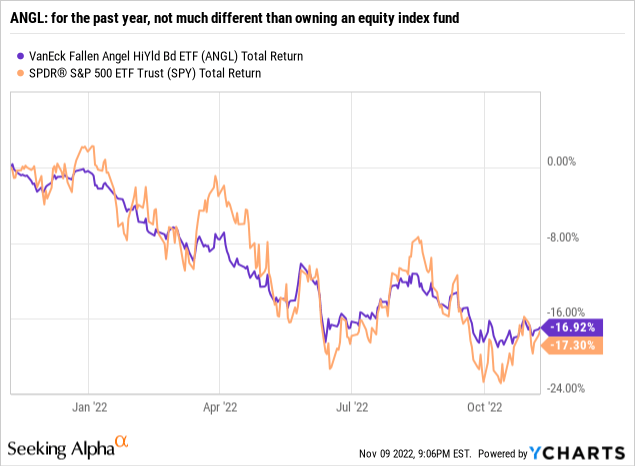

Correlation (vs. S&P 500): High

-

Expected Volatility (vs. S&P 500): Moderate

Holding Analysis

ANGL diversifies across more than 200 bonds. As one might expect, given how the bonds were chosen, the vast majority (over 82%) are rated BB. Another 12% are rated B, and the rest are either not rated or in the C category. Over 80% of the fund’s allocation is to U.S.-based bonds, with a sprinkling of exposure across several countries in Europe and in Canada.

Strengths

Conceptually, within the bond ETF space, this makes a lot of sense. It is like a corporate bond investor’s version of deep value. This portfolio contains many household names. It just holds the bonds instead of the common stocks. The fund has a distinct advantage over many high yield funds, which simply index the high yield market without regard to aspects of a bond, such as fallen angel status.

Weaknesses

But that’s where the good news ends. Because in the modern investment era, they don’t give a lot of “style points” for having a neat, contrarian approach to bonds when it doesn’t work. And, while a fund like ANGL can always produce (i.e. this analysis of the ETF can turn out to be way off), the fact is that ANY corporate bond investment today is fraught with a historically high level of risk. The Fed supported this market in recent years, buying up bonds of weaker companies to avoid a corporate bond disaster. This market suffers from a lack of liquidity. It is just not the same as when investors bought them off of daily lists of bonds in a thin book (see your history books for more on that).

Opportunities

The corporate bond market is “drunk” on BBB-rated bonds. That is the lowest rating that still qualifies a bond to be “investment-grade,” and thus eligible to be owned many very large investors. Many of these bonds should actually be rated lower, but there is a degree of “rating inflation” that has existed since prior to the 2008 Global Financial Crisis.

There could easily be a time in the future (or very soon) where these bonds that rightfully should be downgraded to junk will actually have that happen. For investment grade bond afficionados, that’s a nightmare. But for ANGL investors, it could be the proverbial “kid in a candy store moment,” with so many bonds available at fire sale prices, as BB-rated securities.

Threats

But until that moment happens, ANGL is not much better than traditional high yield bond funds. The Fed has essentially kept this market afloat by literally using part of its huge balance sheet to buy high yield bond funds. No matter what the “sticker price” yield is (currently around 4.8%), the risk is many times that. This ETF has had a drawdown as high as 35%. In environments like the current one, ANGL might as well be considered an equity ETF. As it is, the fund is about 20% off its 2021 high.

Proprietary Technical Ratings

-

Short-Term Rating (next 3 months): Sell

-

Long-Term Rating (next 12 months): Sell

Conclusions

ETF Quality Opinion

There’s a lot to like here, if you could close your eyes and open them when the corporate bond market returns to “normal.” But that could be years from now. So for now, we keep this one on the radar, and look for the conditions laid out above to see if it is something we could one day recommend. Not now.

ETF Investment Opinion

ANGL is a great concept by a strong fund company. But it is not the right style for the times. So we rate it a Sell.

[ad_2]

Source links Google News