[ad_1]

Jacobs Stock Photography Ltd/DigitalVision via Getty Images

Main Thesis / Background

The purpose of this article is to evaluate the Amplify Online Retail ETF (IBUY) as an investment option at its current market price. The fund’s objective is “to provide investment results that, before fees and expenses, correspond generally to the price performance of the EQM Online Retail Index. The Index is a globally-diverse basket of publicly-traded companies that obtain 70% or more of revenue from online or virtual sales.”

I was bullish on IBUY over the past couple of years, and that call was profitable for a time. However, after initially delivering strong returns, the fund saw a sharp reversal in fortunes. While it has been almost a year since I covered it, when I look back over that year, the story is very ugly. In fact, IBUY is down over 44% since my March 2021 article, when I had a positive outlook on it:

Performance (Seeking Alpha)

It should be clear from the title, and from the above graphic, why this has been one of my “worst” calls. Rather than avoid talking about it, I wanted to challenge this prior thesis head on, and admit I was wrong. Looking ahead, it is possible this drop signals a screaming buy opportunity, because it is not often we see funds/sectors fall by this amount.

While I do see a limit on further downside given how far this has dropped, after review, I am taking a more cautious tone. Yes, IBUY could rally from here, and the online sales trend remains favorable for American and global consumers. Yet, there are some significant headwinds right now that make me reluctant to go long a retail play. Inflation is hurting consumer wallets, wages are not keeping pace with inflation, gas prices show no signs of letting up, and federal stimulus has dropped off considerably. Therefore, I see a “hold” rating as most appropriate, and will explain why in detail below.

Fund Is In Bear Market, E-Commerce Sales Remain Elevated

First, I want to take a look at a few positives. After all, I mentioned I am not “bearish” on this fund for 2022, so it is important to highlight a few key reasons why. One, as I alluded to already, IBUY has already taken a dramatic hit to its share price. Of course, this does not mean it is going to reverse any time soon and start out-performing. But it does suggest a lot of pain has already been felt and been baked into the share price. We would need to see a weak macro-environment this year in order for me to predict that this fund will keep pumping out double-digit losses. When we consider the market was as a whole was in correction territory just this past week, and bounced back sharply, I have confidence in the broader support levels for market prices right now.

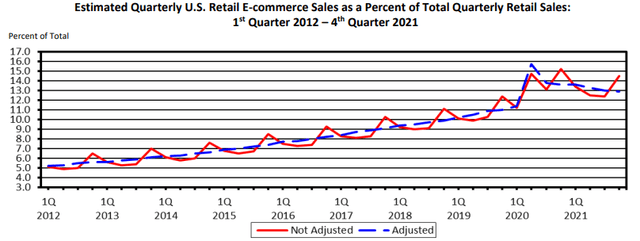

Two, e-commerce remains a trend that many will want exposure to. While no longer a “new” theme, it continues to be an area that captures a larger piece of the pie over time. While e-commerce’s share of total retail sales seems to have peaked in Q2 2020, it still remains at an elevated level compared to where it sat in prior years:

E-Commerce as a Percent of Total Retail (Census Bureau )

Given IBUY’s focus, investors can take some comfort here. While the “stay at home” play for the COVID pandemic is surely cooling, e-commerce is not dead by a long stretch. I would expect its share to continue to grow over time, just not at as quick of a pace leading up to the pandemic. Consumers have adjusted, traditional markets have become more mature / able to compete with e-commerce, and supply-chains are pressuring delivery plays. That said, IBUY still has plenty of upside if e-commerce can gain more and more market share, as is likely over the coming decade.

What Is The Problem? Broad Consumer Pressure

I will now highlight some of the major risks in this space. Importantly, many of these are relevant for other retail names, whether individually or as a sector. But they are also important to IBUY, as the fund needs a strong consumer – willing to spend on travel, goods, and leisure. For the moment, that outlook is undoubtedly pressured.

