[ad_1]

Editor’s note: Seeking Alpha is proud to welcome Sean P. Sullivan as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to the SA PRO archive. Click here to find out more »

In 2019, tech sector performance is somewhat of a question mark. There are significant growth opportunities, specifically within the cloud computing and blockchain spaces. Large tech firms are well-positioned to take advantage of these opportunities as six of the top seven companies with the most cash holdings in 2018 were in the technology industry.

There are also substantial threats to growth in tech in 2019, including heightened regulatory risks, increased global competition, and the overall cyclicality of the tech sector. In the macro environment, the growing consensus of a slowdown in global growth, looming threat of a 2019-20 recession, and the inverted yield curve in late 2018 could lead to a broad decline in the tech sector. When it comes to the inverted yield curve, long-term interest rates falling below short-term rates is an indicator of weakening investor confidence.

Also, as a large subset of decelerating global growth, the ongoing economic slowdown in China is a major risk that should be monitored. Many tech firms are suffering from the trade war between China and U.S. companies have begun to raise alarms about supply chain issues and the need to raise prices or take hits to their profits, due to the extra costs that tariffs introduce. Overall, the push and pull of these growth opportunities and significant headwinds are likely to cause elevated volatility in the tech sector throughout 2019. Instead of avoiding the sector and missing the chance of significant gains, investors should take a position that minimizes risk and capitalizes on the high probability of volatility through a straddle trade options strategy.

Straddle Trade Overview

According to a Natixis Investment Managers survey of institutional investors, 84% expect more volatility in the stock market in 2019 versus 2018. It is expected that the tech sector will be even more volatile than the overall market based on the reasons outlined above. To capitalize on high tech sector-specific volatility, one can execute a long straddle option strategy using a technology sector ETF. A long straddle option strategy is increasingly profitable as the underlying share price moves further away from its current price, in either a positive or negative direction.

Thus, greater tech sector volatility increases the trade’s profit potential. To enter a long straddle option position, buy both a call and a put option near the current share price, with the same strike price and expiration date. This trade has unlimited profit potential, while the maximum loss is limited to the total option premium paid for the call and put options plus any trading fees.

Straddle Trade Specifics Using XLK

Looking at the specifics of a long straddle option strategy, we will use the Technology Select Sector SPDR ETF (XLK). This ETF tracks the overall tech sector, with its top five holdings of Microsoft (MSFT), Apple (AAPL), Visa (V), Intel (INTC), and Cisco Systems (CSCO) making up nearly 50% of its total holdings. To outline the steps and potential profits/losses behind a straddle trade, we will use price data from market close on March 8, 2019. As such, these prices will change based on the date the trade is executed.

The following example uses options with a June 21, 2019 expiration date, but this date can be adjusted as long as the call and put options expire at the same time. The late-June expiration date allows an investor to benefit from increased volatility surrounding second quarter earnings announcements. At market close on March 8, the underlying share price of XLK was $69.81. Entering a long straddle position as of this date, one would buy a call and put option with a $69.00 strike price. Assuming the investor purchases one call and one put option contract, the cost of the call and put option would be $310.00 and $258.00, respectively, totaling $568.00 (excluding brokerage fees) to execute the trade.

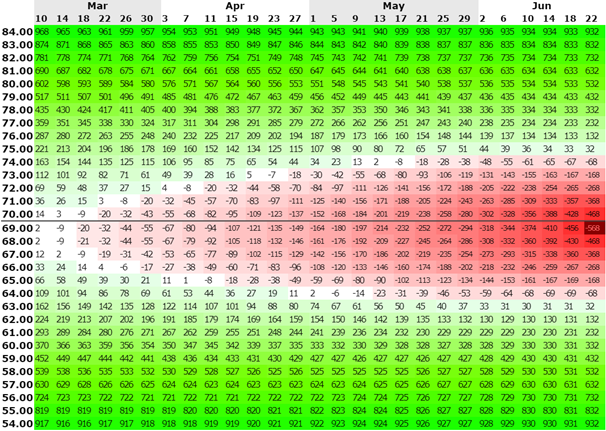

Figure 1 outlines the potential profit in dollars based on the underlying share price on the Y-axis and the date the trade is unwound on the X-axis. In an example of upward price movement, if the share price increases 11.9% to $77.00 by May 1, the straddle can be exited by selling the call and put on that date for an estimated $823.00 and $17.00, respectively, totaling $840.00. This would generate a profit of $272.00 or 47.9%.