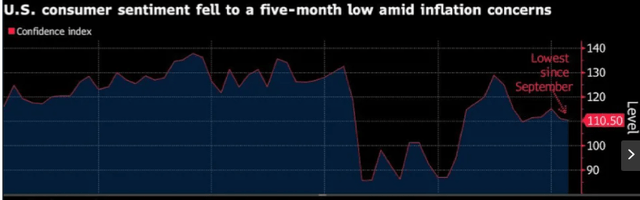

The reasons are multi-fold. We have a geo-political crisis in Eastern Europe that is escalating by the day. Oil prices are up, hurting sentiment (and wallets). Inflation is doing the same, even though wages are rising, inflation is rising faster. Throw in higher housing and food costs, and it should not surprise readers that consumer sentiment is in downward trend. In fact, it has fallen to its lowest level in months, as seen below:

Consumer Sentiment (Yahoo Finance)

While sentiment does not necessarily translate into sales (or lack thereof), it can be a powerful indicator of where we are headed. Yes, consumers can be fickle and sentiment can change quickly, but it can be useful in gauging how strong retail sales will be in the short-term. For me to see sentiment touch on a low not seen since September, I am not wildly optimistic retail is going to drive a stock market recovery. While it could be a contrarian indicator, I am not yet ready to recommend IBUY on that possibility.

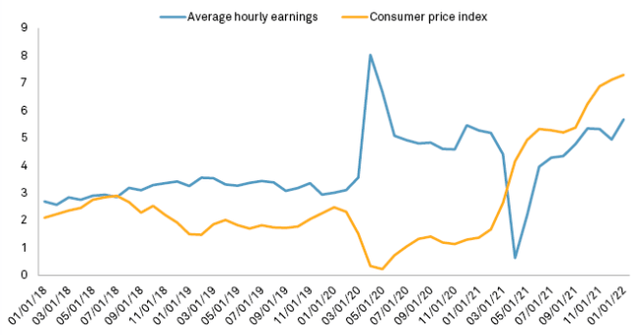

Inflation Is Real, And It Hurts

Let us now examine a few of the reasons why sentiment is down. After all, if it’s a fleeting, transitory sentiment, and the broader picture is strong, than retail sales may actually be going up in the near term. Unfortunately, that is not the case as I see it. One of the key reasons for declining consumer sentiment is inflation, and that problem has been accelerating over the past couple of quarters. While the job market is improving and wages are rising, both of which are signs for a booming retail environment, inflation is counteracting quite a bit of that. To see why, let us note that while wages are up a health amount since last year, the Consumer Price Index (CPI), is rising at a faster clip. This eats away at disposable income, even if incomes are also trending higher:

Inflation Outpaces Wage Growth (S&P Global)

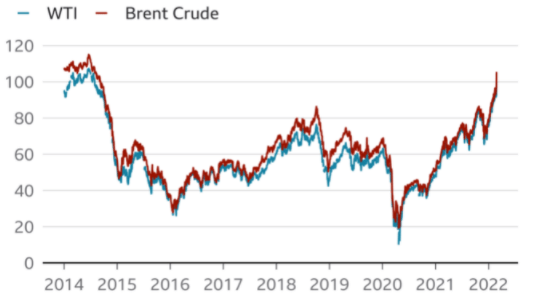

The takeaway here is that this is going to keep sales subdued because consumers can buy less. Despite a stronger labor market and households with more cash, inflation means those same consumers can actually purchase fewer items than they could a year ago. Much of this is driven by the price of oil, which we see at the pump, but also indirectly on everything we buy that is transported – whether by plane, train, or truck. With global supply under pressure due to the situation in Ukraine, the current rise in oil prices is probably sustainable. This could keep the elevated price levels in place:

Oil Prices [BBC]

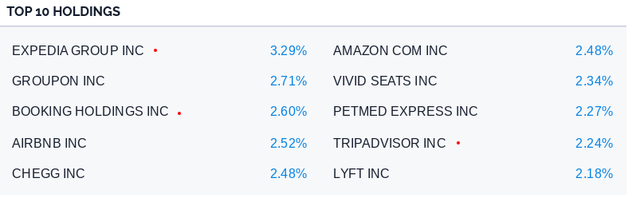

I use this as justification for being concerned about the consumer / retail picture. Oil impacts almost everything that we buy, and its price is up and well supported. Until that reality changes, inflation will be elevated, and purchasing power will be under pressure. This hurts not just retail spending but also travel – since gas prices, airfares, and public transit costs can all rise as well. Considering some of IBUY’s top holdings are directly travel related, this is a headwind that should not be ignored:

Top Holdings (Amplify)

Again, I am not trying to be alarmist here, and I do think the U.S. consumer story has some bright spots. But we should not ignore the bad news, because it is fundamental to my “hold” rating on IBUY going forward.

Stimulus Is Down, Not Expected To Change

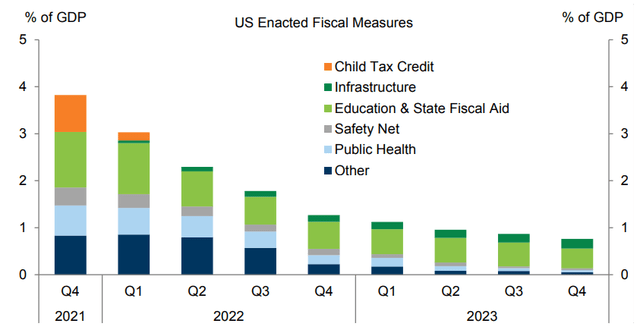

Another point on my modest outlook for the retail backdrop – whether online or in traditional marketplaces – is the winding down of stimulus here at home. While the American consumer was extremely resilient coming out of the pandemic in 2020, this was due in large part to massive federal stimulus measures. Of course, there were other factors as well. These included a shift from work-to-home for many white-collar works (keeping employment levels elevated) and a faster than anticipated stock market recovery. Yet, there is no denying that items like stimulus checks, child tax credits, and federal aid to states and cities helped keep spending elevated.

While that backdrop is all positive, that is backward looking. If we forecast out over the next 12-24 months, we should anticipate a much lower level of federal aid. In fairness, this is not a wild prediction, since fiscal measures have already dramatically fallen from 2020 and early 2021 levels. What is worrisome is that trend is wildly expected to continue through 2022 and 2023:

US Fiscal Support Declining (Goldman Sachs)

The thought here is that consumers / households are in for a rougher road ahead. Again, the rising wages and strong jobs numbers is going to balance this out. But that only helps the people who are actually employed and seeing a boost to their wages. For many other households not participating in this rebound, the reduction of federal stimulus benefits is going to put a dent in their buying power. We have been seeing this play out already since late last year, and helps to explain why retail names, such as IBUY and others, have been under pressure.

IBUY Has Highest Expense Ratio Of Retail Funds I Follow

My final thought on IBUY is short and sweet, and relates to how it stacks up against some of the other retail options I follow. It is important to note these are not direct peers to IBUY. Some of more traditional retail exposure, and others are much more top heavy than IBUY – focusing primarily on just a few popular names. Yet, they are all heavily exposed to the U.S. consumer, and rise and fall based on similar attributes – the labor market, inflation, wages, retail spending, etc.

For comparison purposes, let us look at IBUY and the Consumer Discretionary Select Sector (XLY), the SPDR S&P Retail ETF (XRT) and the ProShares Online Retail ETF (ONLN). All of these offer direct exposure to U.S. consumer spending, and it is notable that IBUY is bar far the most expensive option, in terms of annual expense ratio:

| Fund | Expense Ratio |

| IBUY | .65% |

| XRT | .35% |

| ONLN | .58% |

| XLY | .10% |

There is not much more to say here except that if one is going to buy IBUY and pay the above-average expenses associated with it, there should be a very strong buy case behind it. I don’t see that case right now, so this reinforces my neutral outlook.

Bottom-line

I was dead wrong on IBUY – I fully admit that. But past is past, and what matters now is what the fund will do in 2022. While I am tempted to reiterate a buy call on this fund given its drop deep into bear market territory (which suggests the potential for a correction), I simply see better places to put my money for the time being. I do have some retail exposure, but that is pretty light honestly, given all the headwinds facing the U.S. consumer. As a result, I am placing a hold rating on IBUY, and suggest readers approach this fund very selectively at this time.

[ad_2]

Source links Google News