In an example of downward price movement, if the share price decreases 12.6% to $61.00 by May 1, the straddle can be exited by selling the call and put on that date for an estimated $8.00 and $801.00, respectively, totaling $809.00. This would generate a profit of $241.00 or 42.4%. As seen on the graph, profit on this trade is driven by tech sector volatility and rises as the underlying share price moves away from the strike price. Overall, the maximum gain from this trade is unlimited and the maximum loss is the total option premium of $568.00 plus any brokerage fees.

Figure 1 – Profit/Loss distribution of XLK long straddle trade as of market close on March 8, 2019

Figure 1 – Profit/Loss distribution of XLK long straddle trade as of market close on March 8, 2019

Higher Volatility in the Tech Sector

It is true that this strategy could be implemented by someone in any sector, but there are numerous reasons why technology will be one of the most, if not the most, heavily impacted sectors by this looming volatility. When compared to consumer staples – stocks used by people in everyday life like food, household products, and hygiene – there is a clear negative correlation between the two sectors. While the staples sector acts defensively and steadily climbs year after year with the market, the spread between the two sectors widen in years of under and outperformance of the market as tech increases and decreases drastically.

Early to mid-2019 specifically is a very opportune time to execute a long straddle because of the uncertainty that can make or break the sector. Trade negotiations continue to loom with China, and, according to Trading Economics, the U.S. imported $106.97 billion in electronics from them in 2017. Any decisions will drastically affect technology prices because of the influence trade has on the sector. The ongoing feud between North Korea and the U.S. could strongly impact defense technology and international trade as well.

Nationally, with the effects of the 2018 tax break for U.S. businesses wearing off in 2019, it is a good bet that we will see a high amount of imported goods instead of manufacturing them ourselves. The U.S. also recently exited the longest government shutdown the nation has ever seen. In years directly after government shutdowns, the market has seen increased volatility and 2019 should be similar.

Recent tech sector performance also suggests heightened volatility moving forward in 2019. On August 2, 2018, Apple became the world’s first $1 trillion company. One month later, Amazon (AMZN) topped the $1 trillion market cap threshold as well. Alphabet (GOOG) and Microsoft were third and fourth in market cap, respectively, both nearly eclipsing $1 trillion in Q3 2018. However, looking at the market cap of these top tech firms as of market close on March 8, 2019, one can see a significant drop from Q3 2018 as none are valued over $1 trillion. Microsoft regained its crown from the late 1990s and has taken over the top spot with an $848 billion market cap, followed by Apple, Alphabet, and Amazon. The tech sector is unique in how quickly the tables can turn as, within months, Apple and Amazon lost more than $200 billion in value at the end of 2018 while its share price tumbled.

Microsoft also had its struggles, like most of the tech sector, and found its share price under pressure. However, the company generally held up far better than rivals, perhaps because Microsoft reported earnings for the quarter ended in September that easily beat analysts’ estimates, while Amazon and Apple generally disappointed investors with their guidance in the same period. Microsoft shares fell 11% between September 30, 2018 and the end of the year while Apple shares, in contrast, fell 30% over the same period. The tech sector has made somewhat of a turnaround so far in 2019, with Alphabet, Apple, and Microsoft shares all up around 9%, with Amazon shares gaining just above 5%. As recent swings in the share prices of the sector’s biggest players underline tech’s above average volatility, a straddle option strategy positions an investor well to exploit these price swings.

As a straddle trade is a bet on volatility, some might make the argument that buying the VIX is a better option. The VIX measures the ups and downs of the market, but the straddle position is not only profitable when the sector goes up and down, it is also highly profitable if there is a steady climb or steady fall, something that you would not be able to take advantage of with just holding a position in the VIX.

Conclusion

Overall, we believe that there will be a multitude of factors driving high volatility in the tech sector in 2019. The trade talks with China, the looming threat of a 2019-20 recession, the cyclicality of the tech sector, the government shutdown, and the inverted yield curve in late 2018 will all likely heighten volatility. All these factors are significant to the tech market as they play a very important role in influencing investors’ faith and confidence. We are interested to follow how these factors will impact the sector moving forward, however, as far as we are concerned, a long straddle option strategy would be the best fit when it comes to investing in this type of market.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News